Hi Traders! Weekly summary and review July 30th, 2021 is here. It is now time to recap and summarize the trade setups that we had during this week. Below you will find the short explanation of all the trade setups we had in this week and how it has currently developed now.

Trading Ideas (Blog Posts)

USDCAD – My idea here was “On the H1 chart, based on the Heikin Ashi candles we can see that currently, we have strong bearish bodies here as well in downward moving market conditions so it basically reflects a bearish environment. Until this condition changes my view remains bearish here. In addition to this, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a flat correction is happening in the form of a range. So based on all this my view here is bearish and I expect the price to move lower further in the short term”.

Current Scenario – On the H1 chart, my view was bearish and I was expecting the price to move lower further. The price action followed my analysis exactly as I expected it to here. The price which was moving higher reached the top of the range, respected it and bounced lower. The price then moved lower further as I expected it to and delivered 180+ pips move so far.

Current Scenario – On the H1 chart, my view was bearish and I was expecting the price to move lower further. The price action followed my analysis exactly as I expected it to here. The price which was moving higher reached the top of the range, respected it and bounced lower. The price then moved lower further as I expected it to and delivered 180+ pips move so far.

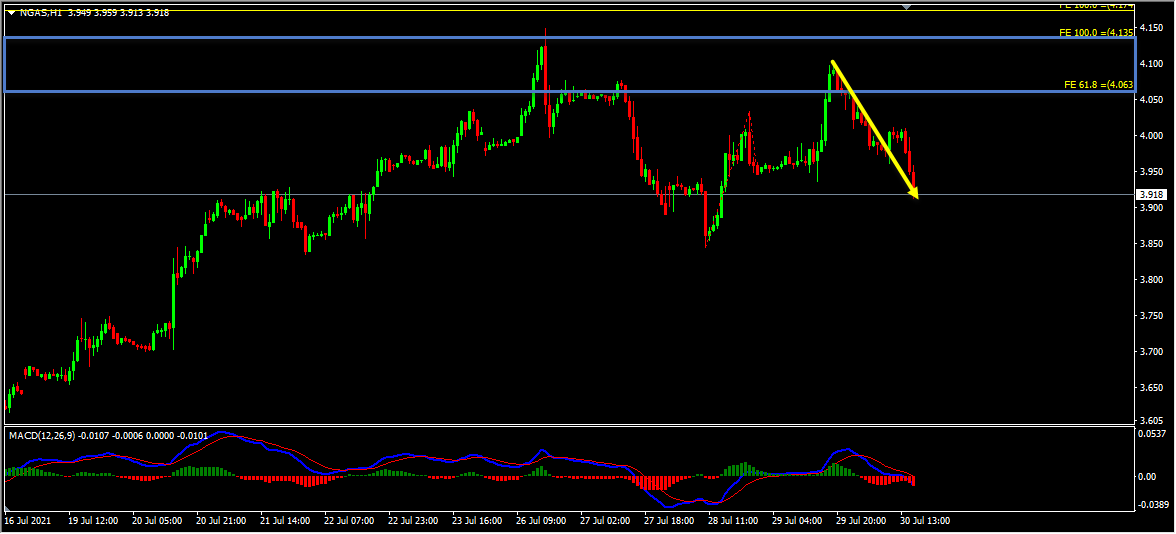

Natural Gas – My idea here was “On the H1 chart, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening in the form of double wave to the upside. While measuring the first wave of this correction we have a key resistance zone that has formed by the 61.8%(4.063) – 100%(4.135) Fibonacci expansion levels. Until this key resistance zone holds my short term view remains bearish here and I expect the price to move lower further”.

Current Scenario – Based on the above-mentioned analysis my view was bearish here and I was expecting the price to move lower further until the key resistance zone holds. After the bearish trend pattern the correction that I was looking for happened in the form of double wave to the upside. The price reached the key resistance zone, respected it and the price which is moving lower has provided a nice move to the downside so far.

Current Scenario – Based on the above-mentioned analysis my view was bearish here and I was expecting the price to move lower further until the key resistance zone holds. After the bearish trend pattern the correction that I was looking for happened in the form of double wave to the upside. The price reached the key resistance zone, respected it and the price which is moving lower has provided a nice move to the downside so far.

Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

For similar trade ideas and much more I invite you to join the Traders Academy Club and improve your trading with us.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician