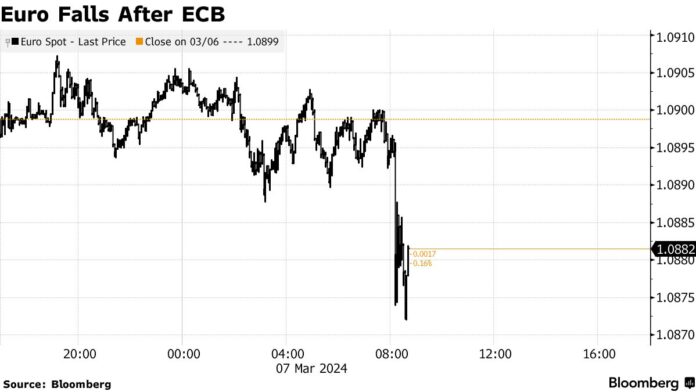

Wall Street traders refrained from making big bets ahead of Jerome Powell’s testimony and Friday’s jobs data. The euro fell as the European Central Bank kept rates steady and lowered its inflation forecasts.

Stocks saw small gains, while bond yields edged lower after jobless claims held at the historically low level of 217,000 — with investors now gearing up for the final payrolls report before the Federal Reserve decision. Traders will once again be glued to their screens as they await to hear further insights from the Fed chief, who signaled Wednesday no rush to ease policy.

Following the ECB decision that bolstered bets on a rate cut in June, central bank chief Christine Lagarde said the economy is weak and risks to growth remain tilted to the downside.

“The ECB is inching closer to the first rate cut,” said Mark Wall at Deutsche Bank AG. “It won’t surprise the market that the ECB is taking a meeting-by-meeting, data-dependent approach.”

S&P 500 contracts signaled the benchmark gauge will extend its advance above 5,100. US 10-year yields fell three basis points to 4.07%. The euro dropped 0.2% and German bonds extended gains. Speculation surged that the Bank of Japan will move this month to hike for the first time since 2007, after a flurry of reports and wage figures helped drive the yen higher.

Corporate Highlights:

- General Electric Co.’s aerospace division set plans to return more of its profits to shareholders, including restoration of a significant dividend as it accelerates earnings as an independent company.

- Two Nvidia Corp. directors sold about $180 million in shares of the chipmaker in recent days, becoming the latest insiders to cash in as the stock continues to push deeper into record territory.

- Micron Technology Inc. was upgraded to buy from hold at Stifel, with the broker saying that average analyst estimates for 2025 are “wrong and too low” for the chipmaker.

- Victoria’s Secret & Co., a lingerie maker, reported full-year sales guidance that fell short of analysts’ expectations.

- Cigna Group has struck deals with obesity drug makers Eli Lilly & Co. and Novo Nordisk A/S that aim to widen coverage by limiting how much employer-sponsored health plans have to pay for the medicines.

- Novo Nordisk A/S touted the potential of its next-generation obesity treatments, releasing promising data on an experimental daily pill and sending the shares soaring to a record.

Key Events This Week:

- Eurozone GDP, Friday

- US nonfarm payrolls, unemployment, Friday

- New York Fed President John Williams speaks, Friday

- ECB Governing Council member Robert Holzmann speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.4% as of 8:37 a.m. New York time

- Nasdaq 100 futures rose 0.6%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The Stoxx Europe 600 rose 1%

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro fell 0.2% to $1.0874

- The British pound rose 0.1% to $1.2748

- The Japanese yen rose 1.1% to 147.72 per dollar

Cryptocurrencies

- Bitcoin rose 0.7% to $66,948.01

- Ether fell 1.4% to $3,794.62

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.07%

- Germany’s 10-year yield declined six basis points to 2.26%

- Britain’s 10-year yield declined four basis points to 3.95%

Commodities

- West Texas Intermediate crude fell 0.7% to $78.54 a barrel

- Spot gold rose 0.5% to $2,159.22 an ounce