One of the largest Venture Capital firms in the world, Andreessen Horowitz raised a staggering $300 million for its crypto-fund. The fund is famous for backing Internet giants like Facebook, Twitter, AirBnB, and Lyft become the first VC firm to have raised such a huge amount to wager on the nascent crypto market. The fund will be focusing on incorporating the traditional features of venture capital in the crypto world.

What is new?

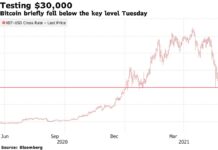

Andreessen Horowitz has brought the first female general partner Katie Haun who was a former prosecutor in the U.S. Department of Justice. She will mainly be involved in leading the fund. The regulatory background of the female General Partner shall strengthen the fund and the investee companies. Although there has been a decline in the value of cryptocurrencies, the VC is able to foresee a bright future for the industry as a whole. This fund marks it first structured vehicle for aggressively investing in the same. It had already invested in blockchain companies like Coinbase, Ripple and CryptoKitties. The company is looking to use the downturns in the industry to its advantage by picking up investments at a floor price.

The VC will look at all types of non-speculative investments for the fund. They will range from directly funding the companies at the seed stage to buying tokens of mature companies. The thesis is that blockchain represents a new era of computing which will allow for eliminating the middlemen and powering trust through a distributed ledger system.

Impact & Approach

Investment criterion for the crypto funds will be flexible and the fund will range across different geographies and asset types. Another General Partner of Andreessen, Chris Dixon emphasized that the crypto fund is independent of other funds and it will not have any cross-sectional impact or vice-a-versa.

The firm is following a patient, long-term approach and the money will be invested in the fund in the next two-three years and the investments shall be held for a longer time duration to ride out any short-term volatility in the markets. Well aware of the current situation of the market, Andreessen is anticipating that there will be several ups and downs in the future. The firm will mainly look at the long-term growth of the funds which means, that the short-term, day to day fluctuations would be ignored.

The Growth of crypto investments over the years and ICOs

Partner Chris Dixon also drew a conclusion on the growth trajectory of the crypto field and believed it is on similar lines to the smartphone app development phase. ICOs are currently not on the cards for the firm. However, once Andreessen figures out a better framework, it would aim to provide a wider access to capital.

The Future Plan

Andreessen Horowitz stepping in the crypto sector at a time when currencies like Bitcoin are hitting yearly lows highlights the firm’s commitment to the blockchain crypto industry. With a 10-year investment horizon, he can face any short-term volatility and can HODL to generate long-term massive returns. The aim is to create a diversified portfolio and to help the crypto world evolve to solving real-world issues

Thanks for sharing this article Vlad