US equity futures climbed, building on Wall Street’s advance after Federal Reserve Chair Jerome Powell said policy makers had made progress in the battle against inflation, raising hopes the central bank is nearing the end of its rate-hike cycle.

Contracts on the S&P 500 and Nasdaq 100 rose, with the latter outperforming after the tech-heavy gauge surged 2.2% to a four-month high Wednesday. Meta Platforms Inc. soared as much as 20% in US premarket trading after the social-media giant’s earnings and buyback news. Pinterest Inc., Alphabet Inc. and Amazon.com Inc. gained in the slipstream.

The Stoxx Europe 600 index extended gains after the European Central Bank joined the tightening party, lifting its benchmark rate by 50 basis points as expected and saying it will review its path after a similar increase in March. Technology stocks led the advance, buoyed by an upbeat outlook from German chipmaker Infineon Technologies AG. European bonds gained, with the yield on 10-year German securities down more than 10 basis points on the day. The euro declined.

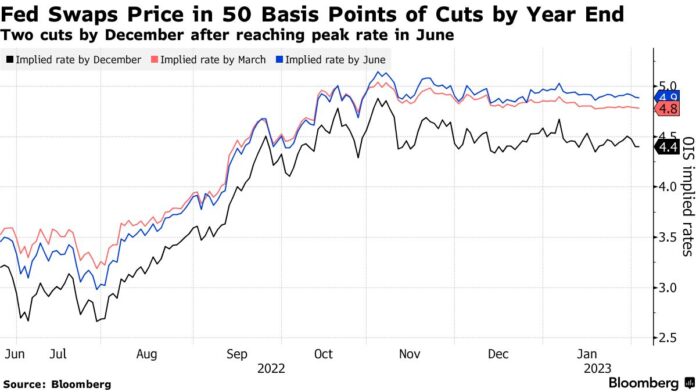

Powell’s comment Wednesday that the “disinflation process has started” suggested that the aggressive tightening cycle is starting to reduce the pace of price growth, even as he warned of a “couple” more hikes to come. Positioning in US swaps markets assumes the Fed is getting closer to cutting rates as traders bet that economic conditions are likely to keep it from the additional rate increases that policy makers still anticipate.

“While the Federal Reserve slowed its pace of rate hikes, there is still plenty of uncertainty on the trajectory of inflation and how the Fed’s tightening of monetary policy will affect economic growth and earnings this year,” said Brad Bernstein, a Philadelphia-based managing director at UBS Wealth Management. “Investors are now shifting their focus to big tech earnings, as guidance from big tech earnings is likely to set the tone and direction of markets in the near-term.”

A gauge of the greenback’s strength hovered around the lowest level since April as global investors position for a potential peak in US interest rates.

Treasury yields held a drop from the US session of about 10 basis points in key maturities across the 2-year to 10-year zone. European bonds broadly advanced, with Germany’s 10-year yield down about three basis points.

The UK’s benchmark stock index pared gains after the Bank of England raised interest rates a half point, and said more increases will be needed if signs of an inflationary spiral persist. The pound held a decline and the 10-year gilt yield retreated from a session high.

Next up is the ECB, which is expected to follow with a hike of similar magnitude.

Adani Crisis

A benchmark of Asian equities climbed about 0.2%, with Hong Kong-listed technology companies among the top performers. The picture was more mixed in Japan and mainland China, while Adani Group companies led the Indian market lower.

The Adani Group’s deepening crisis continued to rumble through markets on Thursday. Adani Enterprises Ltd. slumped more than 15%, before paring some of the loss, after abandoning its follow-on share sale to insulate investors in the offering from the recent rout. The other nine stocks in the group also fell.

The meltdown has wiped out $104 billion in market value for the group’s stocks since US short seller Hindenburg Research made fraud allegations against the conglomerate.

Elsewhere in markets, crude oil was little changed after slumping on Wednesday. Gold hovered around a nine-month high and Bitcoin hit the highest since August in the wake of Fed decision.

Key events this week:

- Earnings Thursday include: Alphabet, Apple, Amazon, Qualcomm

- Eurozone S&P Global Eurozone Services PMI, PPI, Friday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.7% as of 8:23 a.m. New York time

- Nasdaq 100 futures rose 1.6%

- Futures on the Dow Jones Industrial Average fell 0.1%

- The Stoxx Europe 600 rose 0.9%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0983

- The British pound fell 0.5% to $1.2319

- The Japanese yen rose 0.6% to 128.25 per dollar

Cryptocurrencies

- Bitcoin rose 0.5% to $23,808.24

- Ether rose 2.4% to $1,673.99

Bonds

- The yield on 10-year Treasuries declined five basis points to 3.37%

- Germany’s 10-year yield declined 13 basis points to 2.16%

- Britain’s 10-year yield declined 17 basis points to 3.13%

Commodities

- West Texas Intermediate crude fell 0.4% to $76.13 a barrel

- Gold futures rose 1.3% to $1,968.30 an ounce