First part of the EA or robot article received a lot of feedback from our readers and prior to the Brexit vote tomorrow here comes the second part. Today I will continue on the subject with more interesting questions that i have gather from my readers in the past year or so.

Can you blindly rely on a robot for the long run?

The answer is almost no. As you already know the market is a mixture of many variables. When these variables are changing the market prices are changing. Looking at the big picture what is an EA actually? The robot is a software with a set of rules defined by the trader. And here comes the problem. If your set of rules is working today and has been working in the past year or so, there is no guarantee that it will work in two years from now or five.

Let me give you an example. One of the methods that I use to trade for myself is divergences. I have been using them for years now and I will continue to do so. I have even created the Divergence University where all the information and experience I gained during the years is put together and organized in one place as a home course.

I have created a strategy based on divergences called LST. Why am I telling you all that you may ask? BECAUSE, despite my experience, despite my budget to hire the best programmers, i still don’t see a way to create 100% automated divergence robot. Human eyes and brain are commonly unappreciated. For example the LST strategy would scan the market, filter the bad setups, give you alerts and popups etc BUT I will never make it work 100% without the trader pulling the trigger and giving the final yes or no.

There is just too many variable and traps. It is very hard to think of them all, predict them, define them and code them. I’m not saying it is impossible, but it will be very hard to accomplish and quiet expensive. No way a 100% working robot will cost $99.

Why 99% of the robots sold are scam?

There are thousands of reasons but here is the most important ones in my opinion. First of all if you can make money “hands free” why sell the software for a hundred bucks? Why not charge 10,000 or 100,000? If it really delivers there are banks and hedge funds that will buy it right away. They would pay even more.

Second reason. If you are making money and you can prove it why sell your golden goose when you can manage money for others and live off the commissions and fees? 100% risk free for you (capital wise), 100% hands free. Believe me there are people ready to invest right on the spot. Big money too. Managing only 100k or 200k and making 3% return a month, while keeping 50% of the profits means 3k goes to you. What if the amount is 500k or 1 mil? What if the return is 5% on average?

It is really really simple to understand and filter 99% of your emails when you have been on the other side or at least have been trading for some time and gained experience. It is obvious actually.

How to recognize a good Expert Advisor?

Price is one of the biggest and fastest factors that is tightly correlated to quality. It doesn’t apply to the trading business alone. It is not 100% sure that when you pay more you pay for better quality but chances are on your side.

Next extremely important thing to look for is the performance. Unrealistic numbers like 500% a month usually means two thing: fake numbers or huge risk. Either way you want to stay aside. I think it is useless to give you the example from above once again.

Just crunch some numbers and see what happens if you are making 100% a month on average. After a few years of trading, starting with only $100 dollars in his or her account, this trader should theoretically be able to buy the moon – at worst. Don’t fall for that. That’s too easy and I know you are better than that.

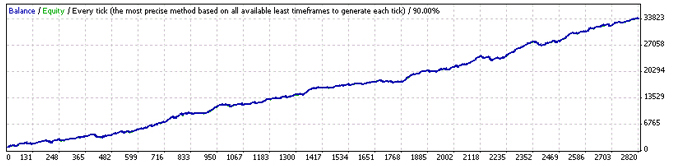

Good expert adviser should have a smooth growing curve. It should have a small drawdown. The risk reward (average win trade vs average loss trade) ratio should be on your side as well. The very minimum I would allow myself to go with is 1:2 – risk $1 with the potential to win at least $2.

Be aware though that when you increase the Reward versus the Risk, the percentage of Winning Trades (win ratio) usually drops. There is always a trade off:

Here is an example:

50 win ratio / Risk:Reward 1:1

50 losing trade x $1

50 winning trades x$1

At the end you will pretty much end up with a small loss, due to the spread and fees.

40% win ratio / Risk:Reward 1:2

60 losing trades x $1

40 winning trades x $2

80 – 60 = $20 profit. You see how higher risk:reward ratio guarantees you profit even when you lose more often than you win. It is all about the statistics.

Generally the Win Ratio and R:R ratio are negatively correlated (if one increases the other one decreases and vice-versa).

There are scalping EAs that will offer 85 win ratio BUT the risk:reward could be awful. 4:1 or even 5:1. So imagine how 1 trade wipes out 5 winners before it. Not very cool.

Here are the numbers for this scenario:

85 wins x $1

15 losses x 5

85 – 75 = 10 profit. You would still make money at the end.

Try to find the balance between the two. Balance is important for your psychological health. Huge drops in your equity or balance is stressful especially when you are trading with bigger accounts. In the last example above you should be ready to take 15 losses in a row before you experience the 85 winners. Hard to imagine it but it is possible. What about 6 or 8 losses?

How long would it take the EA to recovered from 8x$5 when it is making only $1 a trade? 45 trades, that’s correct. Don’t think about the numbers alone. When real money is involved there are emotions involved as well. Robots are here to help us control the fear and greed BUT if you see that 8 losing trades in a row, would you still trust the software? Would it pull the plug or let it run because of the statistics?

This is where it becomes hard for the trader, even when he or she is not behind the mouse to sell or buy. That’s why the BALANCE is important. Look for Win Ratio anywhere from around 30% up to 60-70%. In this case even if you choose to go with negative R:R ratio strategy (risk more per trade than potentially win) and you experience a row of losing trades, it won’t make you jump off a bridge.

I personally prefer the scenarios where the risk:reward is on my side versus the win ratio. Multiple smaller loses opposed to 1 huge win that covers it all. I’m not a fan of the other scenario where you win win win win and bam one loss kills it all.

Can a good robot cost less than $100?

Probably not. There is always the possibility where you will find one – if you do please share it with me ! I haven’t found one in my career yet and haven’t heard of people who have. I work with other professionals (the smart money) and trust me, even they don’t have what retail traders are looking for under $100.

Only profitable robots are high frequency robots but they are far away from retail trading. The technology, the cost to develop etc…

The other profitable EA is the one that is being managed by someone. Can you call that 100% automated expert advisor is up to you. For some it, for some it is not. But again the people who have developed one, didn’t sell it for a hundred bucks. They fall into the two categories explained above – sell for much higher price or manage client’s funds.

I’m leaving you with that. If you are interested in reading more on the EA subject check out the first part of this article here.

If you think this article is helpful please share and like it! I’d love to hear your opinion on the subject – comment section below is all yours!

Yours,

Vladimir