The pound rose to a six-week high as a combination of short-squaring and dollar weakness across the board kept the currency’s recent bullish tone intact.

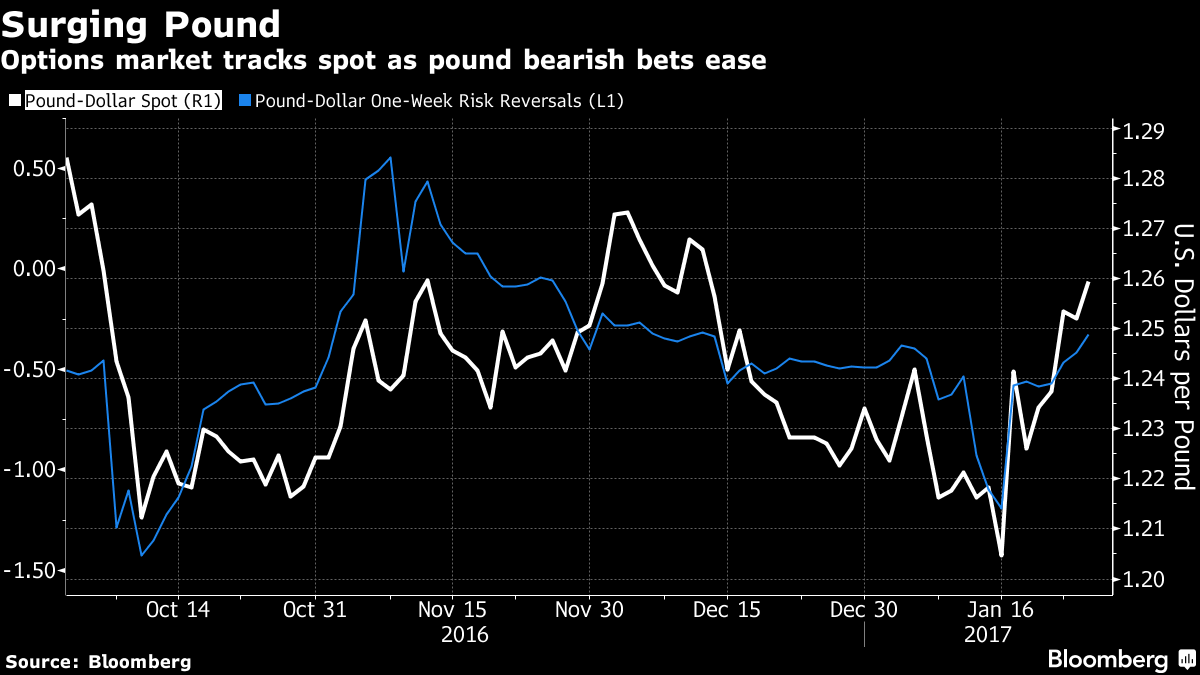

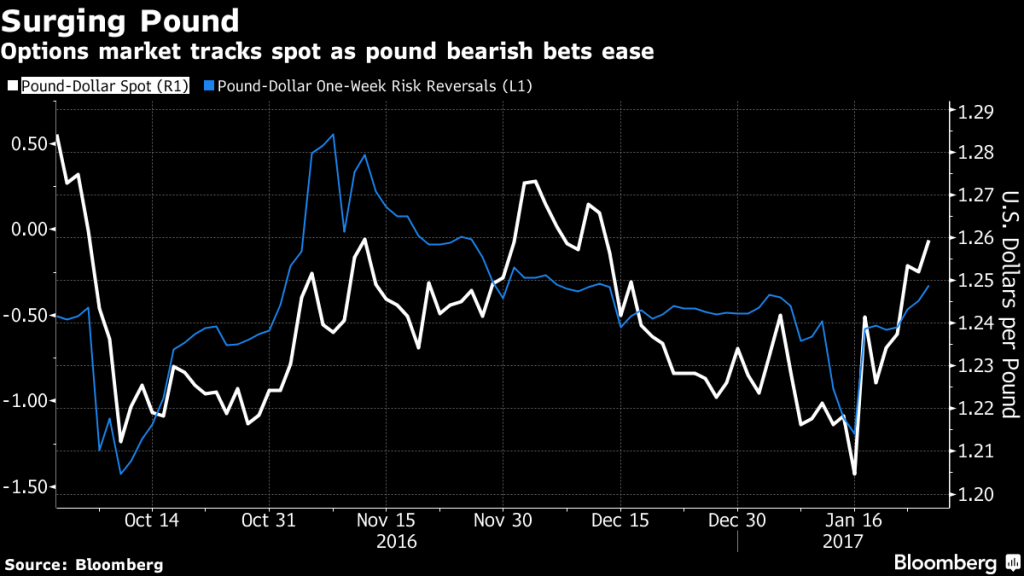

The U.K. currency burst through stops during the London morning, and climbed to as high as $1.2598, the highest since Dec. 14. That move prompted short-term investors to take profit on their longs, with an abundance of offers within the $1.2600 to $1.2650 range, three traders in London and Europe said. Short-term risk reversals that show bearish bets on the currency have eased lately, tracking spot price action higher.

Interbank, real money and macro accounts are still looking to add pound shorts, albeit in slightly better levels, the traders add, with $1.2650 and $1.2800 currently the main levels that gather selling interest.

- The Bloomberg Dollar Spot Index dropped as much as 0.2 percent to 1243.66, while the greenback drops versus all its G-10 peers apart from the Aussie. Fear-greed indicator shows dollar bears have been in control for the longest period since August (see chart). Treasury yields trade in the green, rather than following the dollar’s drop

-

Pound strength spilled over to the euro, which reversed early losses and spiked to $1.0755 high. Offers seen circa $1.0770, while more lie near $1.0800.

-

Against the yen, the dollar holds well above its 112.50 support, cushioning its broader drop. The greenback trades little changed at 113.70 yen on Wednesday, near the middle of the pair’s range since Jan. 17. A move below 112.50 or above 115.50 is needed for a major shift in sentiment. DTCC data shows large expiries roll over today and tomorrow at 114.00

- The Aussie is worst-performer today as fourth-quarter headline and core CPI data missed estimates. It’s now 0.6 percent lower at 0.7543, paring losses from 0.7515 low. There is support at 0.7508, the 233-DMA

- NOTE: Some information comes from FX traders familiar with the transactions who asked not to be identified because they are not authorized to speak publicly

Source – Bloomberg

Nice article

Thank You

Thanks Vlad for sharing.. Good one