Trading forex currency pair correlations is one of the most effective ways to increase the volume of trading opportunities as a forex trader.

While effective trading strategies are a dime-a-dozen, implementing forex currency pair correlations into your trading can result in unforeseen investment opportunities that not only diversify your portfolio but also lead to an influx of trading profits.

With these truths in mind, we’ll go over what currency pair correlations how, how they are formulated, and seven currency pairs to watch for correlations as of 2020.

So, without further ado, let’s dive in.

What are Currency Pair Correlations?

If you’re a technical-based trader that employs graphical charts into your trading strategy then you have undoubtedly noticed how some currency pairs appear to rise and/or fall in relation to one another.

This ‘relationship’ between currency pairs is known as a correlation.

Currency pairs can either have a positive or negative correlation.

A positive correlation reflects a complementary influence on correlated currency pairs, which means that if a currency pair is positively correlated with another then that correlated currency pair will likely rise and fall in congruence with your starting currency pair.

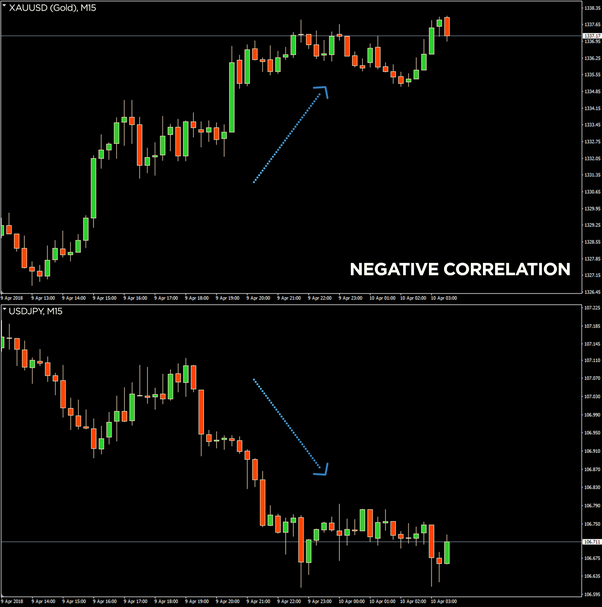

As you have probably deduced already, a negative correlation reflects an opposing influence where the negatively correlated currency pair tends to behave the opposite of the original currency pair.

Therefore, should the price of the starting currency pair rise then your negatively correlated currency pair is likely to depreciate and vise versa.

Now, it is important to remember that correlation does not mean causation.

Which means, just because a currency pair appears to have a strong correlation with another does not necessarily always mean that it will behave in such a capacity.

That is why they are called correlations, not causations.

How are Currency Pair Correlations Determined?

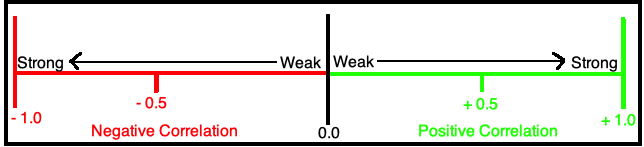

Determining a currency pair correlation is done through a simple correlation coefficient, which ranges between -1 and +1.

As you may have guessed, positive correlation reflects a positive value while negative correlations reflect a negative value.

Assuming that a perfect position correlation is in effect, a correlation coefficient of +1 will compute which means that two currency pairs are strongly likely to move in the same direction as one another.

A perfect negative correlation means ( -1) indicates that both currency pairs are likely to move in opposing directions.

If correlation should ever compute to 0, then both currency pairs possess no correlation to one another.

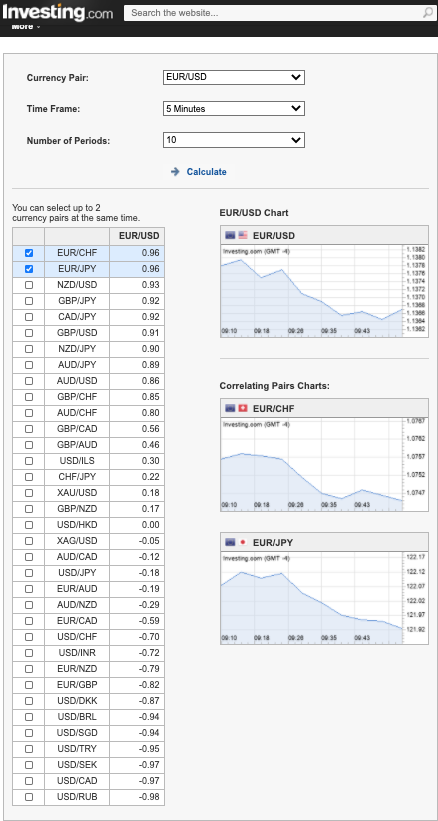

There is a simple and highly effective forex correlation calculator at Investing.com.

Simple, select which currency pair you primarily invest, the designated time frame, and the number of periods and you will see the strength in which multiple currency pairs are correlated with your inquired currency pair.

In the case of the image below, both the EUR/CHF and EUR/JPY share an exceptionally strong positive correlation with the EUR/USD while the EUR/RUB reflects the greatest negative correlation.

Now, there is another important note to bear in mind regarding correlations.

Just as the financial markets evolve, so do currency pair correlations.

Currency pairs that once reflected strong correlations several weeks ago may begin to diminish in correlational strength, it all just depends on how the financial markets are interacting and behaving.

With these facts in mind, if you are a trader who invests daily, it would not hurt to double-check your currency pair correlations every day before trading, not only will it serve as a confirmation but also ensures you’re doing your due diligence as a trader so that way you are propping yourself into the best position possible for success.

Top 7 Currency Pairs for Correlations

When it comes to determining which currency pairs you’d like to use for correlations then a good rule of thumb to use would be the currency pairs that possess the most liquidity.

This means that they lead the markets in market volume, tend to possess a greater deal of volatility, and are amongst the most heavily traded assets.

These include currency pairs such as:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

- USD/JPY

Putting It All Together

Traders can significantly benefit from incorporating currency correlations into their forex trading strategy.

The ability to generate more high-probability trading signals due to strong correlations is a powerful additive that cannot be stressed upon enough.

So long as you possess a consistent and effective trading strategy (which if you don’t we have plenty of on our site) you too can begin to take advantage of strong positive and negative currency correlations.

Remember, correlation does not infer causation and that currency correlations can change over time!

Last not but least, when computing currency pair correlations it is important to ensure that the period and timeframe are equal to what is present on your charts.

Thank you for taking the time to read what I hope was an insightful read for you.

Here are a few additional resources that may prove of value to you:

Tim Lanoue

Guest Blogger