The Nasty Cable (GBPUSD) has been one of the best-performing currency pairs in the last few months. The economic improvements in the UK triggered a rally in the GBPUSD, which is continuously bid on every major dip. The pair traded as high as 1.6602 in January. Since the recent high, the pair has dropped back to test the 1.6300/20 level. The pair found buyers again around the same area, and as a result the pair is trading higher again towards the 1.6500 level.

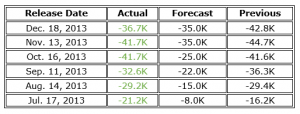

There are some key events lined up for the UK today, including the Claimant count change, the unemployment rate, average earnings index, public sector net borrowing and the MPC meeting minutes. The Claimant count change is expected to register another sharp decline in December. The market is expecting an impressive reading of -35.0K. The last six readings were impressive, and all came better than expected, as can be seen in the figure below. If the theme has to be believed, then there are very less chances that the upcoming data may disappoint.

The figures came better than expected, but the last two readings suggest that the improvement is declining with a minor pace, as shown in the chart below. However, this cannot be considered a negative sign unless the upcoming reading register a substantial miss. At GMT 09:30 AM, the data will be released.

Another important data, which is the unemployment data will also be released at the same time. The market is expecting a 0.1% decline in the unemployment rate from 7.4% to 7.3%. There has been a sharp decline in the unemployment rate in the UK from the last two months. The unemployment rate declined from 7.7% to 7.4%, as can be seen in the chart below. If we witness another decline in the unemployment rate, then it will raise the speculation of a rate hike sooner than expected. The Bank of England keeps a close eye on the unemployment rate, and it is one of the main factors, which is considered in the monetary policy decisions.

Furthermore, the MPC meeting minutes will also be released at the same time. So, there are a lot of things to observe around the same time. In the last minutes, the BOE stated that “the developments in UK financial markets had reflected reactions to the continuation of data suggesting that the domestic recovery remained robust with diminishing inflationary pressure. The first rise in Bank Rate was fully priced in by mid-2015, similar to last month, while respondents to the Reuters survey had, on average brought forward by one quarter their expectation of the first rise, to August 2015. Most respondents expected the first rise to take place one to three quarters after the 7% unemployment threshold had been reached.”

Now, let’s see what the BOE members feel about the last decline in the unemployment rate. In addition, one thing to note here is that if we see a strong decline in the unemployment rate, then the pound may rally quickly, as the rate hike expectations will increase. On the other hand, if the unemployment rate misses the expectations, then it would be interesting to see the GBPUSD reaction. However, there are very little chances that the data will miss the expectations today.

Moreover, the BOC interest rate decision is also scheduled later during the day. It would be interesting to see the Canadian dollar reaction after the release considering the recent decline in the currency value.

Technically, the GBPUSD broke an important triangle on the 4 hour chart yesterday, as can be seen in the chart below. The pair also broke a critical resistance at around the 1.6450 level, and traded higher. The broken triangle and resistance might act as a support for the pair now. If the data comes better than or in line with expectations, then we can see a retest of previous highs in the GBPUSD. The pound may also gain ground against some other currencies like the AUD, NZD and Euro. On the downside, the support lies at around the 1.6410 level, followed by the 1.6360 level for the GBPUSD.

So, take note of these levels friends while trading the GBPUSD pair.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!