There were few important releases scheduled during the yesterday’s New York session, including the US retail sales data, initial jobless claims, the import price index and business inventories data. All these events missed the market’s expectation, which resulted in a down-move in the US dollar. The US dollar was seen trading lower against most of its counterparts, including the Euro, the British pound and the Japanese yen.

US Retail Sales data

The first on the list was the retail sales data. This was the main risk event during the NY session. The market was expecting good numbers this time around with a gain of 0.6%. However, the outcome missed the expectation by a fair margin, as the US retail sales rose by 0.3%. The positive part was that the previous reading was revised up from 0.1% to 0.5%. So, the outcome was not that bad.

Similarly, the US core retail sales was expected to climb by 0.4%, but the report mentioned that the core retail sales managed a rise of 0.1%. In this case also the previous reading was revised up from 0% to 0.4%.

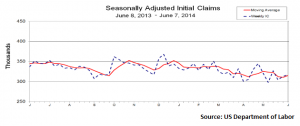

US Initial Jobless Claims

The US initial jobless claims figure was also published at the same time. The market was expecting jobless claims to fall to 310K. However, the outcome was again disappointing, as the US jobless claims rose to 317K. Moreover, the previous reading was also revised up from 312K to 313K. The report mentioned that “the 4-week moving average was 315,250, an increase of 4,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 310,250 to 310,500”. Moreover, the advance seasonally adjusted insured unemployment rate was 2.0% for the week ending May 31.

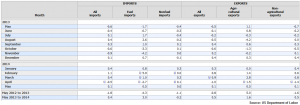

US Import Price Index

The next in line was the US import price index, which was released by the US Department of Labor. The market was expecting a 0.2% rise in the import price index. However, the U.S. import prices ticked up 0.1 percent in May, after a 0.5-percent downturn in April. The main sector adding to the rise in the import price was the Fuel Import, which rose 0.5 percent in May following a 2.7-percent drop in the previous month. All other non-fuel components import price remained same in May.

Technically, the EURUSD pair dropped earlier during the yesterday’s London session. However, after the US data releases the pair managed to shed some of the previous session’s losses. The pair after trading close to the 1.3510 level traded higher close to the 1.3580 level during the NY session. The EURUSD pair has a down-move trend line on the 4 hour chart, which might continue to act as a hurdle for the pair. However, if it manages to break it up, then more gains towards the 1.3600 level is possible in the short term. Alternatively, a failure to break higher might call for a downside move back towards the 1.3500 level.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!