It was the US dollar show in August, as most other major currencies traded lower against the US dollar including the Euro, the British pound and the Japanese yen. The economic data impressed the investors and as a result the US dollar was bid across the board. There were a couple of important economic releases scheduled during the last two days, which came around the market expectations. Some of the important ones were the US services PMI, durable goods orders and CB consumer confidence. The US dollar looks like is overbought against a few other currencies, which means there is a strong chance that a correction might occur sooner or later. Let’s see what we have on the fundamental and technical side.

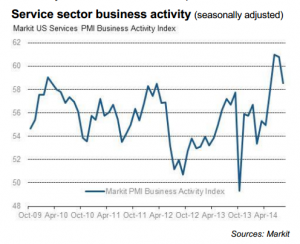

US Services PMI

The first in the line was the US Services Purchasing Managers Index (PMI) which was released by the Markit Economics on Monday. The forecast was slated for a minor decline from 60.8 to 59.5. However, the outcome was on the disappointing side, as the US services PMI fell to 58.5 from 60.8. However, the outcome cannot be seen on the negative side, as the report mentioned that the latest reading remained comfortably above the survey average (55.7) and signaled a strong overall pace of output expansion.

The US dollar traded a touch lower after the release, but later managed to gain bids. Overall, the US dollar consolidated in a range on Monday. The EURUSD pair was seen struggling to break the 1.3200-10 resistance area.

US Durable Goods Orders

Yesterday, the US durable goods orders data was published by the US Census Bureau. The market was expecting a rise of 7.5% in orders in July 2014. However, the outcome was very encouraging, as the US durable goods orders jumped by 22.6%. The only disappointment was from the core durable goods orders, which registered a decline of 0.8%, whereas the market was expecting a rise of 0.5%.

The report mentioned that the new orders for manufactured durable goods in July increased $55.3 billion or 22.6 percent to $300.1 billion, and Transportation equipment was also to $56.6 billion. Overall, the data was on the positive side, which lifted the US dollar in the short term.

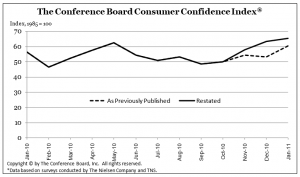

CB Consumer Confidence

Yesterday, later during the NY session, the CB consumer confidence was released by the conference board. The forecast was slated for a decline from 90.9 to 89.0. However, the outcome was much higher than expected, as the CB consumer confidence jumped to 92.4 in August 2014. Moreover, the Present Situation Index rose to 94.6 from 87.9, and the Expectations Index dived to 90.9 from 91.9 in July. This is the fourth consecutive month of a rise in the CB consumer confidence. There was not much reaction from the US dollar after the release, and only traded a touch higher.

Technically, the EURUSD pair is still in a downtrend, but we need to be very careful as there is a chance of a short term correction. On the upside, resistance can be seen around the 1.3230 and 1.3260. On the downside, support is around the 1.3150 level, followed by the 1.3100 level.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast