US equity futures struggled to build on last week’s rally, as investors assessed the potential impact of China’s modest new economic growth target and waited to see if Treasury yields would extend their declines off recent highs.

Chinese leaders set a lower-than-expected 5% economic growth goal, which implies Beijing is unlikely to deploy large-scale stimulus to shore up its economy as it emerges from Covid-era lockdowns. That kept US futures in the red, after Friday’s strong session that saw the S&P 500 benchmark snap a three-week losing streak, and lifted the Nasdaq 100 to its best day since early February. Europe’s Stoxx 600 index also retreated, with commodity and energy shares in particular feeling the heat from Beijing’s growth outlook.

Some analysts saw the unambitious target as positive if it prevents another bout of price growth stemming from the world’s No. 2 economy. Prices for iron ore, crude oil and copper fell, knocking a Bloomberg index of commodities as much as 1% lower.

“The inflation impulse may not be as extreme for the global economy,” Christian Mueller-Glissmann, head of asset allocation research at Goldman Sachs Group Inc., told Bloomberg Television. “Our biggest concern coming into this reopening was oil. A significant increase in oil prices would make the job for the Federal Reserve even more difficult.”

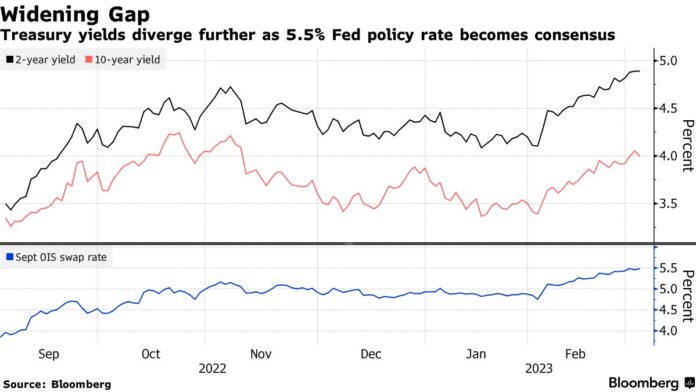

US 10-year Treasury yields have slipped off the psychologically key 4% mark and are currently around 3.91%, more than 10 basis points below levels hit last week. Euro zone yields fell even more sharply as investors trimmed wagers on peak interest rates in the bloc.

Friday’s Wall Street gains were driven by data showing service providers’ costs growing more slowly. Monthly payrolls data due at the end of this week will be crucial after stronger-than-expected figures last month boosted bets on more rate hikes.

Traders are also waiting to see if Fed Chair Jerome Powell’s testimony to the Senate and House committees echoes recent hawkish comments from other rate-setters. But conviction is growing that the Fed’s interest rate rises will not go beyond the 5.4% or so that’s already priced. A 25 basis-point rate rise is expected for the Fed’s March 21-22 meeting, with an outside chance of a 50 basis-point move.

“Powell could surprise markets this week with his testimony but they have already set it up so they hike in 25 basis-point increments,” Nikko Asset Management chief strategist John Vail said on Bloomberg Television.

Vail predicted payrolls data to show a softer figure than the previous month, “and that may calm down some of the fears of the Fed.”

Elsewhere in currency markets, the dollar gained after slipping 0.8% last week

In US premarket trading, shares in Apple rose 1% as the firm geared up to launch its next slate of laptops and desktops.

Key events this week:

- US factory orders, durable goods, Monday

- US wholesale inventories, consumer credit, Tuesday

- Fed Powell’s semiannual Monetary Policy Report to the Senate Banking Committee, Tuesday

- Australia rate decision, Tuesday

- Euro area GDP, Wednesday

- US MBA mortgage applications, ADP employment change, trade balance, JOLTS job openings, Wednesday

- Fed Chair Powell’s semiannual Monetary Policy Report to the House Financial Services Committee, Wednesday

- Canada rate decision, Wednesday

- EIA crude oil inventories, Wednesday

- China CPI, PPI, Thursday

- US Challenger job cuts, initial jobless claims, household change in net worth, Thursday

- Bank of Japan policy rate decision, Friday

- US nonfarm payrolls, unemployment rate, monthly budget statement, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 6:55 a.m. New York time

- Nasdaq 100 futures were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 fell 0.3%

- The MSCI World index rose 0.2%

- S&P 500 futures fell 0.1%

- Nasdaq 100 futures were little changed

- The MSCI Asia Pacific Index rose 0.6%

- The MSCI Emerging Markets Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0644

- The British pound fell 0.3% to $1.1996

- The Japanese yen fell 0.2% to 136.17 per dollar

- The offshore yuan fell 0.7% to 6.9434 per dollar

Cryptocurrencies

- Bitcoin fell 0.5% to $22,372.43

- Ether fell 0.6% to $1,562.8

Bonds

- The yield on 10-year Treasuries declined three basis points to 3.93%

- Germany’s 10-year yield declined two basis points to 2.69%

- Britain’s 10-year yield was little changed at 3.85%

Commodities

- West Texas Intermediate crude fell 1.5% to $78.51 a barrel

- Gold futures were little changed