The US dollar is trading higher against most other major currencies, including the Euro, the British pound and the Japanese yen. One of the major reasons for the same is impressive economic data. There were a couple of important economic releases lined up during this week. The ones worth mentioning are the US services PMI, consumer confidence and the US GDP data. All the mentioned releases posted better than expected readings, which ignited a rally in the US dollar. There were important breaks noted in the pairs like the EURUSD and USDJPY.

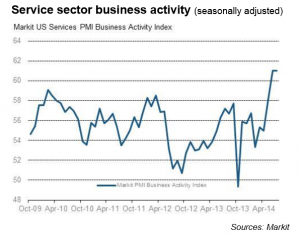

US Services PMI

The first in line was the US Services Purchasing Managers Index (PMI) which was released by the Markit Economics. The forecast was slated for a minor decline from 61.0 to 59.8. However, the outcome was better than expected, as the US services PMI registered a reading of 60.9. The highlight of the report was that the U.S. service sector growth holds at post-recession high in July, but new business and employment both expand at slower rates. This was seen on the positive side by the Forex market, as the US dollar traded higher post release.

US consumer confidence

The next in line was the US consumer confidence which was released by the Conference Board. The market was again expecting a minor decline from 86.4 to 85.3. However, the outcome was very surprising, as the US consumer confidence increased in July to 90.9. This was one of the highest readings in the past seven years.

US GDP

The highlight of the week was the US Gross Domestic Product (GDP) annualized reading which was released by the US Bureau of Economic Analysis. The forecast was a 3% rise in the second quarter, against the 2.1% decline in the first quarter. The outcome was very bullish as the US GDP grew by 4% in the second quarter of 2014. The US dollar immediately surged higher to break critical resistance zone against the Euro and the Japanese yen.

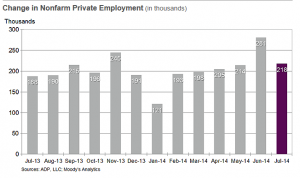

US ADP Employment Change

The US ADP employment change data was also released just before the US GDP. The outcome missed the expectation, but the main thing was that it managed to register yet another 200K+ reading. So, this was again on the positive side for the US dollar investors

Moving Ahead

We have the all-important NFP release today. The market is expecting a decline from 288K to 233K. However, there can be a surprise in the store for us. So, we need to be very careful trading the US dollar moving ahead. Any reading below the 200K might trigger a round of selling in the US dollar.

Technically, the 1.3350-40 is a very important support level in the EURUSD. The pair needs to hold the mentioned support level if it has to correct a bit higher from the current levels. The US NFP release might act as a catalyst for the pair in the short term. On the upside, the 1.3450 level might act as a resistance.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!