Hi Traders! NZDJPY forecast update and follow up is here. On November 18th I shared this NZDJPY Forecast And Technical Analysis post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

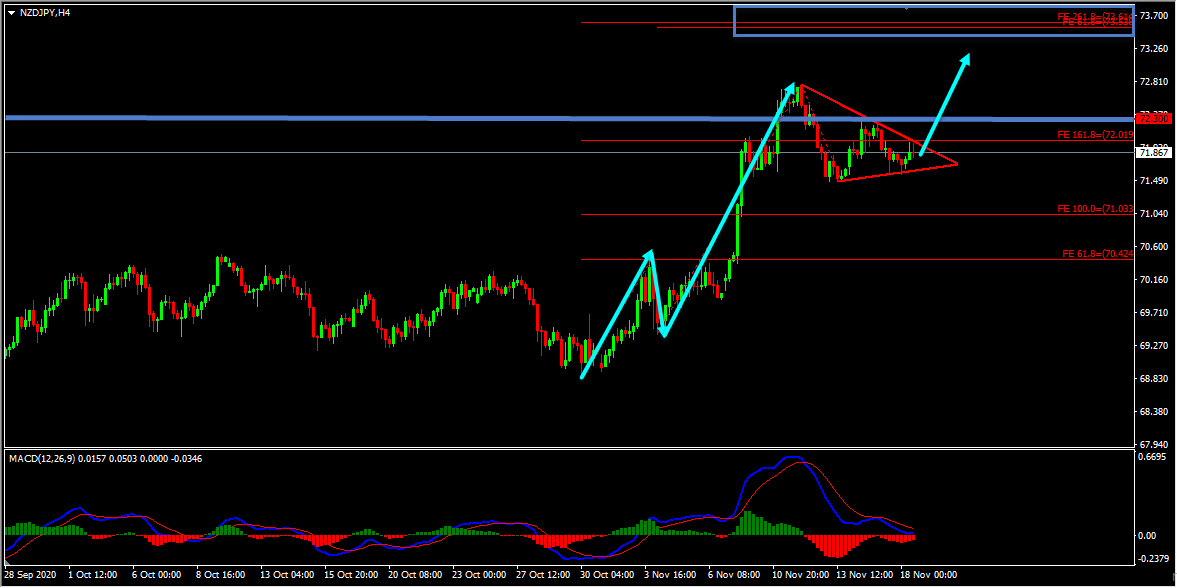

Looking at the H4 chart we could see that the price has created two waves to the upside and currently it looks like a correction is happening in the form of range. While measuring the two waves using the fibonacci expansion tool, we have a magnet zone that has formed based on the 261.8%(73.614) fibonacci expansion level of the first wave and the 61.8%(73.538) fibonacci expansion level of the second wave. Price still has room higher towards this magnet zone and currently there are no signs opposing this bullish view. So based on all this my view here is bullish and if we get a valid breakout above the high at 72.300, we may then consider it as a validation for the bullish view and may expect the price to continue higher further.

NZDJPY H4(4 Hours) Chart Current Scenario

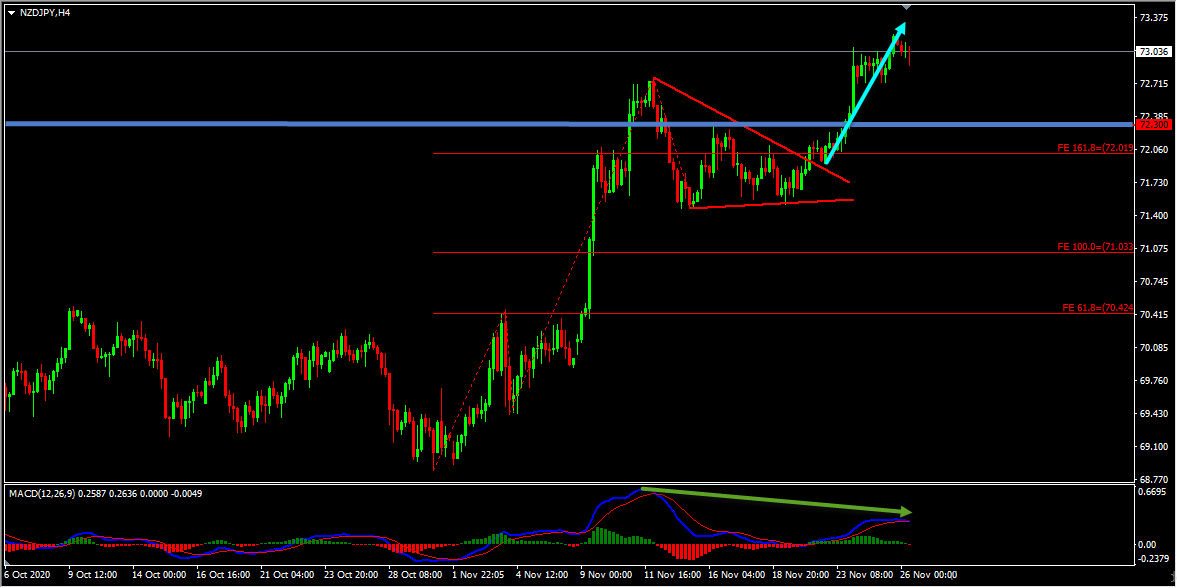

On the H4 chart, the validation for the bullish view which is a valid breakout above the high at 72.300 happened as I expected. In addition to this we already had a valid breakout above the triangle pattern and there were no signs opposing this bullish view. We may consider these as facts provided by the market supporting the bulls. The price then moved higher further and delivered around 100 pips move so far. Currently, on the H4 and H1 chart, we have a bearish divergence in play, this is something that we need to pay attention to. So if you are still involved in the buys then this is a good place to consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Note: If you want to learn about Money Management you can find it here

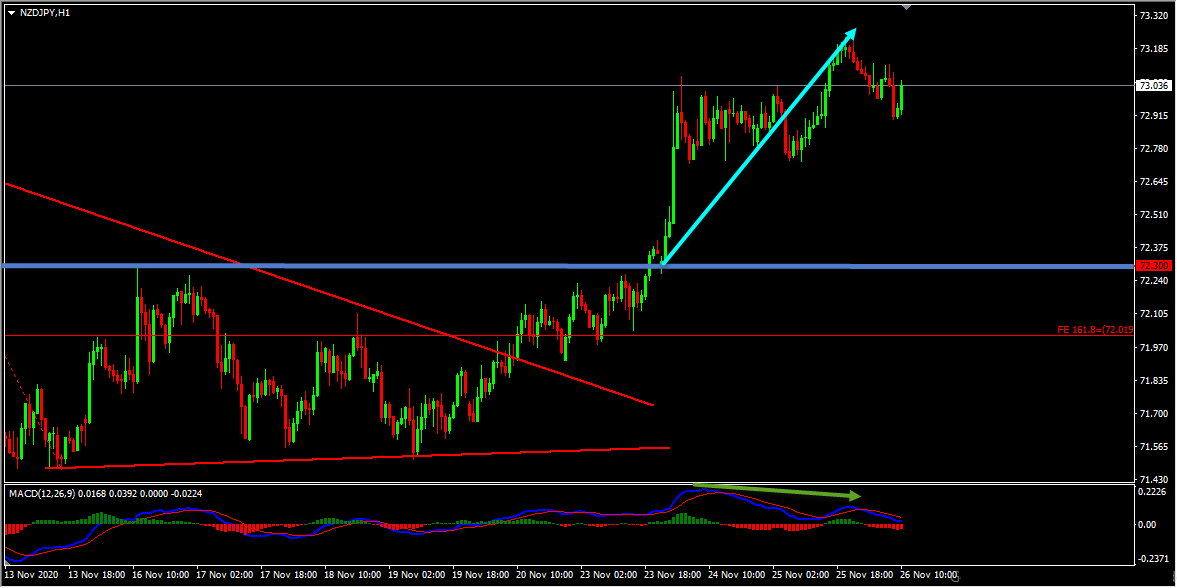

You can see this move clearly on the H1 chart below

So traders when it comes to trading, there are various important factors that we need to pay attention to, just because we have a good setup doesn’t mean that we can enter the trade randomly and it will pay us huge profits. First of all, we need to validate the entry and we should have a perfect entry plan to get into the trade which is a key factor when it comes to trading. This NZDJPY forecast is yet another good example of this scenario.

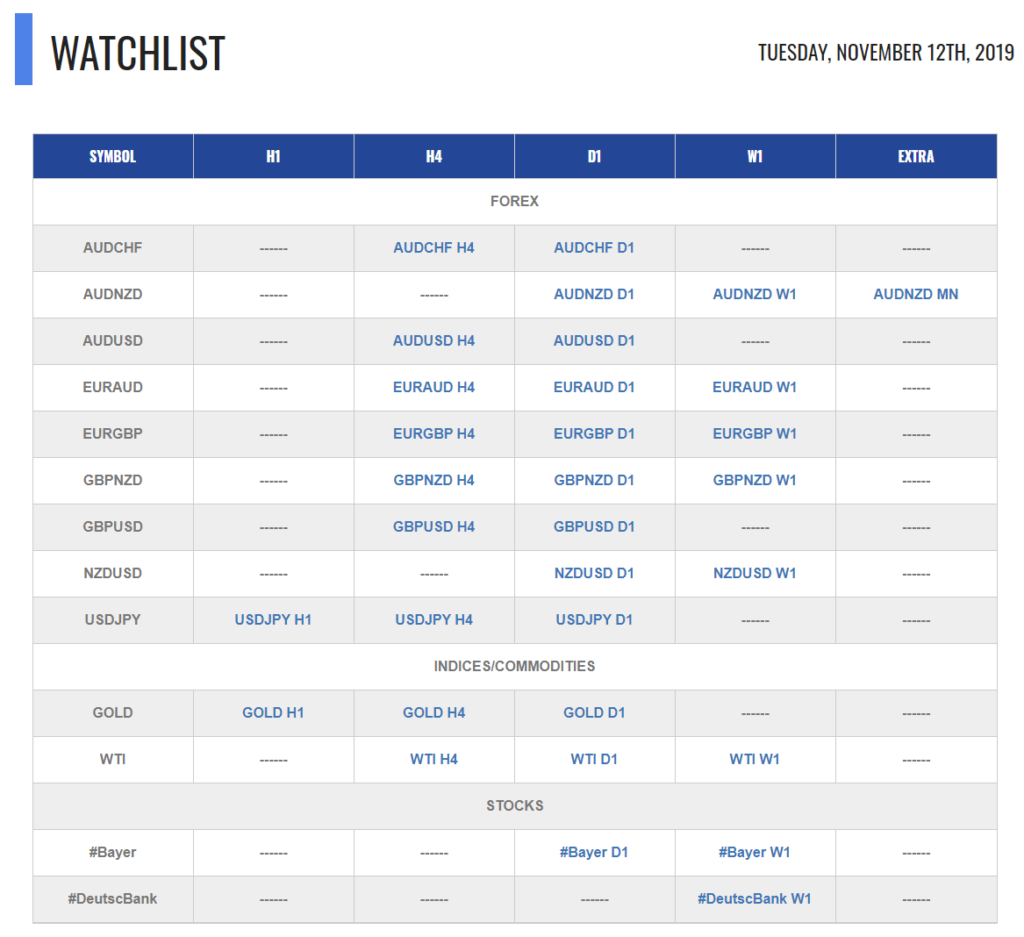

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course, Live Market Analysis every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician