Hi Traders! AUDCAD short term forecast follow up and update is here. On November 2nd I shared this “AUDCAD Short Term Forecast And Technical Analysis” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

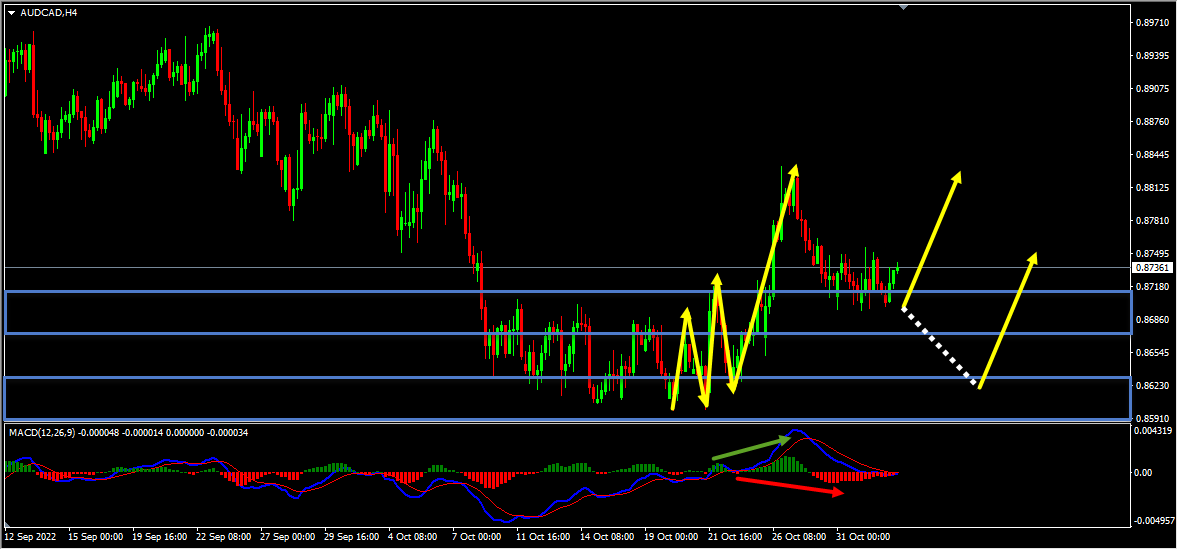

On the H4 chart, we could see that the price which was moving higher has created higher highs based on the MACD indicator, which is a sign of gaining momentum towards the bullish side. Also, the price which is moving higher has created a bullish trend pattern in the form of three higher highs, higher lows, we may consider this as another evidence of bullish pressure. Generally, after a bullish trend pattern, we may expect corrections and then potential continuation higher. Currently, it looks like a correction is happening. In addition to this, the price which is currently moving lower has created a bullish hidden divergence that has formed between the first low that has formed at 0.86203 and the second low that has formed at 0.86958 based on the MACD indicator we may consider this as yet another evidence of bullish pressure. So based on all this, until both the two strong support zones shown in the image below(marked in blue) hold my short term view remains bullish here and I expect the price to move higher further.

AUDCAD H4(4 Hours) Chart Current Scenario

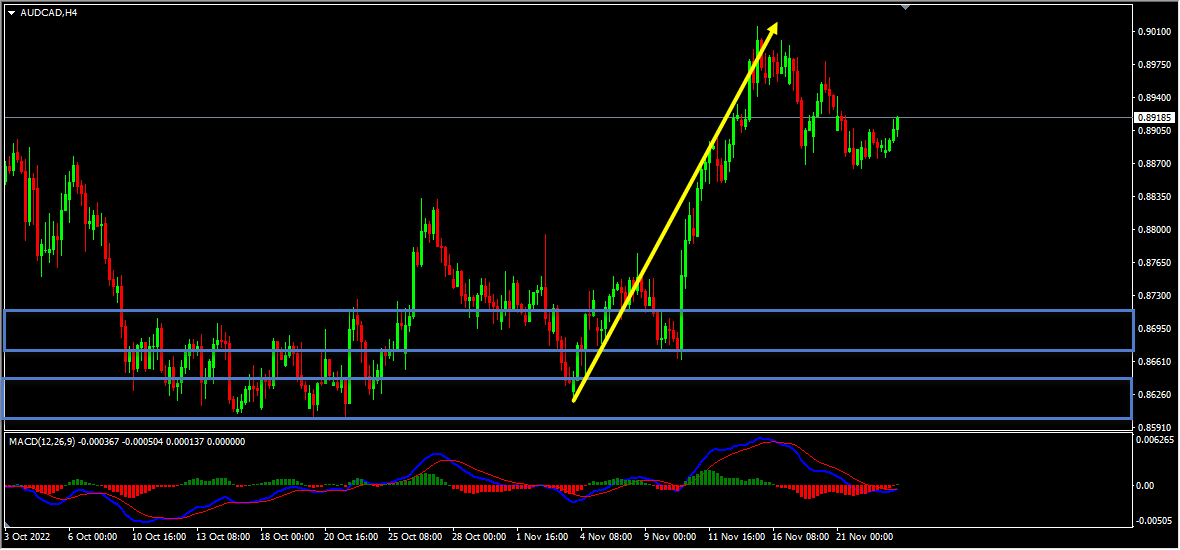

Based on the above-mentioned analysis my short term view was bullish in AUDCAD and I was expecting the price to move higher further until the two strong support zones hold. The price action followed my analysis here exactly as I expected it to. After the bullish trend pattern, we had a deeper pullback with the price reaching the second strong support zone, respected it and bounced higher from this zone and it delivered around 400 pips move to the upside!

On the M15 chart, the market provided us with various facts supporting the bullish view. The price which was moving lower created a bullish divergence between the first low that has formed at 0.86509 and the second low that has formed at 0.86176 based on the MACD indicator. The price then moved higher and broke above the most recent downtrend line, we may consider these as facts provided by the market supporting the bullish view. Then as you can see in the image below how the price moved higher after that and provided an amazing move to the upside.

(Note: You can learn about a Killer Forex Strategy “Double Trend Line Principle” here)

As traders we always have two choices, the first one is to fall in love with our analysis and try to convince the market and expect the price to move in the direction as per our wish. The second one is to follow the facts that the market provides us and make the right actions according to that. As you know the first option won’t help us and as you can see in the example above what happened when we followed the facts that the market hinted us and took the right action according to that.

For similar trade ideas and much more I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Traders Academy Club Team