US stocks and Treasuries posted small moves on Monday as traders recalibrated their bets in the wake of last week’s selloff. Brent crude fell below $77 a barrel.

Contracts on the S&P 500 inched down 0.1% and European stocks pared an earlier retreat. Boeing slumped as much as 9.8% in the US premarket after a fuselage section on a 737 Max 9 aircraft ejected during a flight over the weekend. Spirit AeroSystems Holdings Inc., which installed the panel, dropped 21%.

Oil slid almost 3% after Saudi Arabia cut official selling prices for all regions amid persistent weakness in the market.

Markets are looking for direction after mixed US economic data on Friday capped a week that saw global equities sink the most since October on speculation the Federal Reserve was in no rush to reduce interest rates. Further catalysts may come from the US inflation print due Thursday and the earnings season kicking off Friday with US financial names including JPMorgan Chase & Co and Citigroup Inc.

“Multiples are already priced at rich levels,” BNP Paribas analysts including Calvin Tse and Sam Lynton-Brown wrote in a note. “With the probability of a disappointment in full-year earnings elevated, we believe that downside risks outweigh upside ones.”

According to Bloomberg’s latest Markets Live Pulse survey, the consensus estimate of sell-side analysts is that S&P 500 earnings this year will reach historic levels, but those forecasts are too high. The poll shows an economic slowdown is the biggest risk for the bottom lines this year.

In Europe, German factory orders rose much less than anticipated in November, a discouraging sign for Europe’s largest economy, data showed on Monday.

Seizing Yields

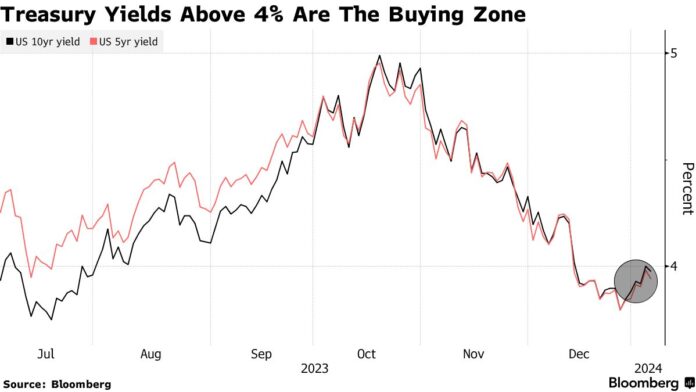

The yield on US Treasuries advanced one basis point to 4.06%. Some traders are unfazed by the recent pullback, seeing it as a chance to seize on elevated yields before the Federal Reserve starts driving down rates.

The dynamic was on display Friday, when bond prices dipped after the Labor Department reported that job growth unexpectedly accelerated last month. But the selloff was curtailed because buyers swooped in as 10-year Treasury yields neared 4.1%, the highest since mid-December.

Elsewhere, Brent halted last week’s rally after the Saudi price cuts. The reductions underscored a worsening global outlook amid strong global supply, including from the US, and outweighed concern over Red Sea tensions and supply disruptions in Libya.

In Asia, the Hang Seng China Enterprises Index closed down 2.3%, led by a selloff in technology shares. Sentiment remains quite negative in China, Nomura Group analysts including Chetan Seth in Singapore wrote in a client note. “There have been more signs of support for the economy, but equity investors still do not appear convinced,” they said.

Key events this week:

- Atlanta Fed President Raphael Bostic speaks, Monday

- US House returns from recess, Monday

- Australia retail sales, Tuesday

- Japan Tokyo CPI, household spending, Tuesday

- Eurozone unemployment, Tuesday

- World Economic Forum’s global risks report released, Wednesday

- US wholesale inventories, Wednesday

- Deadline for US Securities & Exchange Commission to vote on Bitcoin ETF applications, Wednesday

- New York Fed President John Williams speaks, Wednesday

- US CPI, initial jobless claims, Thursday

- China CPI, PPI, trade, Friday

- France CPI, Friday

- UK industrial production, Friday

- US PPI, Friday

- Bank of America, Bank of New York Mellon, BlackRock, Citigroup, JPMorgan Chase and Wells Fargo report fourth-quarter results, Friday

- Minneapolis Fed President Neel Kashkari speaks, Friday

Stocks

- The Stoxx Europe 600 fell 0.1% as of 12:34 p.m. London time

- S&P 500 futures were little changed

- Nasdaq 100 futures were little changed

- Futures on the Dow Jones Industrial Average fell 0.4%

- The MSCI Asia Pacific Index fell 0.8%

- The MSCI Emerging Markets Index fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0939

- The Japanese yen was little changed at 144.62 per dollar

- The offshore yuan fell 0.1% to 7.1720 per dollar

- The British pound fell 0.1% to $1.2707

Cryptocurrencies

- Bitcoin rose 1.2% to $44,770.01

- Ether rose 0.6% to $2,253.75

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.06%

- Germany’s 10-year yield advanced five basis points to 2.21%

- Britain’s 10-year yield advanced five basis points to 3.84%

Commodities

- Brent crude fell 2.6% to $76.68 a barrel

- Spot gold fell 1.3% to $2,019.64 an ounce