Hi Traders! EURNZD short term forecast and technical analysis is here. The way I would like to analyze the chart for setups is based on multi-timeframe confirmations because in my POV if we get more evidences on different timeframes for the same direction then it makes the setup much more reliable. If you would like to learn more about the way we trade and the technical analysis we use then check out the Home Trader Club Spoiler alert – free memberships are available! Let’s start our analysis from the highest timeframe which will be the daily chart here.

EURNZD D1(Daily) Chart Analysis – Bullish Trend Pattern, Strong Support Zone

On the daily chart, the price which is moving higher has created a bullish trend pattern in the form of three higher highs, higher lows, we may consider this as evidence of bullish pressure. Generally, after a bullish trend pattern, we may expect corrections and then potential continuation higher. Currently, it looks like a correction has happened and the price which was moving higher broke above a strong resistance zone, after the breakout this strong resistance zone is acting as a strong support zone for us. Currently the price which is moving lower, reached this strong support zone respected it and bouncing higher from this zone. So everything looks good here for the bulls and we may now move down to lower timeframe and see if we can find evidences supporting this short term bullish view.

EURNZD H4(4 Hours) Chart Analysis – Heikin Ashi Candles, Bullish Trend Pattern, Two Strong Support Zones

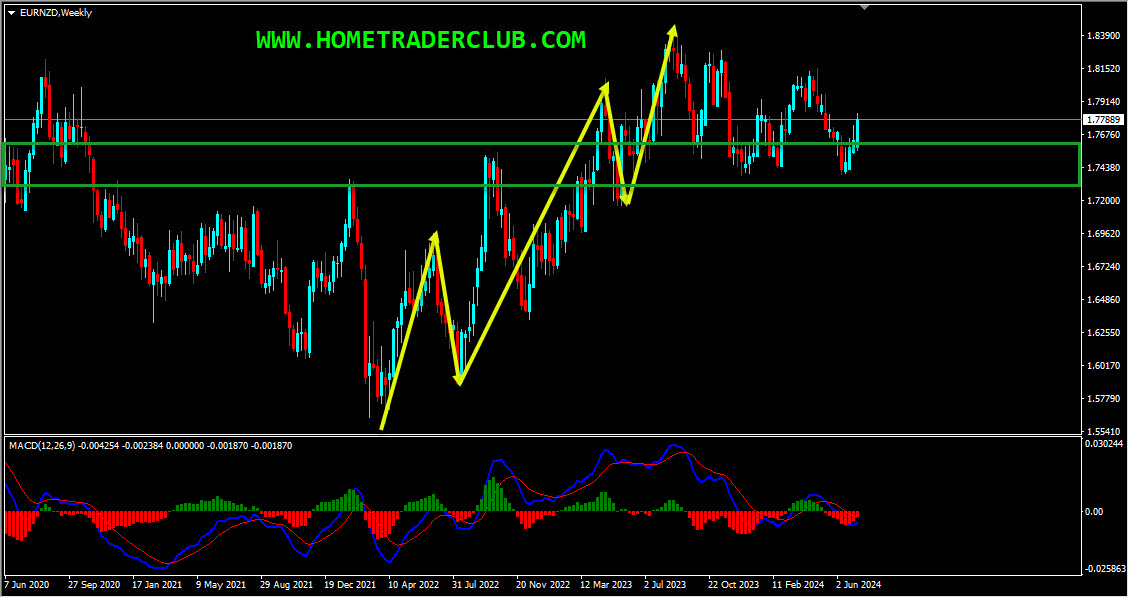

On the H4 chart, based on the Heikin Ashi candles we can see that currently, we have strong bullish bodies in upward moving market conditions so it basically reflects a bullish environment. Also, the price which is moving higher has created a bullish trend pattern in the form of three higher highs, higher lows, we may consider this as another evidence of bullish pressure. Generally, after a bullish trend pattern, we may expect corrections and then potential continuation higher. Currently, it looks like a correction is happening. In addition to this, we had two strong resistance zones that has formed and the price which was moving higher has broken above these zones and is holding above them. After the breakout these strong resistance zones are acting as two strong support zones for us. Until both these strong support zones shown in the image below (marked in green) holds my short term view remains bullish here and I expect the price to move higher further after pullbacks.

Technical Analysis & Forecast Summary

EURNZD D1(Daily) Chart Analysis

- Bullish Trend Pattern, Strong Support Zone

EURNZD H4(4 Hours) Chart Analysis

- Heikin Ashi Candles, Bullish Trend Pattern, Two Strong Support Zones

Trading Tips

It is always recommended to look for confirmations before you jump into any trade. If you are not sure about how to trade this short term buy setup then you can use any setup and strategy that you have in your arsenal to look for bullish moves and join this buy trade.

Also, don’t forget to protect your buy trade using a stop loss and make sure to set a target and keep a proper risk/reward ratio.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

Not sure how to enter a trade? Spot reversals (bounces)? Not sure how to spot breakouts?

I invite you to

And improve your trading with us.

Also, you can get one of our strategies free of charge. You will find all the details here

Download our best forex indicators here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Home Trader Club Team.