The Lost Decade: Introduction

The Lost Decade or the Lost 10 Years is the time after the Japanese asset price bubble’s collapse within the Japanese economy. The term originally referred to the years from 1991 to 2000, but recently the decade from 2001 to 2010 is often included, so that the whole period is referred to as the Lost Score or the Lost 20 Years.

The Lost Decade: Causes

Over the period of 1995 to 2007, GDP fell from $5.33 to $4.36 trillion in nominal terms, real wages fell around 5%, while the country experienced a stagnant price level. While there is some debate on the extent and measurement of Japan’s setbacks, the economic effect of the Lost Decade is well established and Japanese policymakers continue to grapple with its consequences.

Japan’s strong economic growth in the second half of the 20th century ended abruptly at the start of the 1990s. In the late 1980s, abnormalities within the Japanese economic system had fueled a speculative asset price bubble of a massive scale. The bubble was caused by the excessive loan growth quotas dictated on the banks by Japan’s central bank, the Bank of Japan, through a policy mechanism known as the “window guidance”.

As economist Paul Krugman explained, “Japan’s banks lent more, with less regard for quality of the borrower, than anyone else’s. In so doing they helped inflate the bubble economy to grotesque proportions.”

Trying to deflate speculation and keep inflation in check, the Bank of Japan sharply raised inter-bank lending rates in late 1989. This sharp policy caused the bursting of the bubble and the Japanese stock market crashed. Equity and asset prices fell, leaving overly leveraged Japanese banks and insurance companies with books full of bad debt.

The financial institutions were bailed out through capital infusions from the government, loans and cheap credit from the central bank, and the ability to postpone the recognition of losses, ultimately turning them into zombie banks.

Yalman Onaran of Bloomberg News writing in Salon stated that the zombie banks were one of the reasons for the following long stagnation. Additionally Michael Schuman of Time magazine noted that these banks kept injecting new funds into unprofitable “zombie firms” to keep them afloat, arguing that they were too big to fail. However, most of these companies were too debt-ridden to do much more than survive on bail-out funds. Schuman believed that Japan’s economy did not begin to recover until this practice had ended.

Eventually, many of these failing firms became unsustainable, and a wave of consolidation took place, resulting in four national banks in Japan. Many Japanese firms were burdened with heavy debts, and it became very difficult to obtain credit. Many borrowers turned to sarakin (loan sharks) for loans. As of 2012, the official interest rate was 0.1%; the interest rate has remained below 1% since 1994.

The Lost Decade: Effects

Despite mild economic recovery in the 2000s, conspicuous consumption of the 1980s such as lavish spending on whiskey and cars has not returned to the same pre-crash levels. Difficult times in the 1990s made people frown on ostentatious displays of wealth, while Japanese firms such as Toyota and Sony which had dominated their respective industries in the 1980s had to fend off strong competition from rival firms based in other East Asian countries, particularly South Korea.

Many Japanese companies replaced a large part of their workforce with temporary workers, who had little job security and fewer benefits. As of 2009, these non-traditional employees made up more than a third of the labor force. And for the wider Japanese workforce, wages have stagnated. From their peak in 1997, real wages have since fallen around 13% an unprecedented number among developed nations.

The wider economy of Japan is still recovering from the impact of the 1991 crash and subsequent lost decades. It took 12 years for Japan’s GDP to recover to the same levels as 1995. And as a greater sign of economic malaise, Japan also fell behind in output per capita.

In 1991, real output per capita in Japan was 14% higher than Australia’s, but in 2011 real output has dropped to 14% below Australia’s levels. In the span of 20 years, Japan’s economy was overtaken not only in gross output, but labor efficiency, whereas previously it was a global leader in both.

In response to chronic deflation and low growth, Japan has attempted economic stimulus and thereby run a fiscal deficit since 1991. These economic stimuli have had at best nebulous effects on the Japanese economy and have contributed to the huge debt burden on the Japanese government. Expressed as a percentage of GDP, at 240% Japan has the highest level of debt of any nation on earth.

While Japan’s is a special case where the majority of public debt is held in the domestic market and by the Bank of Japan, the sheer size of the debt demands large service payments and is a worrying sign of the country’s financial health.

Interpretation

Economist Paul Krugman has argued that Japan’s lost decade is an example of a liquidity trap (a situation in which monetary policy is unable to lower nominal interest rates because these are close to zero). He explained how truly massive the asset bubble was in Japan by 1990, with a tripling of land and stock market prices during the prosperous 1980s. Japan’s high personal savings rates, driven in part by the demographics of an aging population, enabled Japanese firms to rely heavily on traditional bank loans from supporting banking networks, as opposed to issuing stock or bonds via the capital markets to acquire funds.

The cozy relationship of corporations to banks and the implicit guarantee of a taxpayer bailout of bank deposits created a significant moral hazard problem, leading to an atmosphere of crony capitalism and reduced lending standards. He wrote: “Japan’s banks lent more, with less regard for quality of the borrower, than anyone else’s. In so doing they helped inflate the bubble economy to grotesque proportions.” The Bank of Japan began increasing interest rates in 1990 due in part to concerns over the bubble and in 1991 land and stock prices began a steep decline, within a few years reaching 60% below their peak.

Economist Richard Koo wrote that Japan’s “Great Recession” that began in 1990 was a “balance sheet recession”. It was triggered by a collapse in land and stock prices, which caused Japanese firms to become insolvent, meaning their assets were worth less than their liabilities. Despite zero interest rates and expansion of the money supply to encourage borrowing, Japanese corporations in aggregate opted to pay down their debts from their own business earnings rather than borrow to invest as firms typically do. Corporate investment, a key demand component of GDP, fell enormously (22% of GDP) between 1990 and its peak decline in 2003.

Japanese firms overall became net savers after 1998, as opposed to borrowers. Koo argues that it was massive fiscal stimulus (borrowing and spending by the government) that offset this decline and enabled Japan to maintain its level of GDP. In his view, this avoided a U.S. type Great Depression, in which U.S. GDP fell by 46%. He argued that monetary policy was ineffective because there was limited demand for funds while firms paid down their liabilities. In a balance sheet recession, GDP declines by the amount of debt repayment and un-borrowed individual savings, leaving government stimulus spending as the primary remedy.

Economist Scott Sumner has argued that Japan’s monetary policy was too tight during the Lost Decade and thus prolonged the pain felt by the Japanese economy.

Economists Fumio Hayashi and Edward Prescott argue that the anemic performance of the Japanese economy since the early 1990s is mainly due to the low growth rate of aggregate productivity. Their hypothesis stands in direct contrast to popular explanations that are based in terms of an extended credit crunch that emerged in the aftermath of a bursting asset “bubble.”

They are led to explore the implications of their hypothesis on the basis of evidence that suggests that despite the ongoing difficulties in the Japanese banking sector, desired capital expenditure was for the most part fully financed. They suggest that Japan’s sluggish investment activity is likely to be better understood in terms of low levels of desired capital expenditure and not in terms of credit constraints that prohibit firms from financing projects with positive net present value (NPV).

Monetary or fiscal policies might increase consumption in the short run, but unless productivity growth increases, there is a legitimate fear that such a policy may simply transform Japan from a low-growth/low-inflation economy to a low-growth/high-inflation economy.

In her analysis of Japan’s gradual path to economic success and then quick reversal, Jennifer Amyx noted that Japanese experts were not unaware of the possible causes of Japan’s economic decline. Rather, to return Japan’s economy back to the path to economic prosperity, policymakers would have had to adopt policies that would first cause short-term harm to the Japanese people and government.

Under this analysis, says Ian Lustick, Japan was stuck on a “local maximum,” which it arrived at through gradual increases in its fitness level, set by the economic landscape of the 1970s and 80s. Without an accompanying change in institutional flexibility, Japan was unable to adapt to changing conditions and even though experts may have known which changes needed to be made, they would have been virtually powerless to enact those changes without instituting unpopular policies which would have been harmful in the short-term.

Lustick’s analysis is rooted in the application of evolutionary theory and natural selection to understanding institutional rigidity in the social sciences.

Legacy

After the Great Recession from 2007–2009, Western governments and commentators have referenced the Lost Decade as a distinct economic possibility for stagnating developed nations. On February 9, 2009, in warning of the dire consequences facing the United States economy after its housing bubble, U.S. President Barack Obamacited the “lost decade” as a prospect the American economy faced. And in 2010, Federal Reserve Bank of St. Louis President James Bullard warned that the United States was in danger of becoming “enmeshed in a Japanese-style deflationary outcome within the next several years.”

More than 23 years after the initial market crash, Japan is still feeling the effects of Lost Decade. However, several Japanese policymakers have attempted reforms to address the malaise in the Japanese economy. After Shinzo Abe was elected as Japanese prime minister in December 2012, Abe introduced a reform program known as Abenomics which addresses many of the issues raised by Japan’s Lost Decade.

His “three arrows” of reform intend to address Japan’s chronically low inflation, decreasing worker productivity relative to other developed nations, and demographic issues raised by an aging population. Investor response to the announced reform has been strong, and the Nikkei 225 rallied to 20,000 in May 2015 from a low of around 9,000 in 2008. The Bank of Japan has set a 2% target for consumer-price inflation, although success has been hampered by a massive sales tax increase enacted to protect the government’s balance sheet.

Is this going to be a lesson for the U.S. and Europe?

A very interesting point of view from Takeo Hoshi’s research (an MIT PhD graduate) and what Europe and the US could learn from Japan’s mistakes:

Unfortunately, some European nations seem to be following Japan’s lead, Hoshi said.

“In France, Italy and Spain, bank recapitalization has been delayed and the structural reforms have been slow. Without drastic changes, they are likely to follow Japan’s path to long economic stagnation,” Hoshi and Kashyap wrote.

The problems that held back Japan seem to be less serious in the U.S., Hoshi said: “Employment protection is low in the United States and the labor market shows high mobility. The regulatory advantage for incumbent firms is smaller than in Europe or Japan and starting new business is relatively easy.”

As the researchers noted, the United States and Germany are in a bit better economic shape, partly due to the fact that they did undertake structural reforms sooner rather than later. The U.S. was able to recapitalize its banks more quickly, for example.

Still, five years after the failure of the Lehman Brothers investment bank left the world’s financial markets in chaos, the U.S. and Europe are not yet back to what had looked normal before the crisis, according to the research. For instance, employment levels have not reached the levels seen before the 2007-09 crash.

“The U.S. recovery has been tepid despite a number of extraordinary macroeconomic policies (at least in the traditional sense). This suggests that the U.S. economy also has problems, but they are just different from those in Japan and in Europe,” Hoshi said.

In the years leading up to the financial crisis, the researchers wrote, U.S. growth was fueled by a consumption boom from rapid housing price increases and rising debt levels.

“In a broad sense, the U.S. economy before the crisis was similar to the Japanese or Spanish economies,” noted Hoshi, adding that in Japan, the speculative investment boom in the late 1980s masked structural problems.

Sources: https://en.wikipedia.org, http://news.stanford.edu

Yours,

Vladimir

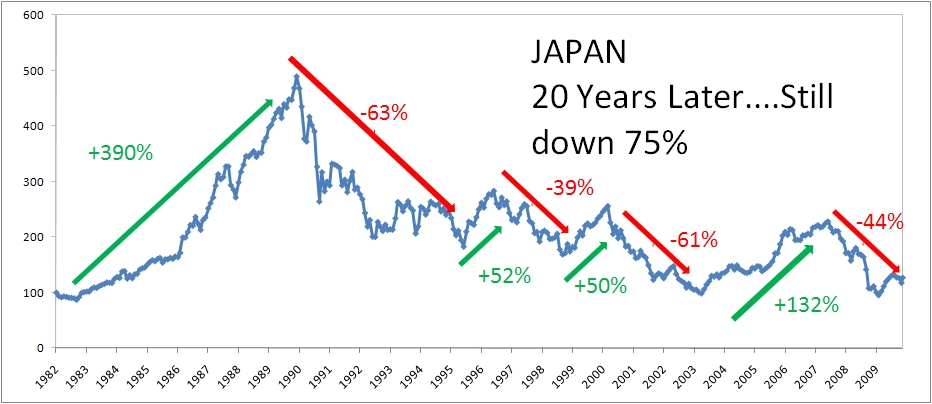

What exactly does the graph at the top of the article measure? The y axis isn’t labelled.

It’s not mentioned at the sources we worked with, but the way I see it, it’s the % growth in their market