The British pound suffered heavy losses recently especially against the US dollar. The GBPUSD pair even traded below the 1.5600 support area and traded as low as 1.5550 area where the British pound buyers somehow managed to hold the downside in the pair. The economic releases in the UK recently were on the negative side, which was one of the reasons for the bearish pressure on the GBPUSD pair.

There were a couple of important economic releases lined up during the last couple of days, including the manufacturing production and the industrial production. The outcome of both releases was lower than expected. However, the FX market sentiment was favoring the US dollar sellers so the downside was limited in the GBPUSD which mostly traded in a range.

UK Industrial Production

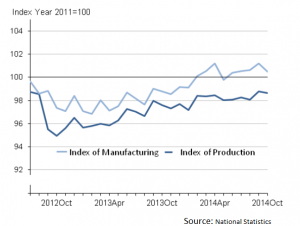

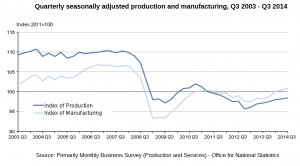

The first important release in the UK was the industrial production data, which was released by the National Statistics. The market was expecting the industrial production to increase by 1.8% in November 2014, compared with the same month of the last year. However, the outcome was lower than expected as it grew only by 1.1%. Moreover, the previous reading was also revised down from 1.5% to 0.8%. The report added that the total production in October 2014 is estimated to have decreased by 0.1% compared with September 2014.

The GBPUSD traded lower after the release and failed to break the 1.5700 resistance area. The British pound sellers were seen aggressive but partially offset by the US dollar sellers. There were some ranging moves noted in the near term.

UK manufacturing Production

The second major release in the UK was the manufacturing production data, which was also released by the National Statistics. The market was expecting the manufacturing production to increase by 3.2% in November 2014, compared with the same month of the last year. However, the outcome was lower than expected as it grew only by 1.7%. This was a lot lower from the last time gain of 2.9%. The report added that the “main manufacturing components contributing to the fall between September 2014 and October 2014 were computer, electronic & optical products; basic pharmaceutical products & pharmaceutical preparations; and chemicals & chemical products”.

The pair continued to range trade as both releases were around at the same time. The most important point to note that sellers failed to capitalize on bad report and still remained higher Intraday.

UK Trade Balance

Today, the UK trade balance report will be released. The forecast is slated for a better reading than the last time. If the outcome exceeds the forecast, then the British pound might come continue trading higher.

Technically, the GBPUSD might form a base around the 1.5600 area where the British pound buyers are likely to take a stand. On the upside, a break of the 1.5700 resistance area might take the pair towards the 1.5800 level.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast