Hi Traders! GBPUSD short term forecast update and follow up is here. On June 23rd I shared this “Technical Analysis – GBPUSD Short Term Forecast” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

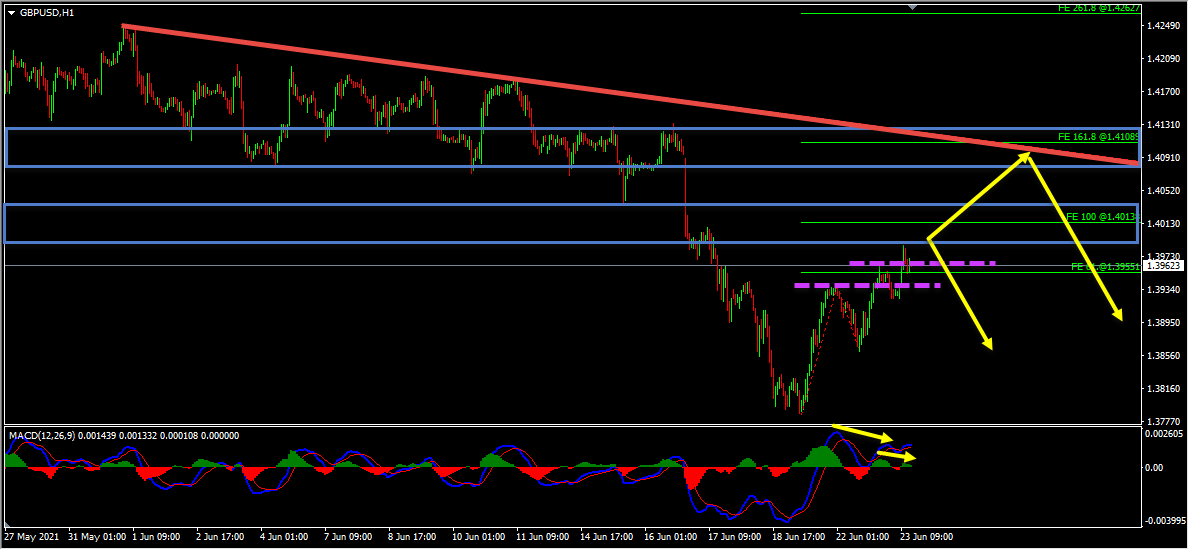

On the H1 chart, the price has created multiple false breaks and bearish divergences between the first high that has formed at 1.39362 and the second high that has formed at 1.39869 which we may consider as evidences of bearish pressure. Also, while measuring the first wave of this correction using the Fibonacci expansion tool, we could see that the 100%(1.40138) Fibonacci expansion level of this first wave coincides with the first resistance zone on the H4 chart which makes this a key resistance zone for us. Also, we could see that the 161.8%(1.41089) Fibonacci expansion level of this first wave and the downtrend line coincides with the second resistance zone on the H4 chart which makes this area a second key resistance zone for us. Until both these key resistance zones hold my view remains bearish here and I expect the price to move lower further.

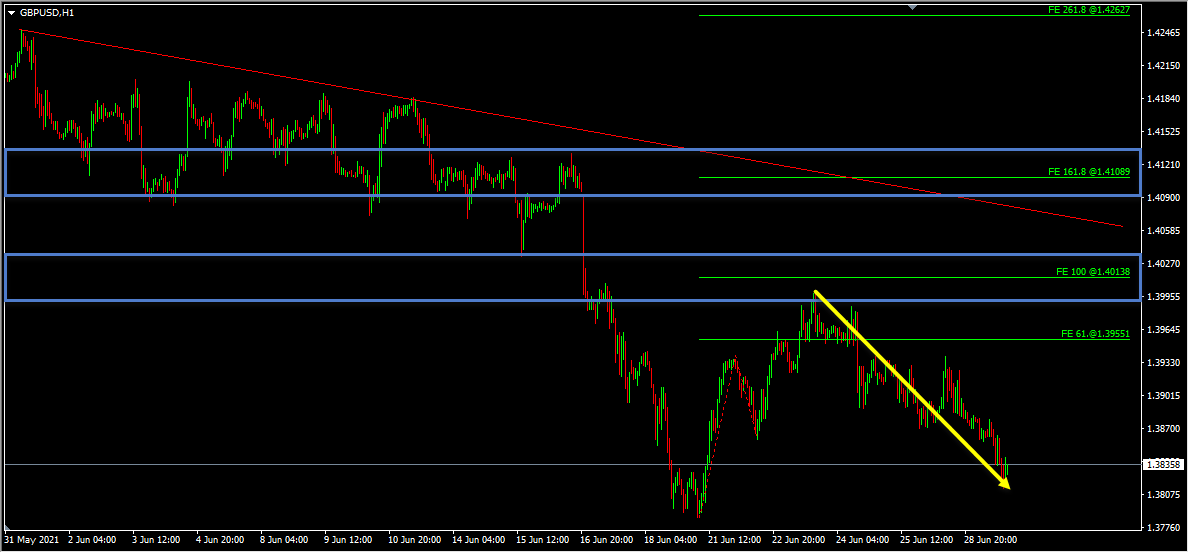

GBPUSD H1(1 Hour) Chart Current Scenario

On the H1 chart my view was bearish and I was expecting the price to move lower further until the key resistance zones hold. The price action followed my analysis exactly as I expected it to here. The price which was moving higher reached the first key resistance zone, respected it and moved lower from this zone. The price then moved lower further as I expected it to and delivered 180+ pips move so far.

The market provided us with various facts supporting the bearish view on the H1 chart. The pullback happened in the form of an ABCD pattern with the price creating a bearish divergence between the first high that has formed at 1.39362 and the second high that has formed at 1.40006 based on the MACD indicator. The price then moved lower and broke below the most recent uptrend line. We may consider these as facts provided by the market supporting the bearish view, also there were no signs opposing this bearish view. Then as you can see in the image below how the price moved lower further and provided an excellent move to the downside.

The market provided us with various facts supporting the bearish view on the H1 chart. The pullback happened in the form of an ABCD pattern with the price creating a bearish divergence between the first high that has formed at 1.39362 and the second high that has formed at 1.40006 based on the MACD indicator. The price then moved lower and broke below the most recent uptrend line. We may consider these as facts provided by the market supporting the bearish view, also there were no signs opposing this bearish view. Then as you can see in the image below how the price moved lower further and provided an excellent move to the downside.

(Note: You can learn about a Killer Forex Strategy “Double Trend Line Principle” here)

As traders we always have two choices, the first one is to fall in love with our analysis and try to convince the market and expect the price to move in the direction as per our wish. The second one is to follow the facts that the market provides us and make the right actions according to that. As you know the first option won’t help us and as you can see in the example above what happened when we followed the facts that the market hinted us and took the right action according to that.

As traders we always have two choices, the first one is to fall in love with our analysis and try to convince the market and expect the price to move in the direction as per our wish. The second one is to follow the facts that the market provides us and make the right actions according to that. As you know the first option won’t help us and as you can see in the example above what happened when we followed the facts that the market hinted us and took the right action according to that.

Not sure how to enter a trade? Spot reversals (bounces)? Not sure how to spot breakouts?

I invite you to join us in our live market analysis, on daily basis, and improve your trading with us.

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician