Hi Traders! EURCAD forecast update and follow up is here. On May 26th I shared this “Technical Analysis – EURCAD Forecast” post. In this post, lets do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

Missed this trade?

Never miss a trade opportunity again! Join the Traders Academy Club

Now let’s summarize the idea first:

- 1 EURCAD W1(Weekly) Chart Analysis – Extreme Divergence, Strong Support Zone

- 2 EURCAD D1(Daily) Chart Analysis – Very Strong Support Zone, Parabolic Sar

- 3 EURCAD H4(4 Hours) Chart Analysis – Bearish Trend Pattern, Range, Uptrend Line Breakout, ADX Indicator, CCI Indicator

- 4 EURCAD H1(1 Hour) Chart Current Scenario

EURCAD W1(Weekly) Chart Analysis – Extreme Divergence, Strong Support Zone

On the weekly chart we had an extreme divergence that had formed based on the MACD indicator, the RSI indicator, and also the Stochastic Oscillator had reached it’s extreme as well. Currently it looks like a correction is happening in the form of potential double wave down. While measuring the first leg of this potential double wave using the fibonacci expansion tool we could see that the 61.8% fibonacci expansion level of the first wave is at 1.49527 which acts as a strong support zone for us. The price still has room lower towards this support zone, we may now move down to lower timeframes and see if we can find evidences supporting this bearish view.

EURCAD D1(Daily) Chart Analysis – Very Strong Support Zone, Parabolic Sar

On the daily chart while measuring the small inner wave we have using the fibonacci expansion tool we could see that the 100% fibonacci expansion level of this first wave at 1.58406 coincides with the weekly support zone. In addition to this, we also have the 200 moving averages coinciding on the same level, which makes this area a very strong support zone for us and the price still has room lower towards this zone. Also while looking at the Parabolic Sar we could see that the dots are above the price which we may consider as evidence of bearish pressure. So the bottom line here is that the daily chart has evidences supporting the bearish view.

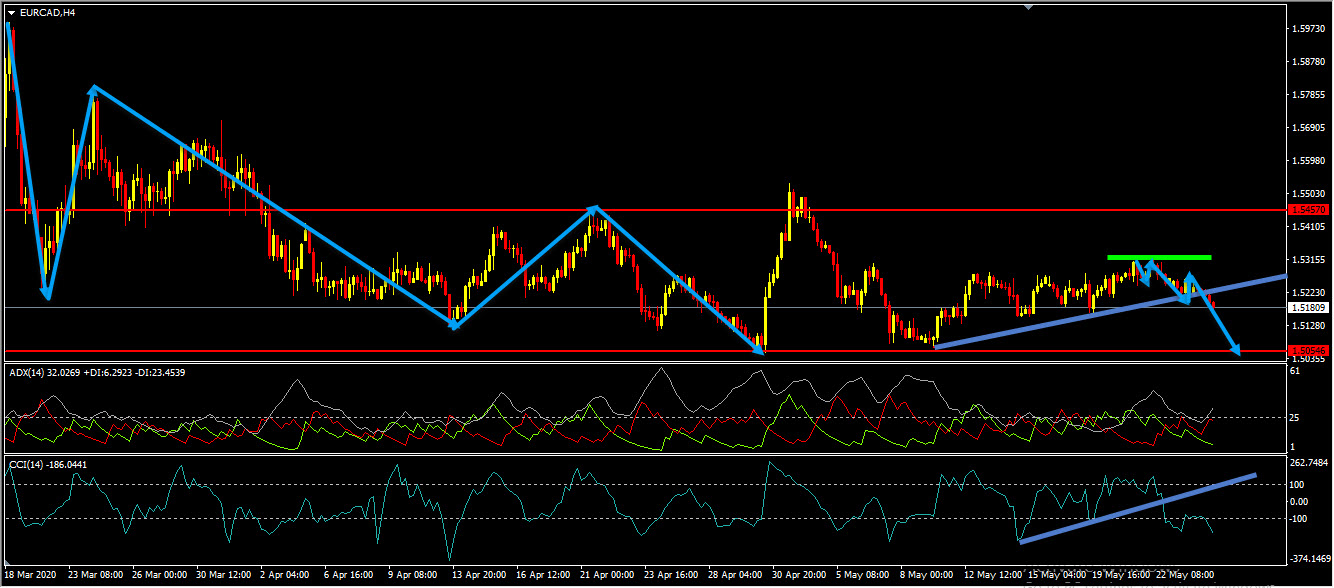

EURCAD H4(4 Hours) Chart Analysis – Bearish Trend Pattern, Range, Uptrend Line Breakout, ADX Indicator, CCI Indicator

On the H4 chart, the price which was moving lower created a bearish trend pattern. Generally, after a bearish trend pattern, we may expect a correction to happen and it looks like the correction is happening in the form of a range. Currently, the price which is moving inside this range has broken below the most recent uptrend line, and this uptrend line breakout has happened in the form of a bearish trend pattern. In addition to this we have an uptrend line breakout based on the CCI indicator as well, we may consider these as evidences of bearish pressure. Also the ADX indicator gave bearish signal at the cross of -DI (red line) versus +DI (green line) and the main signal line (silver line) reads value over 25, we may consider this as another evidence of bearish pressure. Until the last high at 1.53214 holds my view remains bearish here, if we get a valid breakout above this high then this bearish view will be invalidated.

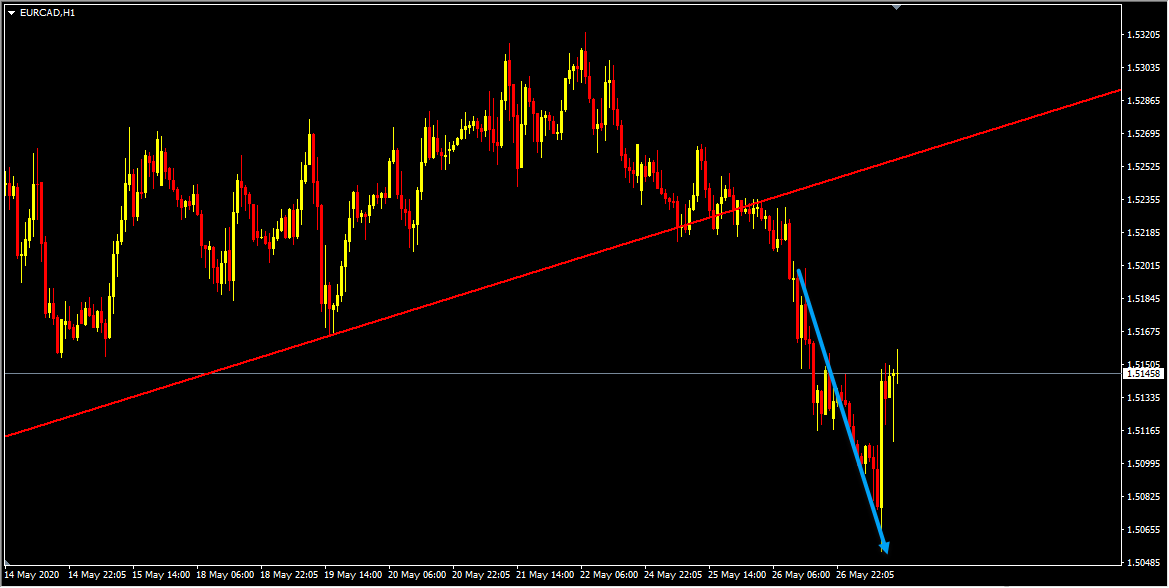

EURCAD H1(1 Hour) Chart Current Scenario

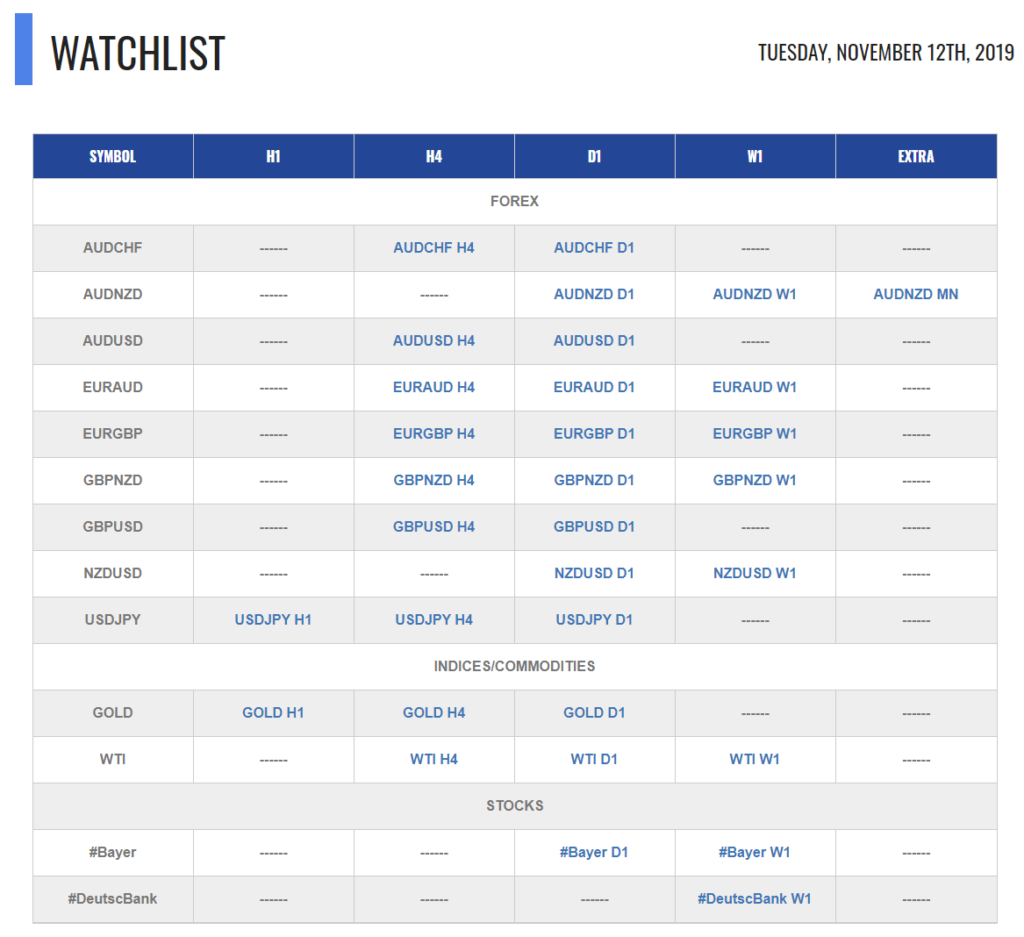

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Trading Room every single day.

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Yordan Kuzmanov

Chief Trader at the Traders Academy Club