The US Dollar traded mixed after yesterday’s FOMC meeting minutes, as there was hardly anything new in

minutes. The US Dollar traded lower a few points, but later managed to move back higher.

However, the most important thing to note from the latest FOMC meeting minutes is the fact that an interest-rate

high is very unlikely in April. It was clear from the fed officials that the fed will take action cautiously until they

start to see some real signs of the global economy picking up.

Another point to note was that a few fed officials were in favor of increasing interest rates in April as well. So, we

can say there are mixed views on the subject. I think it will depend more on the incoming data, and if the labor

market continues to gain momentum, and inflation heads towards 2%, we can see more interest rate hikes.

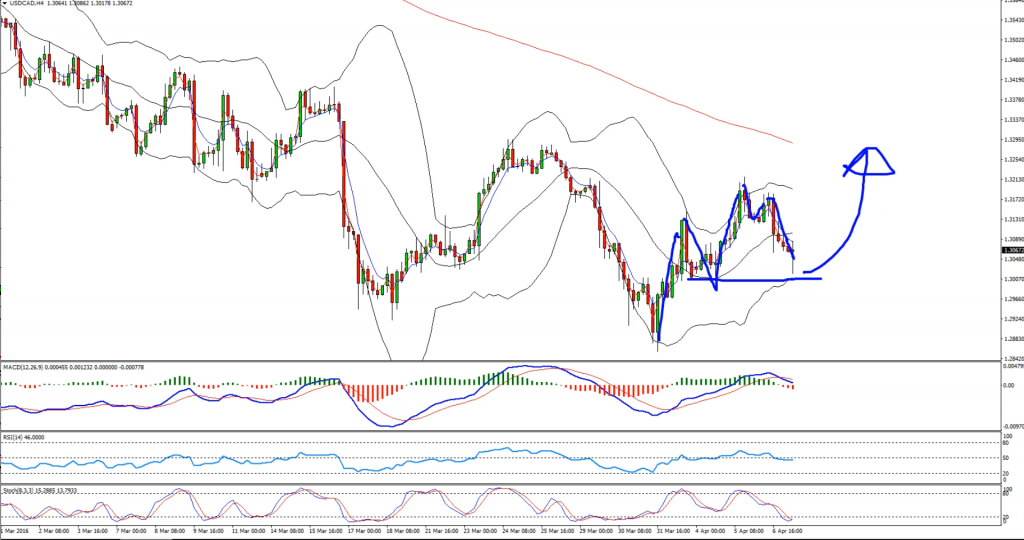

So, there is a chance in the near term that the US Dollar may gain. If we look at the 4-hours charts of the USD/CAD

pair, then it is likely completing a cycle and could find a support near 1.3000-20 for another ride higher.

Technical Analysis

H4 – The 4-hours chart of the USD/CAD pair highlighting a potential cycle completion and a move higher.

Buy Entry:

H1 – Looking at the hourly chart of the USD/CAD pair, there is a minor trend line break noted. Moreover, there are

a few support levels forming near 1.3050-60 from where the pair may bounce.

There is already a potential divergence forming, so we can wait for a false break below the highlighted support

area, a close back above it, and once a bullish candle is formed we can enter a buy trade.

Target 1: 1.3150

Target 2: 1.3200

Stop Loss: 5 pips below 1.3000.

Fundamentals events and Economic news to watch out

Recently in Canada, the Ivey PMI that captures business conditions was released by the Richard Ivey School of

Business. The market was aligned for a rise from 53.4 to 55.0 in March 2016.

However, the result was not as expected, as there was a decline registered in the Ivey Purchasing Managers Index.

It posted a reading of 50.1 in March 2016, and just managed to stay above the neutral level of 50.0.

The report stated that “Employment index (seasonally adjusted) for March stood at 50.7. Inventories (seasonally

adjusted) 48.6, Supplier Deliveries (seasonally adjusted) were 48.5, and Prices were 58.5. The Ivey PMI unadjusted

data for the month of March is 57.9, Employment 50.7, Inventories 50.8, Supplier Deliveries 50.7, and Prices 62.0”.

Overall, the report was not positive, which resulted in a downside move in the Canadian dollar. It also matches our

view with a short-term upside move in the USD/CAD pair. So, I think our idea of buying the pair may work very well

as long as it stays above the 1.3000 area.

Today, the Canadian Building Permits report will be released by the Statistics Canada, which is forecasted to post

an increase of 4.8% in Feb 2016. We need to keep an eye on this event for more action in the Canadian Dollar.

Good Luck with trading traders!

Questions are welcome.