Hi Traders! Here is the AUDUSD forecast update and GBPUSD technical analysis. Yesterday (April 15th) I shared with you the “AUDUSD Forecast“, lets see how this setup has developed now. And also in this post I will share with you my technical analysis on GBPUSD based on the current scenario. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available! In this post first lets do a recap of the AUDUSD idea and see how it has developed now.

Missed this trade?

Never miss a trade opportunity again! Join the Traders Academy Club

AUDUSD

My Idea

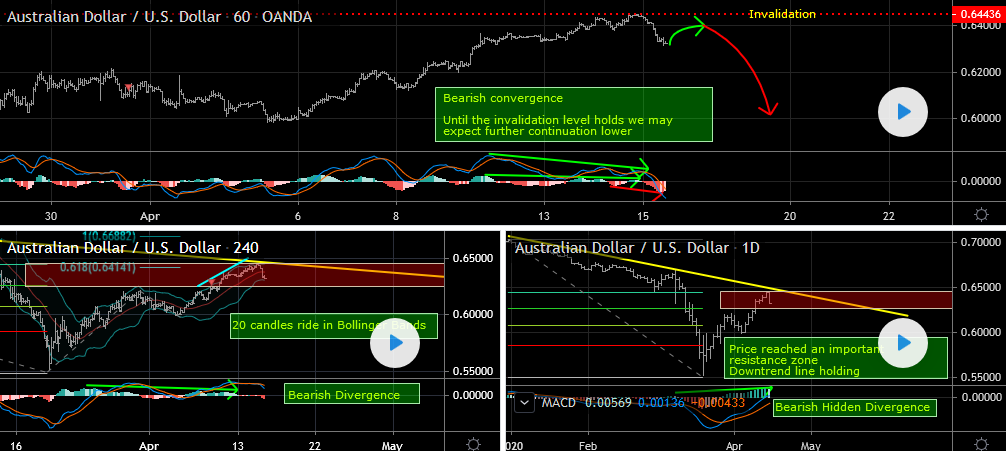

AUDUSD H1(1 Hour) Chart Current Scenario

Based on the above mentioned analysis my view was bearish here, the price moved lower exactly as I expected and it has provided us good profits. Currently I don’t like the way the price is developing as we have an ABCD pattern with a bullish divergence and the price has broken above the most recent downtrend line. This is not a good sign for the trend continuation so if you are still involved in this trade then its a good time to cash out and take your profits.

As you know my view was bearish in this pair based on the muti-timeframe analysis and the price moved lower exactly as expected but we should always be careful and should watch for opposite evidences, once we get them, then the wise thing to do is to cash out of the trade and take our profits, which is exactly what we did here. Always follow the facts, it doesn’t matter what view you had yesterday, what matters is what happens in the market today because the market is dynamic and it doesn’t necessarily have to agree with the way you see it. As long as the market follows my ideas and validates my setups I can trade, if it doesn’t and the facts are against you then there is no need to fight with the market, simply cash out of the trade.

GBPUSD Technical Analysis

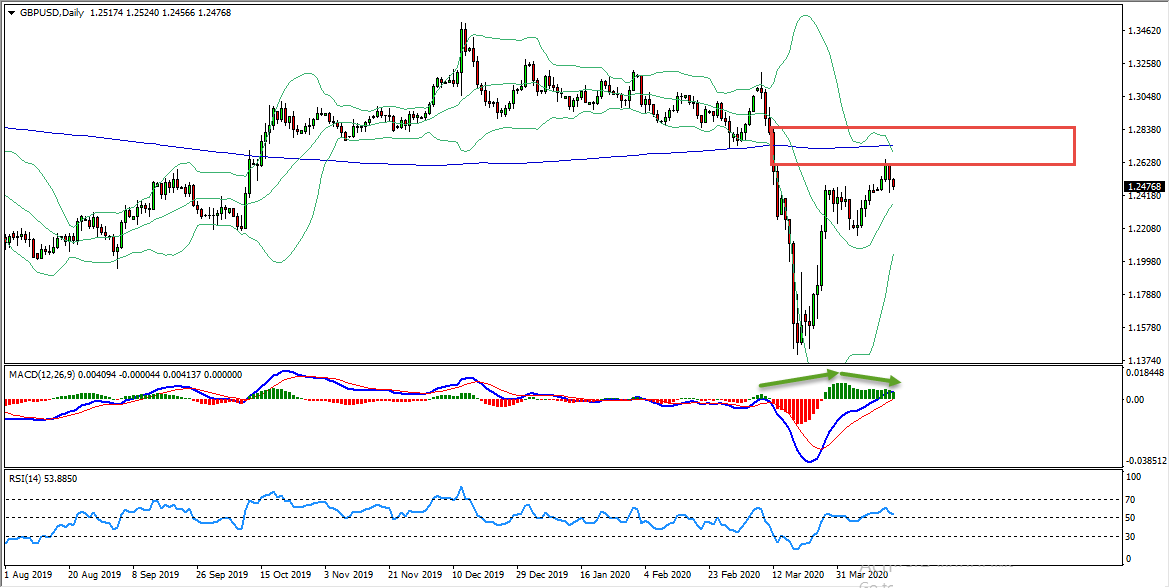

GBPUSD D1(Daily) Chart Analysis

On the daily chart we have an important resistance zone that has formed, currently the 200 moving averages is slowing down and is coinciding in this zone, which makes this area a very strong resistance zone. The price which is moving higher has currently reached this resistance zone. In addition to this we have double wave to the upside with a bearish hidden divergence which has now turned into a continuing bearish divergence. Until this resistance zone holds the price might move lower, this could also be a temporary move in the form of pullbacks and then the price might possibly move higher as well, both scenarios are possible here. So until this important resistance zone holds my view is bearish here, alternatively if the price moves higher and if we get a valid breakout above this resistance zone then my view becomes bullish here.

Also right now with the Corona virus impact the real money flow is not there in the market, a lot of investors and traders are out of the market and are waiting for this crisis to come down. Many traders are sitting on the fence making nothing, what you would see on the market in such period in panics, there are a lot of random fast moves with high volatility, very serious moves, big volumes but these moves are not technical but in such cases its very important to wait for your setups, have your analysis. If the setup comes, trade it and value the risk, if you would be right in high volatility period then once it moves, it moves big and fast but if it doesn’t then you know your risk is limited. Don’t trade without planning your risk its a big mistake.

Also right now with the Corona virus impact the real money flow is not there in the market, a lot of investors and traders are out of the market and are waiting for this crisis to come down. Many traders are sitting on the fence making nothing, what you would see on the market in such period in panics, there are a lot of random fast moves with high volatility, very serious moves, big volumes but these moves are not technical but in such cases its very important to wait for your setups, have your analysis. If the setup comes, trade it and value the risk, if you would be right in high volatility period then once it moves, it moves big and fast but if it doesn’t then you know your risk is limited. Don’t trade without planning your risk its a big mistake.

Watch my video on How to trade during Corona virus Crisis here

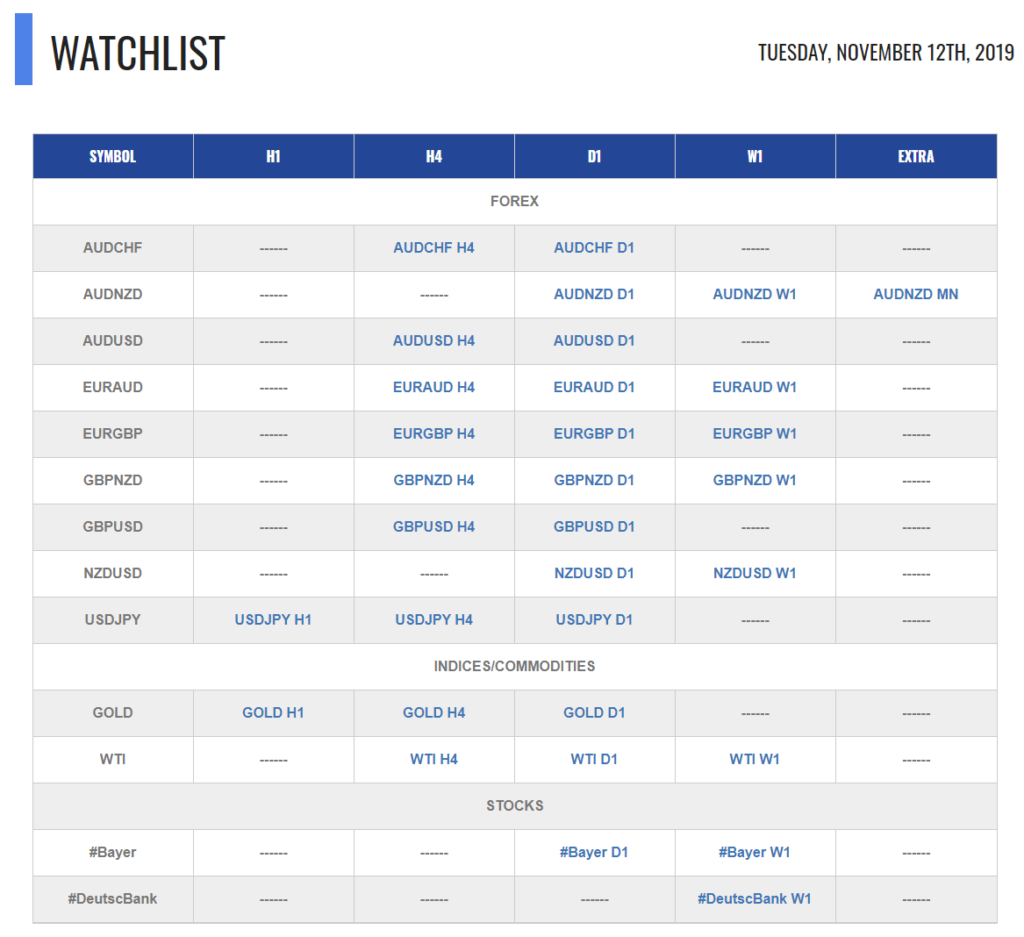

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Trading Room every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician

Very well explained and easy to follow…kudos

Thank you for the update on AUDUSD, will follow it