After a tough December 2024, we wanted to come back stronger and deliver greater results in January 2025. The market was volatile. Trump entered the white house and his second period started and the markets didn’t disappoint. The volatility was there, the setups were there, the trades happened and the results – well, see the results below.

You can watch the video of “Our Top Five Trades in Home Trader Club January 2025” here

Explore My Free Mentorship Program

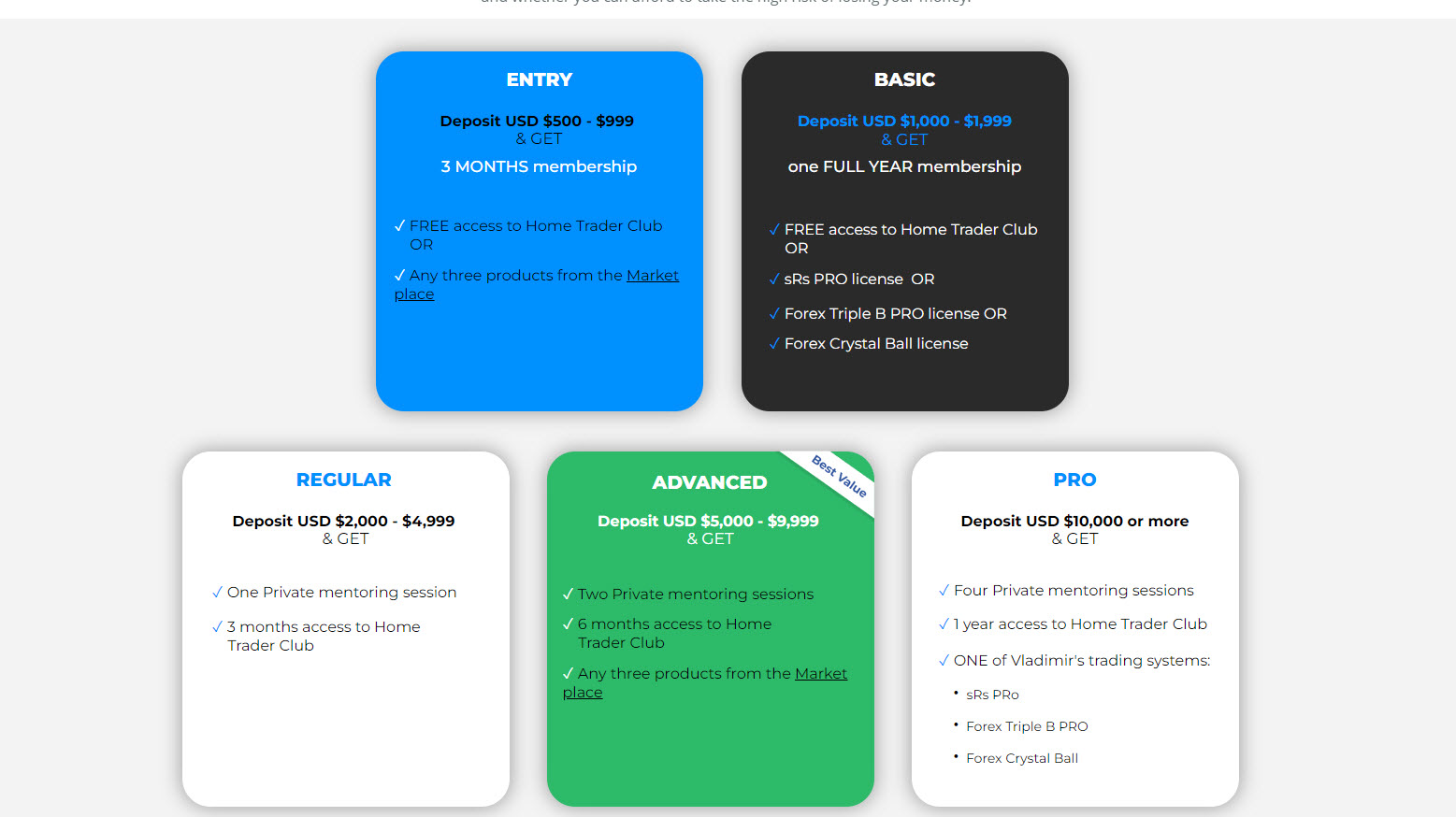

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

EURAUD SELL

W1 – Triple cycle ending with bearish divergence, currently it looks like a potential correction is happening. We got the first push down with bearish hidden divergence

D1 – Bearish divergence on the histogram

4H – Bearish convergence followed by a flat correction and price has broken below the range. My idea here is to sell pullbacks.

Target – 38.2% – 50% Fibo retracement levels of 4H trend

Open

Close

EURUSD BUY

D1 – Bullish divergence

4H – Bullish price action

4H – Retraced to retest recent lows and we take a buy trade

Target – 23.6% and 38.2% Fibo retracement levels of Daily trend

Open

Close

EURGBP SELL

D1 – Price bouncing lower from a strong supply zone

4H – Bearish divergence

1H – Bearish price action, no opposite signs. My idea here is to sell the rallies

Target – 38.2% – 50% Fibo retracement levels of 4H trend

Open

Close

CHFJPY SELL

W1 – Bearish divergence expecting potential correction

D1 – Price is moving inside a range, expecting breakout below the range, pullback and further continuation lower

4h – Bearish price action followed by flat correction. Currently the price has broken below this range. My idea here is to sell the rallies

Target – First target is the 61.8% Fibonacci expansion level of the ongoing wave and the second target is the 100% Fibonacci expansion level of the ongoing wave

Open

Close

OIL BUY

4H – Price has reached a strong demand zone with bullish divergence

1H – Triple descending cycle ending with bullish divergence

M15 – Bullish divergence followed by higher highs, my idea here is to look for pullbacks towards the rejection zone and then to look for buys

Target – 38.2% – 50% Fibo retracement levels of 1H cycle

Open

Close

The trades above are just some of the trades we took during January 2025, both in the trading setups we share with our Home Trader Club members, and in our weekly live sessions. We managed to find a lot of great setups, and the market was delivering good moves and good profits for us.

Looking forward for a great 2025

For any questions feel free to contact us here support@vladimirribakov.com

Yours to your success,

Vladimir Ribakov

Internationally Certified Financial Technician