Welcome to this week’s Forex Weekly Forecast, traders! I’m Vladimir Ribakov from the Home Trader Club, and as always, a big thanks to our partners at Eight Cap for supporting our community. If you’re interested in accessing all the exclusive offers and projects we’ve built with Eight Cap, you’ll find the details in the description below the video.

Watch the Full Weekly Forecast Video

Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

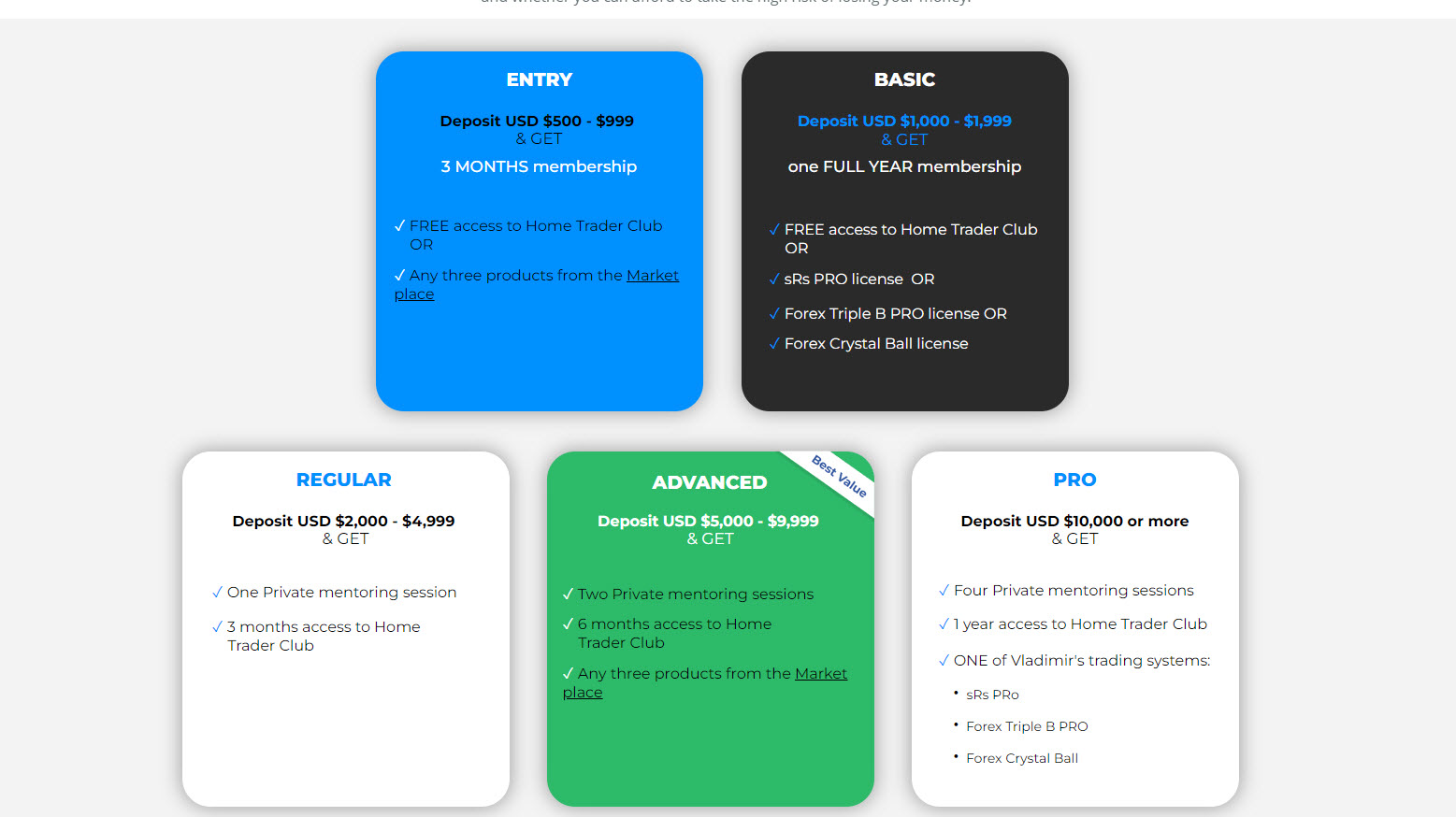

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Now let’s dive into this week’s outlook on EURUSD, GBPUSD, Gold, and Bitcoin.

? EUR/USD Outlook

Last week we expected EURUSD to extend its move lower toward previous lows before any potential bounce. That scenario is playing out, and the structure remains technically important.

Weekly Chart:

The pair has been riding the upper Bollinger Band for over 20 candles – a rare situation. Historically, this has been followed by a significant retrace, often marking a turning point in trend. While the longer-term rally is not necessarily over, I do expect a corrective phase before any fresh push higher.

Daily Chart:

A double divergence appeared between the highs on price and the lower highs on MACD. This typically signals correction.

4H Chart:

On the 4H chart, the break of the trendline plus two downside waves suggest the start of either a zigzag (ABCD) or a triple wave.

If the price completes triple wave down first of all, then I expect it to be pretty much somewhere around these levels. Then, ideally complete some bullish divergence and make a bigger correction.

? Trading Plan:

As long as EURUSD holds below the recent highs, the plan is sell the rallies.

-

Watch resistance zones: broken support turned resistance, and the last swing highs.

-

Expect bearish pressure to persist until bullish divergence forms at lower levels.

? GBP/USD Outlook

GBPUSD also followed our last week’s expectations by breaking the trendline and entering a corrective structure.

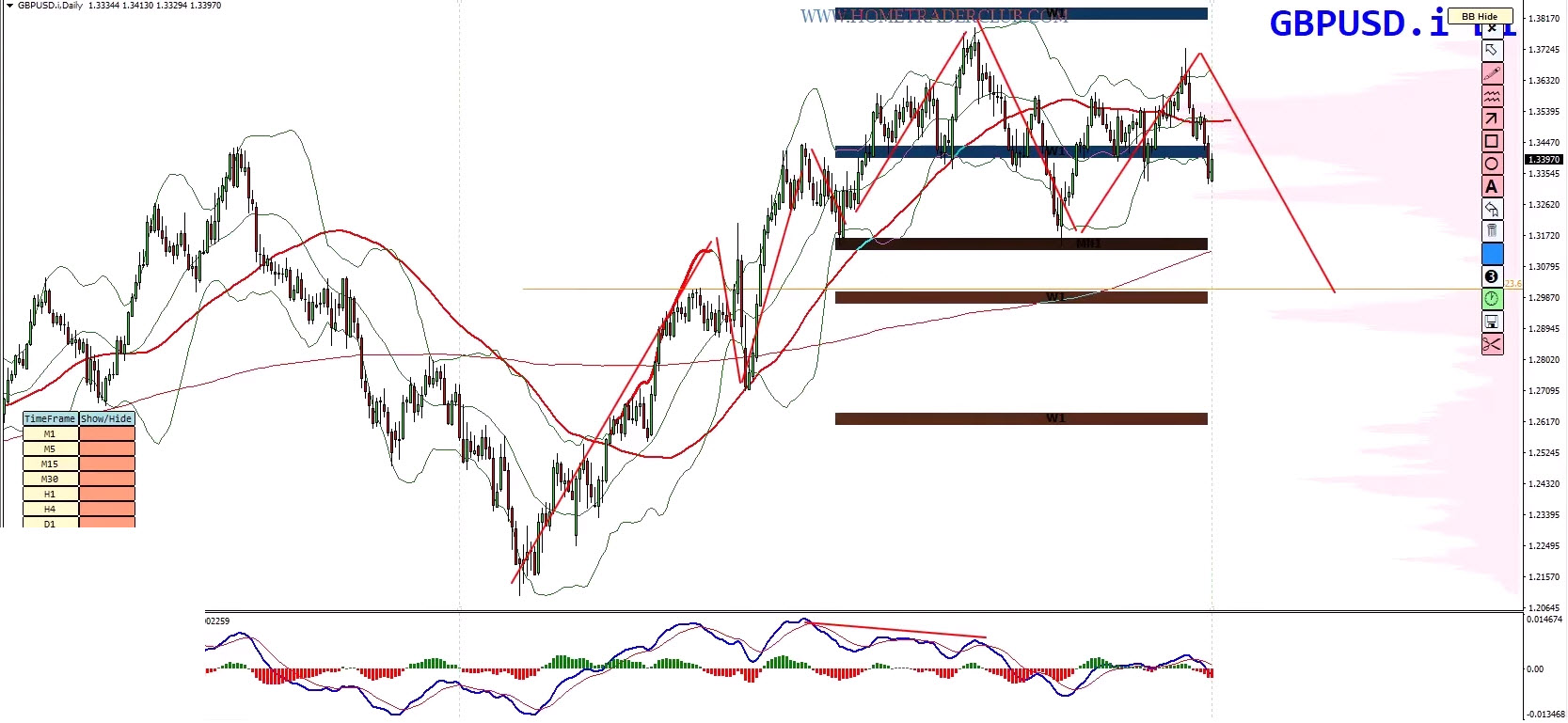

Daily Chart:

We saw a triple wave with ending divergence, usually a sign of correction. This could unfold as either an ABCD structure or a range.

Current Picture:

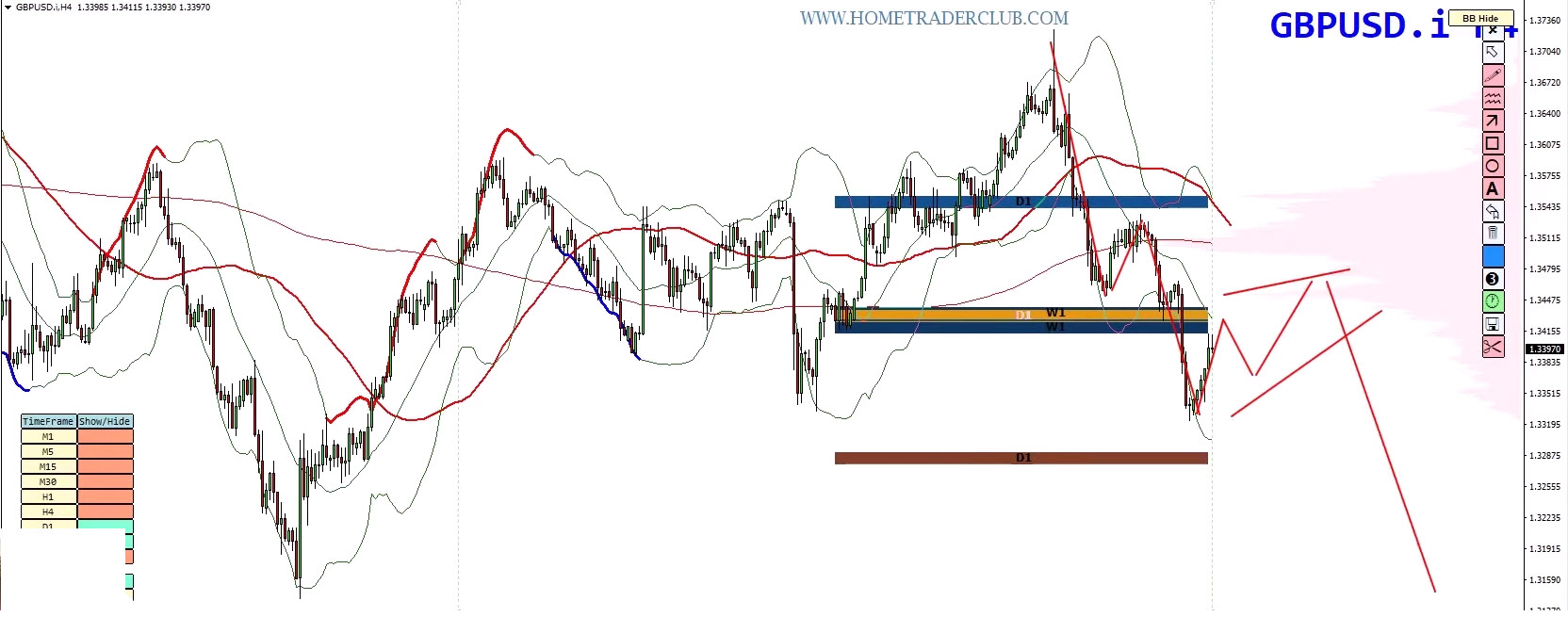

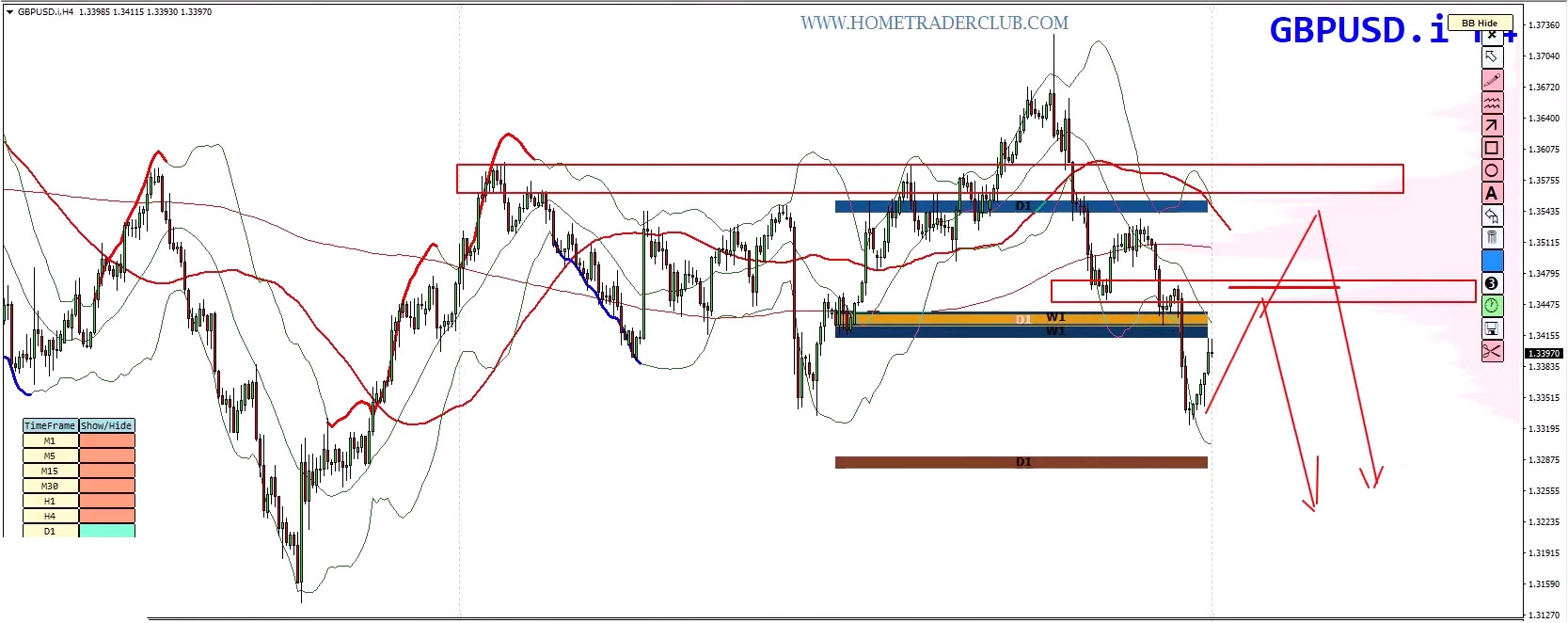

Price broke below the trendline and the KTLI indicator shows we are under a heavy volume-based resistance zone.

On the 4H chart, two downside waves are in place, pointing to either further range development or continuation lower.

? Trading Plan:

-

Look for rallies into resistance (1.3570–1.3600 zone, broken support now resistance).

-

As long as these levels cap, sell opportunities remain valid.

-

Watch for bullish divergence before considering deeper correction scenarios.

? Gold Outlook

Gold continues to dominate headlines with record highs. It’s been on what I like to call “gold on steroids.”

Higher Timeframes:

On the monthly and weekly charts, Gold is trading in extreme overbought conditions with potential bearish divergences forming. But let’s remember: indicators only indicate — price dictates. Trend is still intact.

I say potential divergence because we don’t have a second peak yet here. That means we could see a second peak forming yet or a gold will break it. And there will be no divergence.

Both scenarios are absolutely doable. And that’s why I bring it up again. This is only an indication

Technical Scenarios:

-

A second false breakouts around the highs could set the stage for reversal if followed by lower lows.

-

Alternatively, Gold could complete a corrective zigzag (two waves down, two waves up) before continuation.

? Trading Plan:

-

Trend remains bullish as long as higher highs and higher lows hold.

-

Reversal setups will only be valid if the sequence breaks. Until then, patience is key.

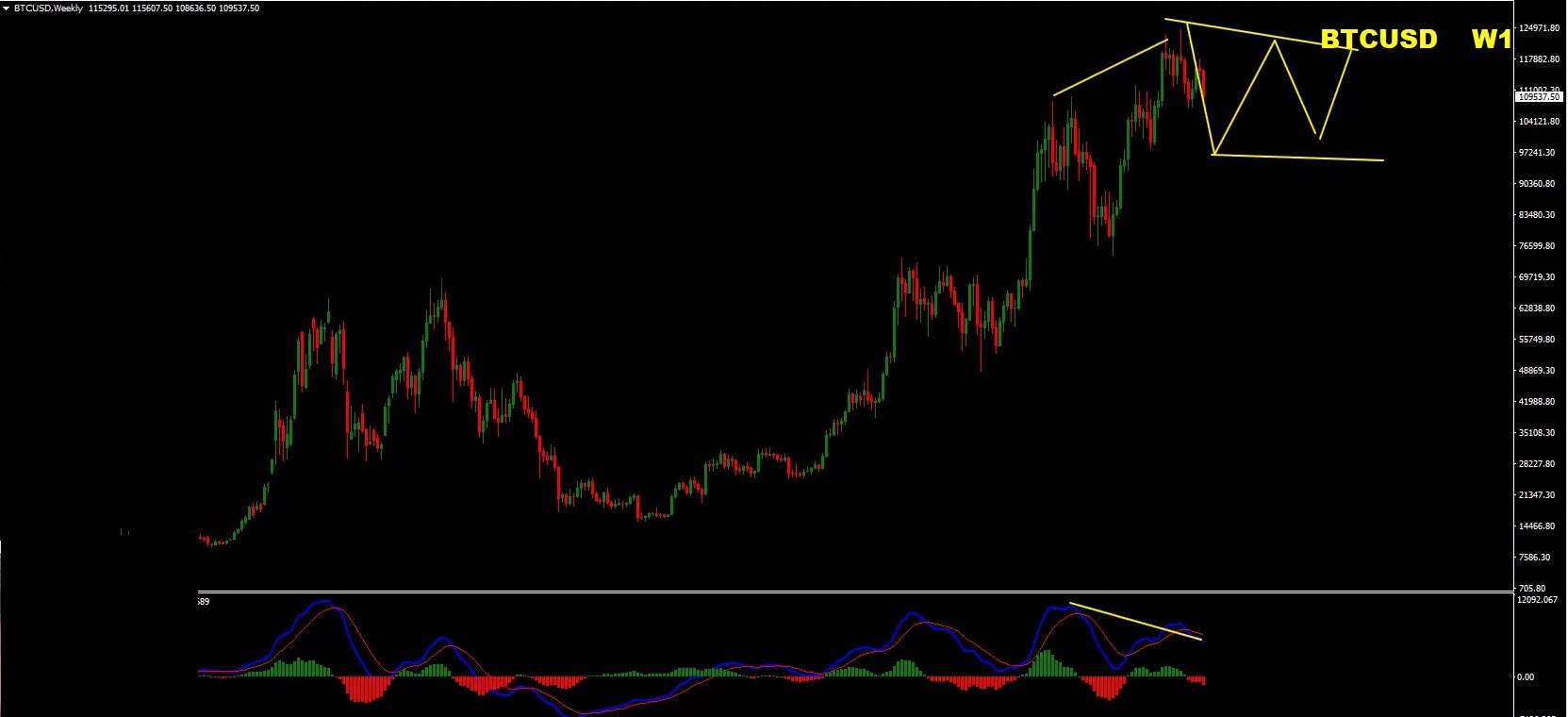

₿ Bitcoin Outlook

Bitcoin remains in a corrective phase after showing clear divergences on higher timeframes.

Weekly & Daily Charts:

We see divergence between higher highs on price and lower highs on MACD, signaling correction pressure. The structure looks like an ABCD correction or possibly an extended range.

Shorter Timeframes:

Broken support now acts as resistance around the 113K–114K zone. Every rally into this area faces selling pressure.

? Trading Plan:

-

Expect Bitcoin to remain under bearish correction pressure.

-

Sell rallies until a clear bullish reversal structure appears.

-

Long-term hype about Bitcoin breaking all-time highs may be premature; timing remains uncertain.

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club