Hi Traders, after a quiet August, the markets are back in full swing — and September is already shaping up to be very exciting. In this week’s Forex forecast, we will review the EUR/USD, GBP/USD, Gold (XAUUSD), and Bitcoin with a detailed technical and fundamental outlook.

As always, a special thank you to our partners at Eight Cap Broker for supporting our community and providing fantastic trading conditions.

? Watch the Full Weekly Forecast Video

Click the link below to watch the forecast video on YouTube

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

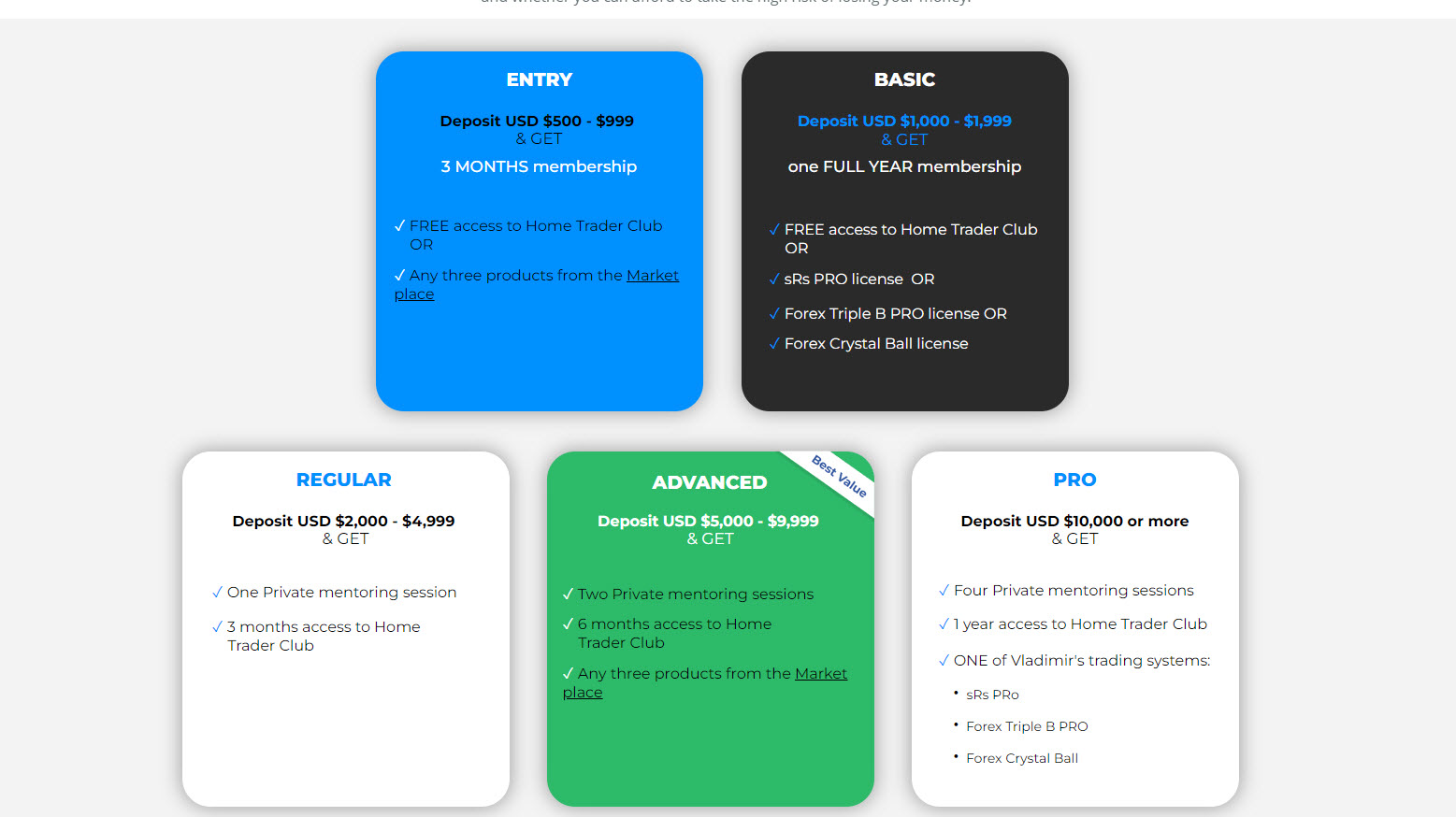

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Let’s dive into the charts and explore this week’s trade setups for EUR/USD, GBP/USD, Gold (XAUUSD), and Bitcoin

? EUR/USD Outlook

The Euro-Dollar pair spent most of August consolidating, which makes sense after its prior declines. Now, with the Federal Reserve rate decision approaching in September, traders are preparing for increased volatility.

Markets are expecting not only a rate cut but also hints of further easing into 2025–2026, which keeps the USD under pressure.

Technical Analysis

-

Weekly Chart: The Euro is trading between broken support (now resistance) and its last high. Interestingly, it has been riding the upper Bollinger Band for more than 20 candles without a retrace, which often signals growing bearish pressure.

-

This behavior resembles 2020’s pattern, when a final rally completed before a major bearish divergence triggered a trend change.

-

Daily Chart:

-

If EUR/USD breaks and holds above the resistance zone, upside potential extends to 1.19–1.20, possibly even 1.22–1.23.

-

Alternatively, the price might create a range and then we may expect a potential continuation higher.

-

Or a deeper correction could trap buyers and drag the pair back toward the 1.14–1.13 volume profile support zone before resuming a rally.

-

-

? Trading Plan:

-

Bullish scenario (60–70% probability): Buy retracements after a breakout above resistance.

-

Bearish alternative: Wait for failure at highs and look for correction setups into 1.14–1.13.

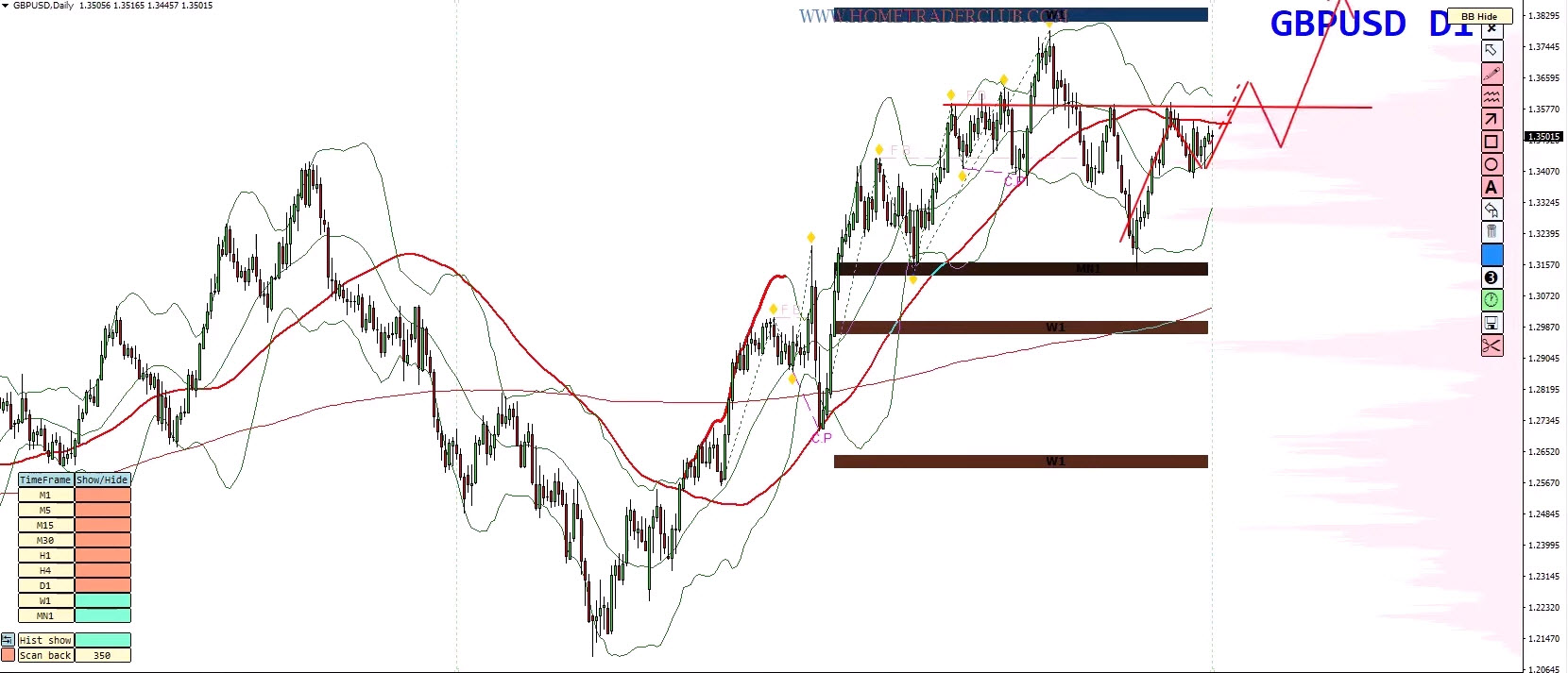

? GBP/USD Outlook

The Pound-Dollar setup mirrors the Euro’s structure but has its own nuances.

Technical Analysis

-

Daily Chart: GBP/USD is forming a mini-range and holding above its volume profile support zone.

-

However, it’s testing a supply area that could either stall the rally or break to confirm further upside.

-

If the pair clears this supply zone and retests successfully, it could extend higher toward 1.40.

-

Conversely, if supply holds, the pair risks a drop, especially if the Fed signals a slower pace of cuts.

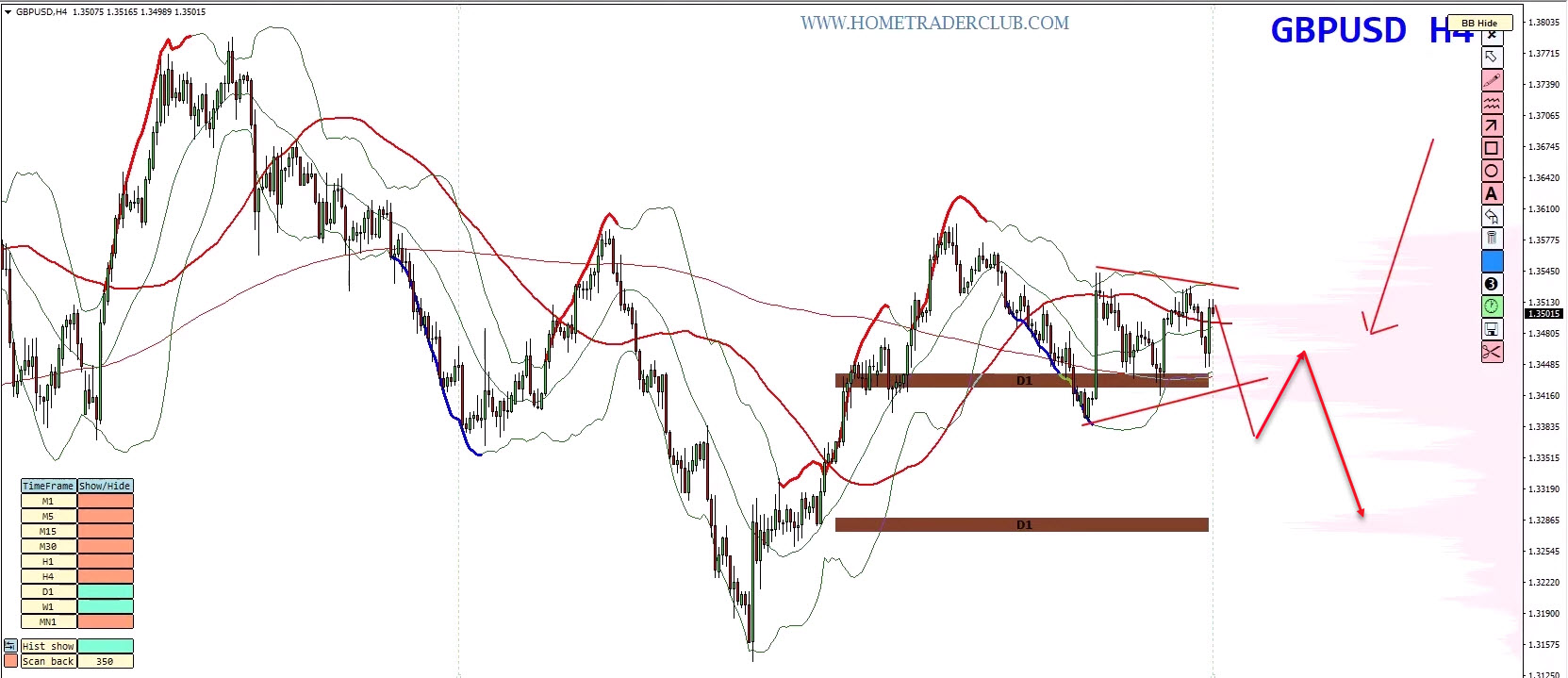

4H Chart Key Levels

-

Watching a developing range structure.

-

A downside break would fit an ABCD correction before longer-term buys.

? Trading Plan:

-

Bullish: Buy dips if GBP/USD breaks above supply, targeting 1.40+.

-

Bearish correction: Sell rallies if the range fails and price drops under key support, aiming for deeper retracements.

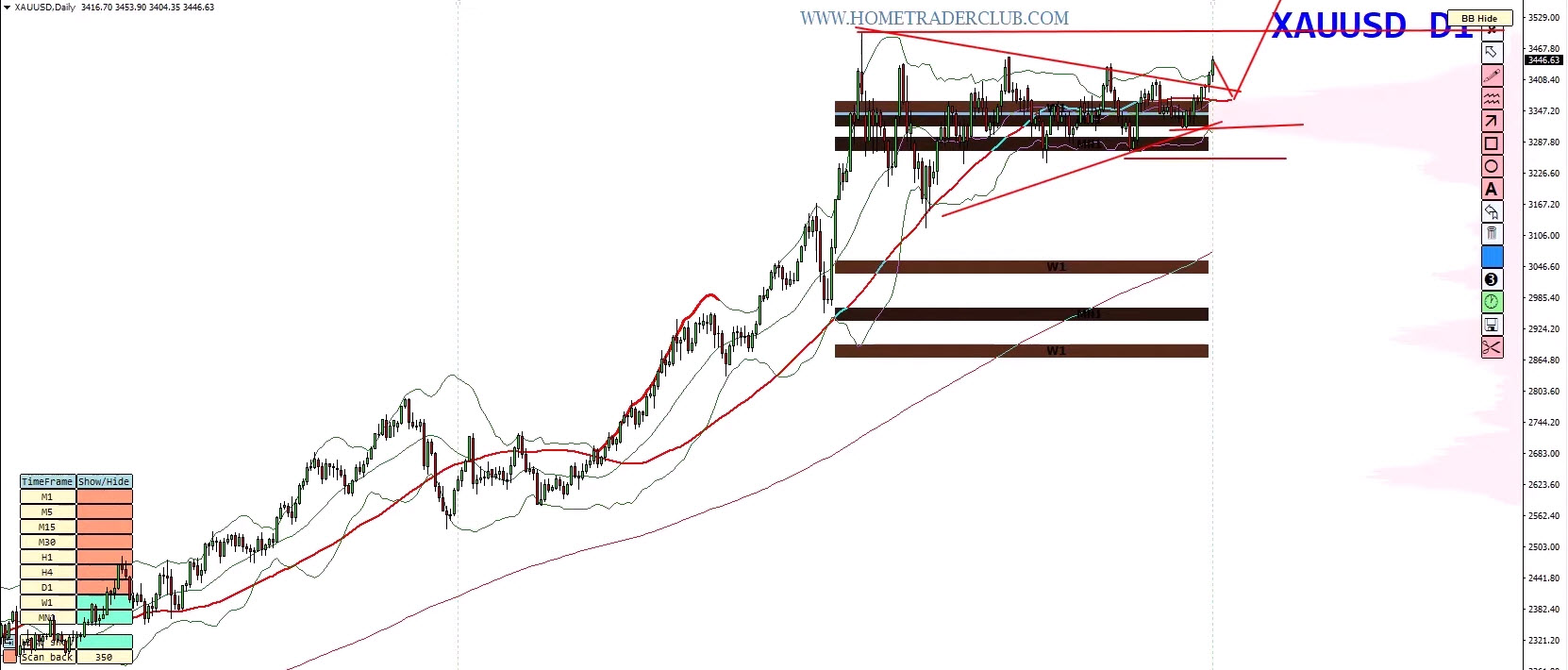

? Gold (XAUUSD) Outlook

Gold finally broke free from its four-month consolidation range. The key question: is this the start of a major rally, or the final leg before a reversal?

Technical Analysis

-

Monthly/Weekly Charts:

-

Short-Term:

? Trading Plan:

-

Short-Term: Buy dips while trend holds.

-

Medium-Term: Prepare for potential reversal setups once divergence completes.

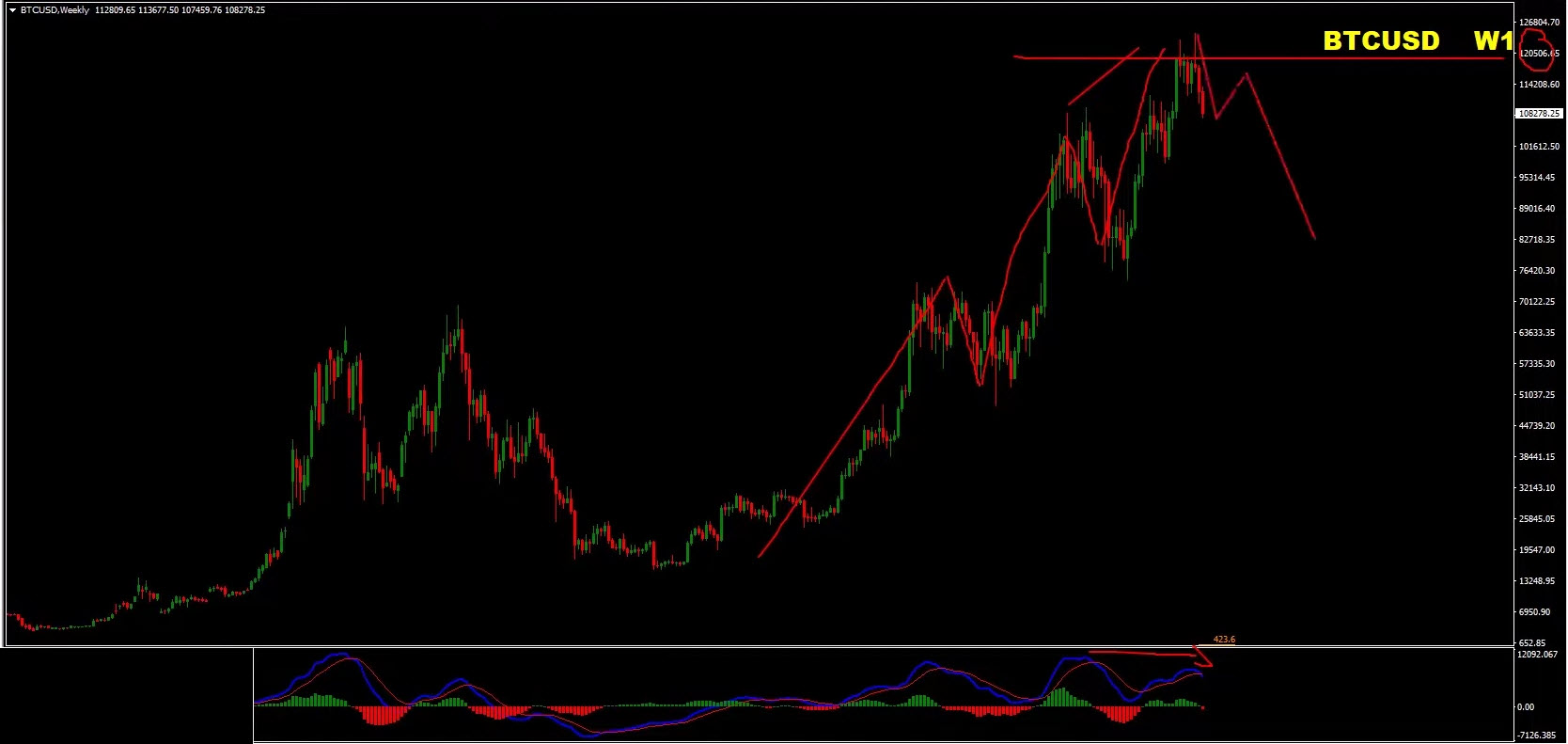

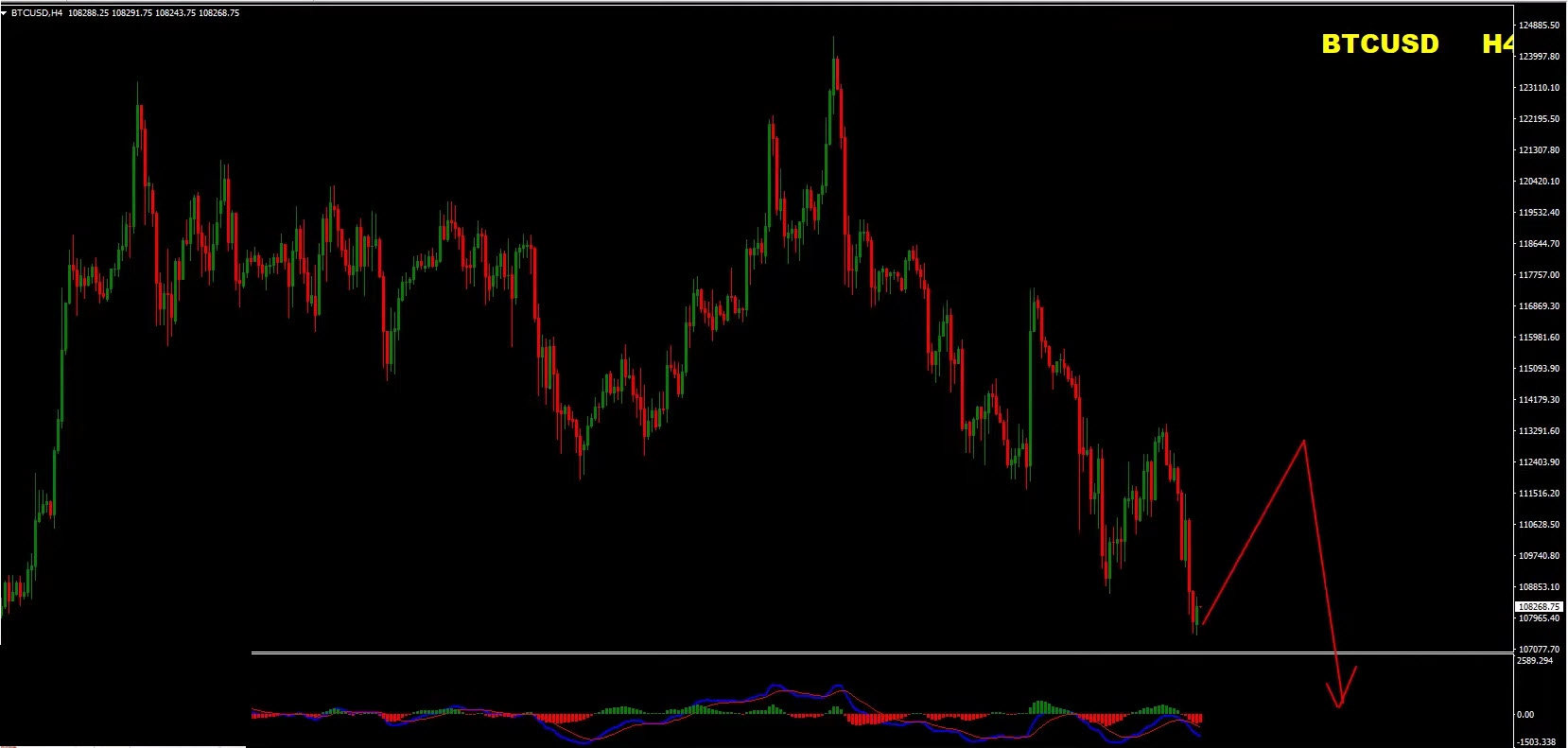

₿ Bitcoin Outlook

While crypto is not always part of our weekly analysis, Bitcoin presents an interesting case.

Technical Analysis

-

Weekly Chart: Bearish pressure is strong after three waves up and a rejection near 120,000.

-

Daily Chart:

-

Short-term pullbacks may occur, but the broader structure suggests Bitcoin could retest 105,000 and even the psychological 100,000 level.

? Trading Plan:

-

Sell the rallies while below 120,000.

-

Target zones: 105,000 → 100,000.

? Key Takeaways

-

EUR/USD: Bullish bias toward 1.19–1.23, but watch for correction into 1.14.

-

GBP/USD: Bullish if supply breaks; bearish correction possible if range fails.

-

Gold: Short-term bullish above support; medium-term risk of reversal.

-

Bitcoin: Bearish pressure intact; rallies are sell opportunities.

? Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

? Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club