Global stocks are on the cusp of finishing a record-breaking month sparked by major progress toward a coronavirus vaccine.

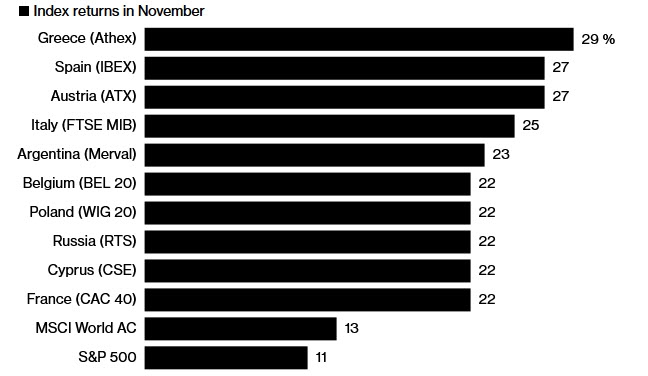

The MSCI World Index has soared 13% in November, the best performance on record. Trading was muted on Monday, with European stocks holding steady and U.S. futures slightly lower.

“I suspect that investors have become cautious after big gains in the last few weeks that were driven by the vaccine news,” said Peter Rosenstreich, head of market strategy at Swissquote Bank. “It’s a big positive as it’s really provided an endgame for Covid-19.”

Europe on Top

European equity markets dominate world’s index chart in November

The rapid pace to a vaccine has given investors the confidence to price in a return to normalcy and faster economic growth, helping lift shares of companies that were hardest hit by the pandemic.

Over the weekend, U.S. Surgeon General Jerome Adams said the federal government hopes to quickly review and approve requests from two drugmakers for emergency approval of their Covid-19 vaccines.

On Monday, the rotation in equities showed signs of a slight reversal. Futures on the tech-heavy Nasdaq 100 Index were little changed, while small-caps, banks and energy producers dropped. The MSCI Asia Pacific Index sank 1.6%, the biggest loss in a month.

The risk-on mood across markets has hurt demand for haven assets. Gold extended a retreat on Monday and is on course for its largest monthly decline in four years. The dollar is poised for a 2.7% drop in November.

Oil retreated 1% in New York. An informal meeting of OPEC+ ministers didn’t reach an agreement on whether to delay January’s oil-output increase. A full meeting of the cartel is planned for later today.

ABN Amro Bank NV fell 6.5% in Amsterdam trading. The Dutch lender plans to cut about 2,800 jobs over four years as it retreats from large parts of its investment bank.

IHS Markit Ltd. jumped 6% in U.S. premarket trading. The research firm with more than 5,000 analysts, data scientists agreed to be bought by S&P Global Inc. for about $39 billion in stock.

These are some key events coming up:

- OPEC holds a virtual full ministerial meeting to make a final decision on whether a production supply hike should proceed as scheduled in January.

- The Reserve Bank of Australia holds a policy meeting on Tuesday.

- Federal Reserve Chairman Jerome Powell testifies before Congress on Tuesday and Wednesday.

- The U.S. employment report on Friday is expected to show more Americans headed back to work in November, though at a slower pace than last month.

Here are the main moves in markets:

Stocks

- Futures on the S&P 500 Index declined 0.3% as of 1:17 p.m. London time.

- The Stoxx Europe 600 Index dipped 0.1%.

- The MSCI Asia Pacific Index declined 1.6%.

- The MSCI Emerging Market Index fell 1.3%.

Currencies

- The Bloomberg Dollar Spot Index declined 0.1% to 1,141.03.

- The euro rose 0.2% to $1.1982.

- The British pound climbed 0.2% to $1.3336.

- The Japanese yen weakened 0.1% to 104.16 per dollar.

Bonds

- The yield on 10-year Treasuries climbed one basis point to 0.85%.

- The yield on two-year Treasuries increased less than one basis point to 0.15%.

- Germany’s 10-year yield rose one basis point to -0.58%.

- Britain’s 10-year yield gained one basis point to 0.292%.

Commodities

- West Texas Intermediate crude dipped 0.7% to $42.15 a barrel.

- Gold weakened 1% to $1,769.74 an ounce.