Highlights of the week:

EURUSD remains in a range and eyes a breakout

GBPUSD: Buyers looks desperate

GOLD and SILVER trading at new highs

Most of the major pairs are consolidating in a range for some time now. The market is quiet, and setting up for a volatile period in the coming days. Fundamentally, there were few major market events scheduled in the last two days. However, there are some key events lined up in the coming weeks, which could trigger a volatility in the market. First, let’s look at the key economic data released in the last two days.

On Monday, there were two important economic releases in the European session, the German IFO business climate index and the Euro zone inflation data. The outcome was positive, as the German IFO business climate index registered a healthy reading of 113.6. The official release statement highlighted that “the IFO Business Climate Index for industry and trade in Germany continued to rise in February. Assessments of the current business situation were significantly better than last month. Expectations regarding future business developments dipped slightly, but remain optimistic. The German economy is holding its own in a changeable global climate”.

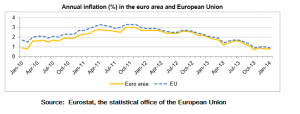

Next in the line was the Euro zone inflation data, which boosted the confidence of the EURUSD buyers. The Euro area inflation registered a growth rate of 0.8%, beating the expectations of 0.7%. The official release statement highlighted that “the largest upward impacts to euro area annual inflation came from tobacco (+0.08 percentage points), electricity and milk, cheese & eggs (+0.05 each), while fuels for transport (-0.19), telecommunications (-0.13) and heating oil (-0.05) had the biggest downward impacts”.

Another boost for the Euro came from the Germany yesterday. The German GDP figures were released, which registered an impressive 0.4% growth rate in Q4, 2014. The key that to note from the release was that “compared with the third quarter of 2013, exports of goods and services were up 2.6% and imports increased by not more than 0.6% in the same period. Consequently, the balance of exports and imports contributed 1.1 percentage points to GDP growth”. The outcome was very positive, and helped the EURUSD in the short term. However, the pair remained capped by the critical resistance yesterday. The sellers were seen active, and were not willing to give up easily. The range trading is still on, and I think we will witness a break and follow through soon for the pair.

The setback for the US dollar came from the consumer confidence released, which declined to 78.1, and the previous reading was also revised down from 80.7 to 79.4. Overall, the data were negative, and the US dollar was seen trading lower after the release. The statement says that “the decline was driven by the Expectations Index, which dropped to 75.7 from 80.8. The Present Situation Index, by contrast, climbed from 77.3 to 81.7.” There were some nasty swing moves noted in the pairs like EURUSD and GBPUSD after the release. One of the most important things to note here is that the GOLD managed to trade above the $1340 level, and registered a solid run up.

Moving forward, we have four important things lined up during the rest of the week. Today at GMT 09:30 AM, the UK’s GDP data will be released. The market is expecting 0.7% growth rate. I would advise to keep an eye on this event, as this might trigger the much-awaited trigger move for the GBPUSD. The buyers are very active these days for sterling, and they might look for buying opportunities. Technically, the pair remains capped by the 1.6740 level, as can be seen in the chart below.

Furthermore, two events from the Euro zone must be watched. The German and the Euro zone unemployment figures are scheduled to be released. Any better than expected outcome may push the Euro higher. Last but not the least, the Fed Chairman, Janet Yellen is scheduled to testify on Thursday at GMT 03:00 PM. Her comments will be watched carefully, as the US dollar looks set for a healthy move either up or down.

So, keep an eye on all these events friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!