Hello traders, Welcome to this week’s Forex Weekly Forecast, where we analyze the key technical and macro drivers shaping EUR/USD, GBP/USD, Gold, and Crude Oil.

As always, this analysis is based on price action, market structure, volume profile behavior, divergences, and multi-timeframe confluence, not predictions. The goal is to identify high-probability scenarios and understand what would invalidate them.

Before we dive in, a big thank you to our partners at Eight Cap Broker for supporting our community.

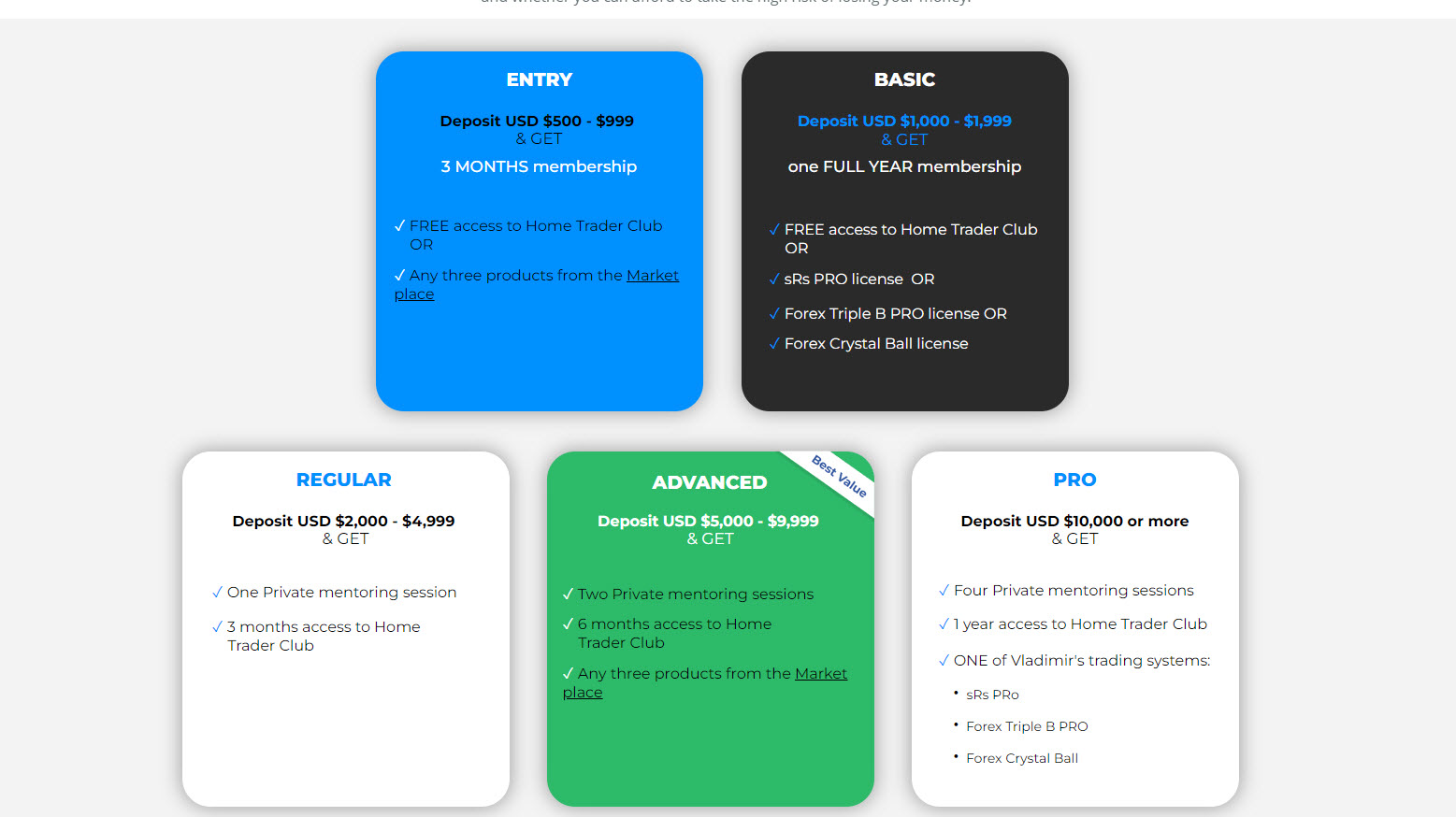

You can continue enjoying all the exclusive offers we have together with them — including up to one full year of free access to Home Trader Club, all our trading systems and tools, private mentoring sessions, and much more.

? Check out the exclusive offers via the link below the video or on vladimirribakov.com

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

- 1 Explore My Free Mentorship Program

- 2 EUR/USD Weekly Forecast – Bullish Momentum Still Intact

- 3 GBP/USD Weekly Forecast – Bull Trend Likely Not Over

- 4 Gold Weekly Forecast – Correction Phase Likely Underway

- 5 Oil Weekly Forecast – Bullish Continuation After Pullback

- 6 Pro Trading Tip

- 7 Join the Home Trader Club

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

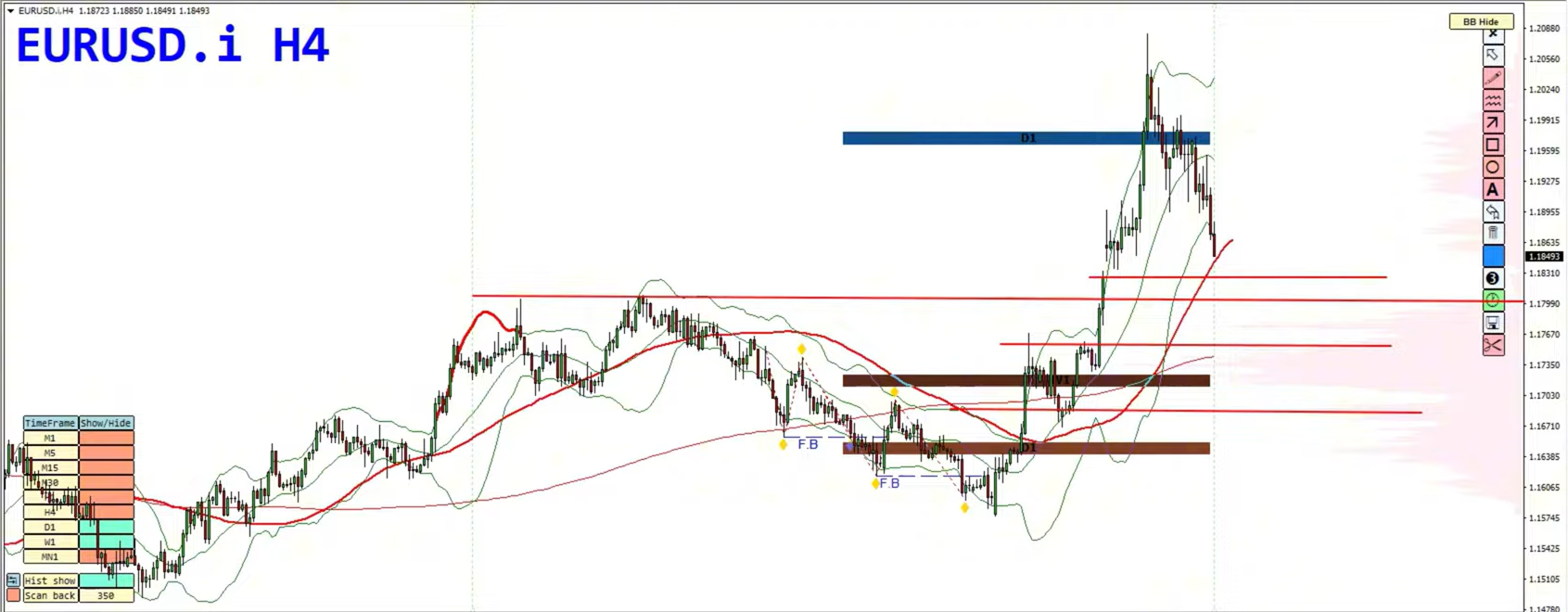

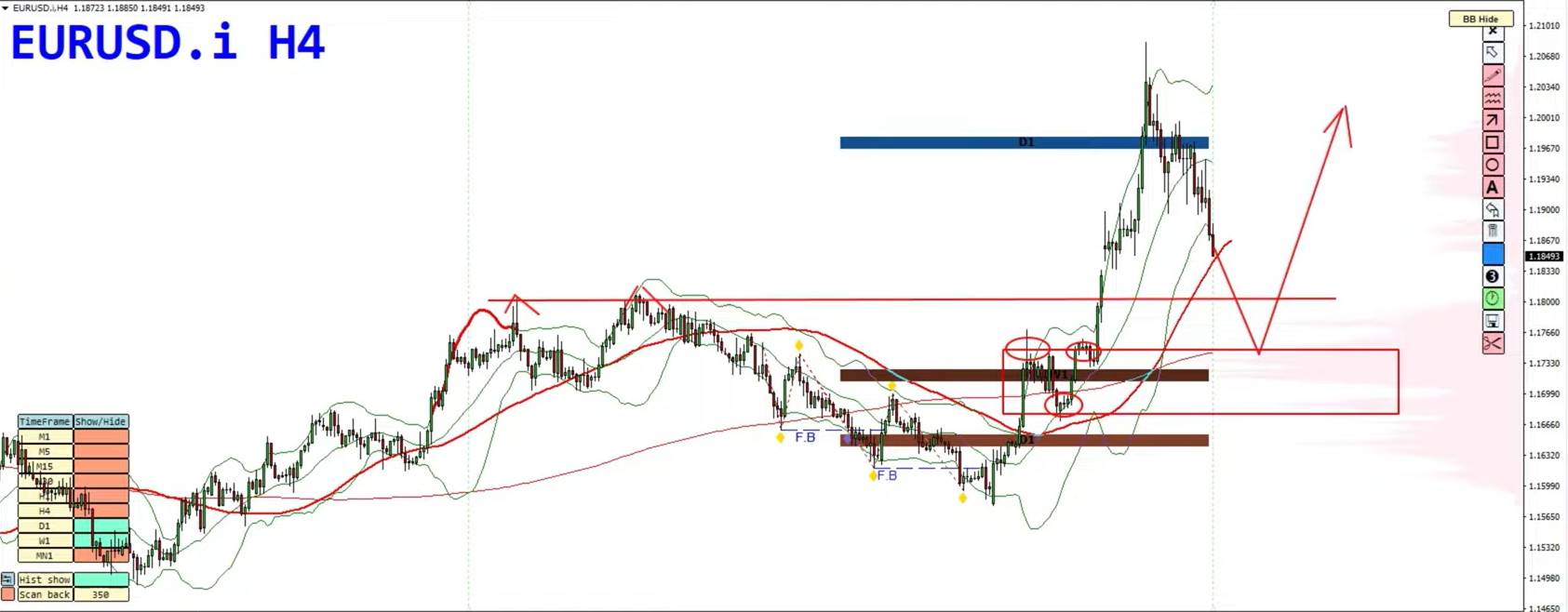

EUR/USD Weekly Forecast – Bullish Momentum Still Intact

Last week, EUR/USD reached the 1.20 area, exactly as anticipated, before reacting lower following the Federal Reserve’s decision to hold interest rates. This reaction was amplified by broader political and geopolitical uncertainty, including the nomination of Kevin Walsh as a potential future Fed chair and ongoing geopolitical tensions.

Technical Outlook

From a weekly perspective, EUR/USD has already cleared a major supply zone, which suggests the previous bullish cycle may be approaching maturity. However, price action does not yet confirm a full trend reversal.

Key observations:

-

Monthly and 7-day performance remain strongly positive

-

The latest pullback lacks impulsive bearish follow-through

-

Volume profile shows a balanced zone supporting price

Price is currently interacting with:

-

A broken resistance now acting as support

-

A major demand zone

-

A high-volume balance area (KTLI indicator)

Additionally, EUR/USD is forming a potential bullish hidden divergence:

-

Higher lows on price

-

Lower lows on momentum indicators

Trading Bias

As long as recent daily lows hold, this move appears to be a corrective pullback, not a reversal.

Bullish continuation targets remain:

-

1.22

-

1.24

-

Potential extension above if momentum accelerates

What Would Change the Bias?

-

A clear break below the recent daily low

-

A completed multi-wave bearish structure (lower highs and lower lows)

Until then, EUR/USD remains structurally bullish.

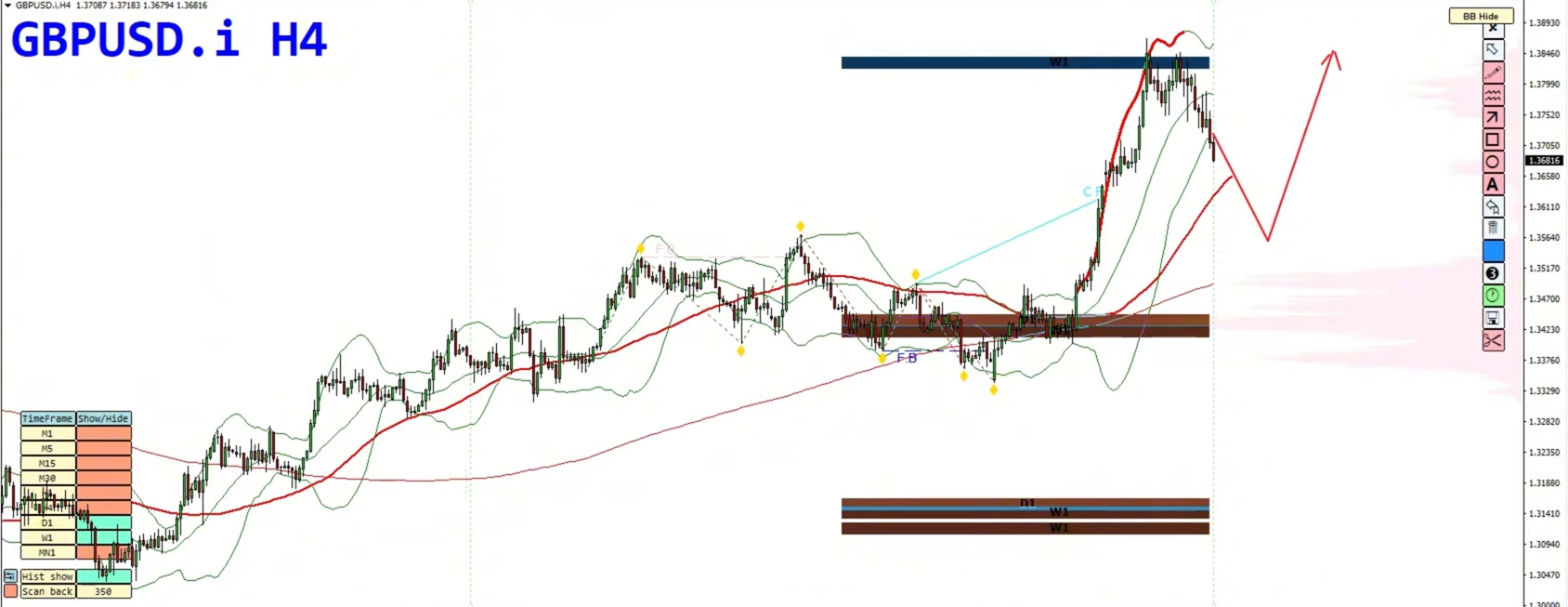

GBP/USD Weekly Forecast – Bull Trend Likely Not Over

Last week’s plan was to buy retracements, and the market delivered even stronger behavior than expected. Instead of deep pullbacks, GBP/USD consolidated briefly before buyers resumed control.

We need to pay attention to the potential bearish divergence which is forming

Technical Outlook

Despite late-week USD strength, the pound remains technically strong:

-

Monthly, weekly, and 7-day performance are ultra-bullish

-

Pullbacks remain shallow

-

Structure continues to print higher highs and higher lows

GBP/USD is currently supported by:

-

A price gap from last week

-

Broken resistance acting as support

-

A rising trend line

-

A volume profile balance area (KTLI indicator)

The market is also working toward completing a bullish hidden divergence on the daily chart, aligning with a previously identified weekly divergence.

Trading Bias

As long as price holds above support, the bias remains bullish, with upside potential toward:

-

1.40

-

1.42

-

1.44 and potentially higher

Risk Scenario

A trend reversal would require:

-

A clear break of the recent daily low

-

A multi-wave bearish sequence

Only then would a “sell the rallies” approach become valid. For now, bullish setups remain favored.

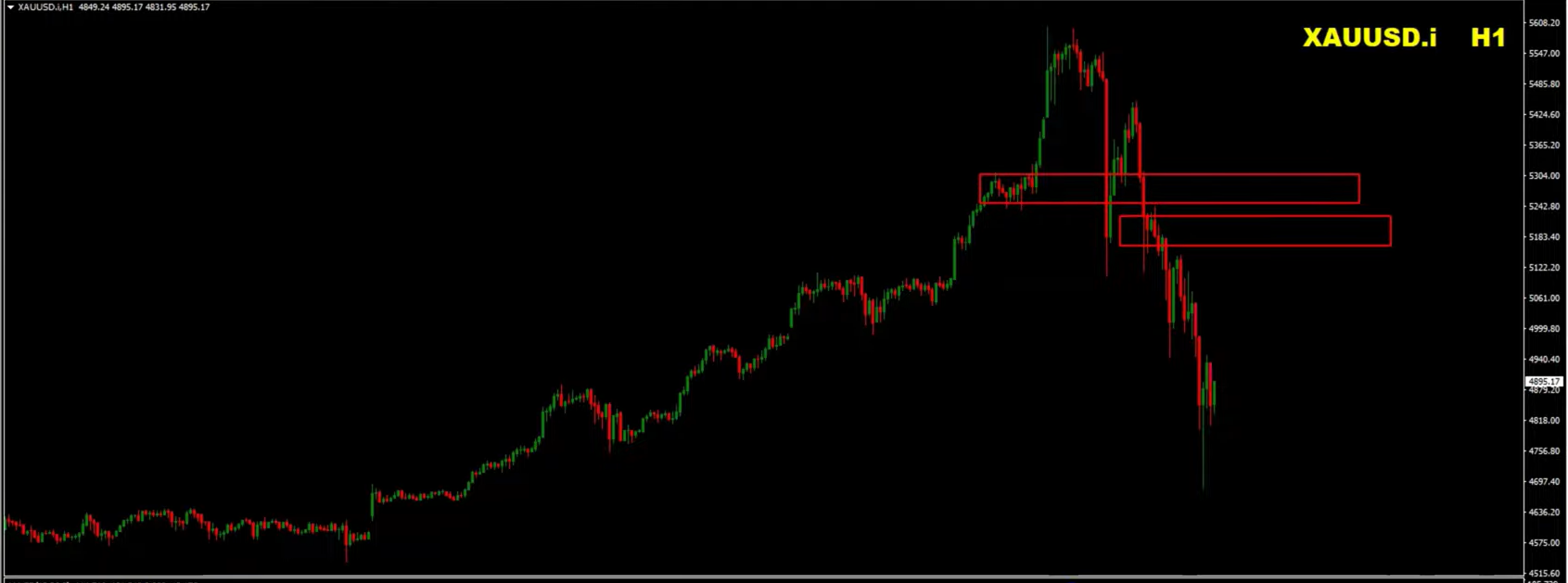

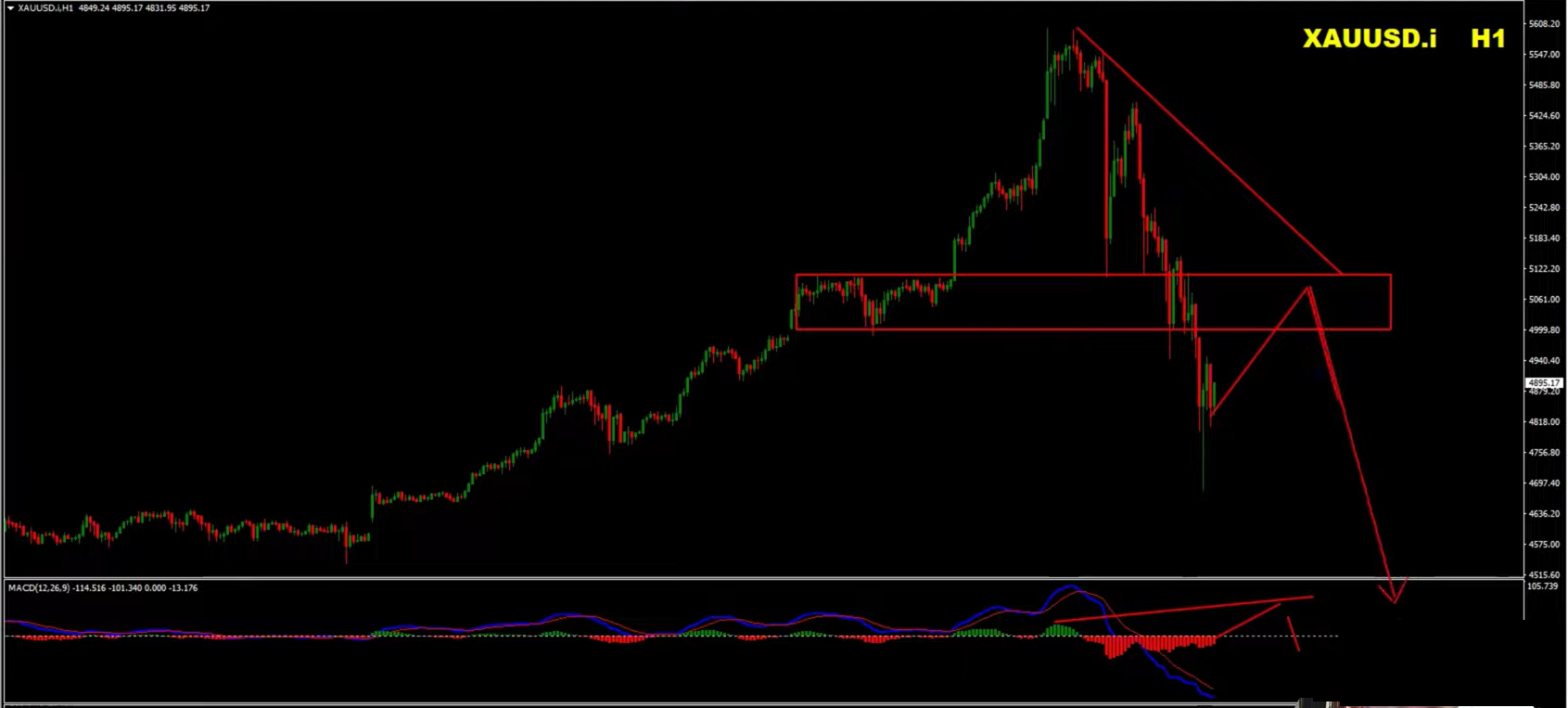

Gold Weekly Forecast – Correction Phase Likely Underway

Gold has experienced an extraordinary and historically abnormal move, with daily volatility reaching levels rarely seen even during crisis periods.

While the long-term bullish outlook remains intact, short-term conditions are stretched.

Technical Outlook

Gold is currently:

-

Overbought on monthly, weekly, and daily charts

-

Printing two strong daily reversal candle patterns

-

Developing a clear wave sequence to the downside

These signals strongly suggest that a corrective phase is unfolding.

Key Supply Zones to Watch

-

5000 – 5100

-

Psychological resistance

-

Heavy transaction volume

-

-

5200 – 5300

-

Prior consolidation range

-

Now acting as potential supply

-

Within these zones, watch for:

-

Bearish hidden divergence

-

Lower highs on price

-

Momentum exhaustion

Trading Bias

As long as these supply levels hold, Gold remains a “sell the rallies” market in the short term.

This is a correction within a broader bullish structure—not the end of the long-term trend.

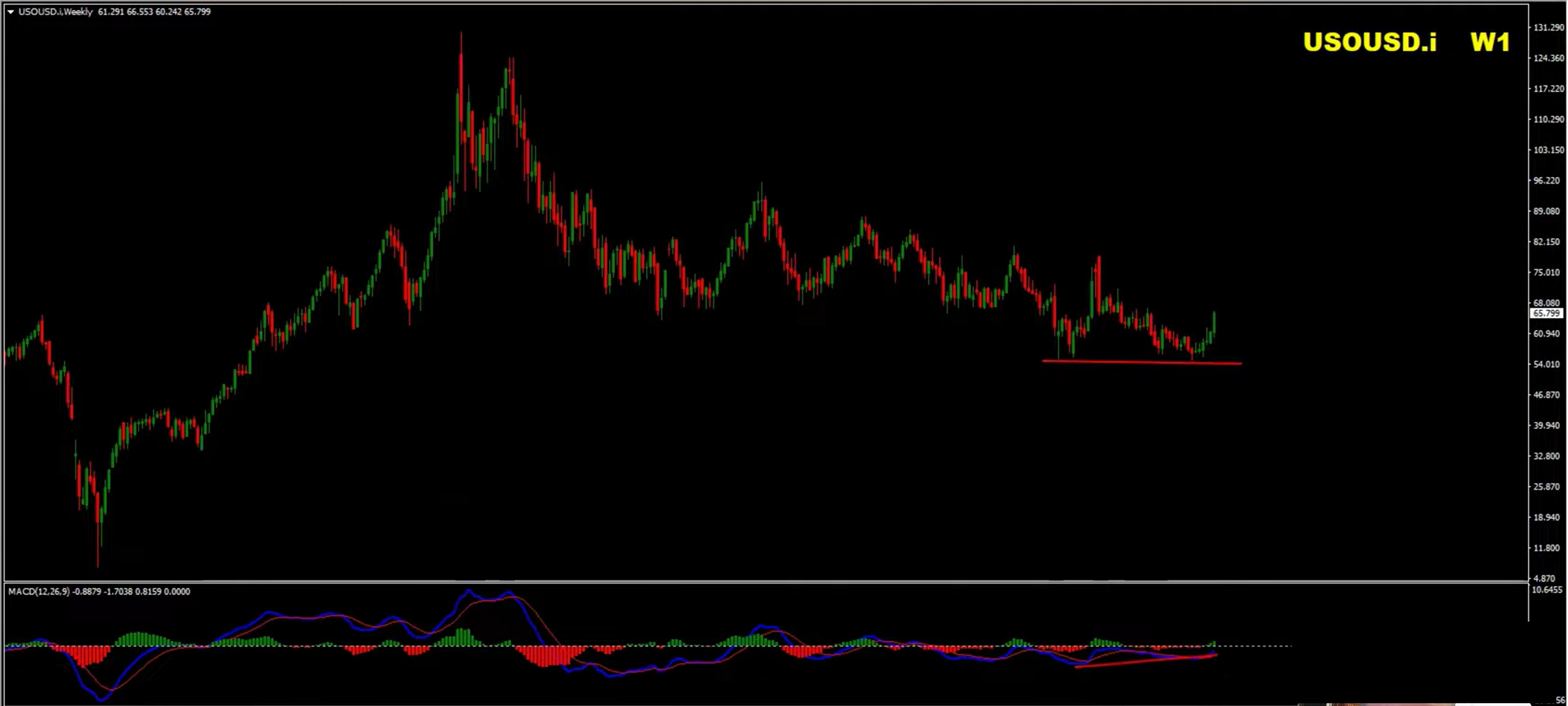

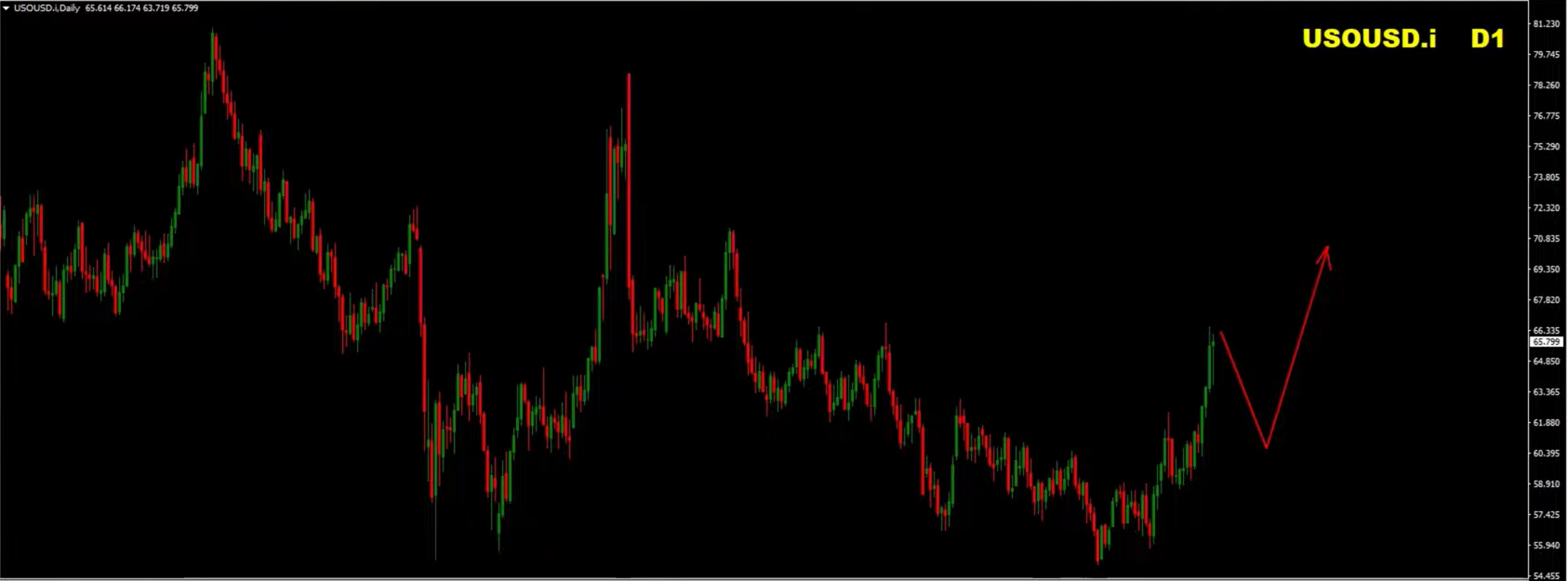

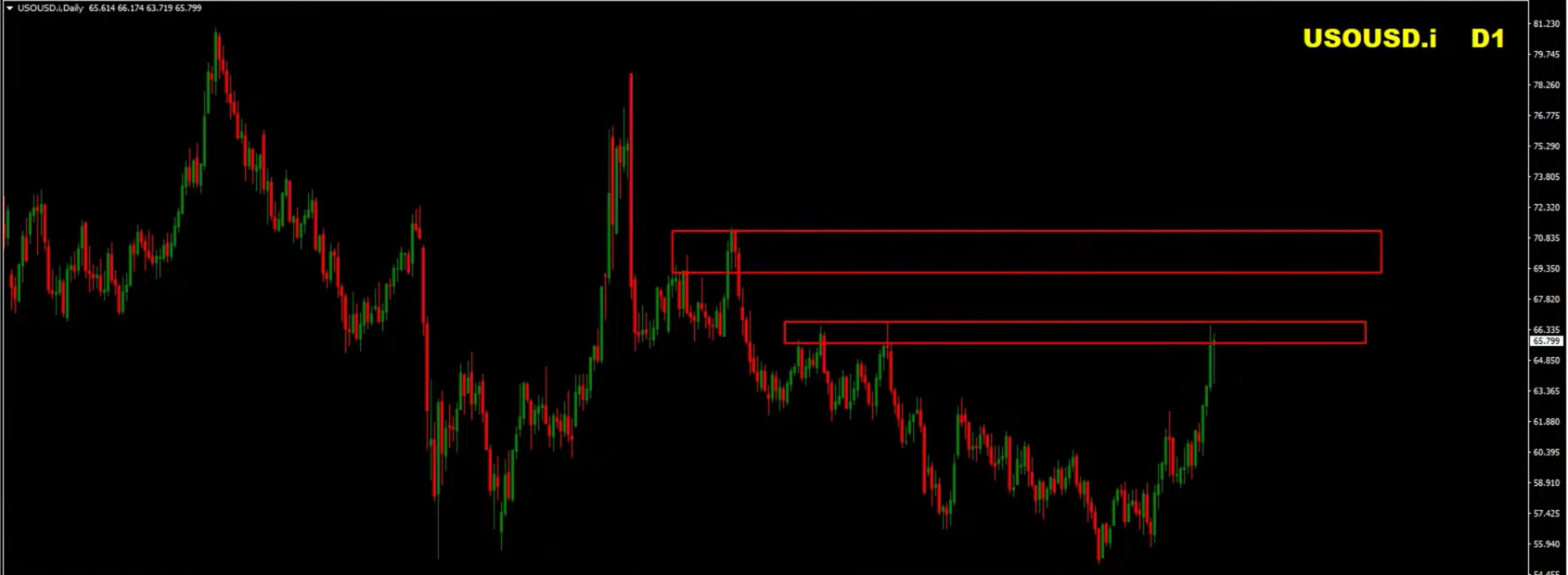

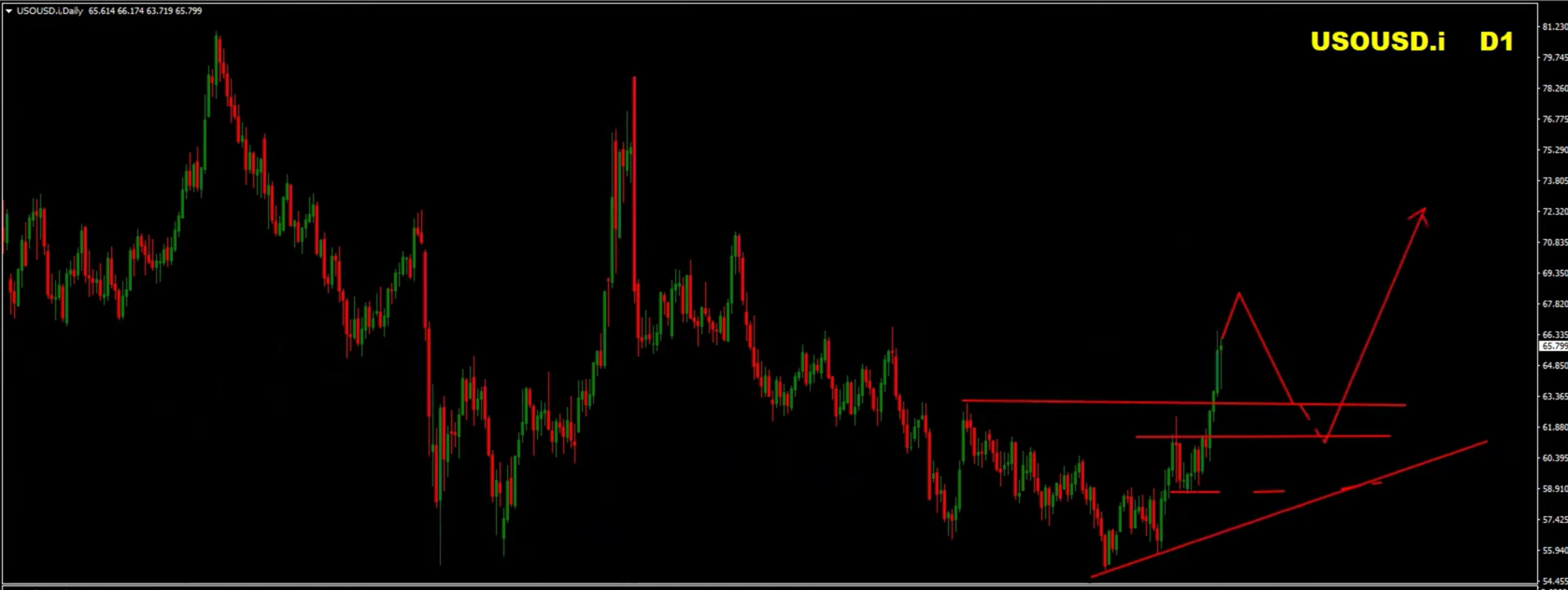

Oil Weekly Forecast – Bullish Continuation After Pullback

Oil is back on the radar following the completion of a bullish divergence on the weekly chart, supported by geopolitical tensions and improving technical structure.

Technical Outlook

Key developments:

-

Weekly bullish divergence completed

-

Daily chart confirms higher highs and higher lows

-

Momentum aligned with price (MACD confirmation)

Oil recently broke a key high, signaling strength, but short-term retracements are likely before continuation.

Key Retracement Zone

-

66 – 67 (primary demand zone)

-

Secondary zone: 68 – 71

On lower timeframes (4H):

-

Watch for corrective wave completion

-

Look for bullish divergence near demand

-

Monitor rising trend support

Trading Bias

Short-term: Expect retracements

Medium-term: Bullish continuation favored

Broken resistance is now acting as support, and structure supports further upside once pullbacks complete.

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club