U.S. stocks rose as investors assessed data that showed fewer Americans applied for unemployment benefits last week and evaluated the outlook for global central bank stimulus after policy makers in Europe decided to slow bond purchases.

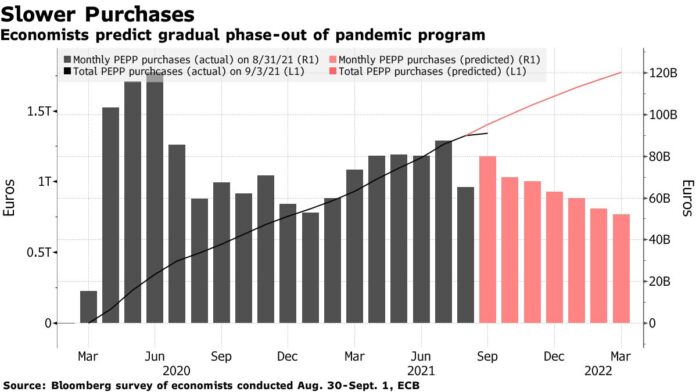

All of the main American equity gauges advanced, with the S&P 500 climbing for the first time since it closed at a record on Sept. 2. The dollar weakened and 10-year U.S. Treasury yields fell. Stocks in Europe rose after the European Central Bank said it will slow its emergency support but keep policy accommodative.

Investors remain on edge as they speculate about the timing of stimulus tapering by central banks even as the relentless spread of the delta virus variant undermines global growth. In the U.S., where calls for the Federal Reserve to start reducing its asset purchases have been growing, data on Thursday showed initial state unemployment claims fell to a pandemic-era low as the labor market continues to recover. China’s regulatory crackdown on the technology sector worsens the macro outlook.

“I don’t think you can bet against this market with the amount of stimulus that’s still out there with the central banks all supporting the markets and with the amount of savings out there and the balance sheets,” Chris Gaffney, president of world markets at TIAA Bank, said on Thursday. “We keep pointing back to both personal and corporate balance sheets that still are in incredible shape. So all of that summed up, I’m pretty much a permanent bull, but I still think that environment is great for companies, good for earnings.”

While Thursday’s jobs report showed a stronger-than-expected labor market, other recent readings on the economy have been mixed. The Federal Reserve’s Beige Book survey showed U.S. economic activity decelerated in the past two months as consumers pulled back on spending due to safety concerns. However, shortages meant inflationary trends remained stubborn, according to the findings. Further evidence of global price pressures came from China, where factory-gate inflation surged.

Still, calls for a reduction in bond purchases are strengthening. Fed Bank of New York President John Williams said it could be appropriate for policy makers to begin tapering this year. Dallas President Robert Kaplan said based on the current outlook he would back a September announcement of a tapering in bond purchases and a possible start in October.

China’s technology stocks slid after officials told firms including Tencent Holdings Ltd. and NetEase Inc. to end their focus on profit in gaming. The selloff extended to the U.S., where NetEase and Alibaba Group Holding declined.

Digital Realty, which manages technology-related properties, tumbled more than 4% after entering into forward sale agreements with banks for 6.25 million shares at $160.50 each.

What to watch this week:

- U.S. President Joe Biden may make his choice this week on whether to renominate Fed Chair Jerome Powell to a second term

- ECB President Christine Lagarde holds a press conference after the bank’s rate decision Thursday

- China PPI, CPI, new yuan loans, money supply, aggregate financing, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.3% as of 10:40 a.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.4%

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.1810

- The British pound rose 0.6% to $1.3853

- The Japanese yen rose 0.4% to 109.84 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.33%

- Germany’s 10-year yield declined three basis points to -0.36%

- Britain’s 10-year yield was little changed at 0.74%

Commodities

- West Texas Intermediate crude rose 0.1% to $69.39 a barrel

- Gold futures fell 0.2% to $1,790.50 an ounce