Forex trading is the act of buying and selling currencies on the largest financial market (foreign exchange market). Those willing to invest their time and effort in learning the market and developing a trading strategy can find forex trading a potentially profitable venture. For beginners, the sheer amount of information and complexity of the market can be overwhelming. However, with the right guidance and approach, forex trading can be an exciting and rewarding experience.

I invite you to join our trading family (Home Trader Club) and enjoy the best of our REAL-TIME trading opportunities and our trading techniques and improve your trading with us.

Explore My Free Mentorship Program

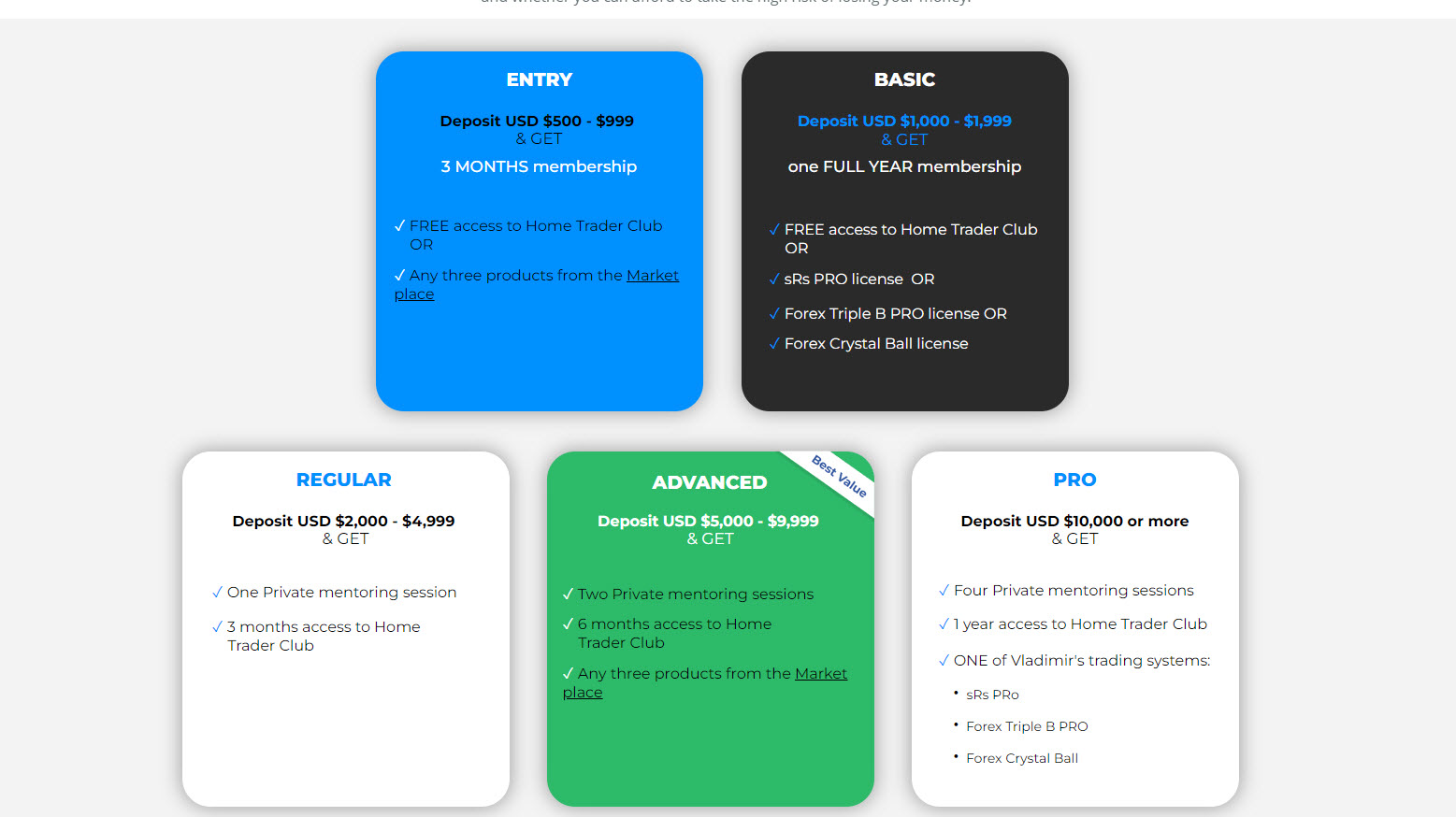

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

This article will explore the top 7 ranked forex trading strategies for beginners. These strategies have been developed over time by experienced traders and have proven effective in the market. By understanding these strategies, beginners can gain a solid foundation for their trading journey and make informed decisions. The strategies are as follows.

Price Action Trading Strategy

The price action trading strategy is one of the most popular strategies used by beginners and experienced traders. It involves analyzing historical price data to identify patterns and trends in the market. Price action traders use charts and technical indicators to identify key levels of support and resistance, which can be used to make trading decisions.

One of the advantages of price action trading is its simplicity. Traders do not need to use complex algorithms or indicators to make trading decisions and can rely solely on their market observations. This strategy also allows traders to focus on the most important aspect of trading: Price.

You can learn in-depth about how to trade with Price Action here

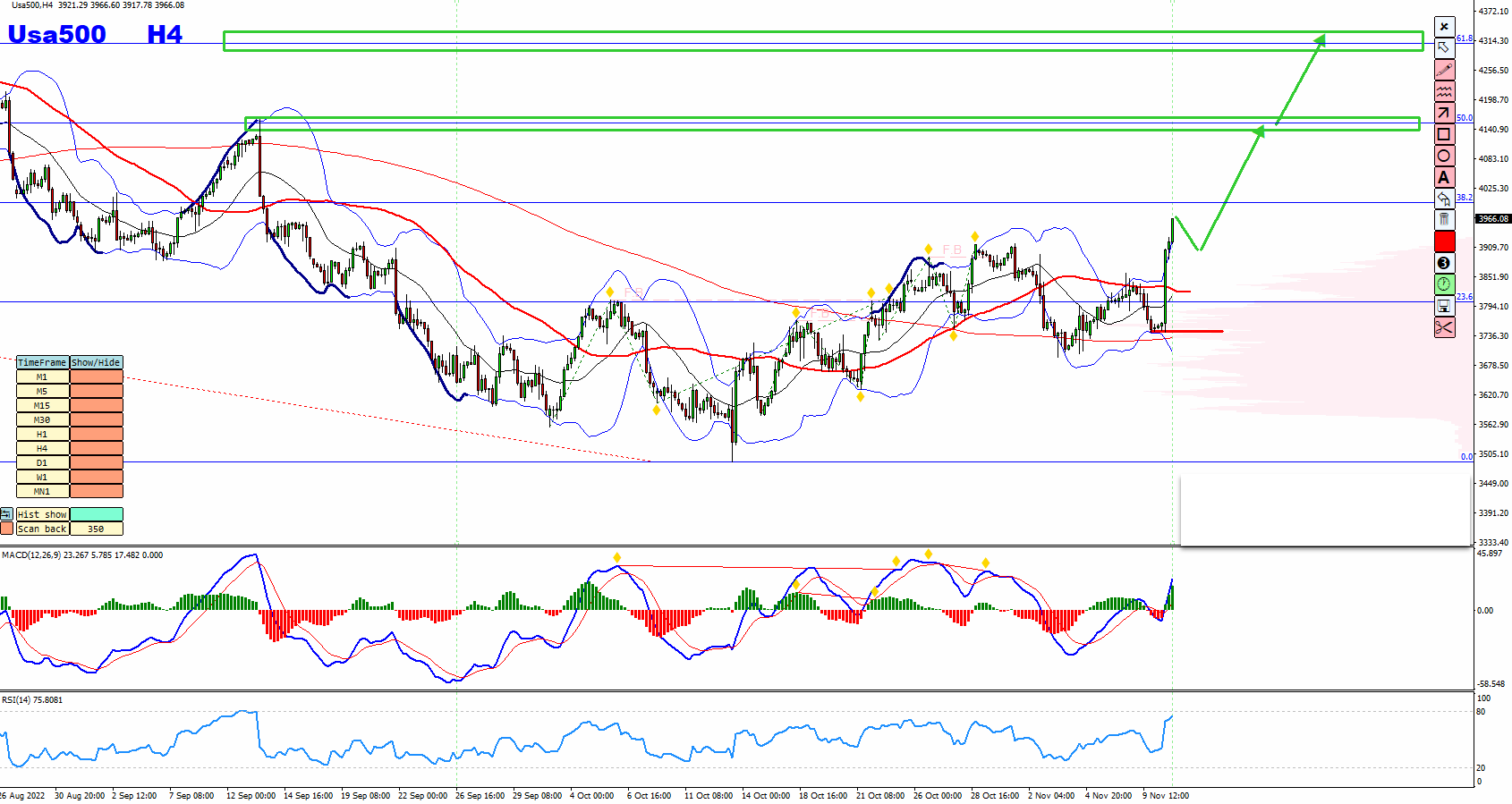

Example of Price Action Trading Strategy from one of our Home Trader Club trades.

In the below example, the price action represents a clear bullish trend pattern in the form of three higher highs and higher lows pattern. Generally, after a bullish trend pattern, we may expect corrections and further continuation, and you can see in the image below the price action moved as per the plan!

Open

Close

Trend Trading Strategy

The trend trading strategy is another popular strategy used by beginners. It involves identifying the direction of the market and trading in that direction. Trend traders look for patterns in the market that indicate a strong trend, such as higher highs and higher lows in an uptrend or lower lows and lower highs in a downtrend.

Trend trading can be a profitable strategy, as traders can ride the trend for a long period of time and make significant profits. However, it requires patience and discipline, as traders must wait for the trend to develop before entering the market.

My favourite trading systems to trade with the trend are –

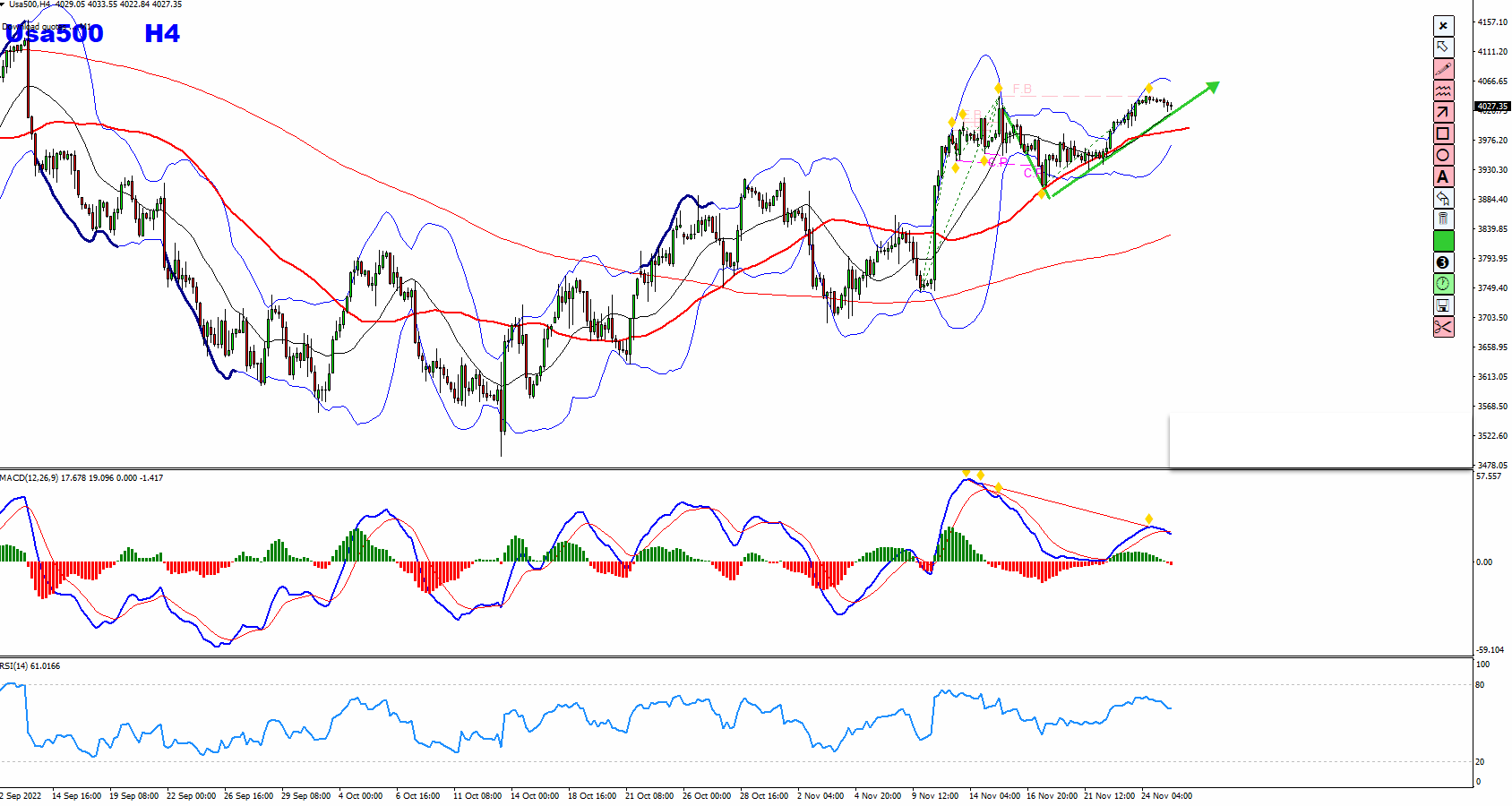

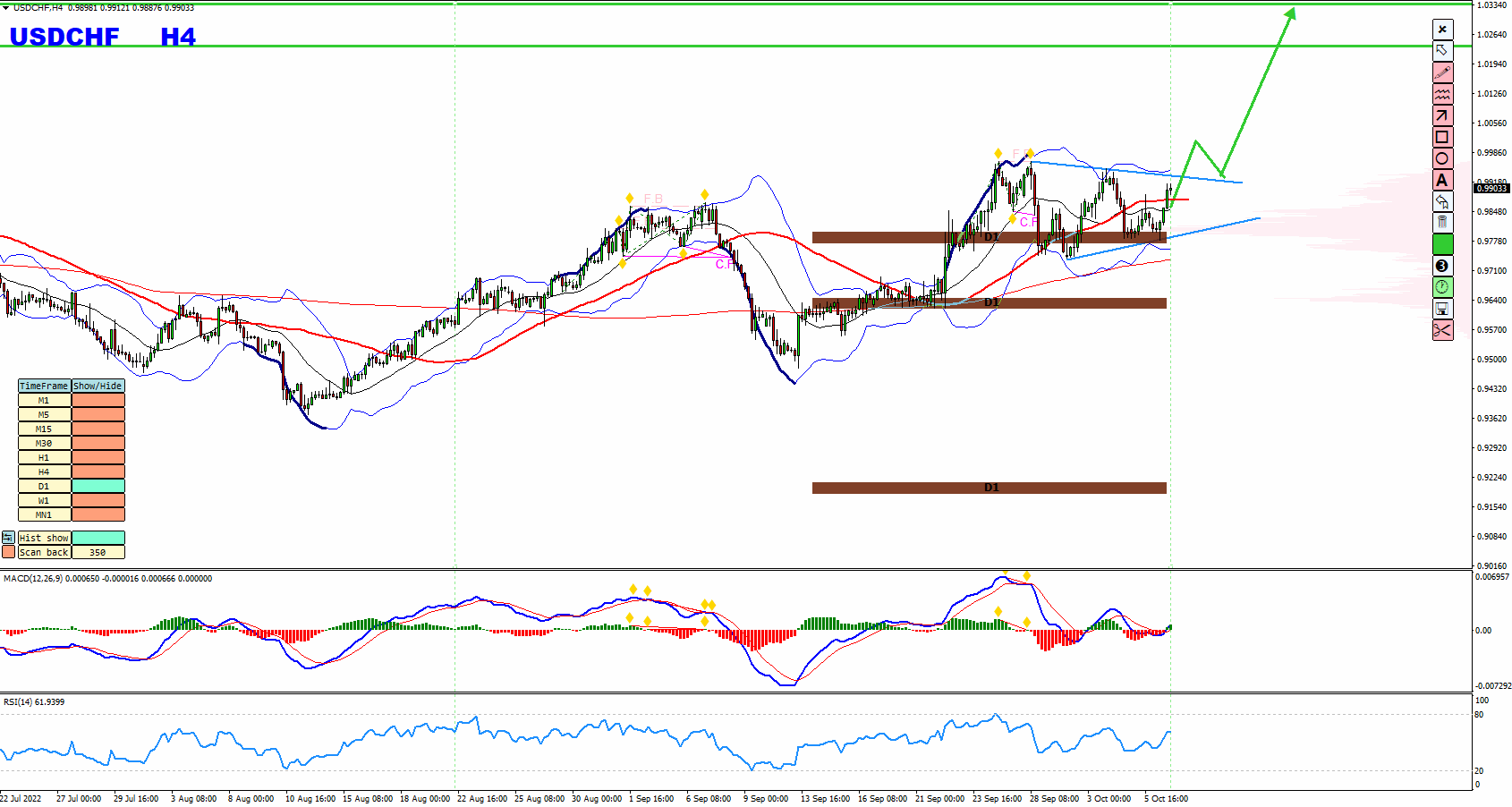

Example of Trend Trading Strategy from one of sRs Pro Trades

In the below example, we have a clear bullish trend followed by a correction in the form of a double wave down, and then the price moves higher. This was when sRs Pro hinted to us an alert for the buys.

Open

Close

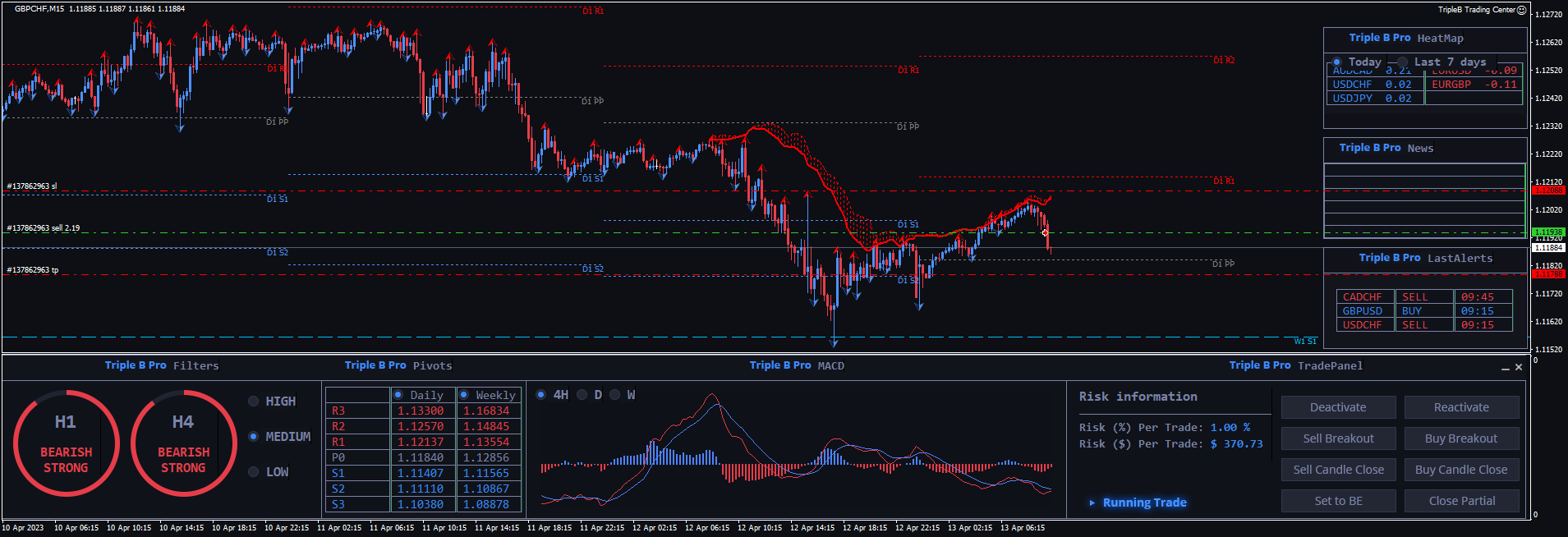

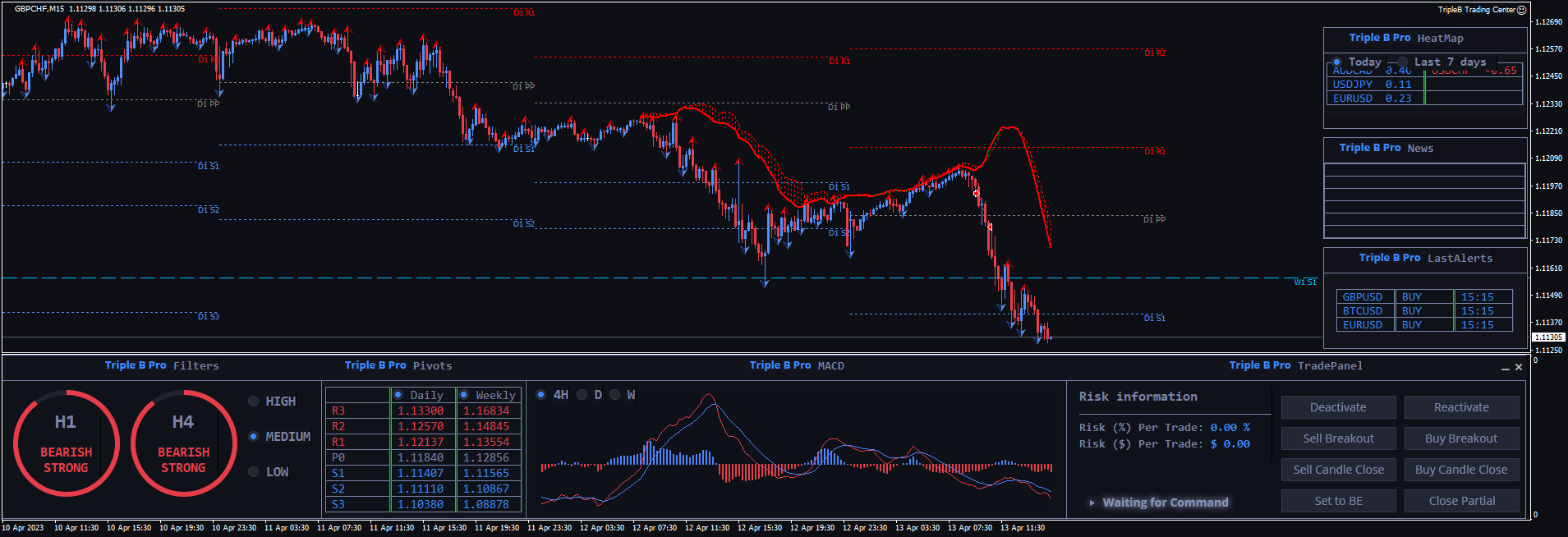

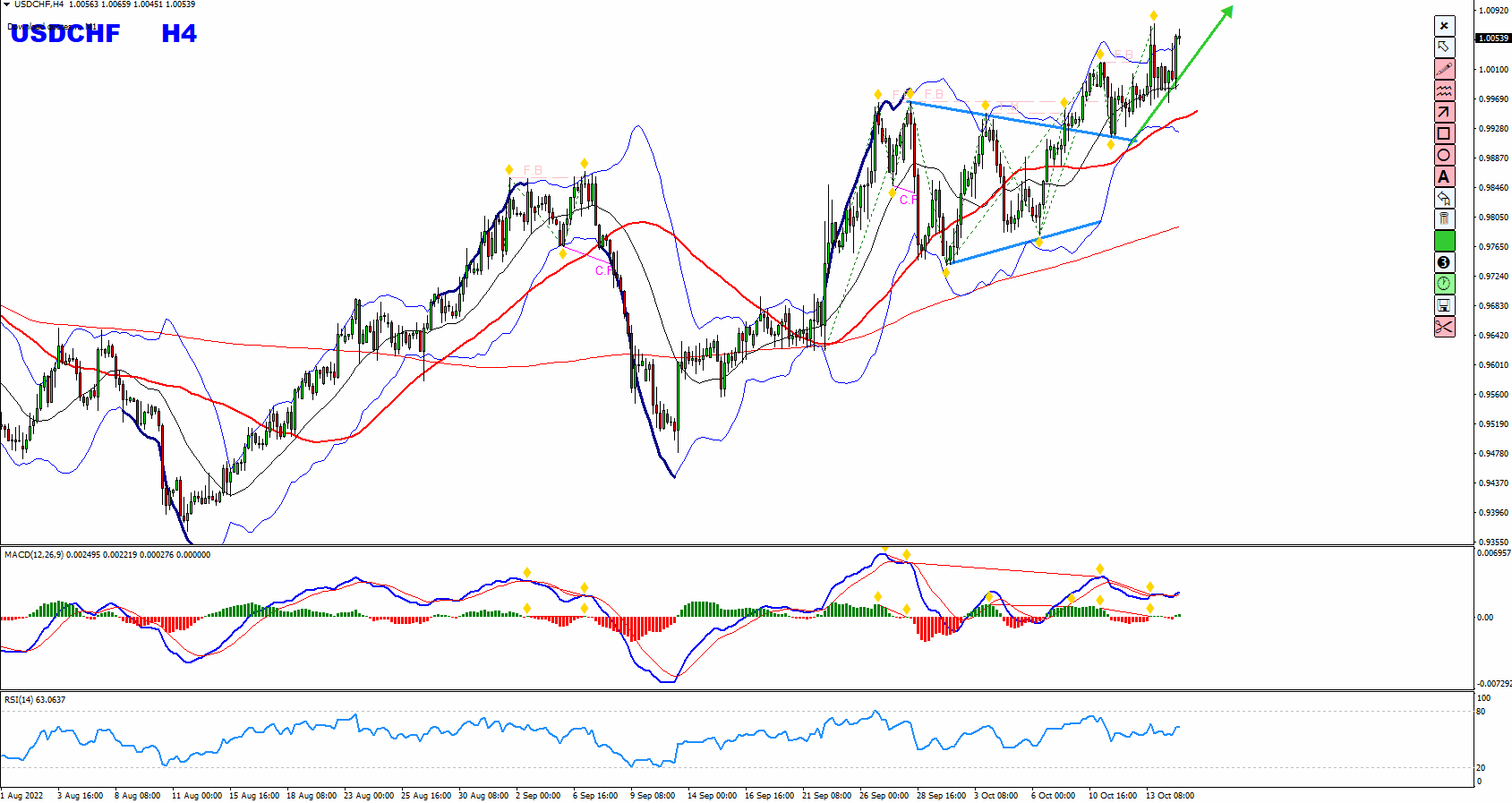

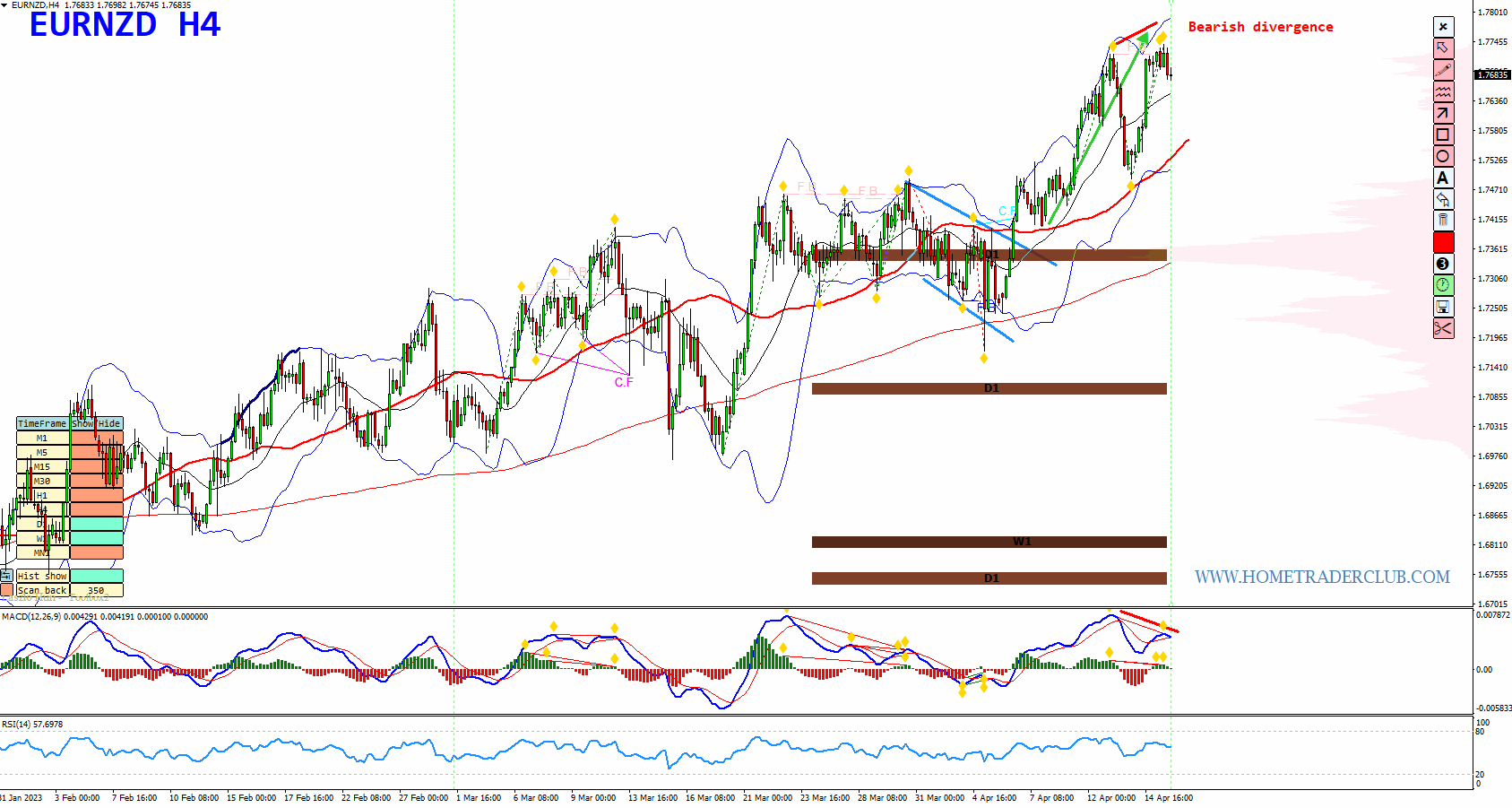

Example of Trend Trading Strategy from one of Forex Triple B Pro Trades

In the below example, we had a clear bearish trend followed by a correction in the form of a double wave to the upside. This is when Triple B Pro hinted to us an alert for the sells.

Open

Close

Range Trading Strategy

The range trading strategy is a popular strategy used by beginners who prefer to trade in a more stable market. It involves identifying key support and resistance levels and trading within that range. Range traders look for patterns in the market that indicate a stable price range, such as repeated bounces between support and resistance levels.

Range trading can be profitable, as traders can make consistent profits by trading within the range. This type of trading strategy requires strict discipline and a lot of patience, as you must wait for the market to reach the support or resistance levels before entering a trade.

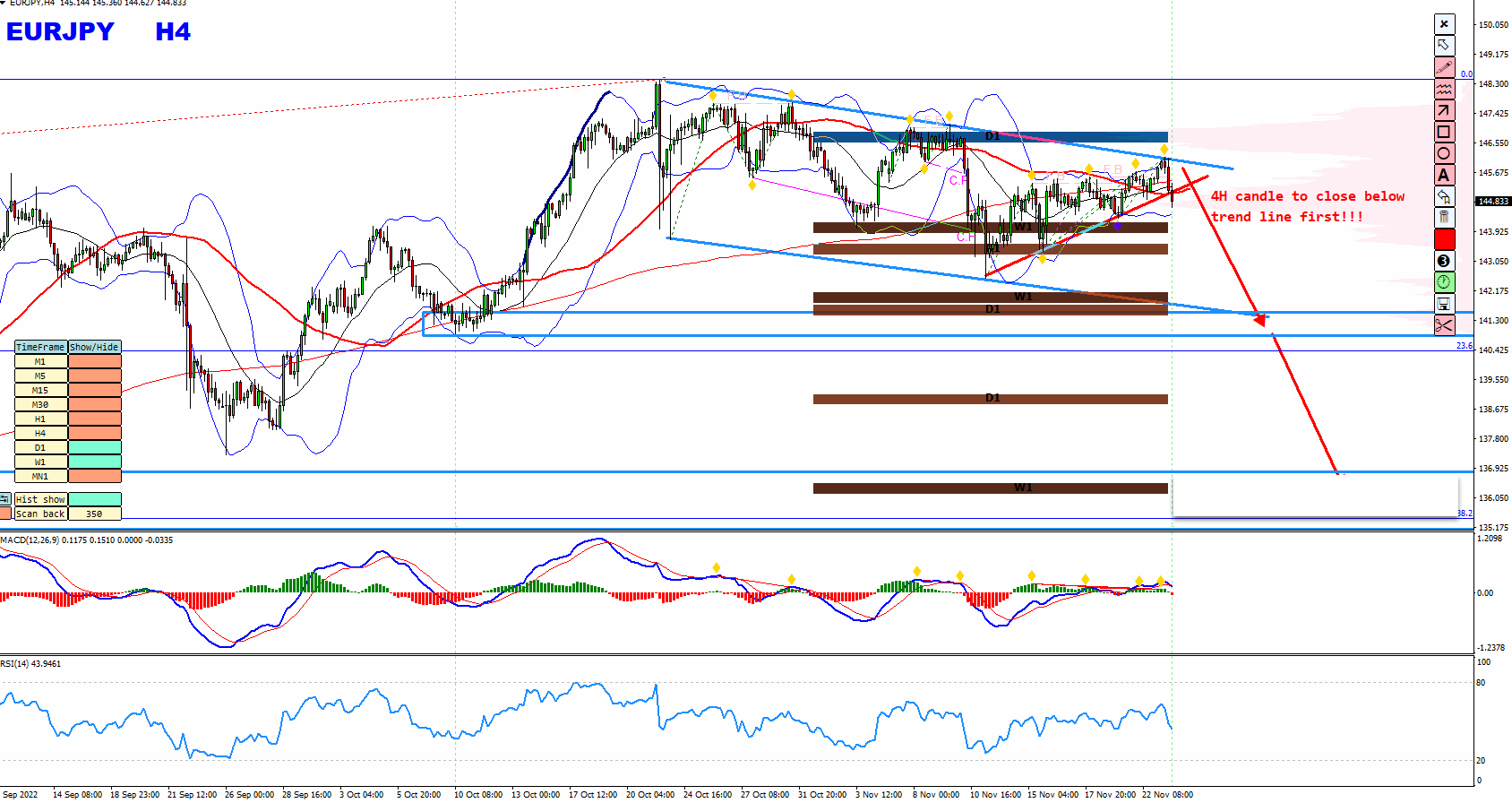

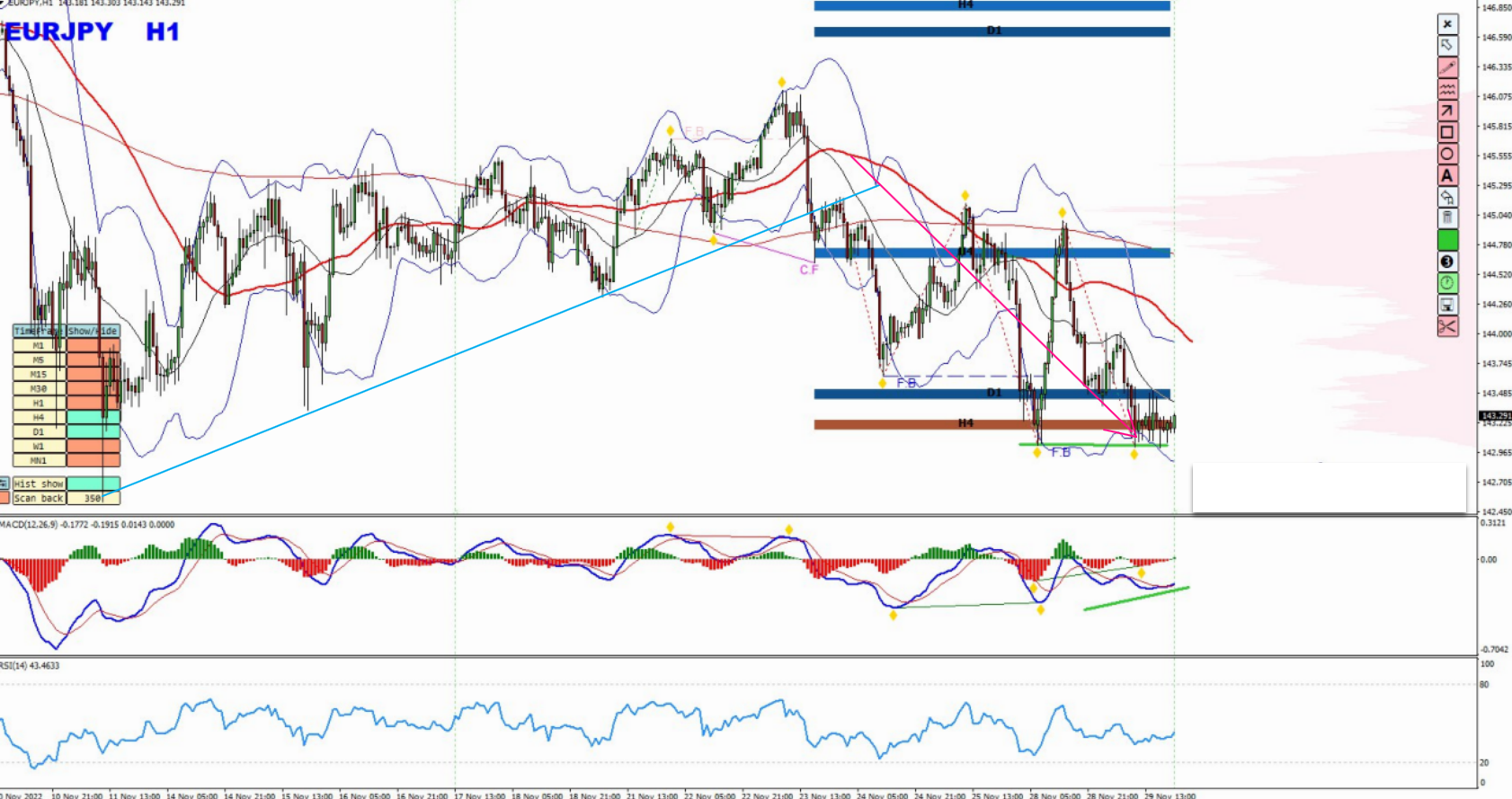

Example of Range Trading Strategy from one of our Home Trader Club trades.

In the example below, we can see that the price, which was moving inside a range, reached the resistance zone of this range, respected it and bounced lower. We also got a breakout below the most recent uptrend line, which is a sign favouring the bears. Then you can see in the image below that the price moved lower as per the plan!

Open

Close

Breakout Trading Strategy

The breakout trading strategy is the next popular strategy used by beginners who prefer to trade in a more volatile market. It involves identifying key support and resistance levels and trading when the market breaks out of that range. Breakout traders look for patterns in the market that indicate a strong breakout, such as a sudden surge in volume or a significant price movement.

Breakout trading can be profitable, as traders can make significant profits when the market breaks out of the range. However, it requires a keen eye for market movements, as traders must be able to identify when the market is about to break out of the range.

Recommended video on the subject –

https://www.youtube.com/watch?v=6-aye2kkwpk&t=4s

Example of Breakout Trading Strategy from one of our Home Trader Club trades

In the example below, the price is moving inside a range, and our plan here is to look for buys after the breakout above the top of the range, and the price moved as per the plan after the breakout as expected!

Open

Close

Scalping Trading Strategy

The scalping trading strategy is another popular strategy used by beginners who prefer to trade in a more fast-paced market. This type of trading strategy is used by traders who prefer to make multiple trades quickly, often within seconds or minutes. Scalping traders rely on technical analysis and often use charts with short timeframes to identify entry and exit points.

This strategy also requires a smaller capital than other trading strategies, as traders only need to make small gains to be profitable. However, a scalping trading strategy requires much time and attention from traders, who constantly monitor the market and make quick decisions. It also requires discipline and patience, as traders need to be able to control their emotions and avoid making impulsive trades.

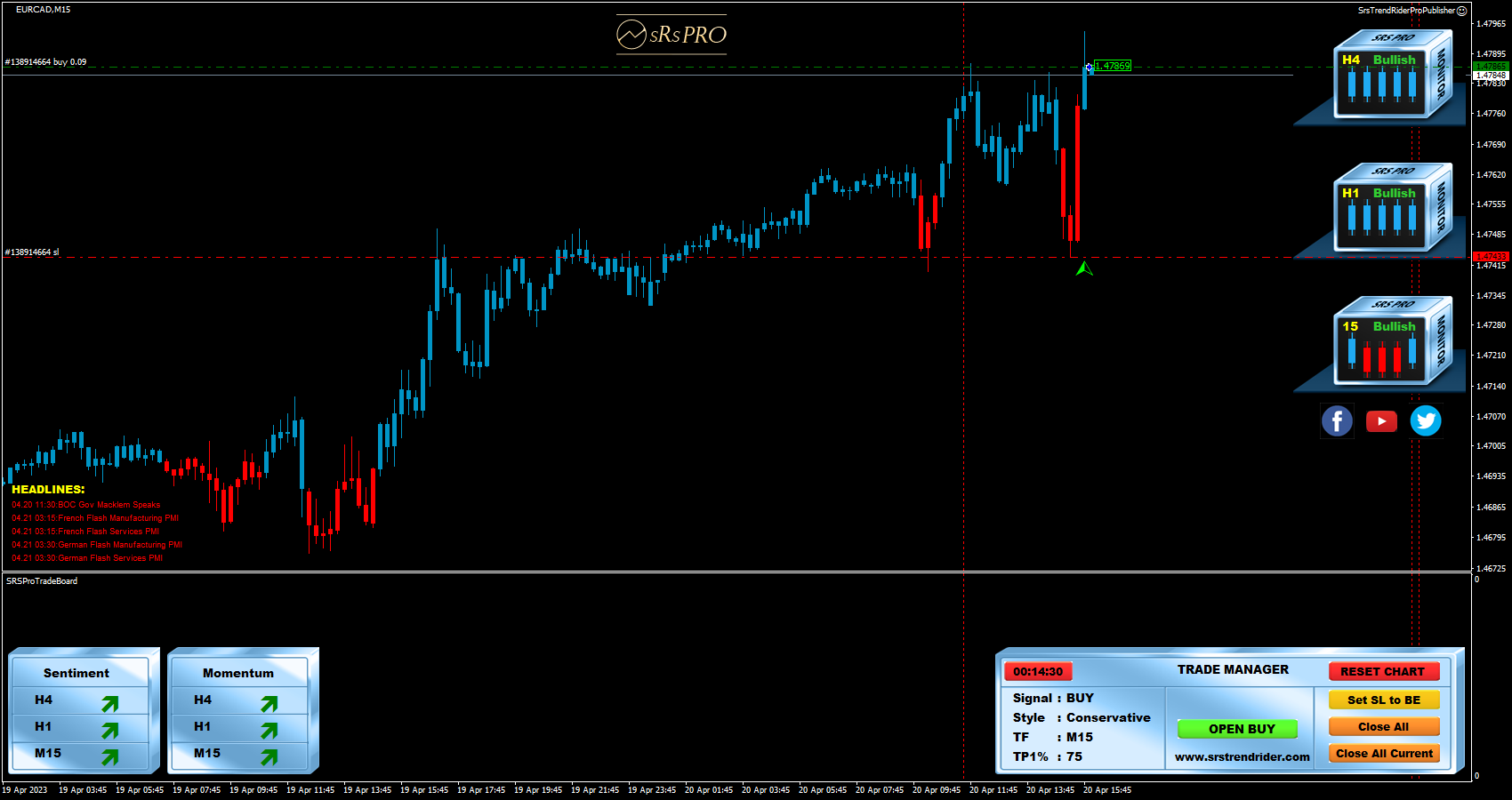

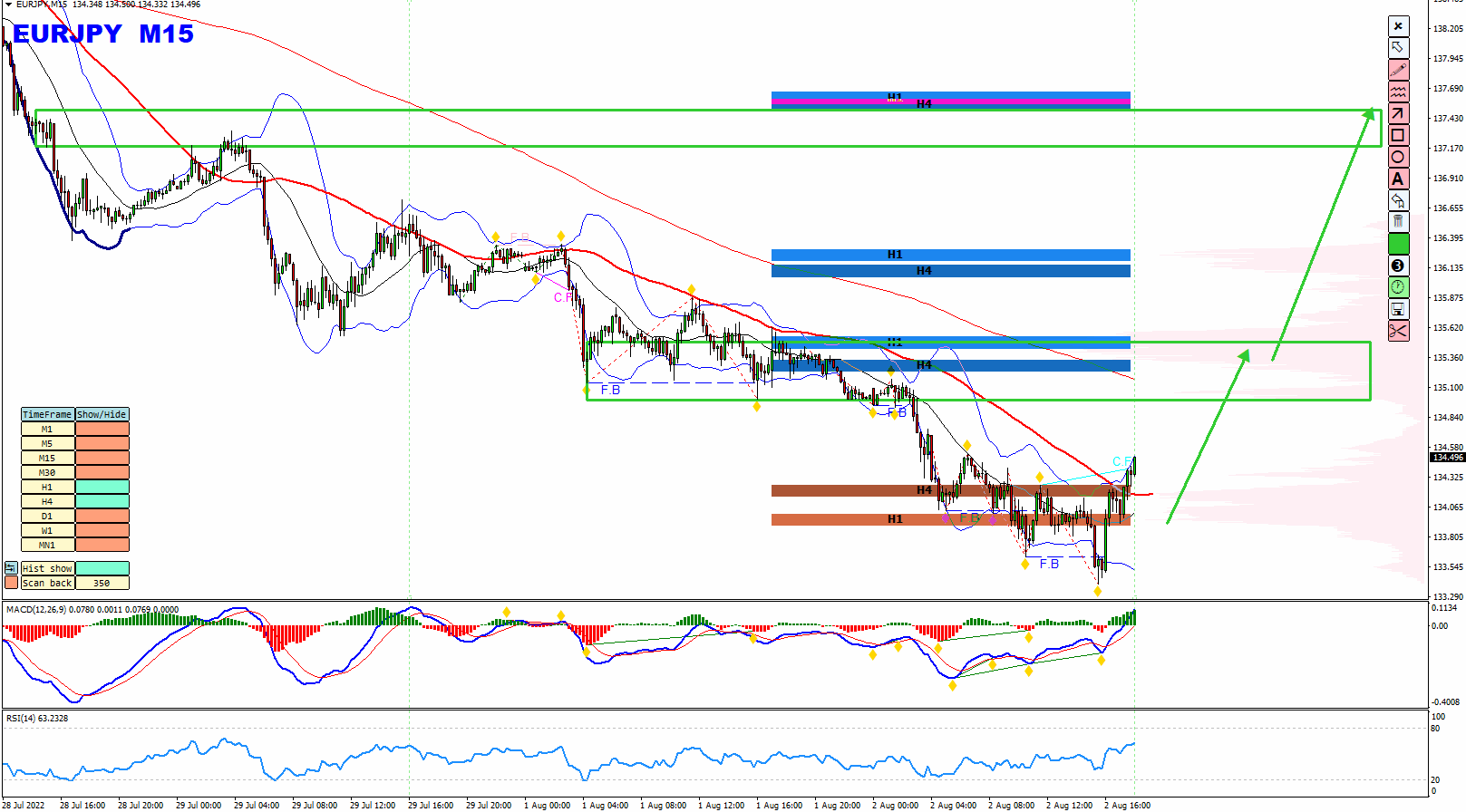

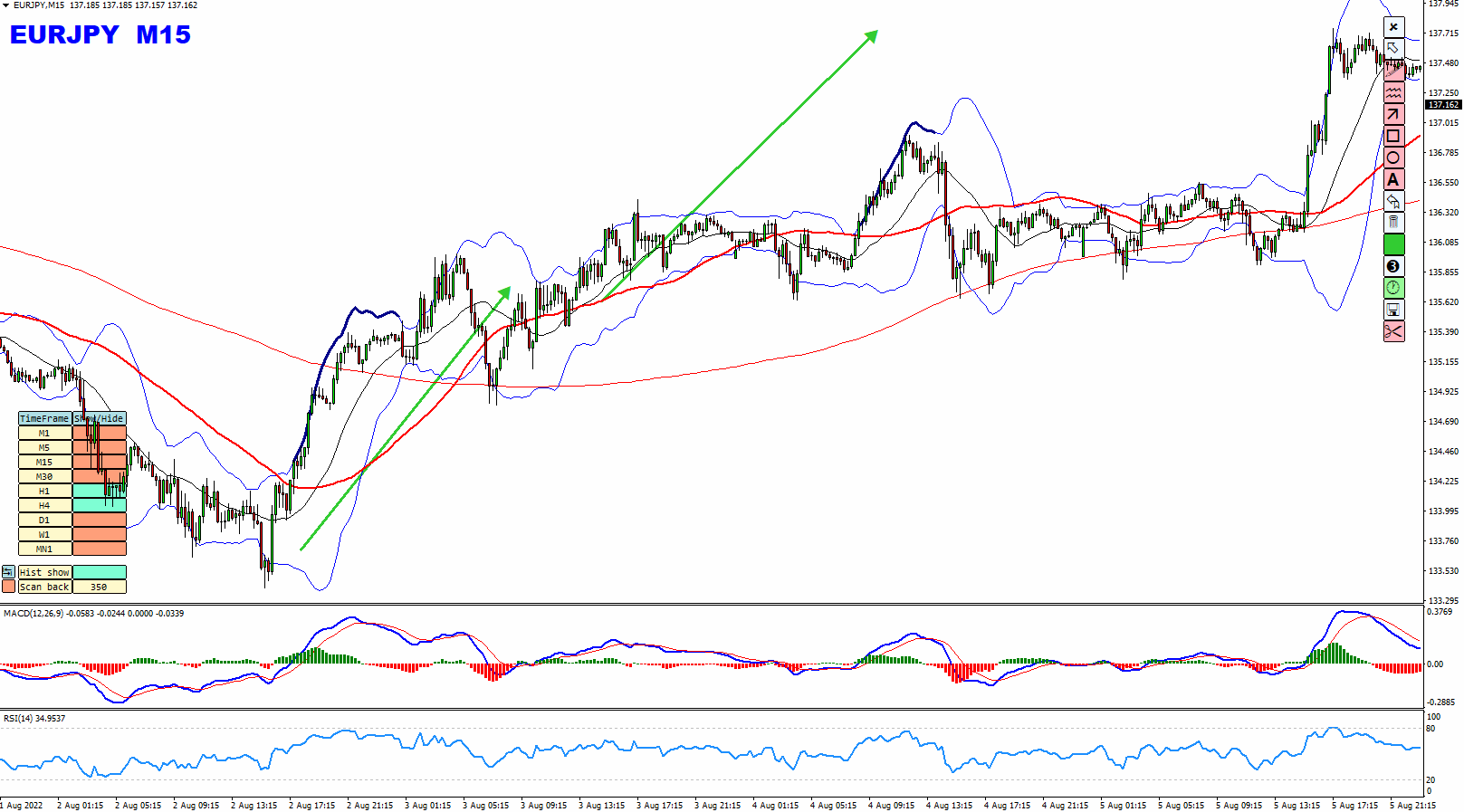

Example of Scalping Trading Strategy from one of our Home Trader Club trades

In this example below on the M15 chart, we were looking to scalp for short-term bullish moves, and the move happened as per the plan!

Open

Close

Position Trading Strategy

Position trading strategy is another popular strategy used by beginners to take advantage of long-term trends in the market. This strategy involves holding positions for an extended period of time, often weeks or months. As this strategy aims to take advantage of long-term trends in the market, it requires traders to have a solid understanding of fundamental analysis and economic trends. It involves using technical analysis and monitoring economic and political developments to make informed trading decisions.

To implement a position trading strategy, traders must first identify an instrument that is trending in a particular direction. They then place a trade in the direction of the trend, intending to hold the position for an extended period. Position traders use technical analysis and fundamental analysis to identify potential entry and exit points for their trades.

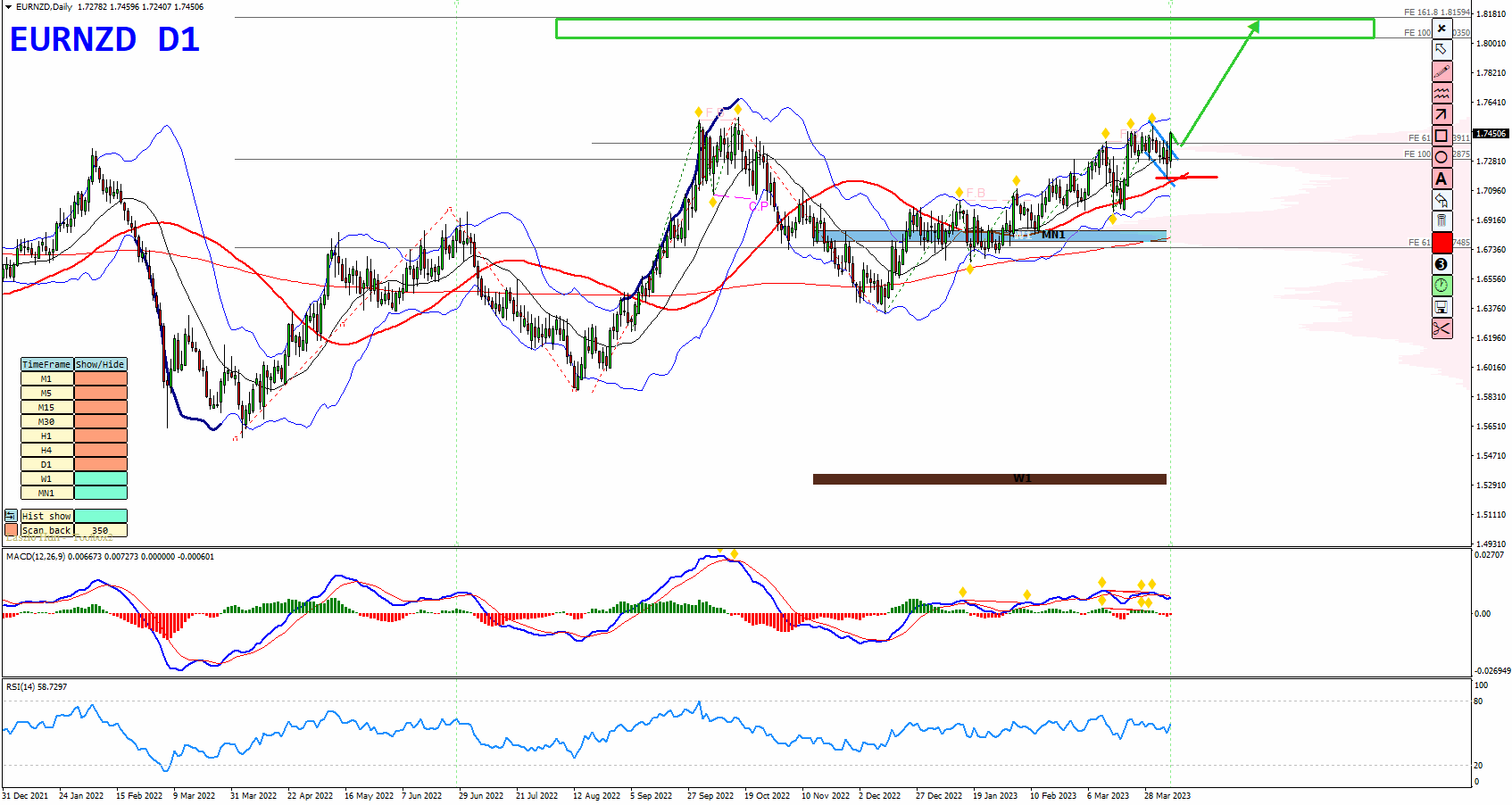

Example of Position Trading Strategy from one of our Home Trader Club trades

This is an example of the position trading strategy. As you can see, we were looking for long-term bullish moves on the daily chart, which happened as planned!

Open

Close

News Trading Strategy

The news trading strategy is a popular strategy used by beginners who prefer to trade based on fundamental analysis. It involves identifying key news events that can impact the market and trading based on the expected impact of that news. News traders look for patterns in the market that indicate a significant news event, such as a major economic report or a central bank announcement.

Recommended video on the subject – https://www.youtube.com/watch?v=Wkxjs2p5hNU&t=169s

News trading can be profitable, as traders can make significant profits when the market reacts to the news. However, it requires a strong understanding of fundamental analysis and interpreting news events correctly.

You can get our Real-Time News Indicator here

Get the best of our trading solutions here.

To understand the differences between our systems, check our road map here.

Conclusion

In conclusion, forex trading can be a challenging but rewarding experience for beginners. By understanding the top 7 ranked forex trading strategies outlined in this article, beginners can develop a solid foundation for their trading journey by choosing the strategies that work for them and are more comfortable with. It is important to remember that trading involves risk and requires discipline, patience, and constant learning. With the right approach and mindset, beginners can succeed in the forex market and achieve their financial goals.

If you have any questions, don’t hesitate to drop a comment below!

Yours to your success,

Vladimir Ribakov

Internationally Certified Financial Technician