Hi Traders! Oil forecast update and follow up is here. On June 29th I shared this “Oil Forecast And Technical Analysis” post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

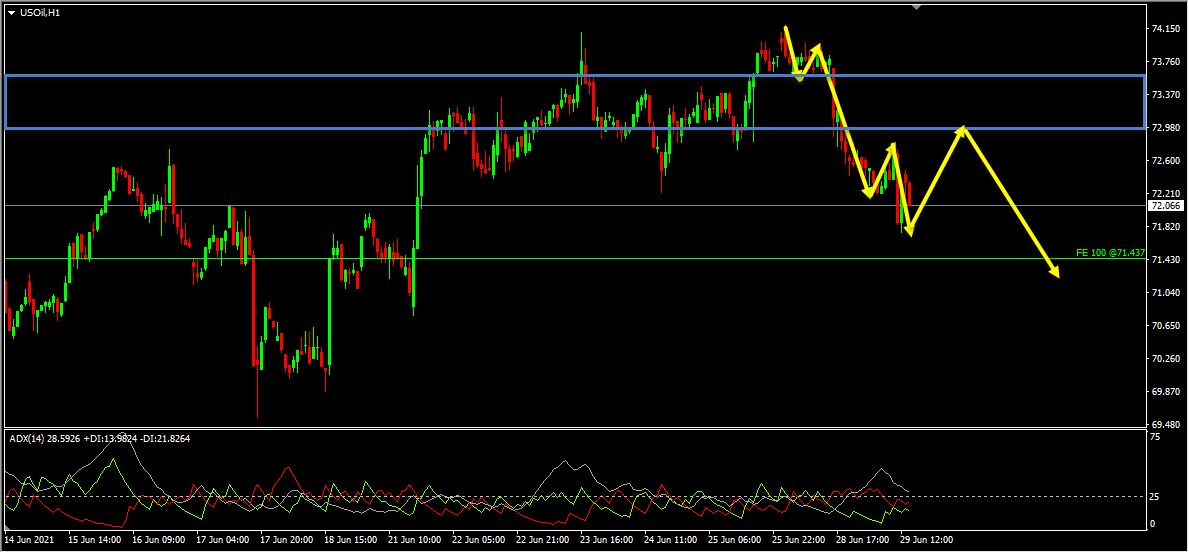

On the H1 chart, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Also, the ADX indicator gave a bearish signal here as well at the cross of -DI (red line) versus +DI (green line), and the main signal line (silver line) reads value over 25, we may consider this as yet another evidence of bearish pressure. Until the strong resistance zone (marked in blue) shown in the image below holds my view remains bearish here and I expect the price to move lower further.

Oil H1(1 Hour) Chart Current Scenario

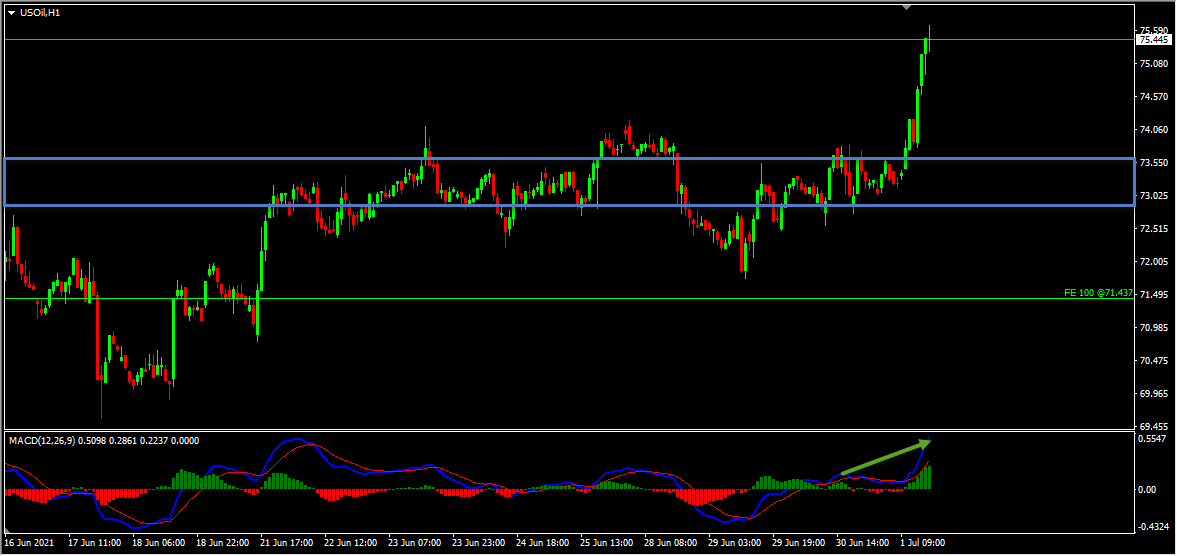

So traders, this is why I wanted to show this example to help you understand why we should always trade based on the facts and hints provided by the market and take the right actions according to that. Even though we had facts supporting the bearish view here, the price didn’t hold below the strong resistance zone, the price moved higher and provided a valid breakout above the strong resistance zone and is currently holding above it. Also, the price has created higher highs, based on the MACD indicator which I see as contradictory signs. You should always keep in mind that losses are part of trading we can’t expect every trade to go as per our plan and provide us profits. In trading, we can’t avoid losses but in order to be successful in trading, we should know how to cut losses early and how to manage the trade when the price goes in the opposite direction. When you see contradictory sign like this opposing our view then it is always recommended to cut your losses early and get out of the trade.

So traders, this is why I wanted to show this example to help you understand why we should always trade based on the facts and hints provided by the market and take the right actions according to that. Even though we had facts supporting the bearish view here, the price didn’t hold below the strong resistance zone, the price moved higher and provided a valid breakout above the strong resistance zone and is currently holding above it. Also, the price has created higher highs, based on the MACD indicator which I see as contradictory signs. You should always keep in mind that losses are part of trading we can’t expect every trade to go as per our plan and provide us profits. In trading, we can’t avoid losses but in order to be successful in trading, we should know how to cut losses early and how to manage the trade when the price goes in the opposite direction. When you see contradictory sign like this opposing our view then it is always recommended to cut your losses early and get out of the trade.

Note: You can watch my webinar on how to cut losses early here

In order to learn about this and much more, I invite you to join the

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician