London Recap

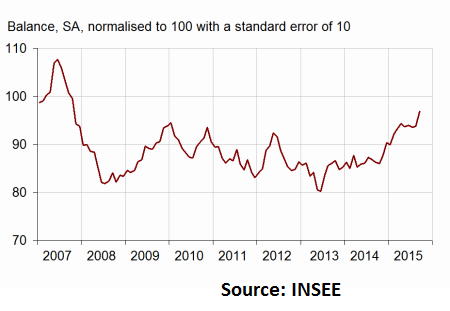

Earlier today during the London session, there were a couple of economic releases lined up in the Euro zone, including the France Consumer Confidence, Italian Wage Inflation and Euro zone M3 Money Supply report. The first was the France Consumer Confidence, which measures the moods of the consumers, through an analysis of a sample of houses was released by INSEE. The market was expecting an increase from the last reading of 93 to 94 in September. However, the outcome was a positive one, as the France Consumer Confidence rose to 97 in September 2015. The last reading was also revised up from 93 to 94.

The report highlighted that “households’ opinion of their financial situation, past as well as future one, has improved. The corresponding balances have respectively gained 2 and 3 points. However, they remain below their long-term average”.

In the Euro Zone, the M3 Money Supply, which is a measure of money supply that was released by the European Central Bank. The outcome missed the expectation, and posted an increase of 4.8% in August 2015, compared with the same month a year ago. The forecast was of 5.3%.

The Euro was seen losing momentum after the release and there lies a risk of more losses moving ahead.

Technical Analysis – EURUSD

The Euro was completely rejected this week around 1.1300 against the US Dollar. There was a nasty rejection noted around the stated level, which ignited a downside move. The EURUSD pair is down by more than 150 pips and trading near 1.1130.

Today, the US Gross Domestic Product Annualized will be published by the US Bureau of Economic Analysis. If the growth rate is more than he forecast, then we might witness more losses in EURUSD moving ahead.