* The US Dollar was seen trading higher not only against the Euro, but also against the British Pound and Aussie Dollar.

* Commodities such as GOLD, SILVER and Oil were also seen trading lower during the past couple of sessions.

* There is a major risk event lined up today during the NY session, as the U.S. GDP report will be published by the US Bureau of Economic Analysis.

* Moreover, the U.S. Personal Consumption Expenditures figures will also be released by US Department of Commerce today.

* The market is positioning itself for the next move ahead of all critical reports, and we may witness swing moves in the US Dollar before and after the release.

U.S. GDP

Today, the United Stated of America will witness a major economic release. The Gross Domestic Product figure, which marks the monetary value of all the goods, services and others on annual basis will be reported by the US Bureau of Economic Analysis.

The forecast for the fourth quarter of 2015, compared with the same quarter a year ago is slated for a growth rate of 1%. So, as per many analysts’ predictions, the US economy is forecasted to grow by 1% in Q4 2015.

The report which will be released today will point the final estimate of GDP growth for the fourth quarter of 2015. If we look at the past records, then there can be substantial difference in values between advance and final numbers.

An analysis conducted by CNBC points this as they quote “the margin of error between advance and final numbers can be so broad as to render early estimates virtually useless”. In short, we can saw a major deviation between advance and final numbers.

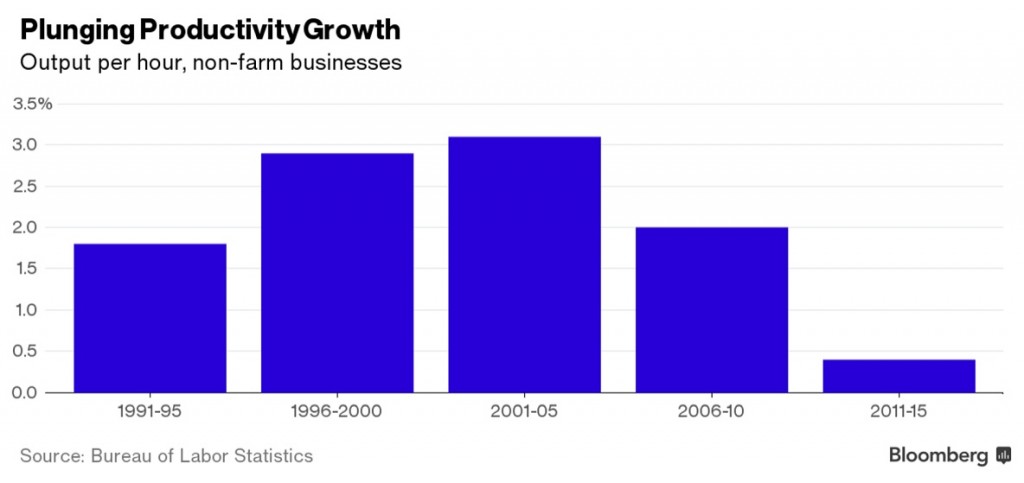

One key focus will be on the poor productivity and rising labor costs. Investors and companies might be keeping a close watch on the numbers.

Asian Session Recap

Today, there was a critical economic news in Japan. The National Consumer Price Index was published by the Statistics Bureau. The forecast was slated for an improvement from the previous reading. The report highlighted that the measure of price movements rose by 0.3% in Feb 2016, compared with Feb 2015.

The report stated the “consumer price index for Japan in February 2016 was 103.2 (2010=100), up 0.1% from the previous month, and up 0.3% over the year”.

Overall, the Japanese CPI failed to ignite a rally in the Japanese Yen. There was hardly any major reaction among the Yen pairs. The USDJPY pair was seen trading with a positive tone during the past couple of sessions, and it looks like the pair is waiting for the upcoming U.S. GDP release for the next move.

Technical Analysis – USDJPY

As of writing, the US dollar traded above the 113.00 resistance area against the Japanese Yen, and was seen trading with a bullish sentiment. It would be interesting to see how far the pair can move and whether it can continue heading higher.

On the upside, the next resistance area could be around the 113.20 levels, followed by 113.45-50. On the downside, the 112.80 level can act as a pivot area for the USD/JPY pair ahead of the U.S. GDP release.

Good Luck traders!