US stocks futures fell and European stocks wavered amid fresh worries about China’s economic recovery ahead of key American price data later this week.

Futures on the S&P 500 and Nasdaq 100 were down about 0.3% and 0.4% respectively after most American equities dropped Friday when wage data showed inflation remains a threat.

The Stoxx Europe 600 index fluctuated after its biggest weekly drop since mid-March. Miners were the leading decliners as iron ore and copper fell. Rio Tinto Group dropped more than 1% after its chairman warned of headwinds from China for raw materials. Bayer AG rose as much as 3.2% after a report that the pharmaceutical company is planning to spin off its agricultural chemicals business.

Equities have been on the back foot at the start of the second half amid concerns economies will buckle under high rates as central banks keep up the fight against rising prices. US Treasury Secretary Janet Yellen said on the weekend she wouldn’t rule out a US recession, noting inflation remains too high.

“Everyone is looking at inflation or has been looking at inflation for a long time,” Nicolo Bocchin, global head of fixed income at Azimut Group, said on Bloomberg Television. “Now it’s time to look at growth.”

Traders will assess US inflation numbers on Wednesday for signals on the Federal Reserve’s likely policy path and the rising risk of a recession. UK jobs data Tuesday will also be crucial in determining the Bank of England’s next policy decision in August.

The 10-Treasury yield was little changed at around 4%, while the two-year yield fell about three basis points to 4.92%. A gauge of the dollar was flat.

An Asia equity benchmark slipped for a fourth day, heading for the lowest close in more than a month. Shares in Hong Kong and mainland China pared gains after Chinese data showed further declines in factory-gate prices while core inflation slowed. The offshore yuan swung to a loss after the data.

Traders had initially focused on optimism that a crackdown by Beijing on Chinese tech companies was nearing an end, sending the Hang Seng Tech Index up as much as 3.2%, before trimming its advance.

“It is clear that China is facing excess supply now,” said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group Ltd. “Demand side policies will be in need,” with the focus now shifting to expectations of fiscal stimulus before China’s July Politburo meeting, he said.

Inflation Data

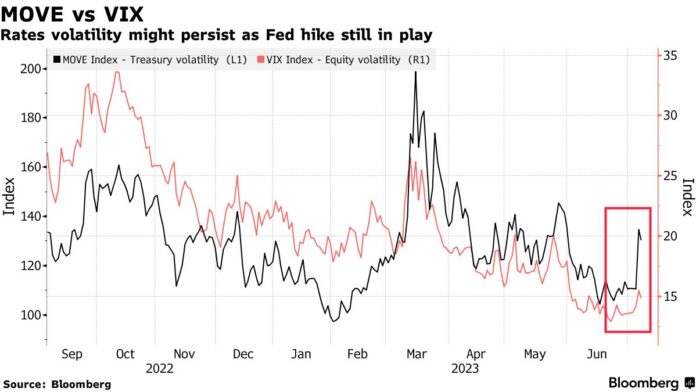

US jobs data last week damped speculation the Fed would leave interest rates unchanged this month. The outlook beyond that is unclear. Payroll figures fell short of estimates but brought signs that wage inflation remains a threat to the Fed’s fight against price gains.

Traders will also be closely watching this week’s US consumer prices data. Bloomberg economists are expecting the headline number to fall to 3.1%, though they don’t see that stopping the Fed hiking at its meeting later this month.

Downside surprises in this week’s inflation indicators could charge up the bulls, taking the S&P 500 above the channel, according to Ed Yardeni, president of his namesake research firm. “On the other hand, higher-than-expected inflation readings could heighten fears that the Fed will have to tighten monetary policy to cause a recession as the only clear way to bring inflation down.”

Key events this week:

- US wholesale inventories, Monday

- Federal Reserve speakers include Mary Daly, Loretta Mester, Raphael Bostic and Michael Barr, Monday

- Bank of England Governor Andrew Bailey delivers speech, Monday

- St. Louis Fed President James Bullard speaks, Tuesday

- Canada rate decision, Wednesday

- US CPI, Wednesday

- Federal Reserve issues Beige Book, Wednesday

- Federal Reserve speakers include Neel Kashkari, Loretta Mester, Raphael Bostic, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- China trade, Thursday

- Eurozone industrial production, Thursday

- US initial jobless claims, PPI, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 was little changed as of 10:35 a.m. London time

- S&P 500 futures fell 0.2%

- Nasdaq 100 futures fell 0.3%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 0.3%

- The MSCI Emerging Markets Index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0968

- The Japanese yen fell 0.1% to 142.40 per dollar

- The offshore yuan fell 0.1% to 7.2408 per dollar

- The British pound fell 0.2% to $1.2818

Cryptocurrencies

- Bitcoin fell 0.1% to $30,163.18

- Ether fell 0.4% to $1,862.42

Bonds

- The yield on 10-year Treasuries was little changed at 4.07%

- Germany’s 10-year yield advanced three basis points to 2.66%

- Britain’s 10-year yield advanced three basis points to 4.68%

Commodities

- Brent crude fell 0.7% to $77.94 a barrel

- Spot gold was little changed