One of the most important events for this week was scheduled during yesterday’s New York session. The Fed interest rate decision and Yellen’s testimony were lined up. Both these events acted as a catalyst in the Forex market as expected. However, the fact remains that most of the major currencies are still trading in a range, including the EURUSD which is stuck in 1.35-1.36 range for the last several days now. Even the Fed was unable to spark a break in the EURUSD pair.

Fed interest rate decision

The fed kept the interest rates unchanged at 0.25% and tapered as expected. They reduced the asset purchases by $10B from $45B to $35B. This was broadly expected by the Forex market. The fed also mentioned that they do not see an early rate hike. This was seen as a negative sign by the market, as a section of investors was hoping for the fed to mention the possibility of a rate hike in the late 2014. This was one of the main reasons for the US dollar weakness during the release time.

Few important points to note from the statement:

> The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury, until the outlook for the labor market has improved substantially in a context of price stability.

> If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.

> When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Overall, the fed mentioned nothing new, and remained firm on their 2% inflation target. It is important to note that the US inflation data was also released earlier during this week.

US Inflation data

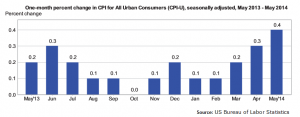

The US Consumer Price Index (CPI) was released by the US Bureau of Labor Statistics on Tuesday. The market was expecting the CPI to be around 2%. However, the report mentioned that the CPI increased 2.1 percent in May on a seasonally adjusted basis, over the last 12 months. This was 0.1% better than expected. This is also the largest 12-month increase since October 2012, according to the report.

Technically, the EURUSD pair dropped in an initial reaction towards the 1.3550 level, but later recovered to trade back towards the 1.3600 level. As of writing, the pair has breached the 1.3600 resistance level, and heading towards the 1.3620 resistance zone. The EURUSD pair has breached an important trend line, which was acting as resistance for the pair. This break can be seen as critical in the short term, as it would encourage the Euro buyers to take the pair higher. On the upside, the next possible resistance can be seen around the 1.3650 level, followed by the 1.3680 level. On the downside, the 1.3580 level might act as a support now.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!