Hi Traders! Weekly summary and review October 22nd, 2021 is here. It is now time to recap and summarize the trade setups that we had during this week. Below you will find the short explanation of all the trade setups we had this week and how it has currently developed now.

Trading Ideas (Blog Posts)

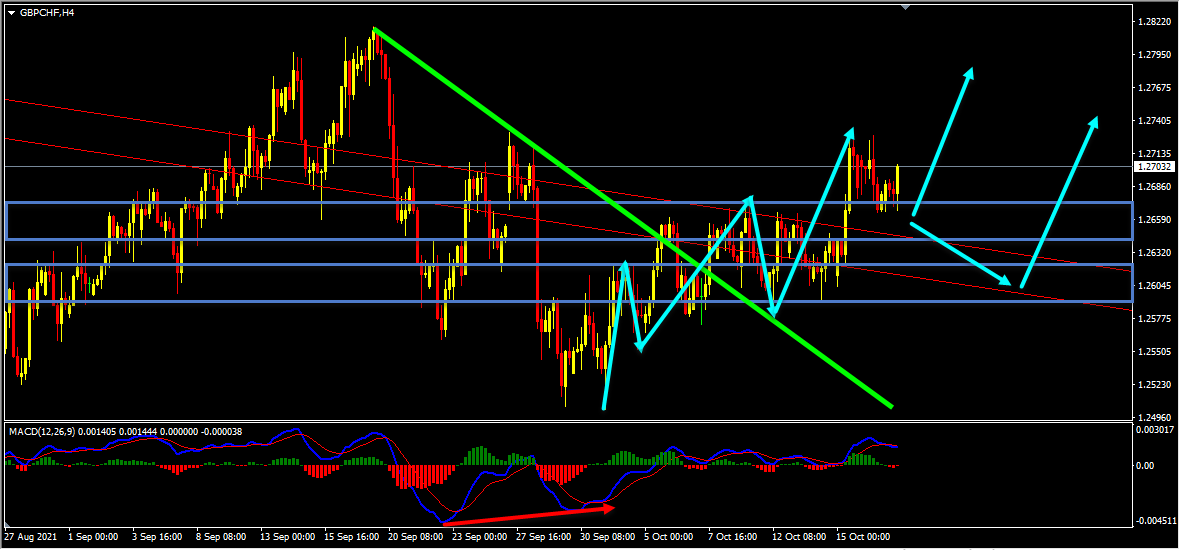

GBPCHF – My idea here was “On the H4 chart, the daily chart pullback ended with a bullish divergence which has formed between the first low at 1.25605 and the second low at 1.25027 based on the MACD indicator. The price then moved higher and broke above the most recent downtrend line, we may consider these as evidences of bullish pressure. Also, the price which is moving higher has created a bullish trend pattern in the form of three higher highs, higher lows, we may consider this as another evidence of bullish pressure. Generally, after a bullish trend pattern, we may expect corrections and then potential continuation higher. Currently, it looks like a correction is happening. We also had two strong resistance zones that has formed and the price which was moving higher has broken above these zones. After the breakout these strong resistance zones are acting as two strong support zones for us. Until both these strong support zones shown in the image below holds my short term view remains bullish here”.

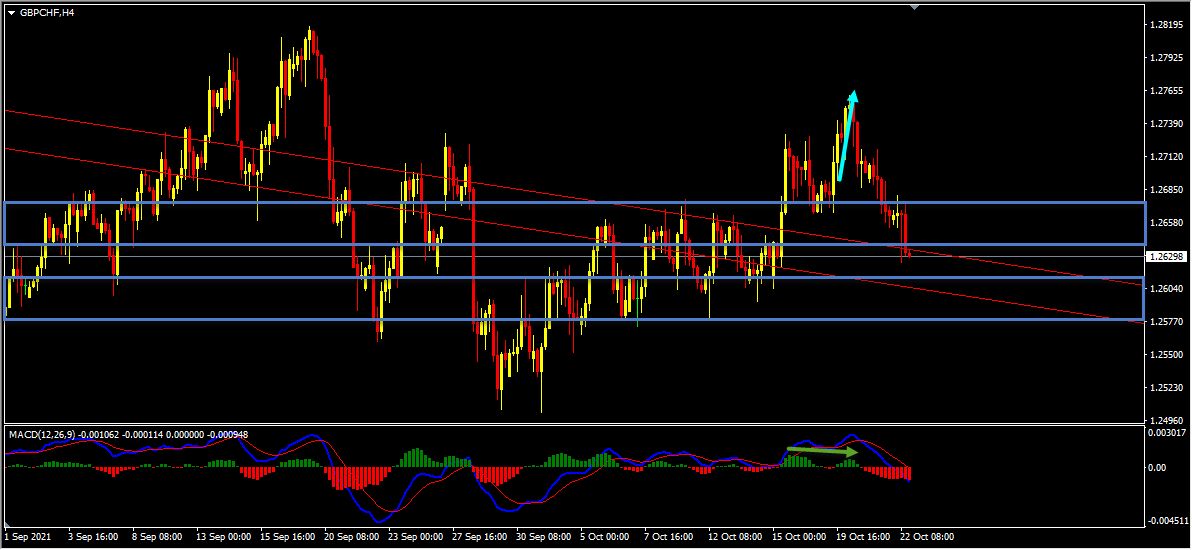

Current Scenario – The price action followed my analysis and moved higher from the first strong support zone, delivering around 70 pips move until it was blocked by a bearish divergence. Currently the price which is moving lower has broken below the first strong support zone. Until the second strong support zone holds my bullish view still remains the same here and we may look for new bullish opportunities with bullish evidences in order to join the bulls again.

Current Scenario – The price action followed my analysis and moved higher from the first strong support zone, delivering around 70 pips move until it was blocked by a bearish divergence. Currently the price which is moving lower has broken below the first strong support zone. Until the second strong support zone holds my bullish view still remains the same here and we may look for new bullish opportunities with bullish evidences in order to join the bulls again.

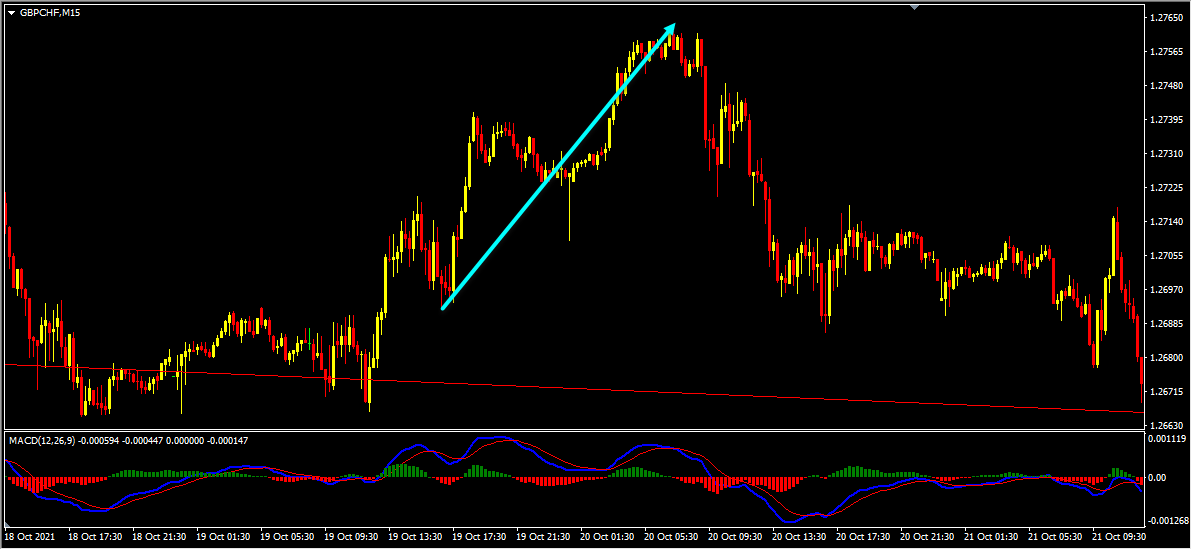

You can see this move clearly on the M15 chart below.

You can see this move clearly on the M15 chart below.

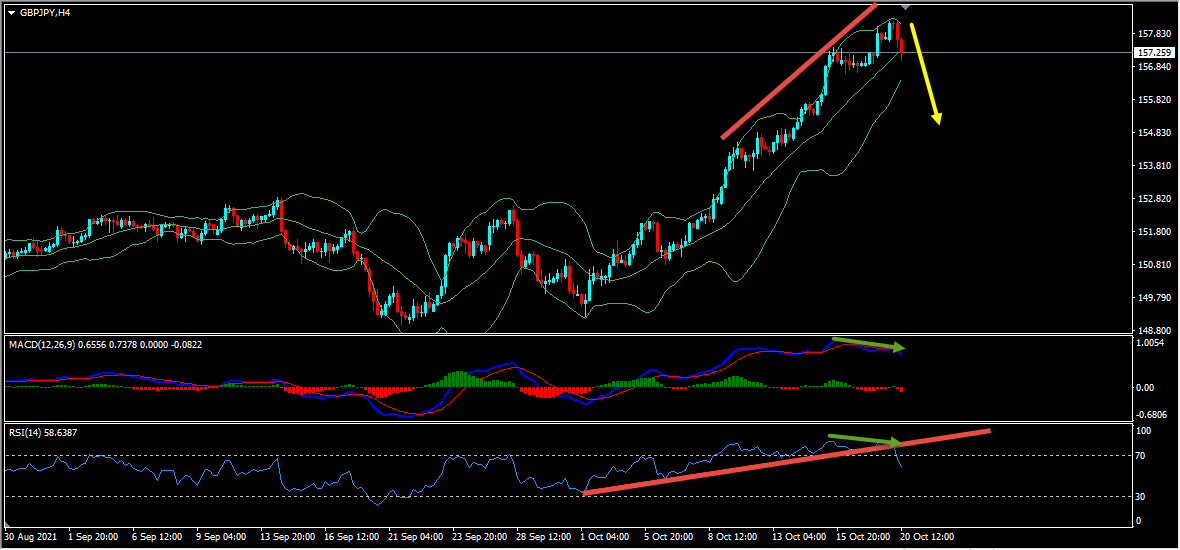

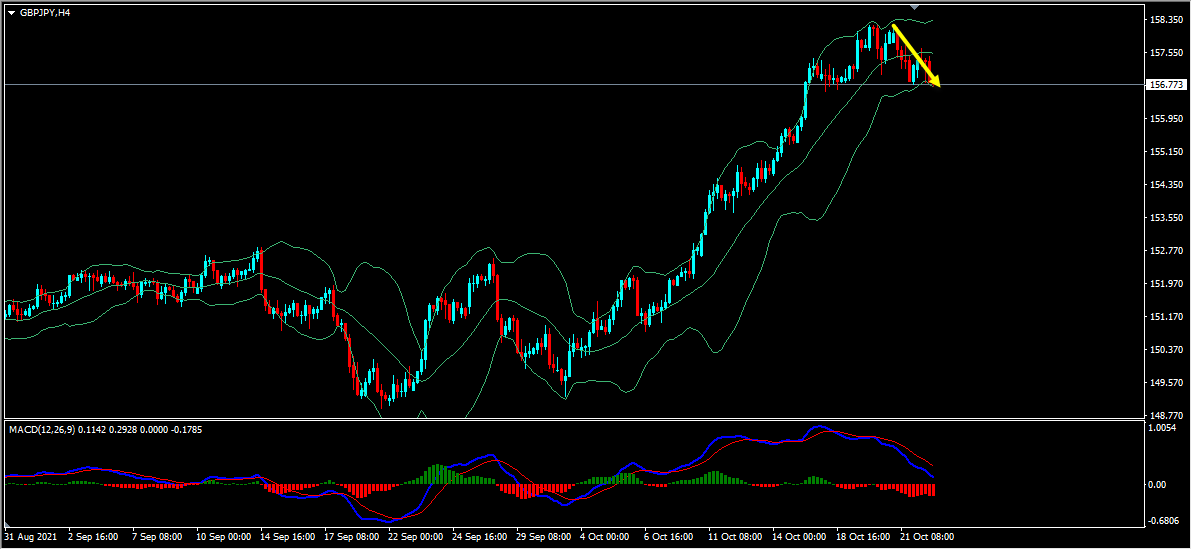

GBPJPY – My idea here was “On the H4 chart, the price which was moving higher has created a bearish divergence that has formed between the first high that has formed at 157.412 and the second high that has formed at 158.212 based on the MACD indicator which we may consider as evidence of bearish pressure. Also, we can see this bearish divergence on the RSI indicator as well followed by the most recent uptrend line breakout, which we may consider as other evidences of bearish pressure. In addition to this, looking at the Bollinger Bands we could see that we have 20+ candles ride on the upper Bollinger Band which we may consider as yet another evidence of bearish pressure. So, based on all this my short term view remains bearish here and I expect the price to move lower further”. Current Scenario – Based on the above-mentioned analysis my short term view was bearish here and I was expecting the price to move lower further. The short term bearish move happened exactly as I expected it to and the price which is moving lower has delivered around 150 pips move so far.

Current Scenario – Based on the above-mentioned analysis my short term view was bearish here and I was expecting the price to move lower further. The short term bearish move happened exactly as I expected it to and the price which is moving lower has delivered around 150 pips move so far.

You can see this move clearly on the M15 chart below.

You can see this move clearly on the M15 chart below.

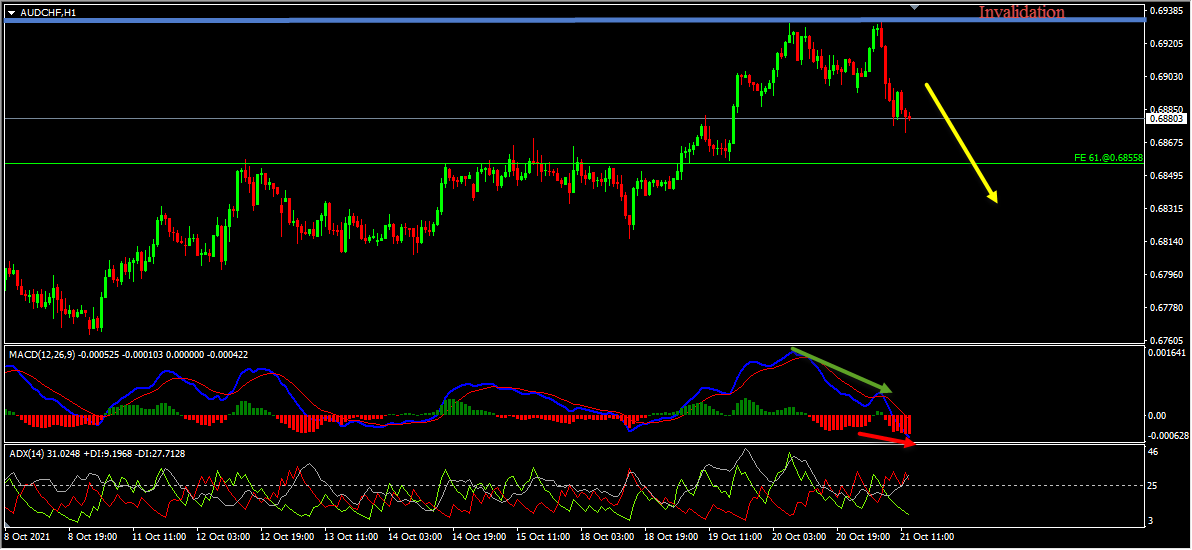

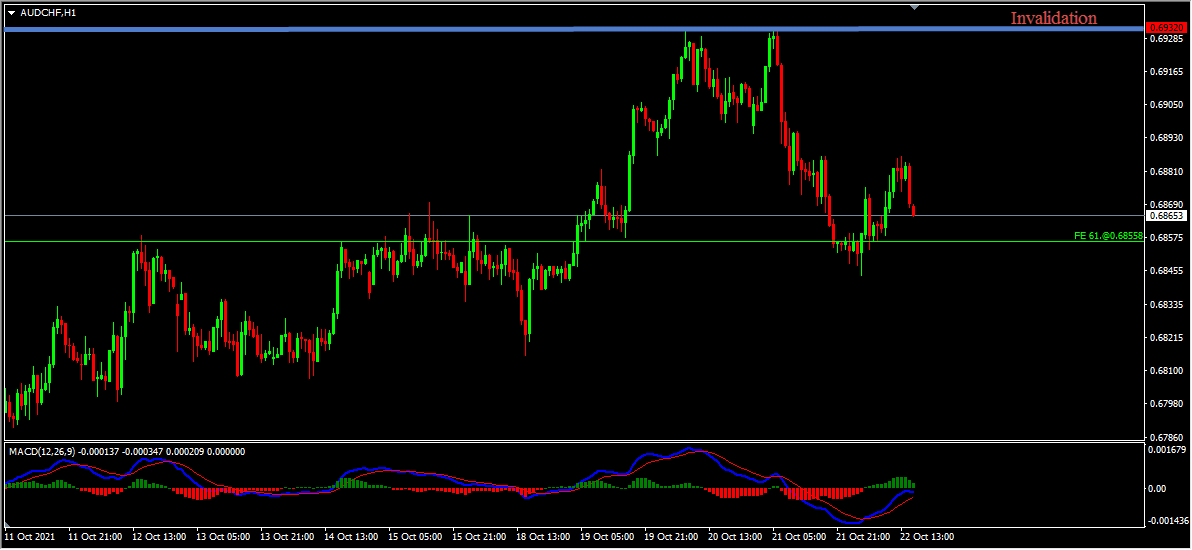

Current Scenario – In this pair the price action is following the bearish expectations so far, until the invalidation level holds my short term bearish view still remains the same here.

Current Scenario – In this pair the price action is following the bearish expectations so far, until the invalidation level holds my short term bearish view still remains the same here. Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

For similar trade ideas and much more I invite you to join the Traders Academy Club and improve your trading with us.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician