There were few important releases scheduled earlier during the week in the UK, including the Consumer Price Index (CPI), Producer Price Index (PPI) index, retail sales data, MPC meeting minutes, business investment data, GDP figures and the Confederation of British Industry (CBI) Industrial Trends Orders. All these events had a major impact on the British pound, as the currency traded mostly higher against most of its counterparts. Let us review the economic releases for a broader outlook of the sterling, and analyze where it can go from here.

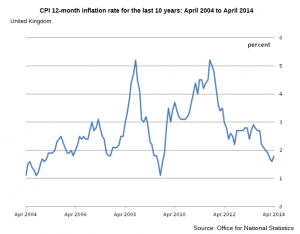

UK Consumer Price Index (CPI)

The first on the list was the Consumer Price Index (CPI) data. The inflation data always play a key role in the economy and have an impact on the currency. The UK Consumer Price Index (CPI) data released by the National Statistics on Tuesday. The market was expecting a rise of 0.3% in the Consumer Price Index in April, 2014. The outcome was better than expected, as the UK inflation was up 0.4% in April 2014. In the terms of yearly change, the UK CPI grew by 1.8% in the year to April 2014, compared with April 2013.

Moreover, the core CPI grew by 2% in the year to April 2014, compared with April 2013. The report also mentioned that “increases in transport costs, notably air fares, sea fares and motor fuels, provided the largest contribution to the rise in the rate. An overall fall in the price of food was the largest offsetting factor“. Overall, the outcome was on the positive side. The GBPUSD pair climbed after the data release, but later found sellers, which took the pair lower again.

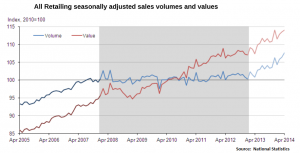

UK Retail Sales data

The next in line was the UK retail sales data, which was released by the National Statistics on Wednesday. The market was expecting a rise of 0.5% in the retail sector in April, 2014. The outcome was better than expected, as the UK retail sales were up 1.3% in April 2014, compared to March 2014. In terms of yearly change, the UK retail sales jumped by 6.9% in the year to April 2014, compared with April 2013.

Moreover, the core retail sales increased by 1.8% in the year to April 2014, compared with April 2013. The report also mentioned that “with the exception of petrol stations, all stores saw year-on-year increases in sales volumes. Notably, the food sector posted its strongest year-on-year growth since January 2002, increasing by 6.3%”. Overall, the outcome was very impressive. The GBPUSD pair spiked higher after the release. The pair was seen trading above the 1.6900 level post release.

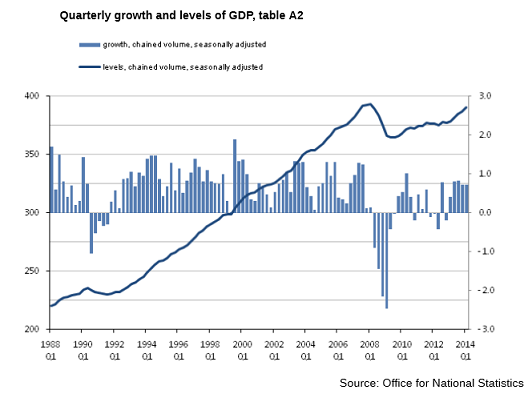

UK GDP

Earlier during the London session yesterday, the UK Gross Domestic Product was released by the National Statistics. The forecast was slated for an increase of 0.8% between Q4 2013 and Q1 2014. The outcome was in line with the expectation, as the UK GDP grew by 0.8%. This means this reading remains unrevised from the previous estimate of GDP published 29 April 2014. This data can also be seen on the positive side. However, the GBPUSD sellers got aggressive after the release, and destroyed the retail sales gain.

Technically, the GBPUSD pair dropped below the 1.6880 level after the GDP data release. However, the pair has breached a down-move trend line on the 4 hour chart, which is likely to act as a support if the pair falls from the current levels. The 1.6830 area is the one to watch out for in the short term.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!