Watch the webinar of How To Trade Divergence – KEY TRADING TIPS!

Hi Traders! In this article, I would like to show you the real power behind trading divergence. I will explain how you can trade short term trades against higher time frames direction, for example – short term sells, vs. longer-term buys.

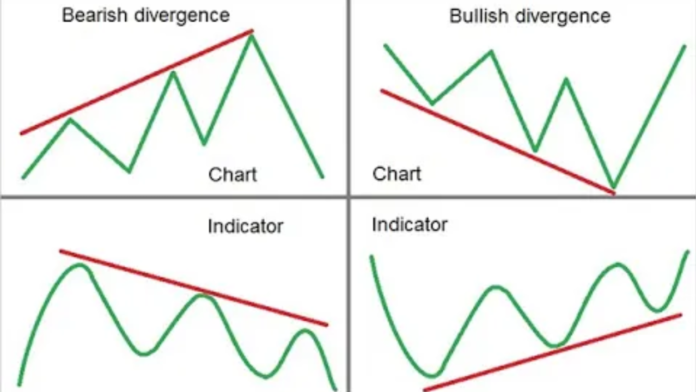

What is Divergence?

Divergence is a situation where the price and the indicator are pointing in opposite directions. When that happens, the indicator basically indicates to us that the buyers or the sellers, depending on the ongoing trend, are losing their power and a trend might stop and reverse.. The forex trading divergence strategy employs the use of any suitable oscillator such as the Relative Strength Index (RSI indicator) or the Moving Average Convergence Divergence (MACD indicator). The oscillators used for this strategy could be found on the MT4 or MT5 platforms or any other trading platform.

Note: If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

Example

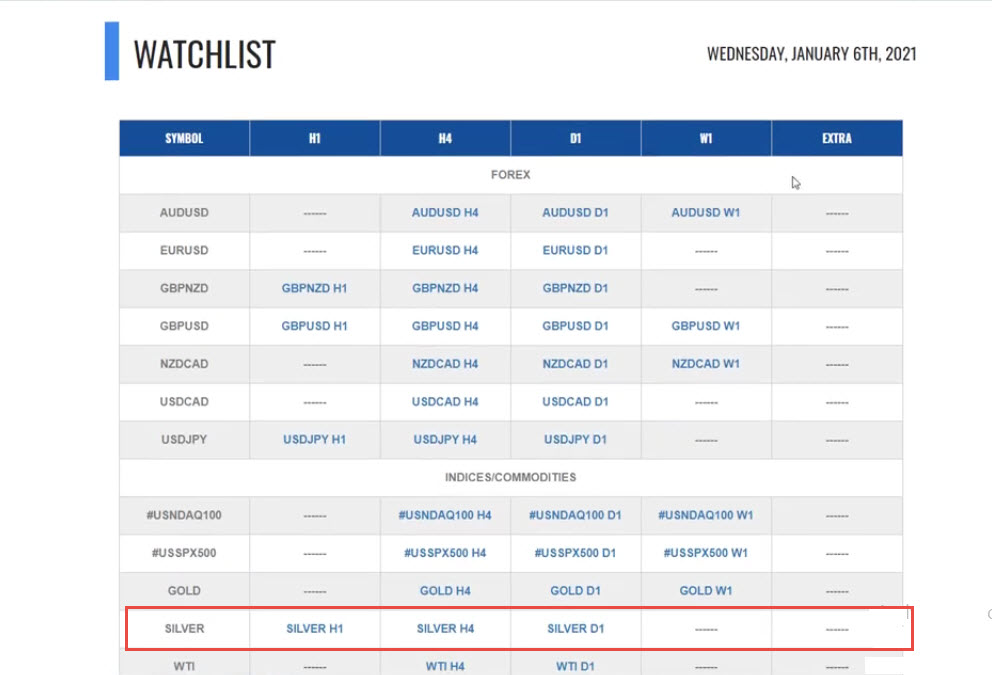

In order to explain how to possibly take a short-term trade against a long-term direction. I will present you an example (Silver) that we’ve discussed, and traded in my Traders Academy Club.

On the table below you can see my trading watch list. This list is all the trading opportunities I share with my followers on daily basis, in Traders Academy Club (you can join us here).

Multi-timeframe Analysis

First, let’s start with Multi-time frame analysis which is a key to your success in trading. Knowing what is going on in the longer-term increases the probability that you are trading in the right direction. You don’t want to be stuck in a situation where daily, and weekly charts are in a strong bearish trend, without any signs for reversal, while at the same time you are attacking the H4 chart for buys. Chances are, it will end badly.

We will start our analysis from the daily chart which will be the highest timeframe in this multi-timeframe analysis. Looking at the daily chart, I found a bullish trending pattern to the upside followed by a pullback, in a format of ABCD correction, and the area shown in the screenshot below becomes a massive support area. There is a bullish divergence based on the moving averages of the MACD indicator and also on the RSI indicator. Later on the price moved higher and broke above the most recent downtrend line.

Then I moved down to the H4 chart where we can see the price gaining momentum by creating three higher highs, higher lows. This by itself is another very strong bullish sign because in a bullish trend the buyers manage to create higher highs, higher lows, that is how we know the buyers are likely in control. So our longer-term idea is to get the pullbacks, ideally towards the next important rejection zones shown in the screenshot below, and afterward, we will be looking for buy setups. We can’t guarantee that we will have such setup at the end, but I do always build a plan to trade, and then I am looking to trade my plan.

But meanwhile, why not to enjoy a short term sell trade here – right? Let me explain why I can do that in this case. The three higher highs, higher lows is a trending pattern but in this case it’s also a full cycle by itself (as I can see each of the legs are built by several waves to the upside which is a great sign) with a clean ending bearish divergence. As it is a completed cycle, and I expect to see pullbacks here, let’s see if I can trade these pullbacks.

The next step here is, I go to a shorter timeframe (in this case H1 chart) this is where the real power comes into play. If we take a look at the last leg from the H4 chart on how it ends, we have a false breakout of the last high, and then we had another attempt to create higher highs which again turned to be another false breakout. All this is followed by a massive bearish divergence.

Also, after the uptrend where the price was creating higher highs, higher lows for the first time the price has changed and has created lower lows. This together with the analysis from the multi-timeframe we get an understanding that we need to experience a pullback here before possible longer-term buys, which allows me to trade short-term opportunities.

Now, we don’t know what sort of setup we will get here, normally we either get ABCD pattern followed by the breakout of the most recent uptrend line.

Or alternatively, we may get any sort of a range.

The price was at the end ranging here, and if the price breaks below the bottom of this range I assume that we are going for the correction aiming to the next critical rejection zones.

Then we got the breakout coming in play and the price validating the zone shown in the screenshot below.

How do I know the price validates this zone?

In order to find this, you can always go to a lower timeframe and see that the price is gaining momentum with the breakout. On the M15 chart, we can see that the price is gaining the momentum in the form of three lower highs, lower lows. This is a good verification which shows that the momentum is gaining.

As we discussed before, we are aiming for the first rejection zone and we follow the price action. I can’t predict until which zone the market will reach, but I do can follow the facts and if the market shows signs of stopping, I close my position. I do know that if I reach the first rejection zone I will be in a good risk/reward, and I am looking to enjoy my profit.

Why Good Risk/Reward ratio is important?

Positive risk-reward guarantees you that even if you have same amount of losses as you have profits, you will still make money. How is it possible? A risk-reward ratio in general means the relationship between the potential loss and the potential profits. Meaning – for every $1 that you are going to risk, what is your potential profit? If it is a positive risk-reward, then for 1$ risk you aim to make more than 1$, and with 50% success rate only, you’ll still make amazing profits.

Key Tips To Trade Divergence

Stick to the higher time frames (at least in the beginning while you are still a newbie) – apply multi time frame analysis to your trading. The combination between divergences and cycles is amazing! You will be surprised how accurately tops and bottoms are identified – Use strong resistance and support or rejection levels. This is helpful for pretty much any trading strategy.

Using false breaks.

The false break pattern in its nature suggests that the momentum is losing its power. This is exactly what the divergence is telling us. False breaks is a great sign to follow when it comes to divergences.

MACD divergence

When using MACD indicator we can spot divergence on the moving averages as well as the histogram. When the divergence appears on both at the same time, it is a confirmation for a stronger signal.

Divergence on both RSI and MACD?

Why not? Actually, it is even better as we have another confirmation. Now what if we have MACD histogram + MACD moving average + RSI divergence at the same time? You just have better chances to end up as a winner at the end of the trade

Short term divergence

As the market moves in cycles on each time frame we see the different time frames completing those cycles and forming divergences. You can benefit from those intraday moves using the powerful combination of market waves/market cycles and divergences. A short-term divergence would be considered as anything below H4 chart.

Long term divergence

Longer-term divergences are considered for any time frame above H4(Including). The H4 chart being the bridge between intraday and longer-term/swing traders might be the ideal option for those looking to trade something in between the short term and long term.

Conclusion

So traders, this is how I trade the divergence and enjoy from both directions. This is what I want to show you in this article, how the multi-timeframe analysis with clear divergence, levels, and verification gives you higher probability trades. I can’t assure whether the price will deliver that move or not, but I do know that when the multi-timeframes are synchronized in the same direction then your odds are always higher. Because you have a different scale of money flow and when they are synchronized in the same direction, and provide you the same opportunity then I know that my chances to win this trade are very high.

Once again I invite you to join me in my club and enjoy from our Live Market Analysis and our trading reports on a daily basis and improve your trading with us.

Also, you can get one of my strategies free of charge. You will find all the details here

Thank you for your time in reading this article.

Yours to success,

Vladimir Ribakov

Certified Financial Technician