Hi Traders! AUDNZD forecast follow up and update is here. On March 17th I shared this “AUDNZD Forecast And Technical Analysis” post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

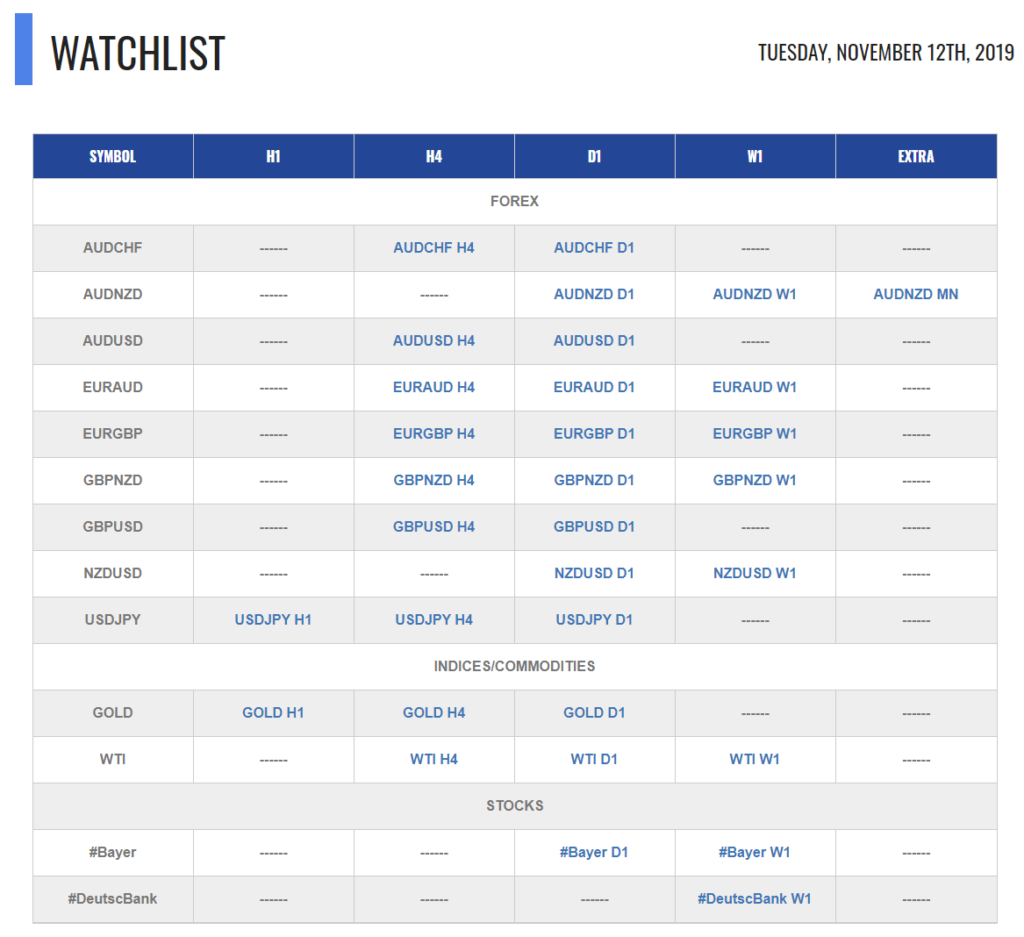

My idea here was “On the H1 chart after the strong bearish move, currently, it looks like a correction is happening in the form of consolidation. While measuring the first wave inside this consolidation using the Fibonacci expansion tool we could see that the 61.8% (1.07686), 100% (1.07823) Fibonacci expansion levels of the first wave coincides with the top of the consolidation which makes this area a strong resistance zone. Until this strong resistance zone holds my view remains bearish here and if we get a valid breakout below the bottom of this consolidation we may consider it as a validation for the bearish view and may expect the price to move lower further”.

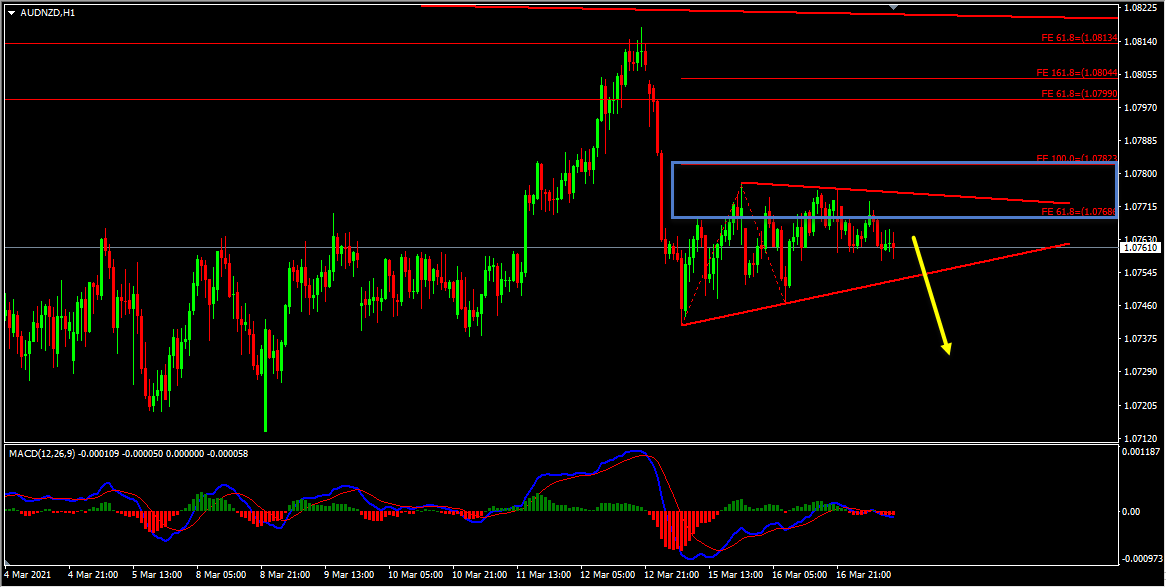

AUDNZD H1(1 Hour) Chart Current Scenario

Based on the above mentioned analysis my view here was bearish and I mentioned that “Until the strong resistance zone holds my view remains bearish here and if we get a valid breakout below the bottom of this consolidation we may consider it as a validation for the bearish view and may expect the price to move lower further”. The price action didn’t follow my analysis here and this idea failed. The price broke below the bottom of the consolidation but the candle didn’t close below the bottom of this consolidation and then it moved back inside the consolidation. Also, there were no signs supporting the bearish view. The price then moved higher and broke above the key resistance zone thus invalidating this bearish view.

So traders, this is why I wanted to show this example to help you understand why we should always trade based on the facts and hints provided by the market and take the right actions according to that. Also, you should keep in mind that losses are part of trading we can’t expect every trade to go as per our plan and provide us profits. In trading, we can’t avoid losses but in order to be successful in trading, we should know how to cut losses early and how to manage the trade when the price goes in the opposite direction.

So traders, this is why I wanted to show this example to help you understand why we should always trade based on the facts and hints provided by the market and take the right actions according to that. Also, you should keep in mind that losses are part of trading we can’t expect every trade to go as per our plan and provide us profits. In trading, we can’t avoid losses but in order to be successful in trading, we should know how to cut losses early and how to manage the trade when the price goes in the opposite direction.

Note: You can watch my webinar on how to cut losses early here

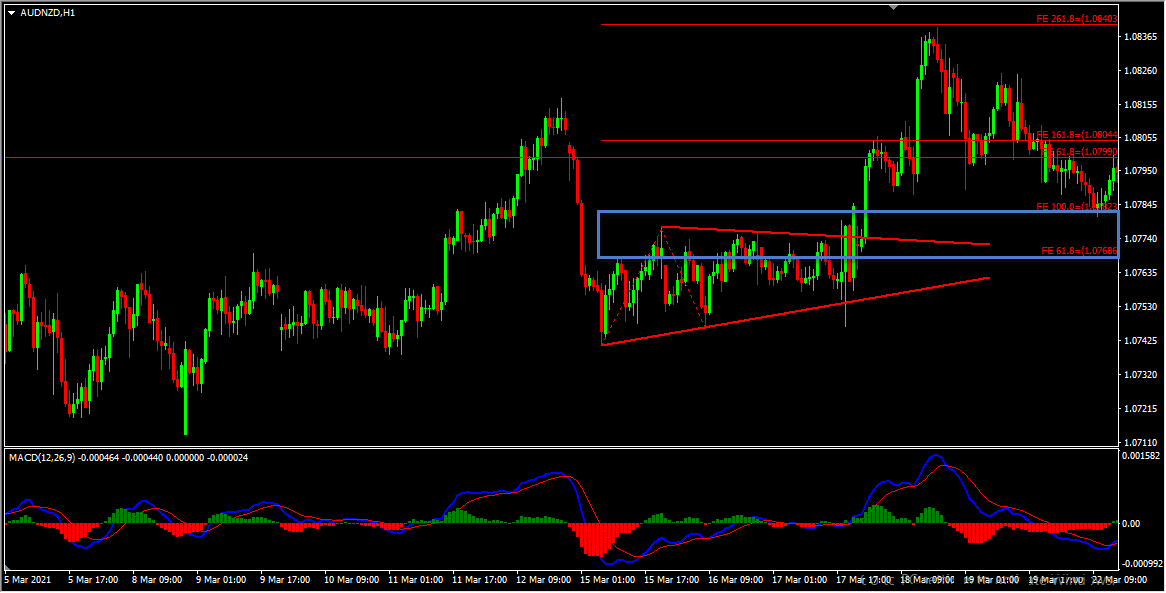

In order to learn about this and much more, I invite you to join the Traders Academy Club and you can also get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course, Live Market Analysis every single day.

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Yordan Kuzmanov

Chief Trader at the Traders Academy Club