US equity futures rose Monday, signaling a bounce for stocks on Wall Street after a bruising August so far for investors. Bonds were broadly weaker.

Contracts for the S&P 500 and the Nasdaq 100 gained at least 0.5%, with the underlying gauges set to trim three weeks of declines. Palo Alto Networks Inc. rallied in premarket trading after the cybersecurity company’s billings forecast beat estimates. European stocks rebounded from a six-week low as higher energy prices buoyed oil producers like TotalEnergies SA and Shell Plc.

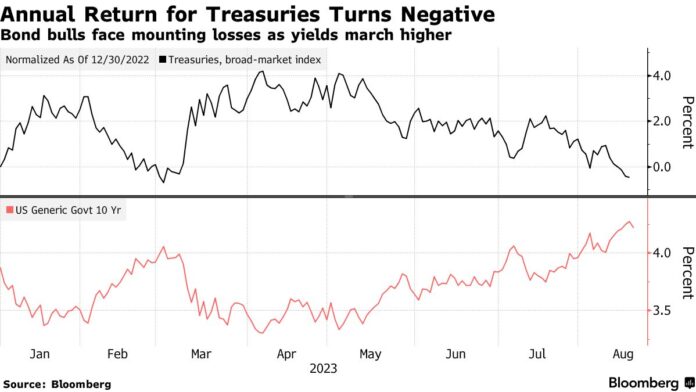

Treasury yields resumed their advance, rising across the curve. The 10-year climbed toward the highest level since November 2007, while the 30-year was near 2011 highs.

The upturn for stocks follows a run of sharp losses, with the S&P 500 down 4.8% this month as investors brace for the potential of interest rates remaining higher for longer. The next clues on the policy outlook will come from this week’s annual gathering of central bankers at Jackson Hole, Wyoming, with Federal Reserve Chairman Jerome Powell due to speak Friday.

Confusion over China’s policy approach to stemming the nation’s property slump kept the more positive mood in check. Chinese lenders on Monday cut their one-year loan prime rate by 10 basis points and kept the five-year prime loan rates unchanged, even after policymakers called for more lending. Traders had expected a 15-basis-point cut on both rates.

“I do think there is more volatility ahead as the market is not happy with the lack of stimulus in China and especially credit availability for consumers,” said Evgenia Molotova, senior investment manager at Pictet Asset Management. “The narrative in the US is more and more toward a soft-landing. The risk to this is potential inflation resurgence due to strong consumer spending and salary growth.”

Powell is expected to strike “a more balanced tone in Wyoming, hinting at the tightening cycle’s end while underscoring the need to hold rates higher for longer,” according to Anna Wong at Bloomberg Economics.

“The Fed have done almost everything they need to do to get inflation down to target and it would surprise me if there was a lot more rate rises to come,” said David Henry, investment manager at Quilter Cheviot.

On the earnings front, the week’s key event is Wednesday’s report from Nvidia Corp., the chipmaker whose blowout revenue forecast helped ignite this year’s rally in artificial intelligence-linked stocks.

Meanwhile, two of Wall Street’s top strategists are at odds about the outlook for US stocks following as debate rages over whether the economy can avoid a recession. Morgan Stanley’s Michael Wilson — a stalwart equity bear — says sentiment is likely to weaken further if investors are starting to “question the sustainability of the economic resiliency.” But his counterpart at Goldman Sachs Group Inc., David Kostin, says there’s room for investors to further increase exposure if the economy stays on course for a soft landing.

Wilson said stock investors had now become too optimistic about a soft landing, while cooling inflation has crimped Corporate America’s ability to raise prices. Kostin said a recent decline in a Goldman equity sentiment indicator could turn out to be short lived if market conditions continue to improve.

In other individual stock moves Monday, Nikola Corp. slid in US premarket trading after the maker of electric big rigs warned it may not reach its full-year delivery target as it grapples with fallout from recent battery incidents. Napco Security Technologies Inc. fell more than 30% after the electronic security device maker said it would have to restate three quarters of financial statements.

In energy markets, European benchmark gas prices soared as much as 18% as traders priced in the possibility of supply disruptions from a potential strike in Australia. Oil rose for a third day as signs the physical market is tightening offset growing demand risks in China and the US. Global benchmark Brent traded above $85 a barrel and is up more than 2% since last Wednesday’s close.

Key events this week:

- US existing home sales, Tuesday

- Chicago Fed’s Austan Goolsbee speaks, Tuesday

- Eurozone S&P Global Services & Manufacturing PMI, consumer confidence, Wednesday

- UK S&P Global / CIPS UK Manufacturing PMI, Wednesday

- US new home sales, S&P Global Manufacturing PM, Wednesday

- US initial jobless claims, durable goods, Thursday

- Kansas City Fed’s annual economic policy symposium in Jackson Hole begins, Thursday

- Japan Tokyo CPI, Friday

- US University of Michigan consumer sentiment, Friday

- Fed Chair Jerome Powell, ECB President Christine Lagarde to address Jackson Hole conference, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.5% as of 8:26 a.m. New York time

- Nasdaq 100 futures rose 0.7%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.6%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.0900

- The British pound rose 0.1% to $1.2750

- The Japanese yen fell 0.4% to 145.98 per dollar

Cryptocurrencies

- Bitcoin fell 0.7% to $26,051.4

- Ether fell 0.9% to $1,674.05

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.30%

- Germany’s 10-year yield advanced five basis points to 2.67%

- Britain’s 10-year yield was little changed at 4.68%

Commodities

- West Texas Intermediate crude rose 1.5% to $82.43 a barrel

- Gold futures rose 0.3% to $1,922.60 an ounce