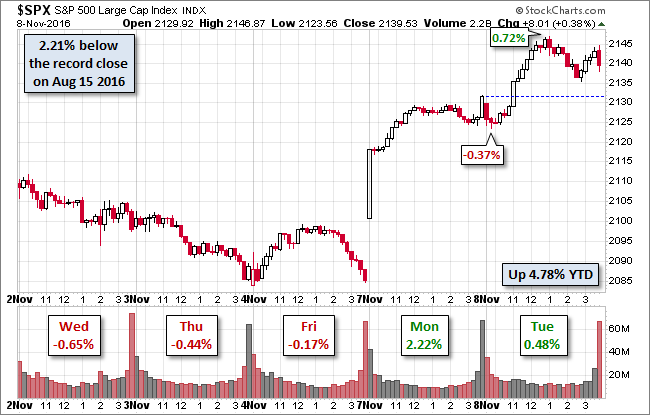

The Monday rally snapping a nine-day selloff in S&P 500, the longest selloff in nearly 36 years, continued Tuesday in a more subdued mode. The index opened lower, hitting its -0.37% intraday low in the first 30 minutes of the session and then rose steadily to its 0.72% midday high.

It then zigzagged during the afternoon and closed with a modest 0.38% gain. In two days the S&P 500 has erased about 85% of the nine-day selloff. All eyes are now on the behavior of the markets when the election results are revealed.

The 10-year Note closed the session at 1.88%, up five BPs from the previous close.

Here is a snapshot of the past five sessions.

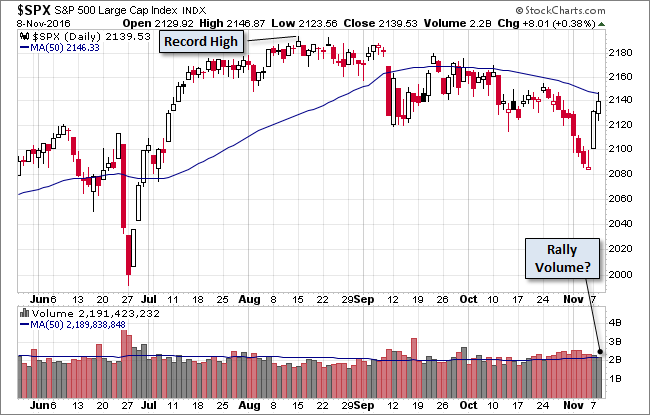

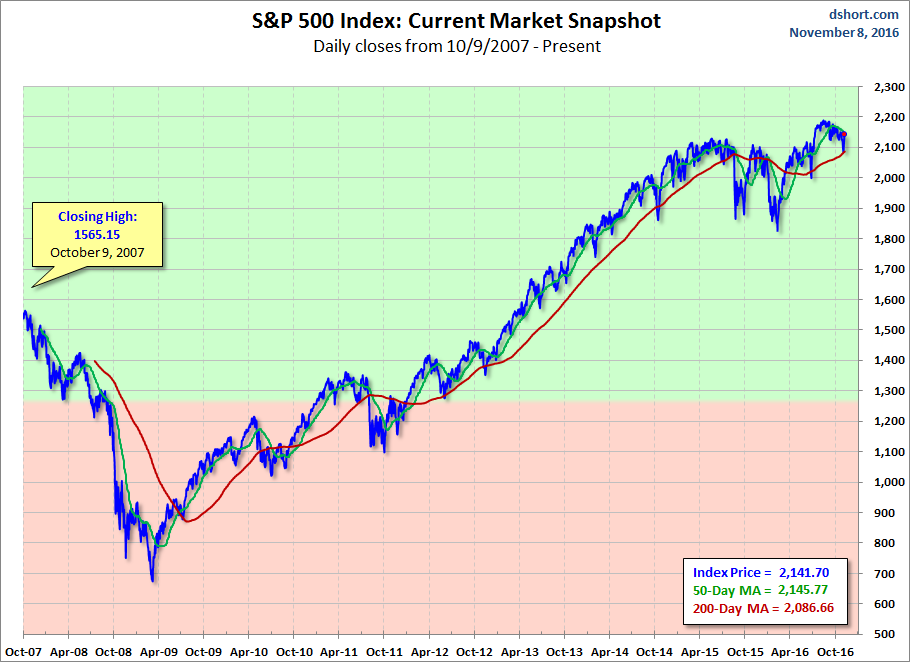

Here’s a daily chart of the index. Rally volume remains unimpressive. Note that the 50-day moving average was an apparent point of resistance for Tuesday’s trade.

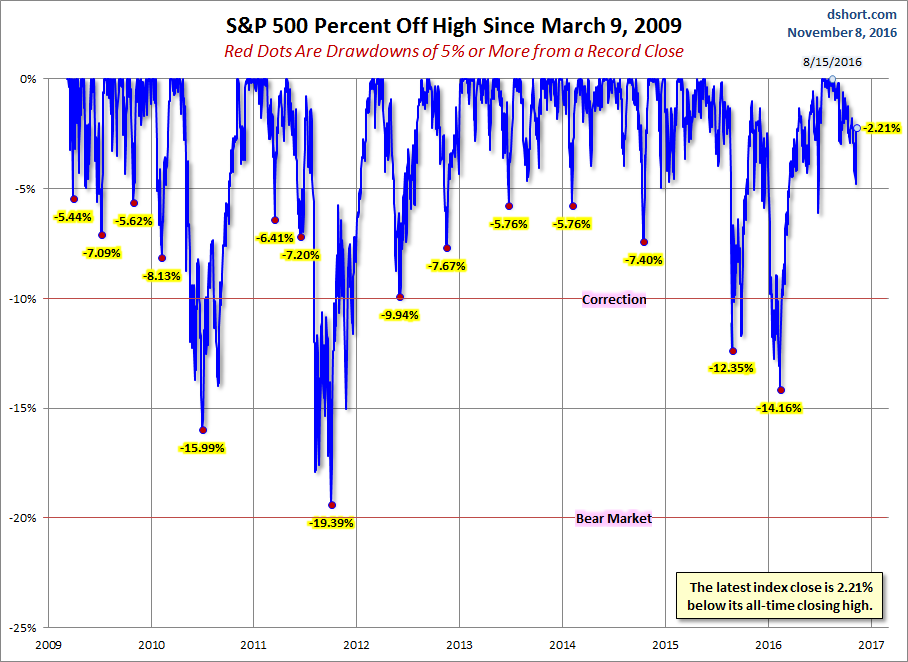

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

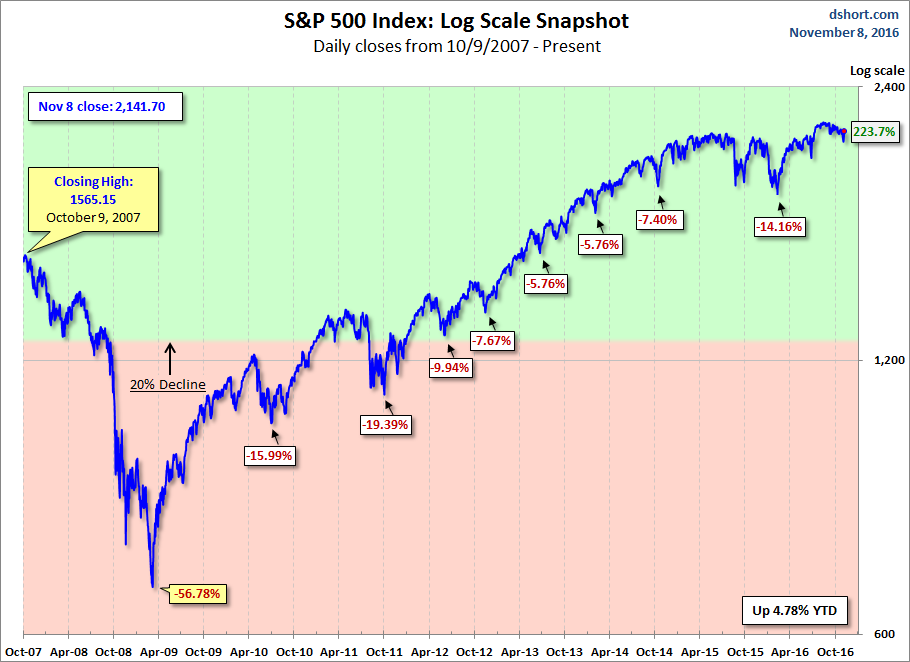

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

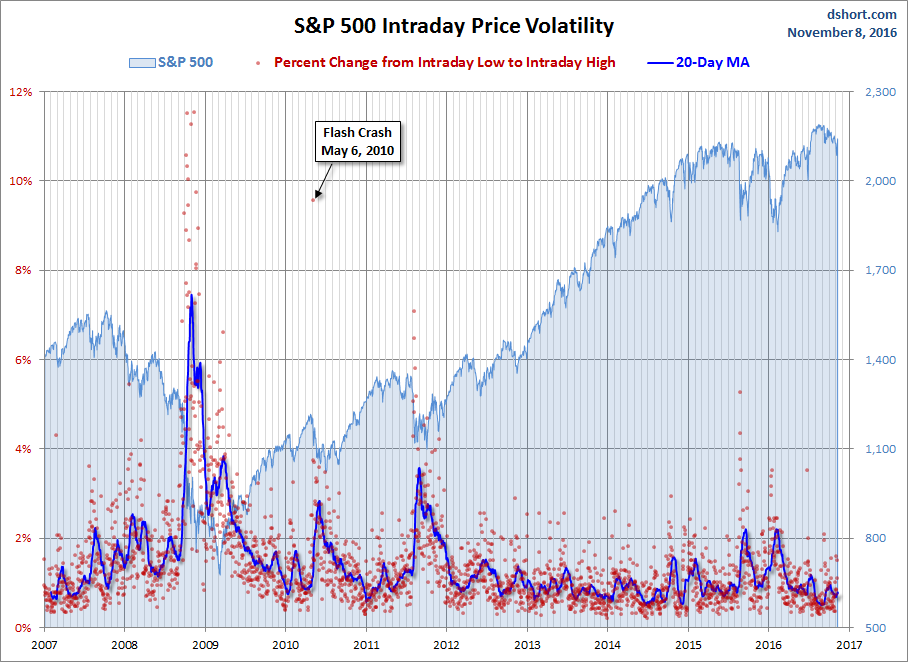

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

You are welcome guys

Thank you so much for sharing it

Lucky to have a mentor like you.

Very useful info, thank you.

Thanks for the analysis Vlad