In the expansive realm of Forex trading, individuals with varying levels of expertise are consistently on the lookout for the ultimate solution – a foolproof strategy that ensures success in the dynamic and unpredictable market. The essence of this article is to delve into the extract of key takeaways and profound wisdom shared from my extensive experience. The allure of finding the “best” strategy in the ever-evolving Forex market is strong, as traders are constantly adapting to new information, technologies, and global economic conditions. As with any trading strategy, individuals need to approach it with a critical mindset, considering their risk tolerance, financial goals, and the ever-changing landscape of the Forex market.

This article is available to you, thanks to the support of our recommended broker Eight Cap

- 1 Explore My Free Mentorship Program

- 2 The Quest for the Ultimate Strategy:

- 3 The Pitfalls of Static Strategies:

- 4 The Evolution of a Trader’s Journey:

- 5 The Epiphany: Adapting to Market Phases:

- 6 The Strategy Unveiled: Analyzing Market Phases:

- 7 The Role of Divergence and Indicators:

- 8 The Essence of Trading Comfort:

- 9 Conclusion:

Explore My Free Mentorship Program

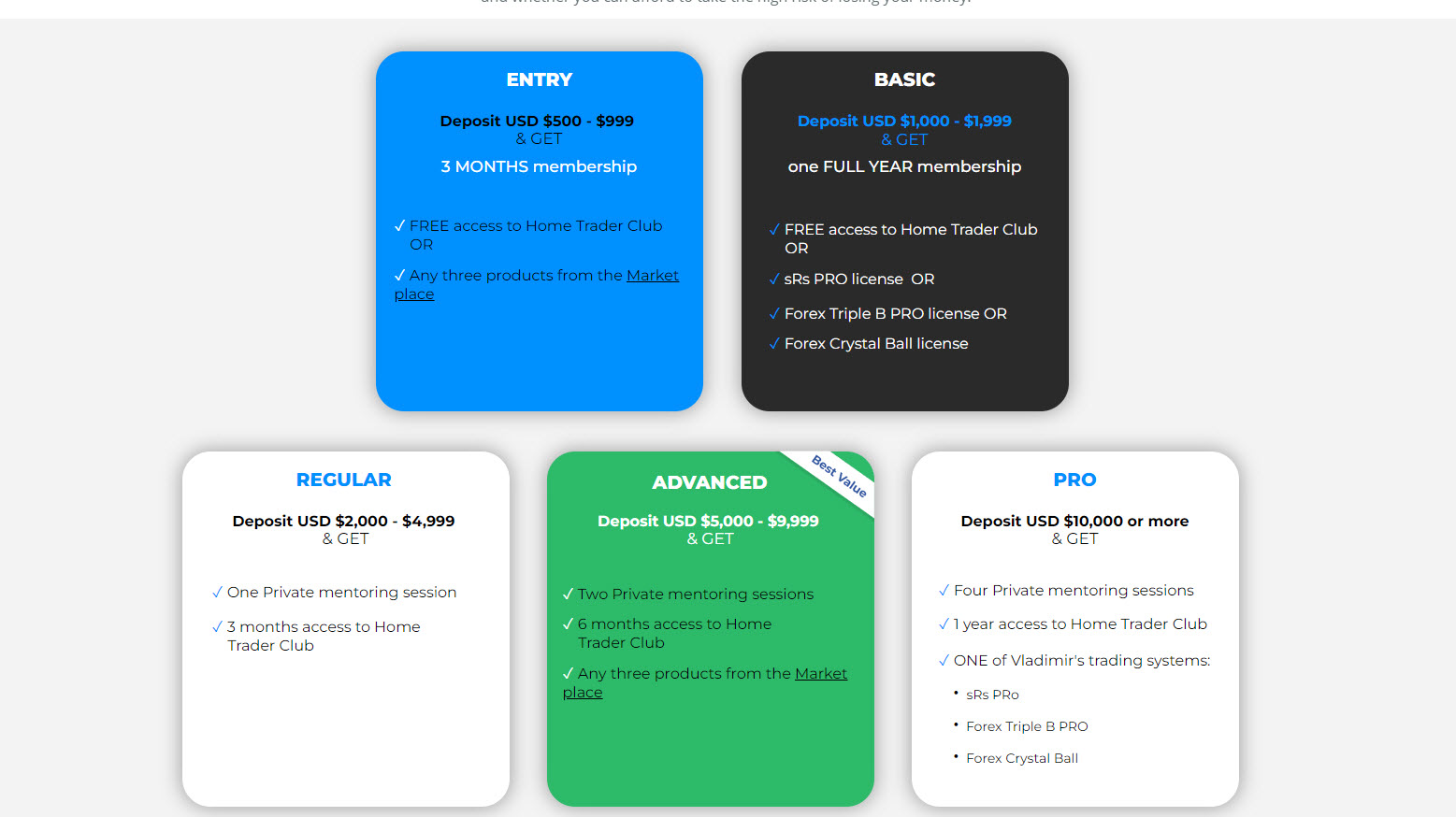

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

The Quest for the Ultimate Strategy:

I initiate my discourse by recognizing the abundance of Forex trading strategies available in the market. I underscore the difficulty in distinguishing genuinely effective strategies amid the plethora of options. This introduction sets the stage for a narrative that revolves around the challenges and nuances of navigating the complex world of Forex trading.

I adopt a somewhat skeptical tone as I delve into a common phenomenon among traders – the belief that they have stumbled upon a revolutionary and foolproof trading strategy. However, I hint at the underlying theme that, in reality, the outcomes of such strategies often differ from the optimistic expectations.

Drawing from my extensive 15-year trading journey, I share insights into my own experiences, which encompass both successes and setbacks. This personal touch lends authenticity to my narrative, making it relatable to other traders who may have encountered similar highs and lows in their trading endeavours.

I disclose that I experimented with a variety of strategies during my trading career. These range from fundamental and straightforward support and resistance methods to more intricate and advanced techniques such as London and US session breakouts. By mentioning specific strategies, I provide a glimpse into the diverse approaches I explored, showcasing the breadth of my experience and the evolution of my trading methodology over time.

The Pitfalls of Static Strategies:

A key challenge faced by many traders—their difficulty in adapting to the ever-changing conditions of the Forex market. The central theme revolves around the dynamic nature of the market, where the effectiveness of trading strategies is contingent on specific phases and conditions. I emphasize that what might be a successful strategy in one market scenario may quickly lose its effectiveness in a different set of circumstances.

For instance, I explain that a trend-following strategy, which capitalizes on the persistence of market trends, might result in losses when faced with a choppy market characterized by erratic price movements without a clear trend. Conversely, a reversal strategy, designed to profit from trend reversals, may prove ineffective amid a strong and sustained trend. This example serves to highlight the importance of aligning trading strategies with the prevailing market conditions.

The term “inherent inflexibility” encapsulates a critical flaw in the approach of many traders. Despite the market’s dynamic nature, traders often become rigid in their adherence to specific strategies, even when the market dynamics shift. This resistance to change can be detrimental, as once successful strategies may become obsolete or counterproductive under different circumstances. The statement suggests that successful trading requires a continuous evaluation and adjustment of strategies based on the evolving conditions of the market.

My insight implies that adaptability is a key attribute for successful trading. Traders need to be vigilant, recognize changes in market dynamics, and be willing to modify their strategies accordingly. Failure to do so may result in missed opportunities or, worse, financial losses. Overall, the passage underscores the importance of flexibility and adaptability as essential qualities for navigating the complexities of the Forex market.

The Evolution of a Trader’s Journey:

Looking back on my journey as a trader and the evolution of my trading strategies. I recount a spectrum of approaches, ranging from basic concepts like support and resistance to more intricate techniques such as Fibonacci analysis and the use of indicators. Through this retrospective exploration, I acknowledge the inherent merits in each strategy I experimented with.

The diverse array of strategies mentioned implies that I have actively sought to understand and implement a broad range of trading methodologies. This willingness to explore different approaches suggests a dynamic and adaptive mindset, a crucial aspect for success in the ever-changing landscape of financial markets.

Despite the differences in complexity and methodology among the various strategies, I identify a common thread that runs through my experiences—the imperative for traders to consistently adapt and adjust their approaches in response to evolving market conditions. This recognition reflects a key insight gained through my practical experiences: the flexibility to pivot strategies based on the dynamic nature of the market is a critical component of sustained success in trading.

Having arrived at this realization, I am prompted to share a foundational concept that has become the bedrock of my trading success. Although the statement doesn’t explicitly mention the specific concept, it implies that the forthcoming information will revolve around a fundamental principle that has significantly contributed to my achievements as a trader. This foundational concept is likely to encapsulate the essence of adaptability and continuous learning, echoing the notion that successful traders are those who can navigate and thrive in the ever-changing conditions of the financial markets.

The Epiphany: Adapting to Market Phases:

I emphasize the critical role of market analysis and stress the significance of recognizing the specific phase in which the market currently exists. Whether the market is in a trending phase characterized by a clear and sustained direction, a corrective phase marked by price retracements, or a ranging market where prices move within a relatively confined range, I assert that each scenario demands a nuanced and tailored approach.

The crux of my perspective lies in the idea that the key to successful trading is the ability to identify patterns and behaviours associated with each market phase. This implies a departure from a one-size-fits-all strategy and underscores the importance of adaptability and situational awareness. In a trending market, for instance, a trader might employ strategies that capitalize on the momentum, while in a ranging market, strategies designed to exploit price fluctuations within a confined range could be more effective.

By highlighting the need to understand and align with the current market phase, my conclusion speaks to the dynamic nature of financial markets and the imperative for traders to stay attuned to changing conditions. It suggests that a successful trader is one who can read the market like a book, recognizing the story it tells through its various phases, and adjusting their trading approach accordingly. In essence, the simplicity of the conclusion underscores the sophistication that comes with a deep understanding of market dynamics and the ability to adapt strategies to match the prevailing conditions.

The Strategy Unveiled: Analyzing Market Phases:

When discussing trading trends, I highlight that in a clear and sustained trend, certain patterns consistently repeat. This repetition, according to me, provides optimal opportunities for traders. This insight underscores the idea that recognizing and exploiting repetitive patterns in a trending market can enhance a trader’s ability to make informed and profitable decisions.

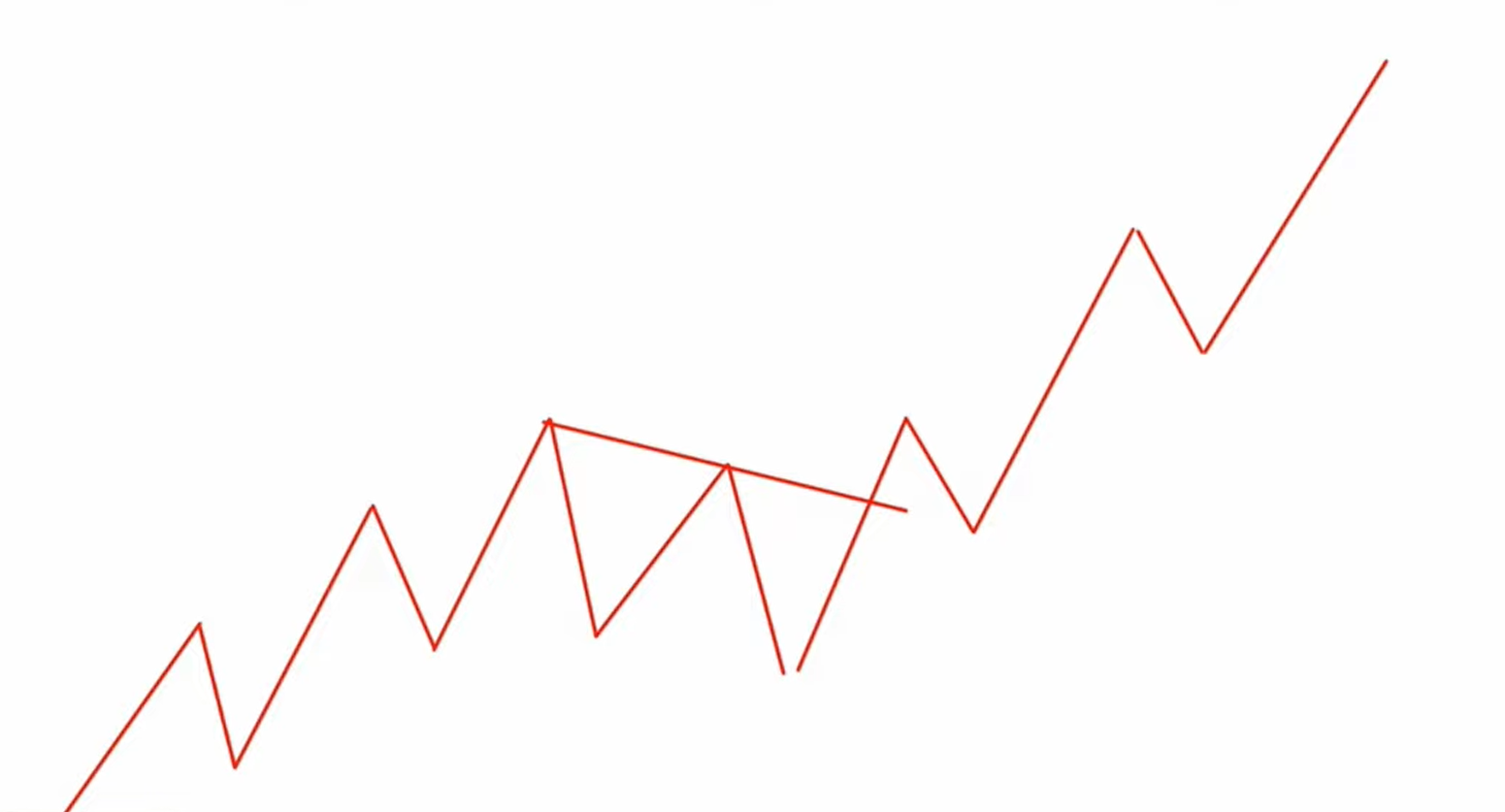

The concept that price is moving based on is the sequence of highs and lows in the same direction followed by a corrective structure. This is how the market moves in any timeframe. An uptrend is when the price creates higher lows and higher highs, so after an uptrend is defined, the market tends to create a correction. Most of the time this correction might happen in the form of two waves down after which the price continues the trend.

In less common cases, the market tends to make a ranging correction in the form of a triangle, pendant, flag, etc… after which the price continues the trend.

In very rare cases we might get a deep pullback to the previous low and then the price might continue the trend.

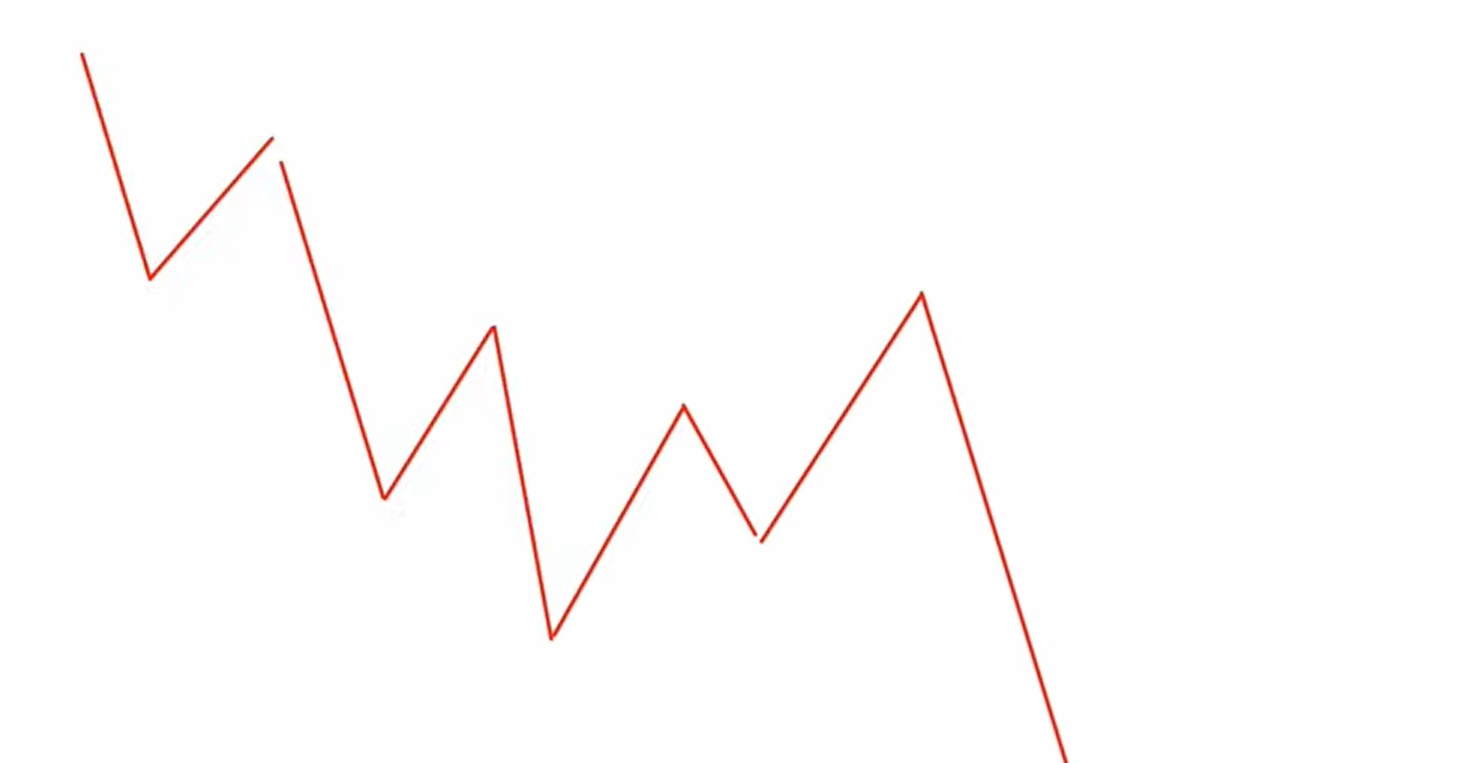

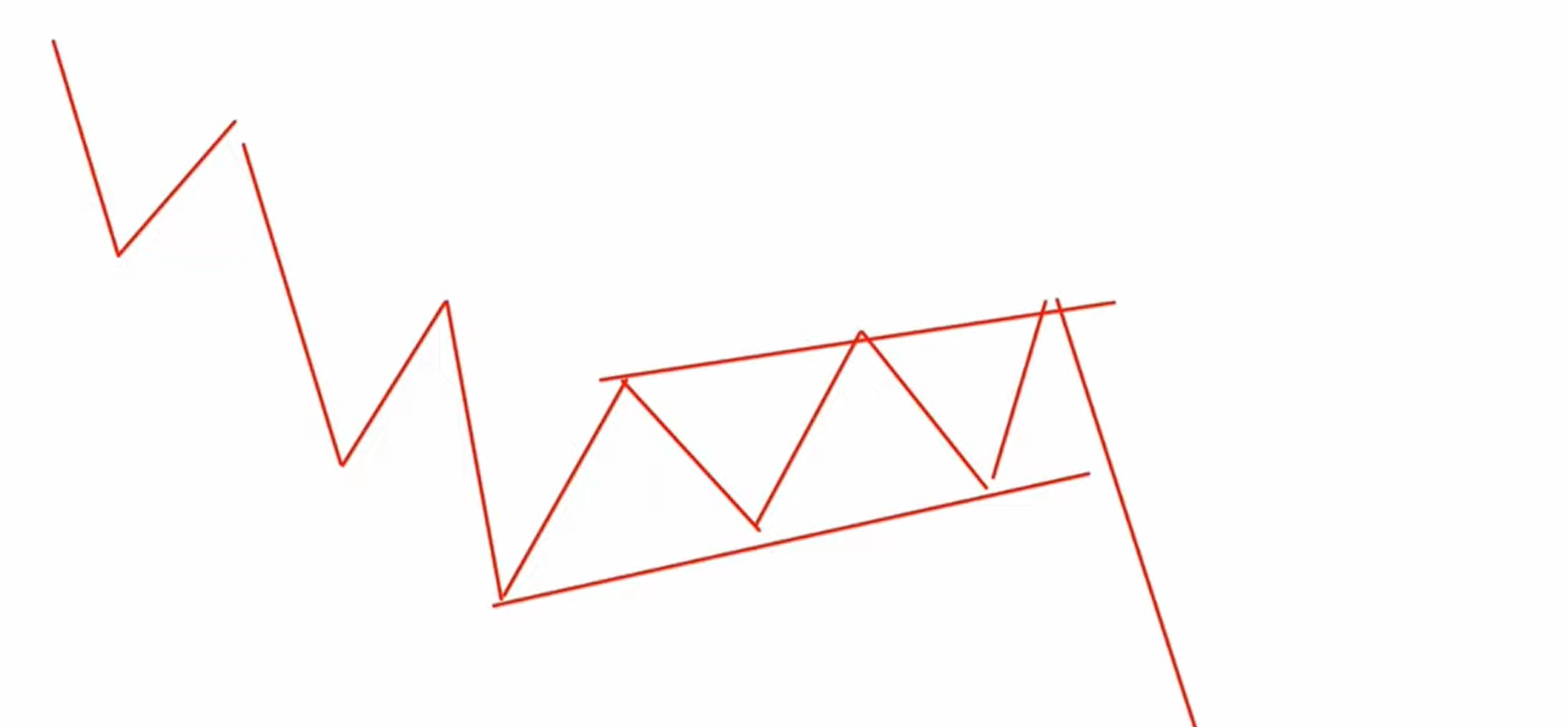

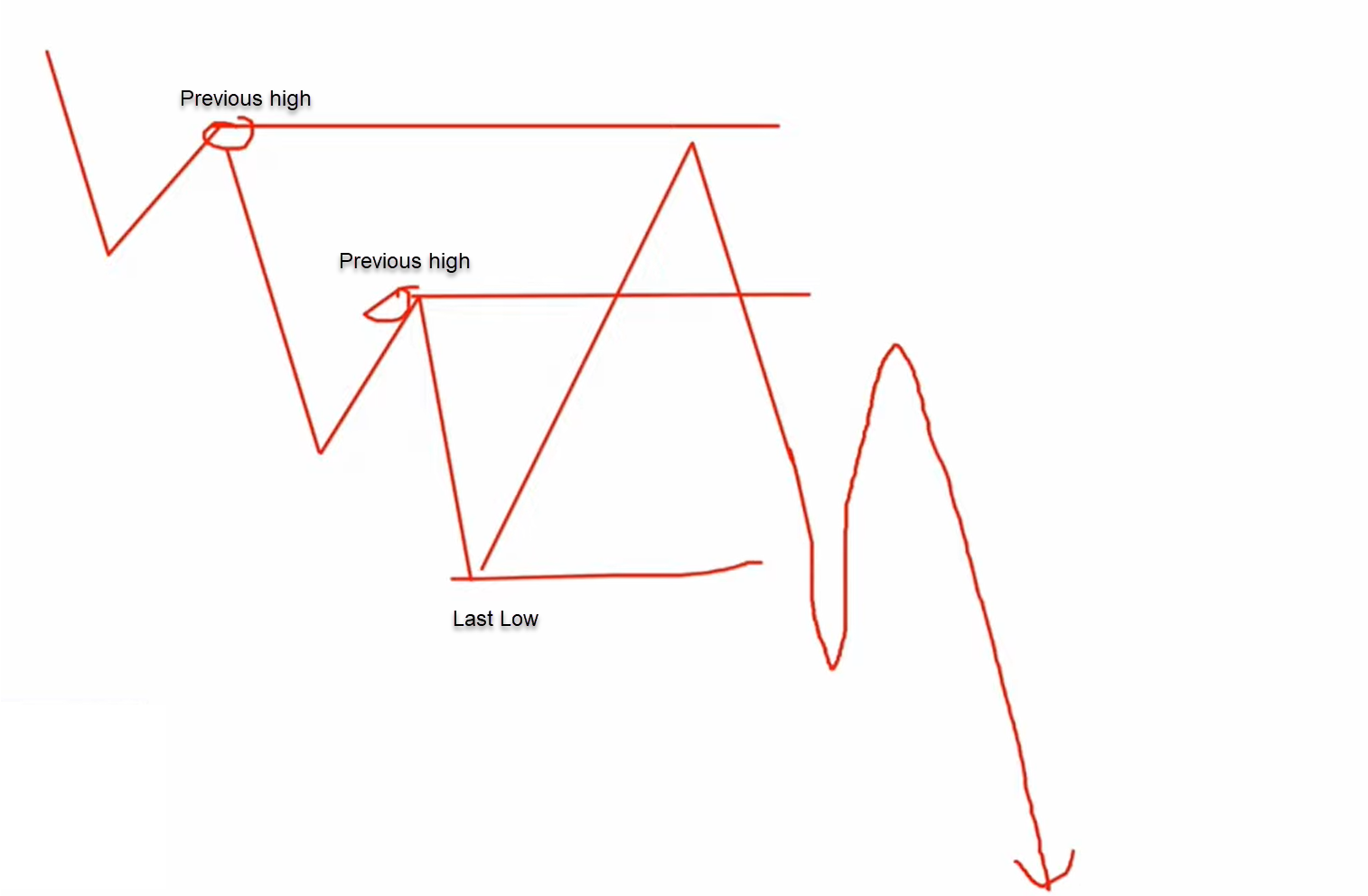

It’s just the vice versa for the downtrend. A downtrend is when the price creates lows highs and lower lows, so after a downtrend is defined, the market tends to create a correction. Most of the time this correction might happen in the form of two waves to the upside after which the price continues the trend.

In less common cases, the market tends to make a ranging correction in the form of a triangle, pendant, flag, etc… after which the price continues the trend.

In very rare cases we might get a deep pullback to the previous high and then the price might continue the trend.

Each wave on a timeframe is a sequence of highs and lows on the lower timeframe. For example, each wave on the weekly chart is a sequence of highs and lows on the daily chart.

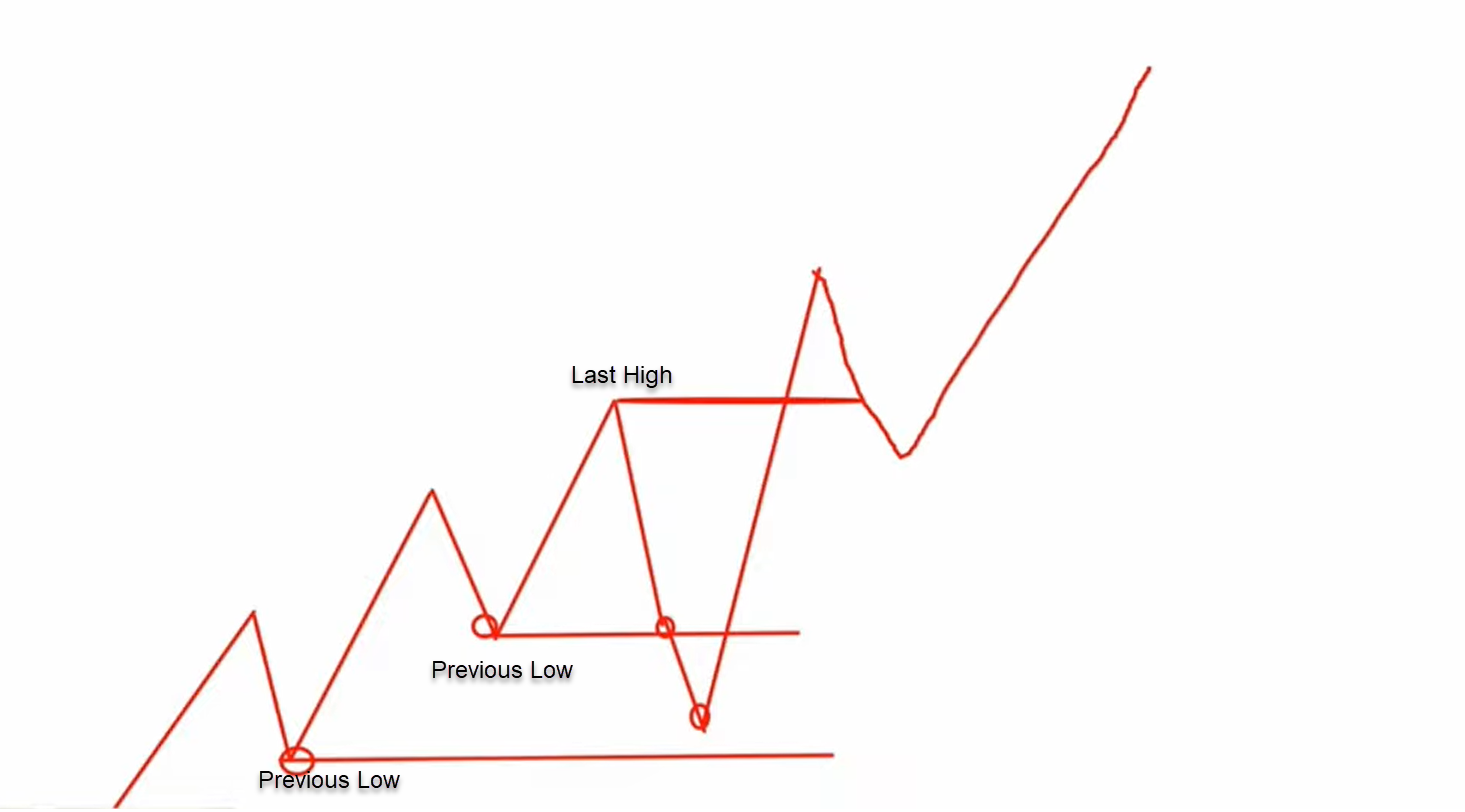

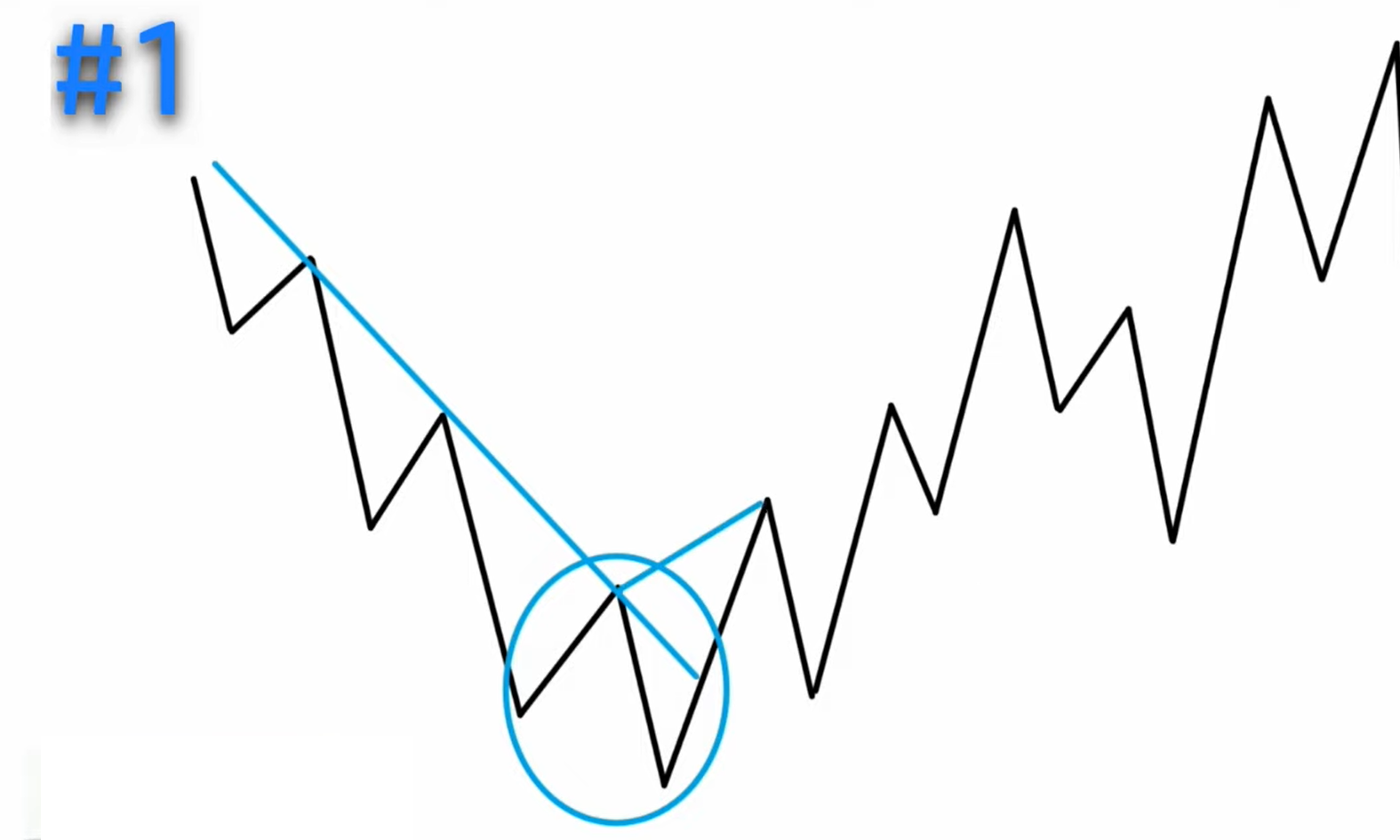

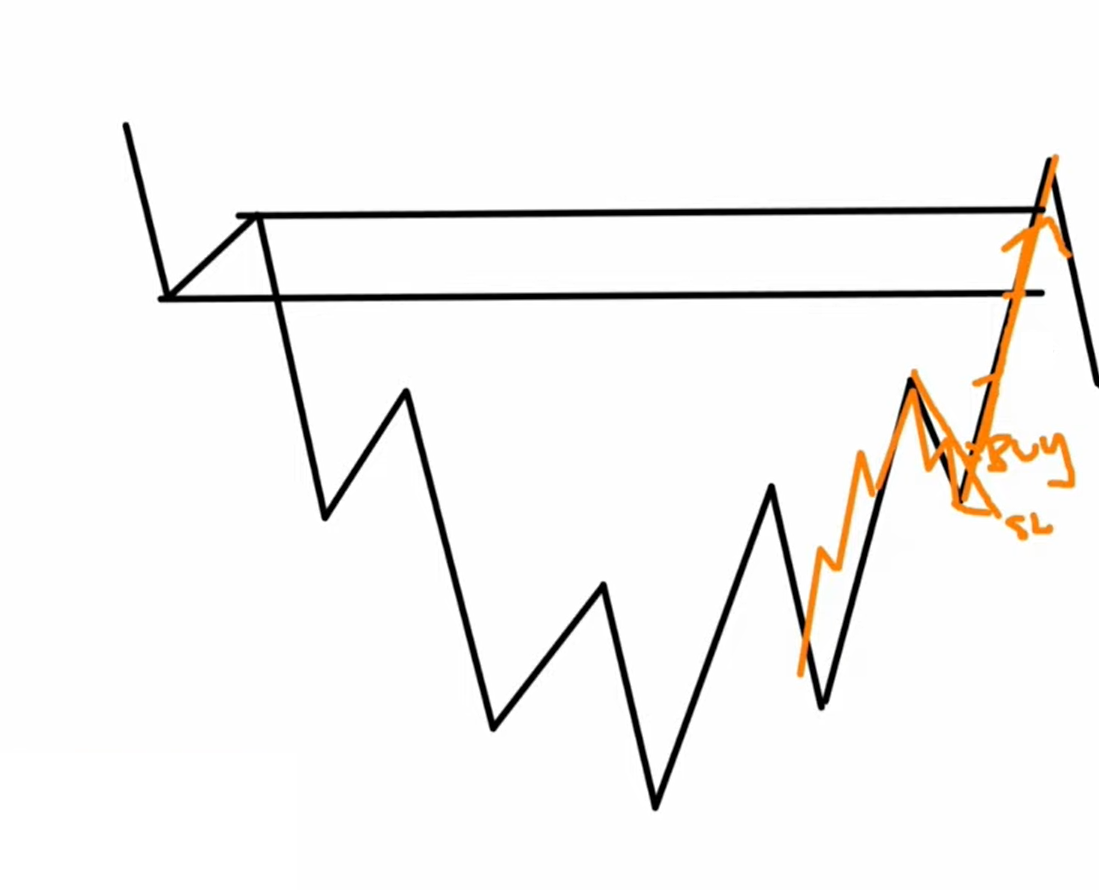

There are two key moments that I want you to pay attention to. The first key moment is when the trend changes. For example, in the image below you can see that the price has created a sequence of lower highs, and lower lows and then the market made a bullish turnaround and created higher highs, higher lows, and also a breakout of the most recent downtrend line. When such things happen, you need to remember that as long as the last low holds there is a good chance for a potential trend change to happen or at least a correction. It’s just the vice versa for the bearish turnaround.

The broken resistance will become a support and the previous support in the downtend will become a demand zone where the buyers love to buy.

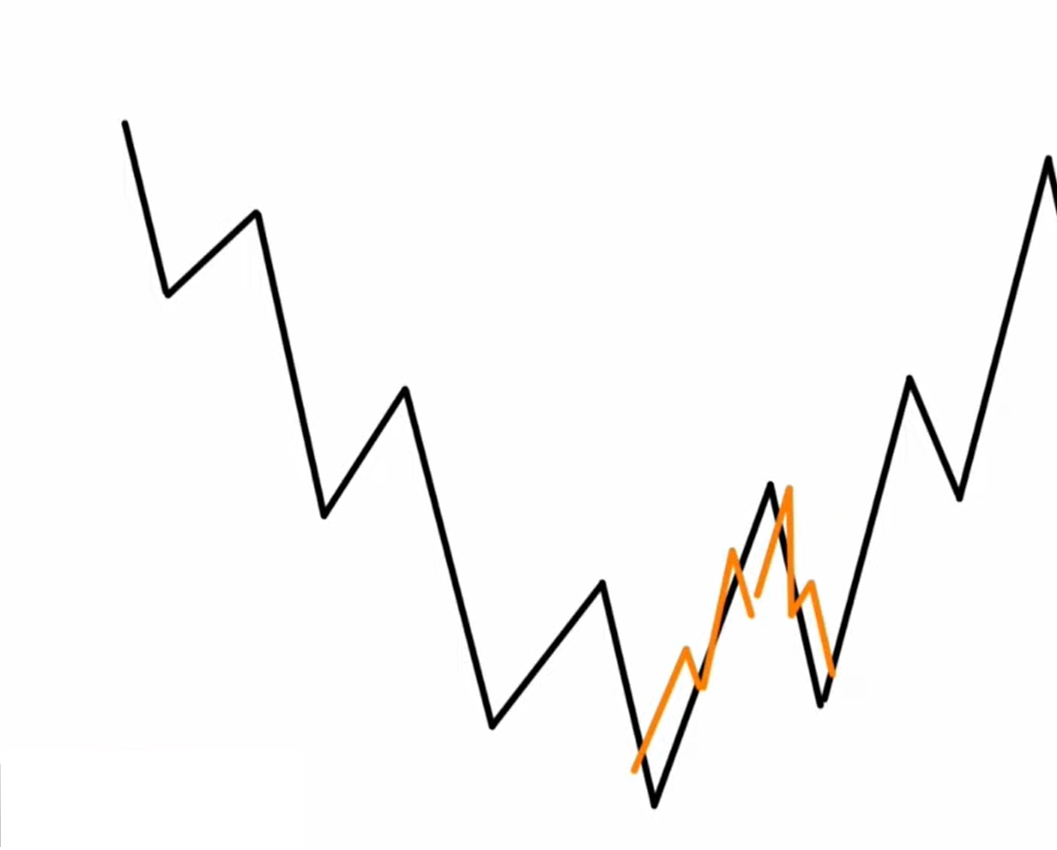

The second key movement is when the turnaround happens and then on the lower timeframe you start to see trending conditions followed by a correction and this is where we need to start looking for the buy opportunity.

The target here would be the previously broken support zone which now acts as a resistance zone.

Additionally, I emphasize the importance of comprehending market sentiment by noting that specific patterns associated with different phases can signal opportunities. This implies that a nuanced understanding of market sentiment allows traders to align their strategies with the prevailing conditions, enhancing the probability of success.

Support and resistance levels are critical markers on a price chart that indicate potential turning points in the market. By being adept at identifying these levels and understanding when to enter or exit positions, traders employing my strategy can make more informed decisions, adding a layer of precision to their trades.

Overall, my strategy is characterized by its adaptability and responsiveness to the specific conditions of the market. It suggests that successful trading involves more than just adhering to a fixed set of rules; rather, it requires a continuous analysis of market dynamics and a skillful adjustment of strategies based on the prevailing sentiment and phase. This adaptive approach aligns with the broader theme of understanding the market as a dynamic and ever-evolving entity.

The Role of Divergence and Indicators:

My acknowledgment of the usefulness of technical analysis tools like divergences and indicators suggests that I have explored a diverse set of methodologies in my trading journey. However, my warning against over-reliance on indicators underscores a common pitfall in trading — the assumption that a single tool or strategy can guarantee consistent success. Market conditions are dynamic, and what works exceptionally well in one scenario may not yield the same results in another.

The underlying message in this cautionary note is that successful trading requires more than just the adoption of sophisticated tools; it demands a nuanced understanding of the limitations and contextual applicability of these tools. Traders need to be adaptable and recognize that the effectiveness of any strategy is contingent on the prevailing market conditions.

The Essence of Trading Comfort:

The acknowledgment of the myriad strategies available reflects the vast landscape of approaches that traders can adopt. My emphasis on the uniqueness of each trader suggests an appreciation for the fact that what works for one individual may not be suitable for another. This recognition of individuality is an important departure from the notion that there is a one-size-fits-all solution in trading.

The mention of factors such as logic, comfort, and execution highlights the multifaceted nature of successful trading. Logic speaks to the rationality and sound reasoning behind a trader’s decisions. Comfort is a subjective aspect, indicating that traders should feel at ease with their chosen strategies and risk tolerance. Execution refers to the ability to implement trades effectively, emphasizing the practical and operational aspects of trading.

The key takeaway from my message is the importance of developing a personalized and adaptable trading strategy. Traders are encouraged to align their approaches with their unique characteristics, preferences, and comfort levels. This personalized touch is seen as a critical element in achieving consistent profits over time, suggesting that a strategy that resonates with an individual is more likely to be adhered to and successfully navigated through various market conditions.

You can watch the video of this webinar here

Conclusion:

In conclusion, my journey through the intricacies of Forex trading provides valuable insights for both novice and experienced traders. The key takeaway is the recognition that success in the Forex market is not about discovering a universal strategy but rather about adapting to market phases. By understanding the nuances of trends, corrections, and ranging markets, traders can significantly increase their probabilities of success. My emphasis on the importance of personalized, adaptable strategies serves as a guiding principle for those navigating the complexities of Forex trading.

To your success,

Vladimir Ribakov

Home Trader Club