Hi Traders! NZDJPY forecast follow up and update is here. On July 7th I shared this “Technical Analysis – NZDJPY Forecast” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

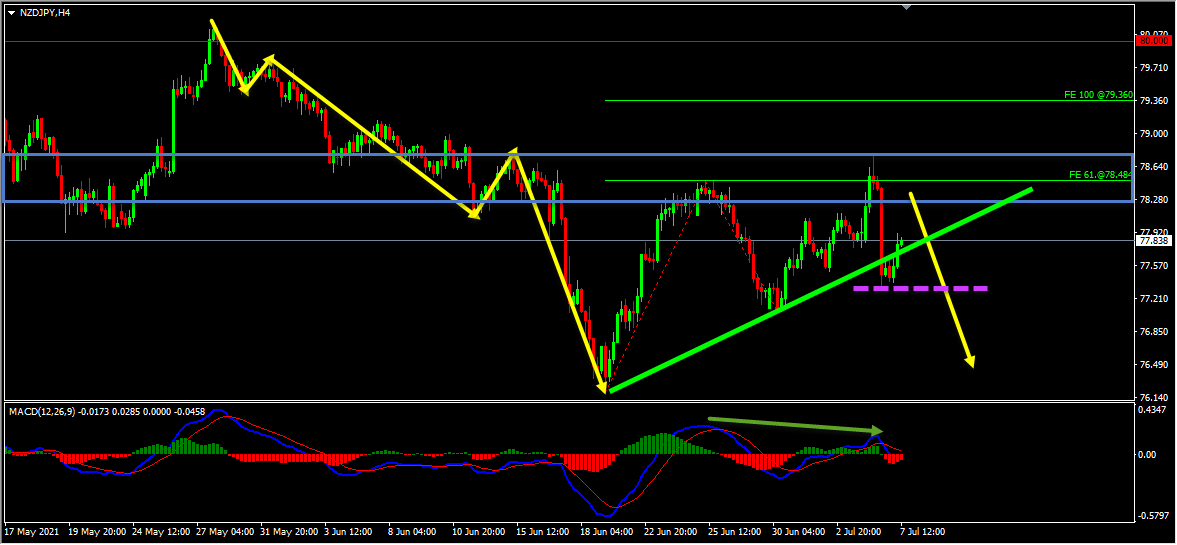

On the H4 chart, the price which was moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening. Also, while measuring the first wave of this correction using the Fibonacci expansion tool, we could see that the 100%(78.484) Fibonacci expansion level of this first wave coincides with a strong resistance zone which makes this area a key resistance zone for us. The price reached this key resistance zone, respected it and is moving lower from this zone. We also have a bearish divergence that has formed between the first high that has formed at 78.475 and the second high that has formed at 78.764 based on the MACD indicator. The price then moved lower and broke below the most recent uptrend line and currently it looks like a pullback is happening. We may consider these as other evidences of bearish pressure. Until the key resistance zone holds my view remains bearish here and if we get a valid breakout below the low at 77.323 we may then consider it as a validation for the bearish view and may expect the price to continue lower further.

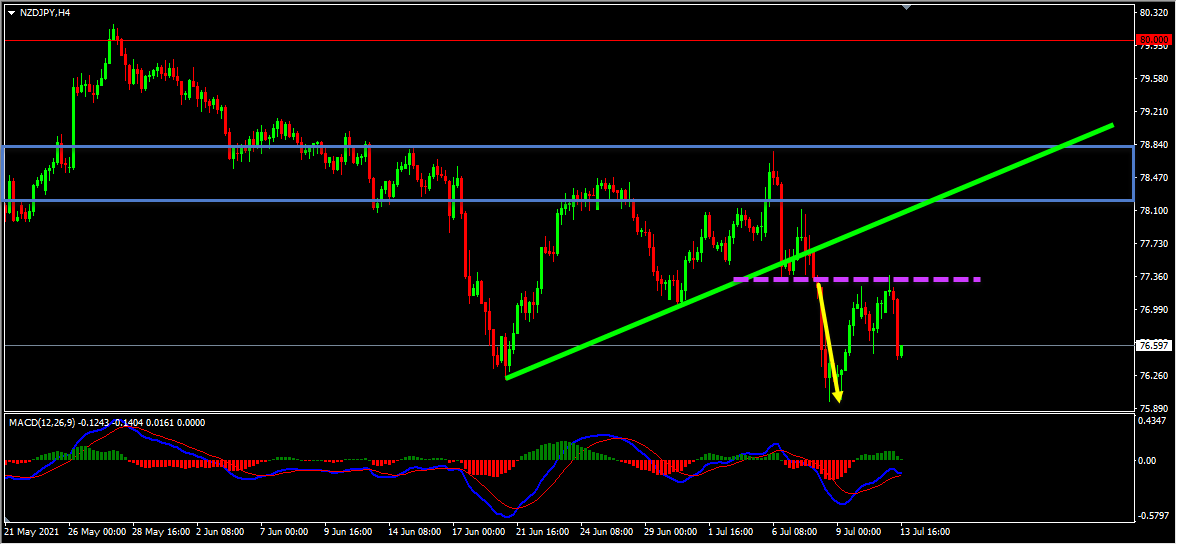

NZDJPY H4(4 Hours) Chart Current Scenario

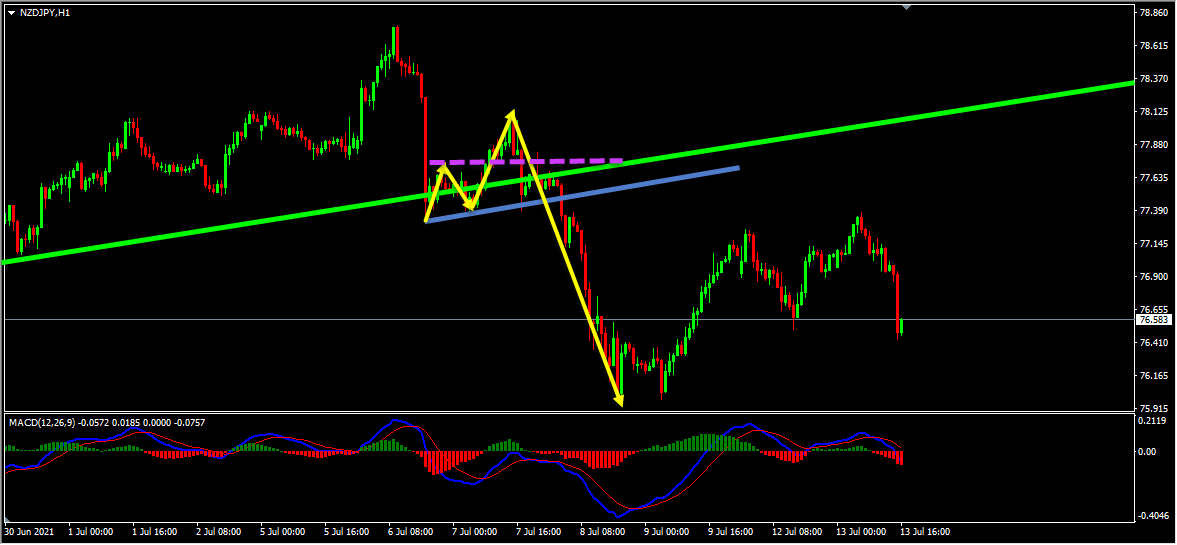

On the H1 chart the market provided us with various facts supporting the bearish view. After the breakout of the most recent uptrend line on the H4 chart we had a pullback, this pullback happened in the form of an ABCD pattern on the H1 chart. We had a false break of the high at 77.657 and then the price moved lower and broke below the most recent uptrend line. We may consider these as facts provided by the market supporting the bearish view and also, there were no signs opposing this bearish view. The price then moved lower further and provided an excellent move to the downside as you can see in the image below.

On the H1 chart the market provided us with various facts supporting the bearish view. After the breakout of the most recent uptrend line on the H4 chart we had a pullback, this pullback happened in the form of an ABCD pattern on the H1 chart. We had a false break of the high at 77.657 and then the price moved lower and broke below the most recent uptrend line. We may consider these as facts provided by the market supporting the bearish view and also, there were no signs opposing this bearish view. The price then moved lower further and provided an excellent move to the downside as you can see in the image below. So traders when it comes to trading, there are various important factors that we need to pay attention to, just because we have a good setup doesn’t mean that we can enter the trade randomly and it will pay us huge profits. First of all, we need to validate the entry and we should have a perfect entry plan to get into the trade which is a key factor when it comes to trading. This NZDJPY forecast is a perfect example of this scenario.

So traders when it comes to trading, there are various important factors that we need to pay attention to, just because we have a good setup doesn’t mean that we can enter the trade randomly and it will pay us huge profits. First of all, we need to validate the entry and we should have a perfect entry plan to get into the trade which is a key factor when it comes to trading. This NZDJPY forecast is a perfect example of this scenario.For similar trade ideas and much more I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Yordan Kuzmanov

Chief Trader at the Traders Academy Club