Hi Traders! US Session General Analysis August 22nd 2017 is here. Its time to analyze and find out the best trade setups that market is providing for us. My analysis of some of the important currency pairs and stocks are as follows:

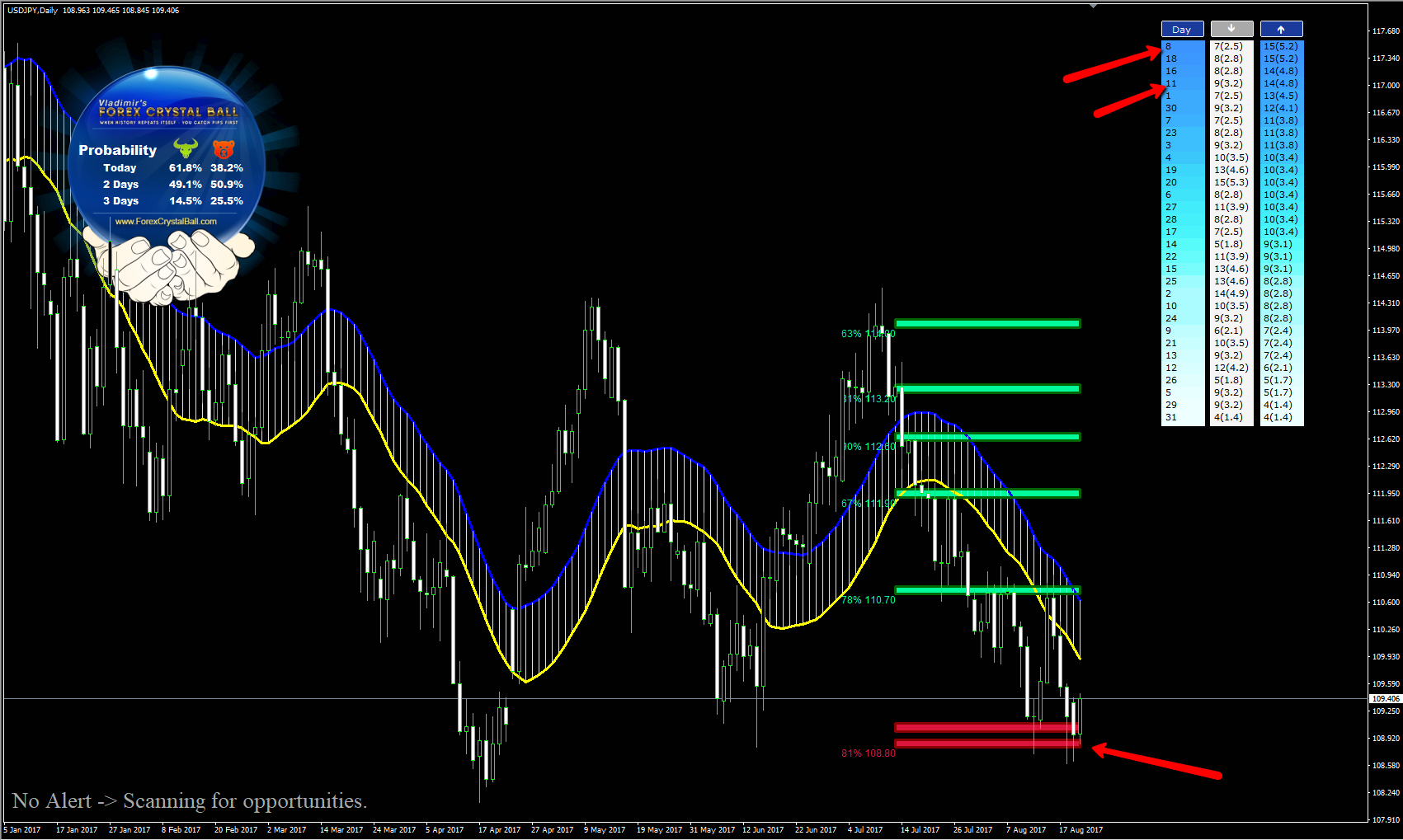

USDJPY Daily Chart:

On the Daily chart the price has created a range between 108.810 – 114.336 with the highs reaching the same resistance zone and lows reaching same support zone. There are two false breaks which confirms this range is a valid one. Currently the price is at the bottom of the range and we may expect the price to move higher if we don’t have a valid breakout at the bottom of the range.

In addition to this as an added confirmation of the bullish moment that we are expecting, price has created a bullish divergence so we may expect the bulls to take charge soon.

In addition to this as an added confirmation of the bullish moment that we are expecting, price has created a bullish divergence so we may expect the bulls to take charge soon.

Crystal Ball Confirmation:

Crystal Ball also gives us confirmation from the Statistical indicator with very strong dates for bullish reversal and currently price has reached a great support zone (two action zones very close to each other)

USDJPY H4 Chart:

On the H4 chart the price has created a smaller range and is moving inside this range. The price is now above the bottom of this range and we also have a bullish divergence that has formed so we may expect this bullish momentum to continue further and the price to reach the top of this range.

Western Union Weekly:

We have been following this setup for some time now. On the weekly chart the price has created a range with the highs and lows reaching the same support and resistance zone respectively. Currently the price is at the middle of this range and we might see the price to reach the bottom first of all in case it breaks down and may move lower if in case we get a false break we may expect the price to move higher and reach the top of the range.

Western Union Daily:

On the daily chart the price has created a double bearish cycle which has completed itself. We also have confirmation of reversal in the form of bullish divergence and the breakout of the down trendline. Now the price is moving lower which is expected to be a correction and once this correction ends. We are after buys.

Western Union H4:

On the H4 chart we are following this potential correction (shown in the screenshot) that is happening at the moment. We want last low to hold in order to look for buys here (18.40). If last hold doesn’t hold we will probably see 16.50 level.

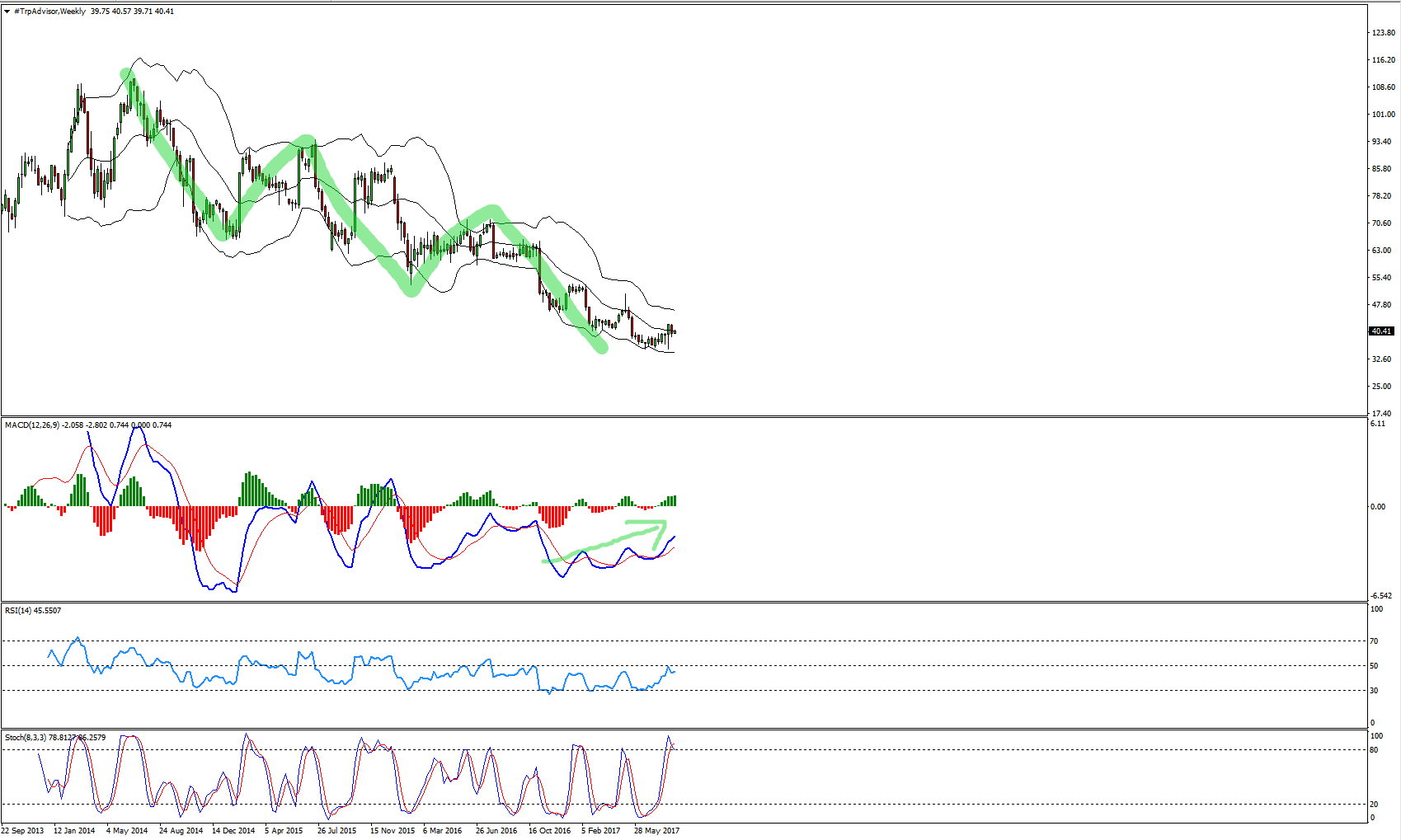

TripAdvisor Weekly Chart:

We are following this bearish cycle on the weekly chart which seems like it has come to its end. We also have a bullish divergence that has formed which we may consider as a factor for confirmation of bullish reversal.

Trip Advisor H4 Chart:

On the H4 chart the price has created higher highs already and currently it looks like a small correction is happening and once this correction completes itself, we may expect the bullish momentum to continue and the price to reach higher.

You want to trade such predictions automatically? You want a robot that will help you to analyze the markets and show you the strong dates for bullish and bearish reversals? You want a robot to show you the great support and resistance zones?

You can get the Forex Crystal ball for free!. You can get it here Download and make your trading life easier!

You can get more trade ideas by joining my club for free now. You can enroll today here:

Also you can get one of my strategies free of charge. You will find all the details here

Yours,

Vladimir

Your trading style is unique. love it Vlad

Perfect analysis