The US dollar is trading higher against most of the major currencies, including the Euro, Swiss franc, the Australian dollar and the Japanese yen. One of the main reasons for the rise is impressive economic data released in the US. There were few important economic releases scheduled in the US this week, including the US Nonfarm payrolls data, the unemployment rate, ADP nonfarm employment change and ISM manufacturing PMI. All these events came out positive and helped the US dollar to gain ground in the short term.

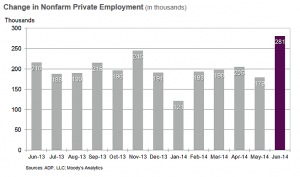

US ADP Nonfarm employment change

Earlier during the week, the US ADP Nonfarm employment change data was published by the Automatic Data Processing, Inc. The market was a good gain this time around. However, the outcome was way above the expectation, as the US ADP Nonfarm employment change registered a reading of 281K, beating the expectation of 200K. This means private-sector employment increased by 281,000 from May to June, which is an impressive reading. Carlos Rodriguez, president and chief executive officer of ADP mentioned in the report published that the June jobs number is a welcome boost. The number of construction jobs added was particularly encouraging, representing the highest total in that industry since February of 2006. The US dollar traded higher post the data release.

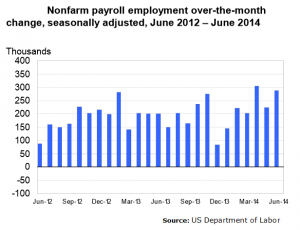

US NFP Report

Yesterday, the US Nonfarm payrolls data was published by the US Department of Labor. The market was expecting a minor decline from the last time. However, the outcome was again encouraging. The US nonfarm payroll employment increased by 288,000 in June, beating the expectation of 212K. This was one of the best gains in the recent times, which means that the US labor market is improving. The report mentioned that the Job gains were widespread, led by employment growth in professional and business services, retail trade, food services and drinking places, and health care.

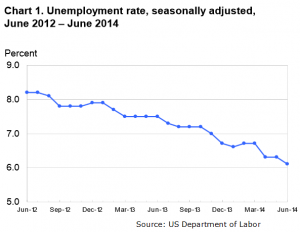

US unemployment rate

The US unemployment rate was also released at the same time by the US Department of Labor. The market was expecting the US unemployment rate to remain stable at 6.3%. However, the outcome exceeded the expectation, as the US unemployment rate fell to 6.1%, down by 0.2%. The main point to note from the report was that the number of unemployed persons decreased by 325,000 to 9.5 million. Over the year, the unemployment rate and the number of unemployed persons have declined by 1.4 percentage points and 2.3 million, respectively.

Overall, the data was on the positive side and must encourage the Fed to continue with the taper. This is broadly in the favor of the US dollar.

Technically, there was an important up-move trend line on the 4 hour timeframe for the EURUSD pair. After yesterday’s release, the pair breached the mentioned trend line and traded lower. It has even breached the 55 and 100 moving averages on the 4 hour chart. Currently, the pair is flirting with the 200 moving average, as buyers managed to hold the downside around the 1.3600 support area. The RSI is below the 50 level, which is not a good sign in the short term. So, as long as the pair is trading below the broken trend line, then more losses are possible towards the 1.3550 support level.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!