Bitcoin Options introduction subdued in wake of Futures Letdown. Bitcoin advocates are taking a more measured approach over the introduction of options for the world’s largest cryptocurrency after the wild ride they took with futures.

While the contracts that provide the right, but not the obligation, to buy or sell a specified amount of coins within a set time period have been available on some online exchanges, they’re heading for the mainstream, just as futures did during the height of the crypto mania in 2017.

A consortium known as Bakkt, which includes the parent company of the New York Stock Exchange, began offering options earlier this month. CME Group Inc., one of the first U.S. regulated exchanges to offer Bitcoin futures, will launch their own options on Jan. 13.

“It’s hard to say who exactly will show up on day one,” Tim McCourt, global head of equity index products at Chicago-based CME, said in a phone interview.

In the case of futures, the debut session on the Cboe Global Markets Inc.’s exchange in December 2017 triggered trading halts as volume surged beyond dealers’ expectations. A year and a half later, the Cboe stopped listing the futures as demand evaporated in the wake of the bursting of the crypto bubble in 2018.

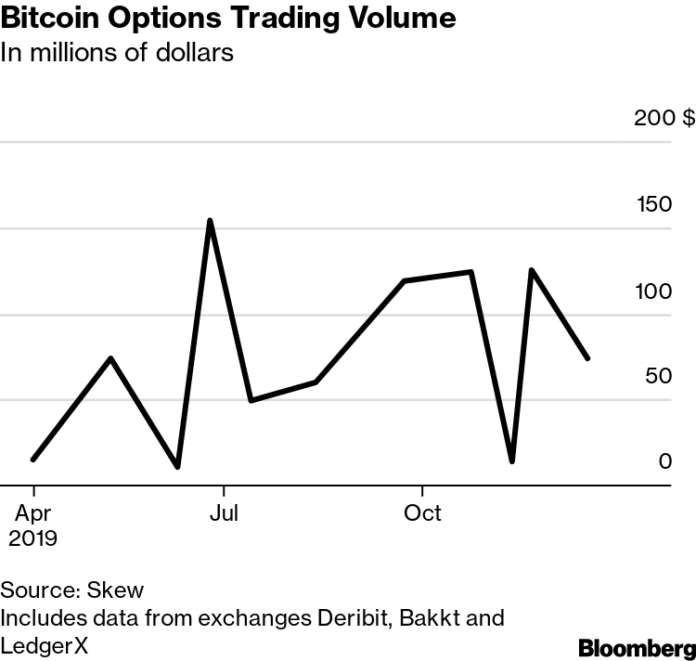

Up until now, options trading has been mostly a niche of professional traders. Average daily volume has hovered around $22 million for the past year, with more than 95% happening on just one exchange, Deribit, according to derivatives tracker Skew. That compares with $1 billion in daily volume for Bitcoin and about $10 billion for the Bitcoin futures market.

Traders may be most excited by the Dec. 27 introduction of options by OKEx, a popular exchange in Asia that is registered in Malta. Like many crypto trading platforms, the companies are adding more complex avenues to wager on price moves with Bitcoin no longer just going straight up.

While Bakkt and CME serve many institutional clients, most continue to stay away from the crypto market, spooked by greater regulatory and political scrutiny, an abundance of scams and the coins’ huge volatility.

“A lot of people are excited without knowing why exactly,” Sam Bankman-Fried, who heads large cryptocurrency trader Alameda Research, said in a phone interview. “Sometimes people go through a lot of work to list options, and there’s no one buying it.”

Bankman-Fried, who also co-founded the FTX derivatives exchange, said options can be helpful for so-called miners and people holding vast quantities of coins such as hedge funds that won’t or can’t sell them. Options can then offer a way to cut volatility risk. Some retail investors may wish to speculate using options as well.

“You get a little bit bored staring at the same graph all day,” said Bankman-Fried, who is planning to offer options on his exchange. “Options offer a legitimately new thing for them to be trading.”

While many crypto holders used to lend out their coins, yields on such lending have declined, and many coin owners may make more money by using call overwriting strategies, instead, said Josh Lim, head of trading strategy at Galaxy Digital Holdings Ltd. in New York.

Beyond Bitcoin, demand for options is questionable. At Deribit, which began offering Bitcoin options in 2018 and Ether options earlier this year, interest in Bitcoin option contracts has held up, but orders for Ether contracts have been waning since May, according to the company’s data.

“A lot of people ask us, ‘why don’t you do Ripple options?’ and it’s a lot of work,” Luuk Strijers, an executive at Deribit, said in a phone interview from Amsterdam. “I don’t think the options space is ready for smaller coins than Ether. It’s simply too small.”

Still, as more exchanges offer contracts, the crypto options market could grow 10 to 20 times in size, Strijers said. He points to Amazon.com Inc., where trading volume of options on its stock is just a tad lower than the trading volume of its shares.

“This will reduce spreads and improve liquidity in the market,” said Kyle Samani, co-founder of Austin, Texas-based Multicoin Capital Management LLC.

That said, the same argument was made about futures when the price of Bitcoin was more than double the current value.

I am a traders academy club member,can I get pass for VIP price action course?

Hi Jonathan

No, the offer is a new offer and you can enjoy it right here –

https://vladimirribakov.com/christmas-offer/

Thank you Vlad