There was a series of important events lined up during this week, including the UK inflation and labor market report, Euro Zone inflation report and Fed’s Janet Yellen speech. All these events played a crucial role in the market movements during last four days. The economic data in the US and UK continues to improve, which can ignite bullish momentum for the US dollar and the British pound against all the major counterparts moving ahead.

Fed’s Yellen Speech

The Fed chairwoman Janet Yellen delivered a speech on Wednesday. The key thing to note of the speech was the remark regarding the inflation rate and interest rates moving ahead. She was more dovish than the market was expected, which resulted in a down-move for the US dollar. Her comments were focused on the fact that the central bank is not in any sort of hurry to raise the interest rates. “I hope it’s completely clear that while monetary policy is very accommodating at this point, and I focused on the need to keep it so or to adjust it to make sure the recovery remains on track,” Yellen said during a question-and-answer session at the Economic Club of New York, according to an article on CNBC.

However, a fact cannot be denied that the recovery in the US is on the track, which could help the US dollar in the medium term, and unless some weakness emerges, the Fed might continue with their taper plans.

UK Inflation and Employment Report

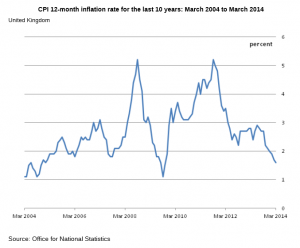

During this week, two important events were lined up in the UK – inflation and employment report. The inflation report from the UK suggested that the Consumer Prices Index (CPI) grew by 1.6% in the year to March 2014, down from 1.7% in February, and CPIH grew by 1.5% in the year to March 2014, down from 1.6% in February. RPIJ grew by 1.8%, down from 2.0% in February. The outcome was mostly in line with the expectations. The BOE will be keeping a close eye on the inflation, as if it comes closer to their projections, then it would again raise the rate hike speculations.

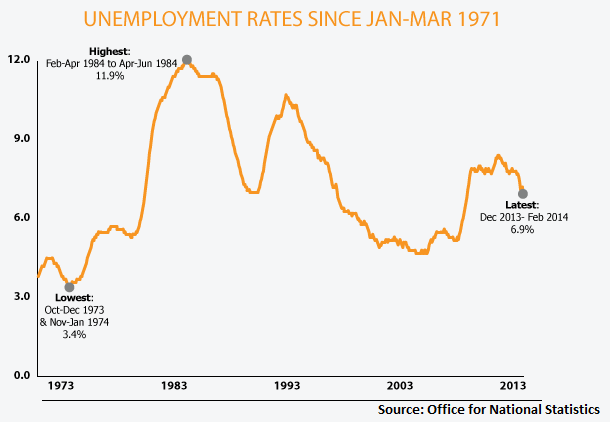

Another important event was the UK employment report, which again surprised the market with solid improvements in the labor market. The report highlighted that the employment in the UK was up by 239,000 from September to November 2013 and up by 691,000 on a year earlier to 30.39 million for December 2013 to February 2014. The main thing to note from the report was that the unemployment rate fell to 6.9%, down by 0.2% from the previous reading of 7.1%.

This came as a solid boost for the GBPUSD pair, as the buyers took the pair above the 1.6828 resistance level to register a new high at around the 1.6840 level. However, the momentum faded after the pair tested the 1.6840 level. This failure also occurred just around a trend line, as can be seen in the chart below. The pair fell back close to the 1.6800 level during the latter part of the US session yesterday. Nevertheless, there is no denying that this particular move can be seen as a correction in the pair, and it might continue to rise again.

We have a holiday today, which means there might be very less movements in the market. So, we will have to wait for the next week to witness some more action.

So, keep an eye on all important notes friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!