Watch the video of this Trading Strategy

Hi Traders! Finding the most accurate trading setup is usually something that can be EASY done looking backwards on the charts. No one can predict in advance how their trade will end and how the market will decide to go. BUT the great news is that you can increase your chances to end up winning, by applying several trading principles. And that’s exactly what you will find here, in this article.Keep reading.

MULTI-TIME FRAME ANALYSIS AND TRADING

First of all you should define what a high accuracy strategy or signal means to you. Is it the win/loss ratio? Is it about how often your final target (take profit) is reached? This definition alone opens a huge discussion and multiple variables. However, we are going to find one constant among all these variables: Overall Market Direction.

The accuracy of the strategy and the signals that the strategy generates depends on whether you understand the flow of the market on a bigger scale than the one you are trading. In other words – multi time frame analysis.

If you are trading M5 chart, you probably don’t care much about W1 and Monthly charts. Make sure to go in the direction of the 1 or 2 higher time frames of the one you are trading. This is a very common mistake I see traders do on a daily basis.

You can determine the direction of the market in various ways and there is no better or worse in technical analysis (as long as it is used correctly. I personally use cycles, and waves combined with divergence while using technical indicators such as the moving average, MACD, RSI, etc… But my first weapon in technical analysis is always – price action. If the price moves is clear – it’s already telling 50% of the story.

DIVERGENCES AND DIVERGENCES SYNCHRONIZATION

You can’t really expect H1 chart bearish divergence to be a signal or sign of market reversal, when H4 and D1 charts are pushing full force to the upside, and they show no signs whatsoever of momentum exhaustion, slow down or divergences.

When you are trading multi time frames, treat every time frame as a separate one. Once they all start showing the same signs and synchronized in the same direction, this is where the best and most accurate trading signals normally appear.

Think about it, it is logical. If you see sell on the H1 chart, and the traders who trade H4 chart also see sell setup, and the traders that work on D1 chart also see sell signal what is the logical outcome? Price to push lower. Again, we can’t guarantee that a down move will really happen, but we can guarantee that the probabilities for that are much higher and trading is a business of probabilities.

PRICE ACTION

Price action is an extremely important (fair to say also – MOST important) part of every trader’s life that uses technical analysis in his trading, regardless of whether one admits it or not. Most technical indicators are based on price action data. The price is the core of the indicators. Remember – indicators job is to indicate! Price – is telling you the real value and real story!

Same applies to chart patterns, trend lines, harmonic patterns, Japanese candlesticks and so on. It all starts with price action.

If you didn’t invest time, effort and money into learning about price action, it is time to do so.

Note: If you want to learn about price action trading, you can watch this video here

Example

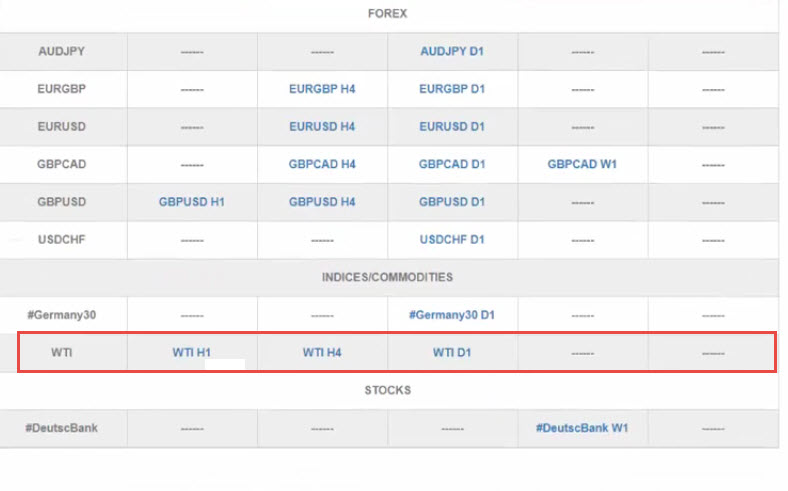

To help you understand this strategy I will take a trade (Oil) from our Traders Academy Club trading report. On the table below you can see my trading watch list. This list is all the trading opportunities I share with my followers on daily basis, in Traders Academy Club.

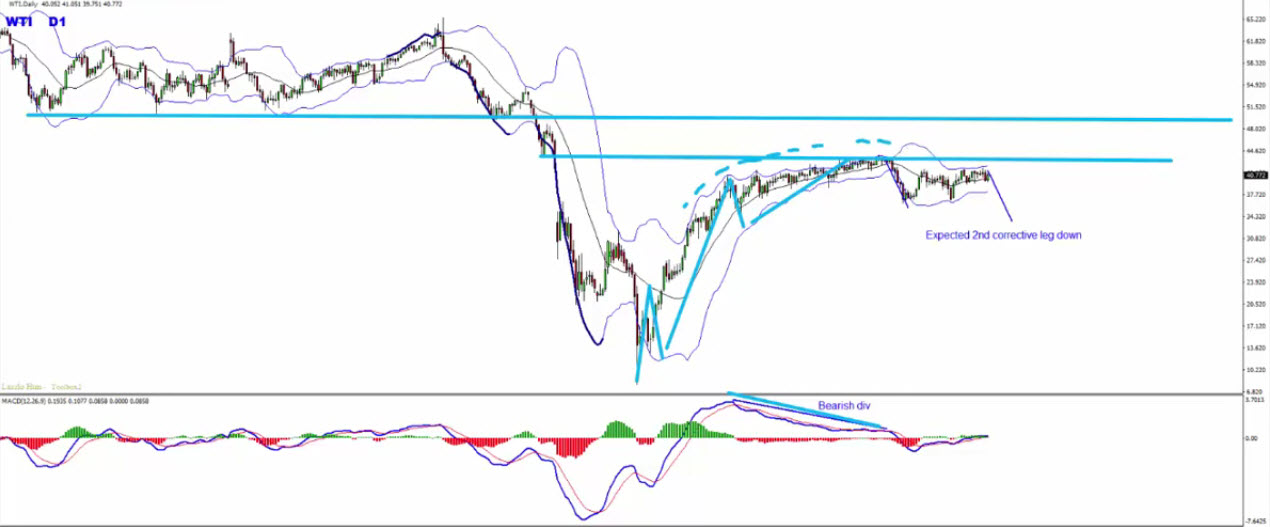

On the daily chart I spotted a bearish divergence besides that we have a key resistance zone as shown in the screenshot below. After the rallies we can see that the price has problems breaking above this resistance zone.

After this the price made a move down and came back to the broken resistance. It broke above this resistance, and then it broke below this resistance again and since this movement the area marked in red holds.

After this the price made a move down and came back to the broken resistance. It broke above this resistance, and then it broke below this resistance again and since this movement the area marked in red holds.

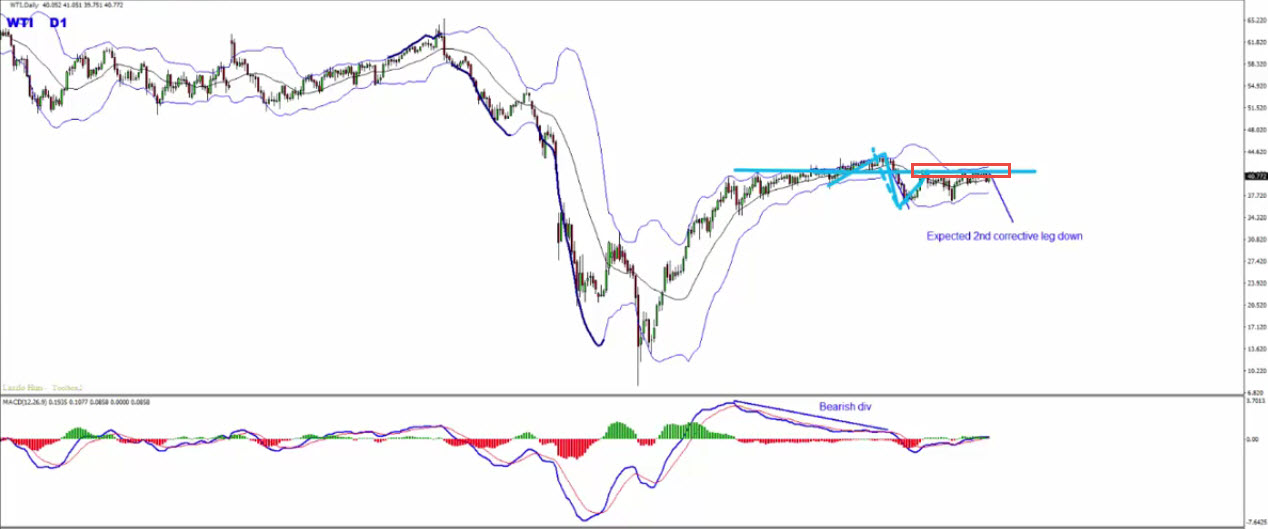

Now we step to lower timeframe and the idea here is to find evidences for synchronization. This means if the higher timeframe analysis is in one direction and on the lower timeframe if I have evidences for the same direction then this is where you will be able to spot high accuracy trades with high potential risk:reward ratio. (I say it as a potential one because in advance when you step into a trade we have no idea besides wishes how the trade will actually develop. That’s why you should rely on the market to bring in a trade and let the market be the one to tell you when to get out of it).

Now we step to lower timeframe and the idea here is to find evidences for synchronization. This means if the higher timeframe analysis is in one direction and on the lower timeframe if I have evidences for the same direction then this is where you will be able to spot high accuracy trades with high potential risk:reward ratio. (I say it as a potential one because in advance when you step into a trade we have no idea besides wishes how the trade will actually develop. That’s why you should rely on the market to bring in a trade and let the market be the one to tell you when to get out of it).

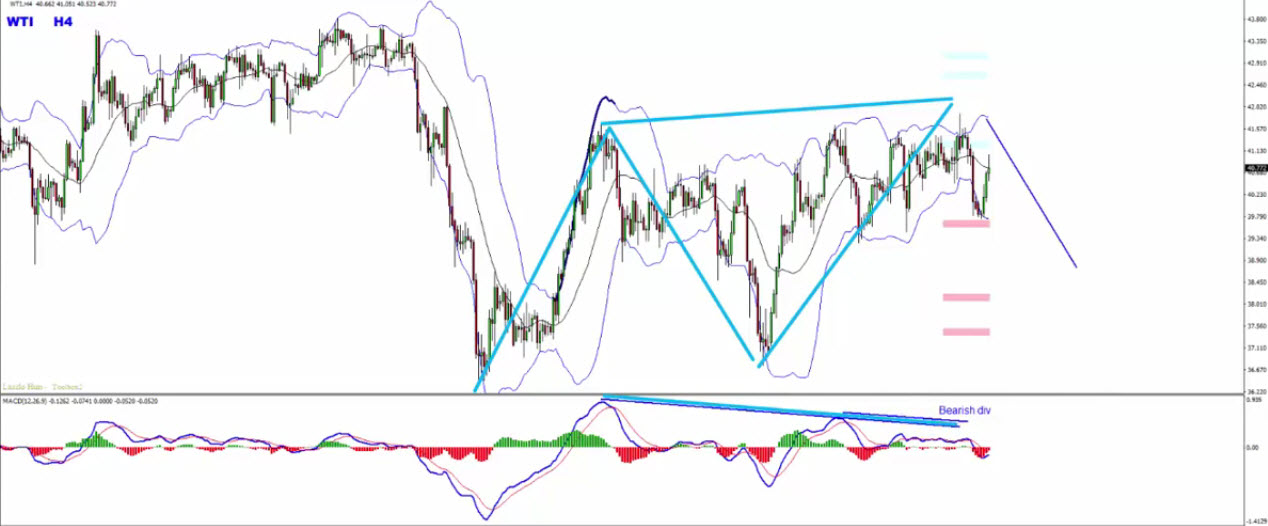

So looking at the H4 chart we could see that the price has created two waves to the upside and these big waves ended with a massive moving averages bearish divergence based on the MACD indicator.

In addition to this the last part has its own bearish divergence at the very same zone and then the price has moved lower and broken below the most recent uptrend line and is holding below it.

In addition to this the last part has its own bearish divergence at the very same zone and then the price has moved lower and broken below the most recent uptrend line and is holding below it.

Now I go to one timeframe lower to try and find the opportunity to get into the trade.

Now I go to one timeframe lower to try and find the opportunity to get into the trade.

Based on one of the techniques I use I want to see the bears gaining momentum.

How do we find the bears gaining momentum?

When the price manage to create lower highs, lower lows. IT IS THAT SIMPLE!

So from this area there are several ways to enter a trade. Now you can apply all the knowledge you have and enter the trade based on the candle stick pattern, the broken support and resistance levels, broken trend lines, etc…

Note: I personally usually many techniques to enter and exit a trade if you want to learn them then you can join my Traders Academy Club here

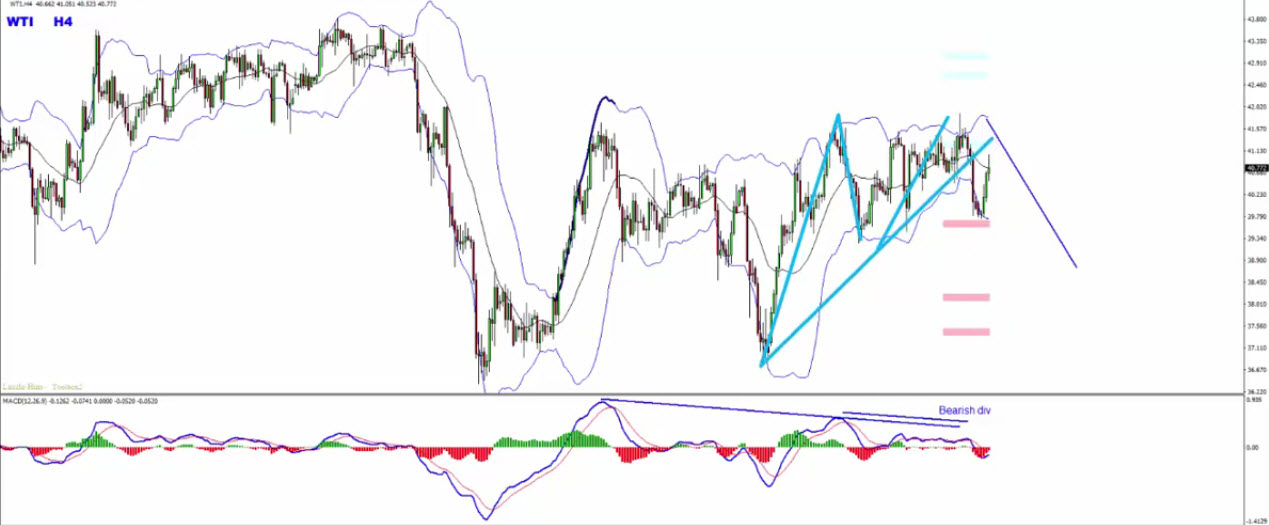

One of the techniques that I use is ABCD breakout, we have three waves to the downside supported by higher timeframe analysis, and we have here a hidden bearish divergence for a possible trend continuation. So the break below the most recent uptrend line would be the sign for me to step into this trade. After I get into this trade I do want to see the price gain momentum by creating a bearish trend pattern, this would be the sign for me to know that if my analysis is right. If it doesn’t follow this then I have to reconsider my analysis.

One of the techniques that I use is ABCD breakout, we have three waves to the downside supported by higher timeframe analysis, and we have here a hidden bearish divergence for a possible trend continuation. So the break below the most recent uptrend line would be the sign for me to step into this trade. After I get into this trade I do want to see the price gain momentum by creating a bearish trend pattern, this would be the sign for me to know that if my analysis is right. If it doesn’t follow this then I have to reconsider my analysis.

Note: A very important tip to remember here is if you draw the lines, and you anticipate the market to move in a specific direction but the market doesn’t then the market is not wrong here the analysis you made is wrong, and you have to adjust it.

Note: A very important tip to remember here is if you draw the lines, and you anticipate the market to move in a specific direction but the market doesn’t then the market is not wrong here the analysis you made is wrong, and you have to adjust it.

As you can see in the screenshot below this is what exactly happened here, after the ABCD pattern with the bearish hidden divergence and the breakout of the most recent uptrend line, the price moved lower and created a bearish trend pattern and moved lower further.

So traders this is what I wanted to show you how the full synchronization looks like, on the daily chart the levels were respected, the H4 chart verification and the H1 chart provided an opportunity. It doesn’t have to be D1, H4 and H1 it can be any three timeframe combinations of your choice (but following time frames, not random).

So traders this is what I wanted to show you how the full synchronization looks like, on the daily chart the levels were respected, the H4 chart verification and the H1 chart provided an opportunity. It doesn’t have to be D1, H4 and H1 it can be any three timeframe combinations of your choice (but following time frames, not random).

.

Conclusion

Many traders especially the beginners believe there is some sort of secret hidden things behind the price, some others believe that there is holy grail which you can use and always win. I want you to understand that its a myth, such things don’t exist and as high as your techniques could be there might still be different periods in the market. In some periods everything you touch will work out amazingly and some other periods will not be like that. That’s the real world of trading.

In some cases the market will not agree with your analysis and technique and will go in the opposite direction. It is very important to understand this because when you start your trade the emotions are so high, and we always believe that every trade is going to be a winner. But it’s not always like that, when you approach a trade you do want to rely on the charts that provides you the facts to get into a trade and also it’s very important for you to rely on the same chart to get you out of the trade (meaning when it shows opposite signs to step back). When you see such signs then don’t try to convince yourself thinking maybe I’ll just let it run a bit more because you heard in some forum that this and that should happen. All that are good but the best is what the chart tells you. The bottom line here is that if you rely on the chart to get into a trade then rely on the same chart to get out of it.

Once again I invite you to join me in my club and enjoy from our Live Market Analysis and our trading reports on a daily basis and improve your trading with us.

Also, you can get one of my strategies free of charge. You will find all the details here

Thank you for your time in reading this article.

Yours to success,

Vladimir Ribakov

Certified Financial Technician