In this article, I’ll share with you my analysis of GBPNZD and Silver. A detailed analysis of these instruments is as follows.

You can watch the video explanation of this forecast here:

GBPNZD

Weekly timeframe – On the weekly chart, the price is moving inside a bearish channel with a clear structure of lower highs and lower lows. There is a good chance that this bearish momentum will continue further in the longer run.

The price has broken below a key volume zone based on my volume profile Key Trading Levels Indicator. There is a high probability that the price will retest this level and move lower further towards the next demand zones shown in the image below.

Daily timeframe – Daily chart also supports the weekly direction by making its own structure of lower highs and lower lows. In addition to this, the price is holding below the volume area mentioned above. If we plot the Fibonacci expansion on the ongoing waves, we have two key zones that have formed, as shown in the image below. This makes me think that the bearish momentum isn’t over yet and the price might move lower toward these key zones until it is blocked by a bullish divergence. Then, we might see the trend changes on the short term.

H4 timeframe – On the H4 chart, the price is moving in a clean bearish channel, as you can see in the image below

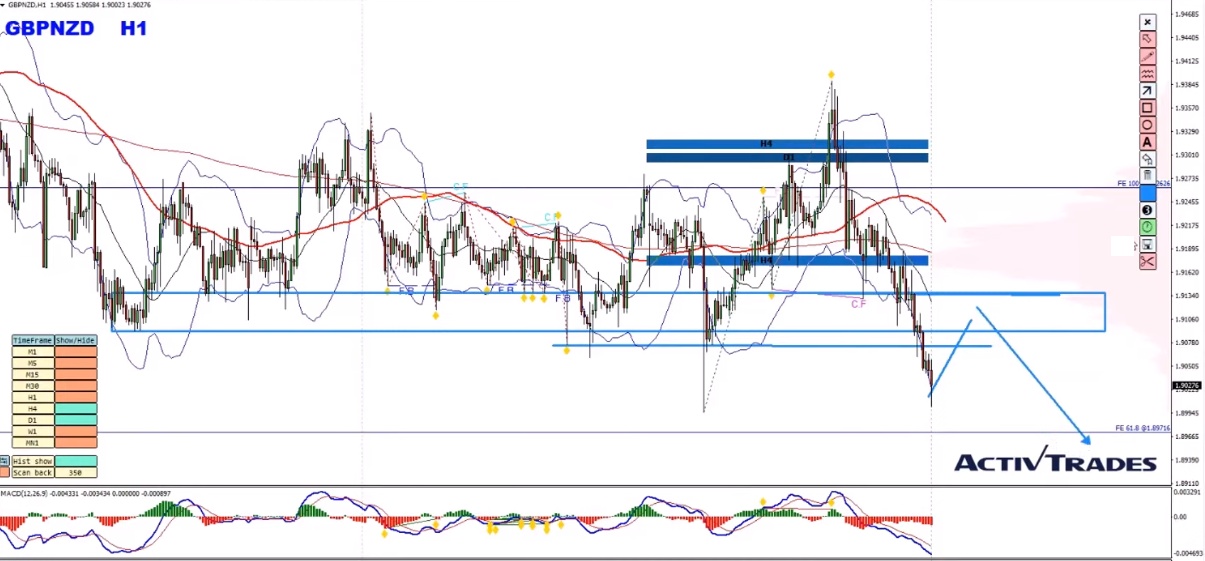

H1 timeframe – For any bounce closer to the resistance area shown in the image below, we should start looking for bearish evidence in order to be able to join the sells.

Silver

Weekly timeframe – On the weekly chart, I believe the ongoing rally is coming to an end, with the price nearing the top of the bearish channel where the key volume zone coincides. This is the place where I expect the Silver to face some rejection.

Daily timeframe – On the daily chart, we have two support zones and two ongoing rising trend lines, as shown in the image below. From my point of view, any bounce down should provide a final rally toward the previous highs. Buy the dips is my plan for this one on the short term.

Another interesting fact that I would be paying attention to is we have an ongoing bullish trending structure. So if we manage to see the price pulling back and completing a bullish hidden divergence, then this could be a very nice buy opportunity.

That would be all for this weekly forecast. I wish you a successful trading week ahead.

Our recommended CFD broker – ActivTrades

If you have any further questions, don’t hesitate to drop a comment below!

Yours to your success,

Vladimir Ribakov

Certified Financial Technician