The Euro was seen trading lower in the past couple days against the US dollar, as it was unable to break the 1.2900 resistance area. However, it looks like that the EURUSD pair is stabilizing around the 1.2800 area. The pair was seen trading higher during yesterday’s London session. There were a few economic releases lined up, which ignited a rally in the Euro, and the shared currency was seen trading higher not only against the US dollar, but also against the Australian and New Zealand dollar. Let us have a look at the economic data released yesterday.

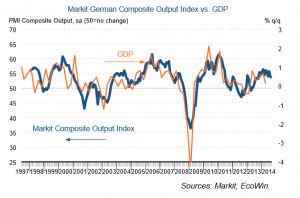

German Manufacturing and Services PMI

Yesterday, the German manufacturing and services PMI were released by the Markit economics during the London session. The forecast was of a decline in both the PMI’s. However, the outcome was mixed, as the German services PMI climbed from 54.9 to 55.4 and manufacturing PMI declined from 51.4 to 50.3. The report highlighted a few good points and mentioned that the current period of growth now stretches to 17 months. This was taken on the positive note by the market.

The EURUSD pair was seen trading higher. The pair was seen consolidating around the 1.2840 level before the release, but it managed to clear the resistance and traded higher.

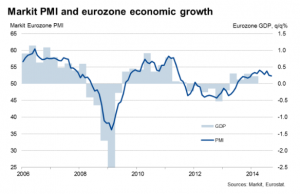

Euro Zone Manufacturing and Services PMI

Later, the Euro zone manufacturing and services PMI were released by the Markit economics during the London session. The forecast was again of a decline in both the PMI’s. However, the outcome was disappointing, as the Euro zone services PMI dropped from 53.1 to 52.8 and manufacturing PMI declined from 50.7 to 50.5. The most disappointing part to note from the report is that the average quarterly reading for the three months to September was also the lowest so far this year.

There was no major reaction from the Euro, as the EURUSD pair managed to hold ground. Actually, the Euro buyers were somehow expecting a poor outcome. So, when that did not happen, the EURUSD pair got bid during the session.

French Manufacturing and Services PMI

The French manufacturing and services PMI were also released by the Markit economics during the London session. The French PMI’s managed to register a better than expected outcome. The French manufacturing PMI climbed from 46.9 to 48.8 and services PMI declined from 50.3 to 49.4. To be precise, one sector registered expansion, and another failed to do so.

Technically, the EURUSD pair traded towards the 1.2900 level during start of the NY session yesterday. However, the upside was limited, as the pair failed one more time to break above the mentioned resistance zone and traded lower. The 1.2840-30 is acting as a support now, and as long as it holds a run towards the 1.2900 level is possible.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast